*This is the first in a three-part series in which we examine the evolution of software-integrated payments and fintech. In this first part, we explore the evolutionary journey for software providers and the globalization of the SaaS-payments business model.

SaaS (Software as a Service) platforms and ISVs (Independent Software Vendors) continue to grow into their strategic potential in payments, which is only the beginning of a broader expansion into fintech. Integrated fintech, starting with payments, is unlocking new propositions and revenues for software providers. SaaS-fintech services are easier to use and distribute and increase the overall utility of the SaaS package. We expect best-in-class software providers to drive a significant portion of their ongoing revenue growth from payments and fintech as this business model wins market share globally.

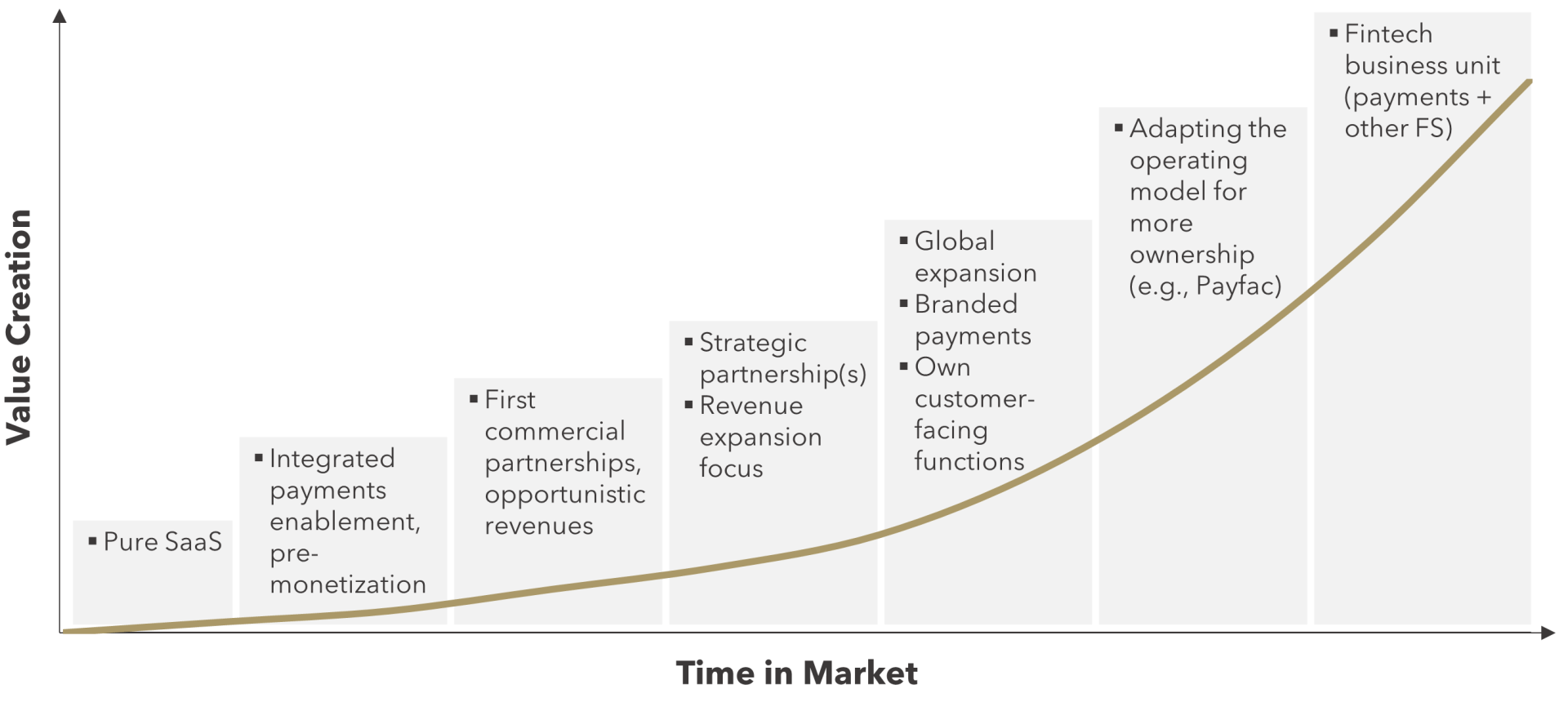

Software providers do not leap directly to sophistication and scale. As illustrated in Figure 1 below, SaaS/ISVs tend to follow a common evolutionary journey.

FIGURE 1: SaaS-payments Business Model Evolution

At the outset of this journey into payments, software providers are generally focused on basic utility, ensuring that software customers have access to payment services via plugins or similar passively supported offerings. As the strategy develops, the product and go-to-market strategies evolve, for example, owning the brand and customer interfaces. The more deeply that payments are imbedded into the software, the higher the value creation for customers. A well-integrated software platform becomes a one-stop-shop for merchants, with one single point of service, data, settlement, billing, and business insights.

SaaS-payments providers demonstrate low customer acquisition costs and low costs to serve which allows for significant monetization expansion with scale. Smaller ISVs generally earn less than 30% of payments gross margin while large-scale software platforms can earn more than 80% of the payments take rate.

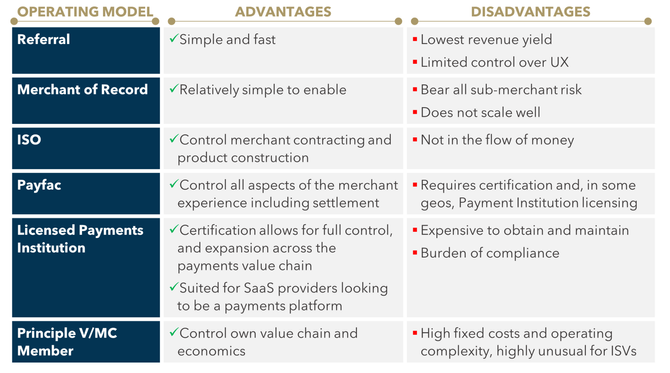

As SaaS-payments franchises grow, the operating model for payments can also evolve. As shown in Figure 2 below, software providers have a range of operating model alternatives, each with corresponding advantages and disadvantages.

FIGURE 2: Payments Operating Models, Pros and Cons

Establishing a simple referral relationship with a PSP is the easiest operating model; this is where ISVs generally begin. More sophisticated models such as registered ISO or payment facilitator, allow the software provider to assume greater control of the customer, though these models also increase risk, fixed costs, and operating burdens. The payfac model is not the right model for all ISVs and expanded ownership of the product does not necessitate being a payfac.

Payfacs generally white-label the services of a preferred strategic payment partner and more deeply integrate this partner to control and customize the customer onboarding, pricing and contracting, payment checkout, customer servicing, and settlement. Shopify and Airbnb, respectively, operate as a payment facilitator and a licensed e-money institution; models that allow them to control all the customer facing aspects of their integrated payments offering. Also given their global footprint, these payments franchises require dozens of people for technical development, product management, risk management, and payment operations.

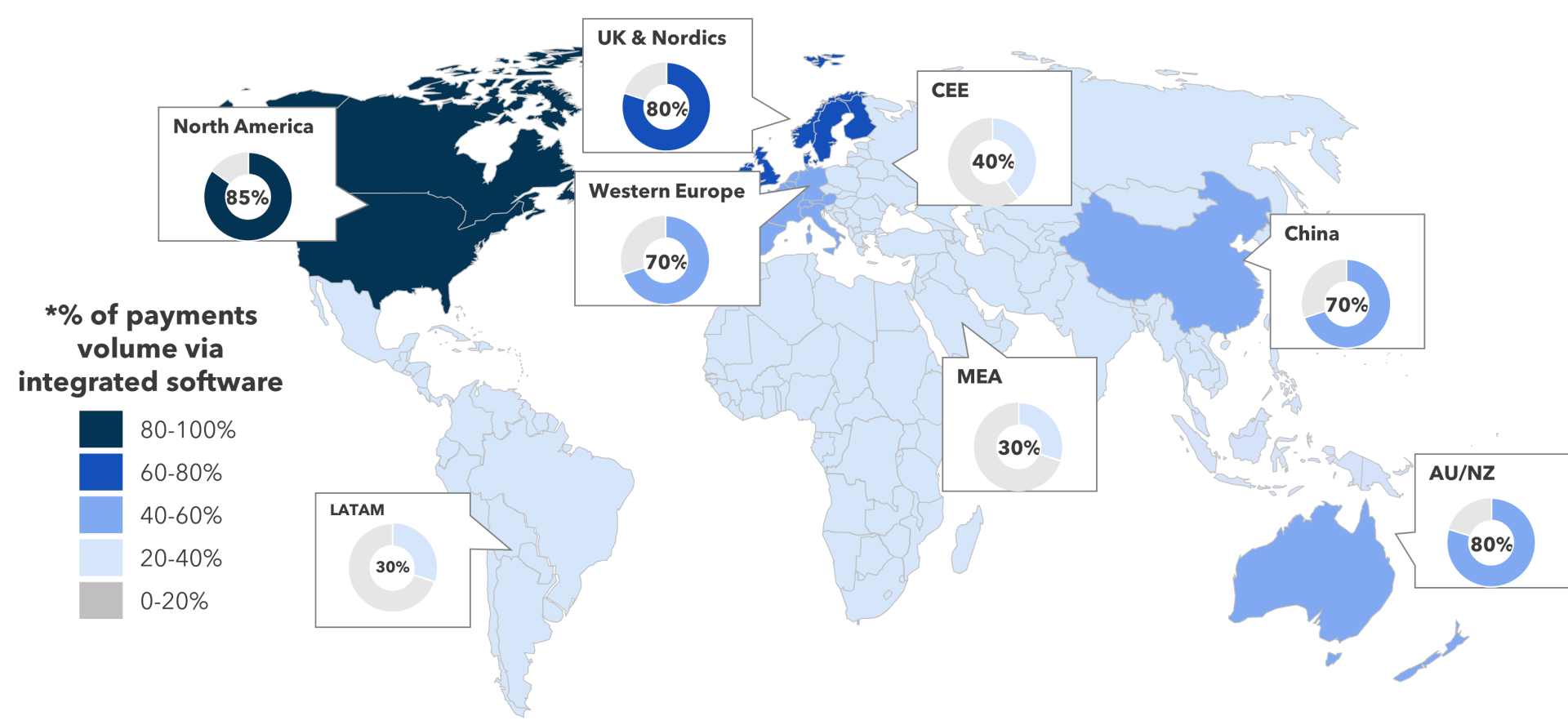

Geographic expansion becomes the growth priority for software providers that have an established payments strategy and operating model in their home market. Many of the largest SaaS-payments franchises emanate from North America and are now expanding globally. Global markets have ample white space to expand integrated payments. As shown in Figure 3, software integrated payments represent 40% or less of payments volumes in regions like LATAM, CEE, and MEA, compared to 85% of volume in North America.

FIGURE 3: Maturity of Integrated Payments Globally*

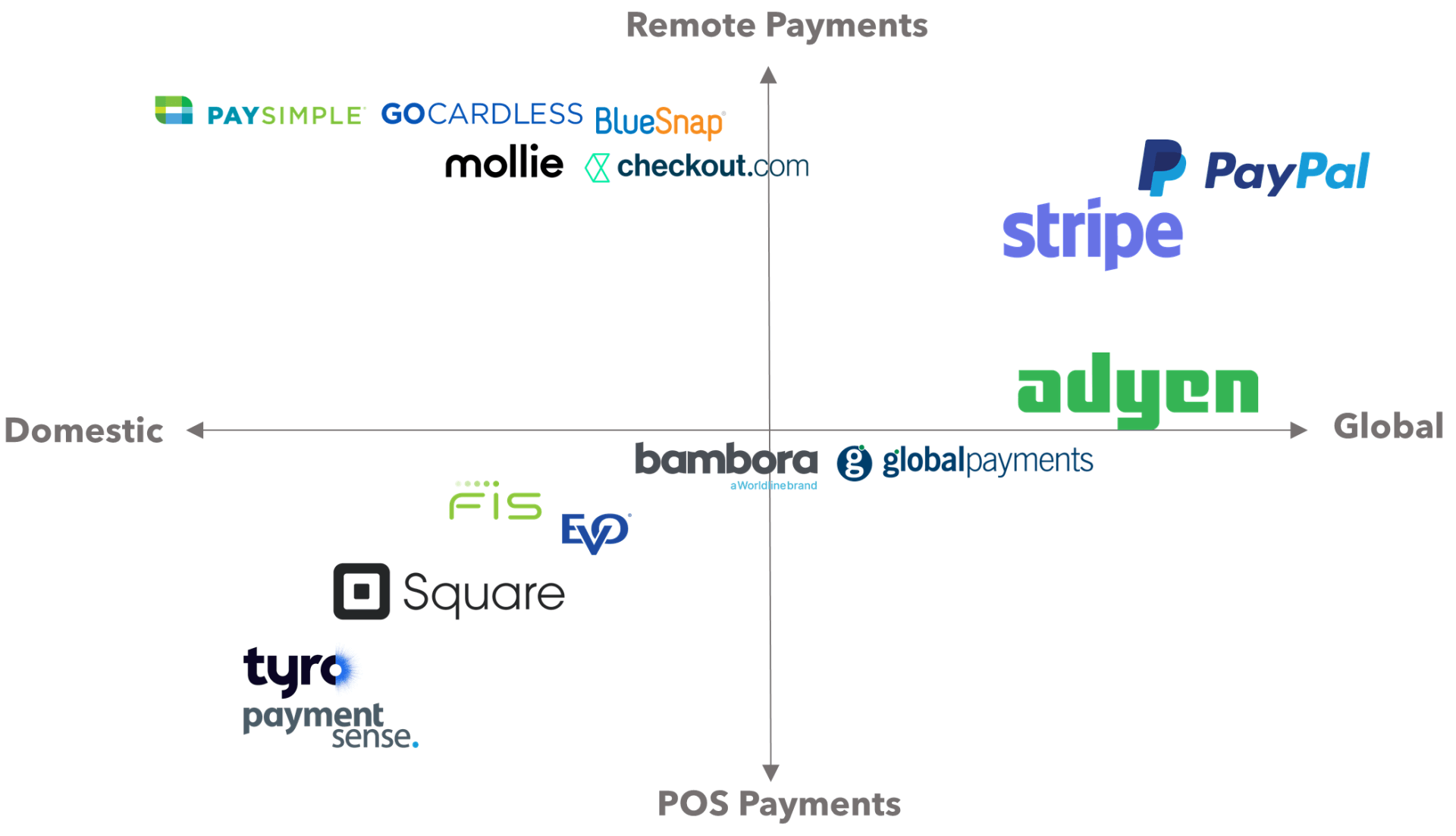

Globalization presents many challenges such as the need to support local, alternative payment methods as well as adaptations to various aspects of operations (languages, currencies, risk, compliance, etc.). Physical POS payment services are particularly challenging to expand globally. Globalization often requires an expanded network of payment partners, although market-leading payments partners are increasingly global (as well as increasingly omni-channel). SaaS-payments is not a one-size-fits-all operating model and we observe a broad community of potential payments partners with differing geographic and capability strengths, as shown in Figure 4 (note that this figure is not comprehensive as there are countless payments providers supporting ISVs globally).

FIGURE 4: Leading Payment Partners Enabling SaaS-payments

Stripe is a leading payments partner to SaaS platforms (with a concentration in e/m-commerce) and these platforms are helping to fuel Stripe’s meteoric growth. Stripe Connect provides unique ease-of-use with a robust feature-set and technical support that is specifically designed for platforms. PayPal also supports many leading global SaaS providers with its one-of-a-kind global footprint and massively scaled customer base (with the iZettle acquisition boosting omni-channel capabilities). Adyen is more recently focused on the SaaS segment, where they bring a powerful global footprint and omni-channel capability set. For POS-centric SaaS platforms, Square has a strong position in the U.S. as does PaymentSense in the U.K. and Tyro in Australia.

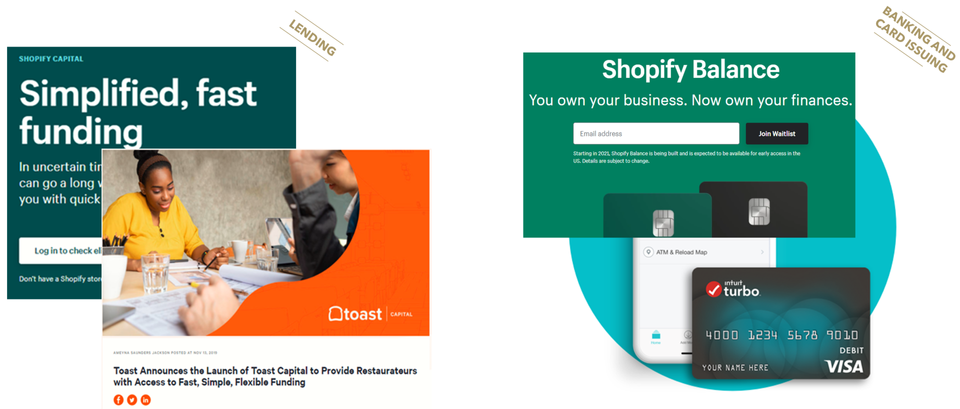

The potential for ongoing value creation for ISVs and SaaS platforms in fintech is massive. Most of the software providers that we support and observe are still in the early stages of evolving and scaling their strategic payments propositions. Furthermore, payments are only the first of many potential integrated fintech products. Leading SaaS platforms are now adding an array of financial services such as lending, card issuing, bank accounts, payroll, and cash management services (examples of such products are shown in Figure 5 below).

FIGURE 5: Selected Examples of Expansion Initiatives Beyond Payments

Fintech is a massive opportunity for software providers, and we expect financial services to be a primary growth driver in the SaaS market for years to come. Beyond the vast incremental revenue pool, integrated financial services also improve the feature set and user experience in the core software product. Optimizing the fintech opportunity is an evolutionary journey for software providers. Finding the right operating model, selecting the best-suited partner(s), enriching the integrated feature set and customer experience, and then globalizing the franchise are key milestones along this journey.

Please do not hesitate to contact Charlotte Al Usta Charlotte@FlagshipAP.com or Joel Van Arsdale at Joel@FlagshipAP.com with comments or questions.