Lost in the escalating hype and company valuations of fintechs is the changing role of banks in merchant payments. Historically, the market for merchant payments in North America and Europe was owned by banks, but now, banks own less than half of merchant acquiring market share in North America and Europe. Over the last two decades, banks have typically been sellers of merchant assets. Today, we still see some banks which are sellers, but we also see many leading bank franchises either re-entering merchant payments organically or doubling down via expansionary M&A.

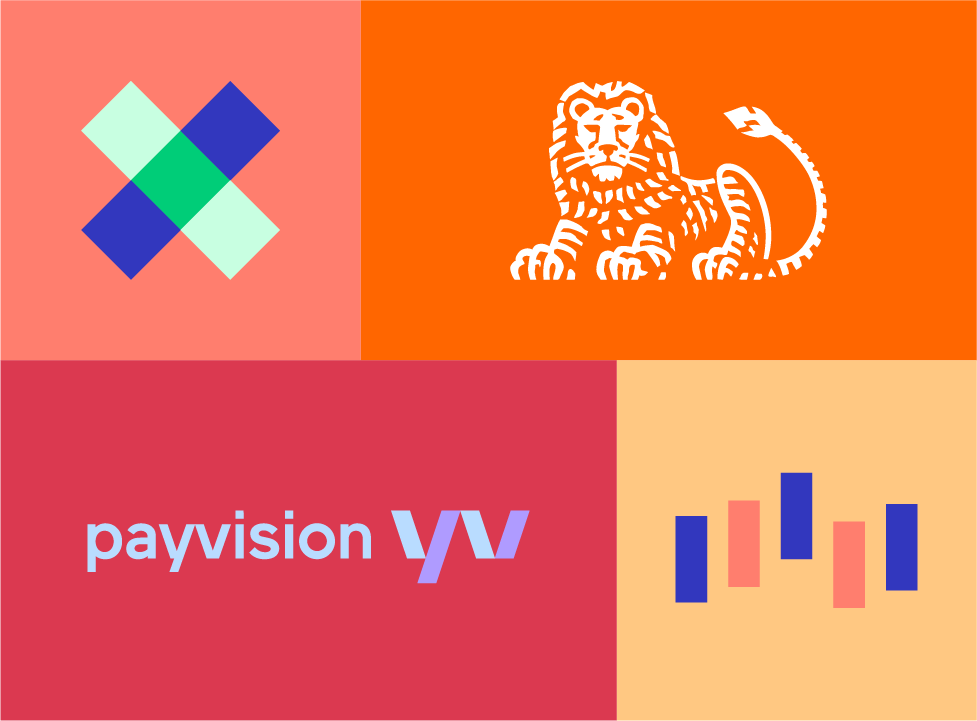

FIGURE 1: European (including UK) Merchant Acquiring Market Shares by Type (% of card turnover)

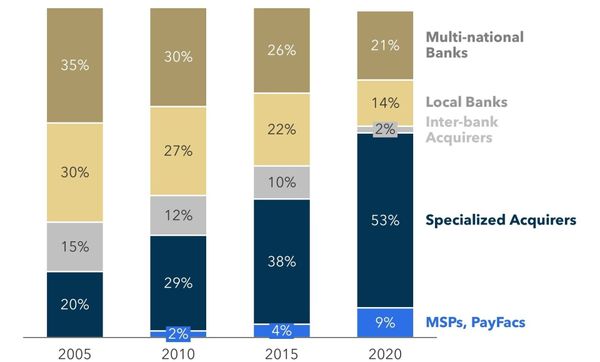

Much of the reduction in bank market shares in merchant acquiring (as shown in Figure 1) was driven by M&A: banks divesting ownership stakes in merchant payments assets, often via the formation of merchant acquiring alliances with processors. This trend started in the United States in the 1990’s and continued into the 2000’s. In Europe, this same trend started a bit later before accelerating in the 2000’s. In Figure 2, we highlight the timeline for select bank acquiring alliance formations and dissolutions in North America and Europe. Bank market share reductions in Europe were also driven by divestment of interbank processors/acquirers, an operating model which eroded over time as banks pursued their own strategies and were attracted by highly accretive exit multiples.

FIGURE 2: Select Bank Alliance Formations in North America and Europe and Divestments of Interbank Processors

Bank acquiring alliances have generally served their purpose in helping to create value for the respective stakeholders. Banks benefit from enhanced scale economies and capex avoidance while the acquiring specialists benefit from expanded scale and enhanced go-to-market channels. Digital commerce introduced certain pressures on the bank-alliance operating model, however. Digital commerce is more cross-border centric, whereas these bank alliances are often bound by domestic borders. Bank distribution is also somewhat less relevant in a digital world in which payments are integrated and distributed via SaaS (software as a service) providers.

Digital forces of disruption, which create both opportunities and threats for banks, are motivating some banks to pursue merchant payments with renewed vigor. Banks have good reason to be threatened by fintechs such as Square, PayPal, and Stripe, which are increasingly offering a broader array of financial services (working capital, cash services, virtual banking, etc.). Banks also have good reason to be excited about the potential to leverage their banking relationships and assets to compete in merchant solutions. Banks have for too-long under-delivered on the potential to integrate payments, cash management, and banking in a truly-valued-added way (fueled by rich data services).

In North America and Europe, we see a handful of banks which are effectively ‘doubling down’ on merchant payments by investing in significant acquisitions. Each of these five banks (JPM, ING, Santander, BofA, and US Bancorp), along with their key acquisitions, are described in Figure 3 below. We also observe several notable banking franchises (RBS, Deutsche Bank, and Citibank) that organically re-entered merchant payments with the help of operating partners.

FIGURE 3: Banks Investing and Exiting Merchant Payments

-960w.jpg?width=960&height=219&name=Figure+3c+(2)-960w.jpg)

Sources: Flagship Advisory Partners

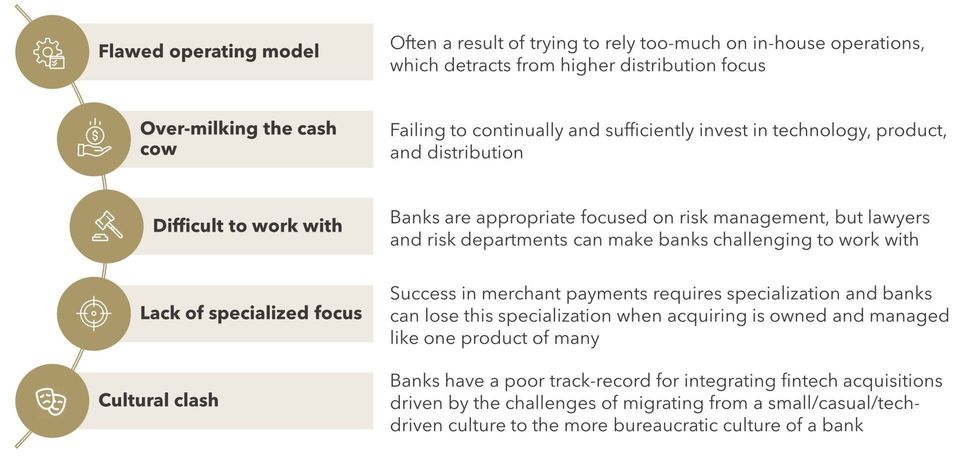

Banks with a leading brands and market positions should be focused on maximizing value creation from merchant payments. But there are also many pitfalls (described in Figure 4) for banks to avoid, particularly when M&A is involved.

FIGURE 4: Pitfalls for Banks in Merchant Payments

To operate successfully in merchant payments, banks must leverage strategic operating partners. Few banks have the wherewithal to compete with global specialists on their own. Choosing the right partners in the right areas of operations is critical. To sustain growth, banks must also maintain ongoing investment into product technology and distribution. Global competitors such as Adyen and Stripe never slow down, never stop investing into product technology and expanded distribution. Banks too often execute a major investment, only to later back-off from either product technology development or distribution spend. Growth requires a merchant services franchise to continually invest in product technology and sales & marketing (i.e., >25% of net revenue). Additionally, banks must learn to be easy to work with, with both customers and partners. Merchant payments are increasingly part of a broader SaaS ecosystem and inability to work within an ecosystem of partners will cripple long-term growth. Lastly, banks must develop and maintain a degree of specialization in merchant payments, ensuring that delivery on key success factors are not lost in the organization and go-to-market approach.

Recently, many leading global banking franchises are bucking the long-term trend of divestment and market share pullback by investing to grow in merchant payments. It will be interesting to see if these banks find and sustain success. Banks have many assets (particularly brand and potential for rich data services) which can help to drive success in merchant payments. Unfortunately, banks also have many pitfalls to avoid and too often we see these pitfalls hinder banks’ ability to drive sustained growth in merchant payments.

Please do not hesitate to contact Joel Van Arsdale at Joel@FlagshipAP.com with comments or questions.