In collaboration with Flagship Advisory Partners, TreviPay has released a new report, “Opportunities to Digitize B2B Commerce with Pay by Invoice and the Automation Flywheel”. This report examines how B2B Pay by Invoice and the automation flywheel can streamline accounts receivable and accounts payable workflows, improve cash flow, and reduce friction in B2B commerce. The report also includes an analysis of the top 50 retailers in the US and Europe with a maturity assessment of their corporate buyer programs, providing benchmarks for businesses investing in digital payment transformation.

From this report, you will learn about:

- Trends in 2026 and beyond

- Pain points across A/R and A/P

- Emerging expectations across industries

Download the full report here: B2B Buyer Programs Benchmark Report | Flagship x TreviPay

SELECT REPORT EXTRACTS

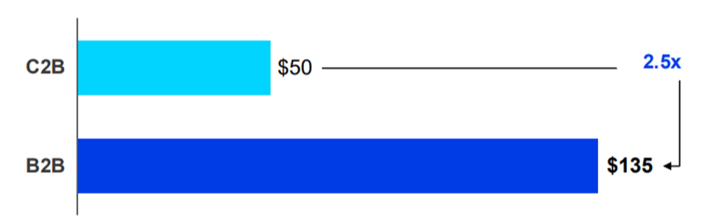

The B2B (business-to-business) payments market represents a $135 trillion opportunity, more than 2.5x larger than consumer commerce. Yet the market is weighed down by manual processes, fragmented workflows and costly inefficiencies.

1. Global C2B and B2B Market Size

(2023; est. in trillions of $; % of total)

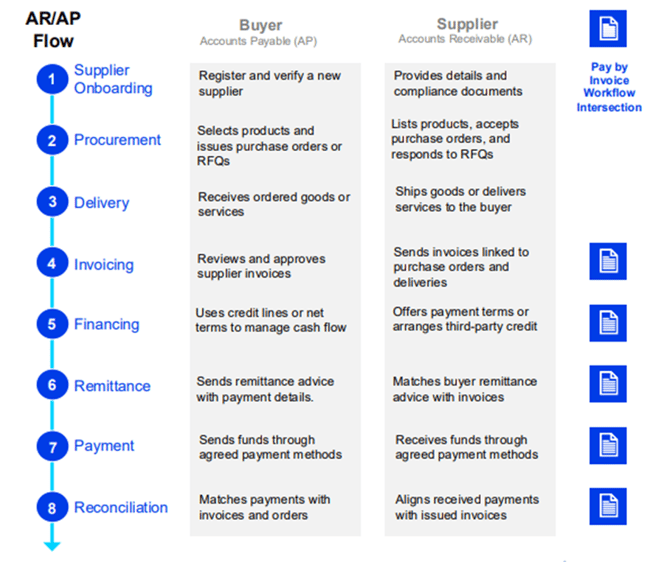

Fintechs are working to solve the many pain points of B2B commerce and the AR (accounts receivable, also referred to as order-to-cash) and AP (accounts payable, also referred to as source-to-settle, procure-to-pay) process, as discussed in our previous insight. However, we are still in the early days of adoption, with automation penetration still relatively low.

As businesses look to streamline these interactions, B2B Pay by Invoice (i.e. also referred to as net terms, trade credit) is one such tool to simplify the process for buyers and suppliers.

2. B2B Workflow and B2B Pay by Invoice

Source: Flagship Advisory Partners

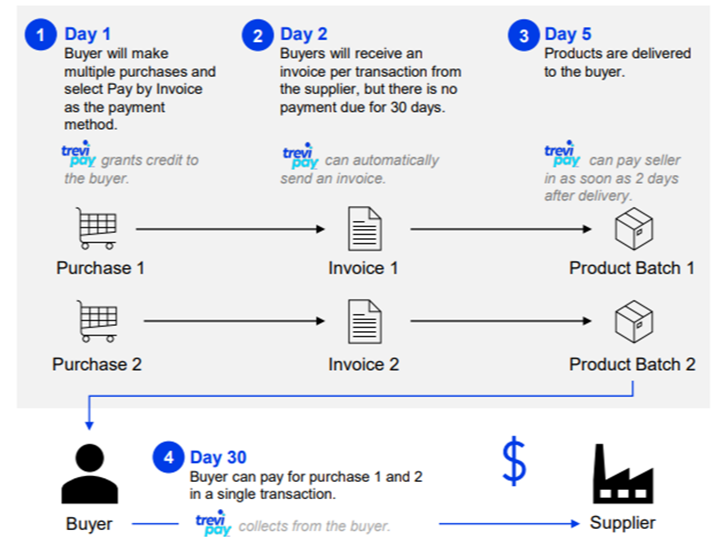

B2B Pay by Invoice (also known as net terms or trade credit) enables flexible financing between the buyer and supplier. This enables corporate buyers to have a line of credit for a certain number of days (most common is 30-day).

3. Illustrative Example of B2B Pay by Invoice (30 days)

(net 30 days example)

Source: Flagship Advisory Partners

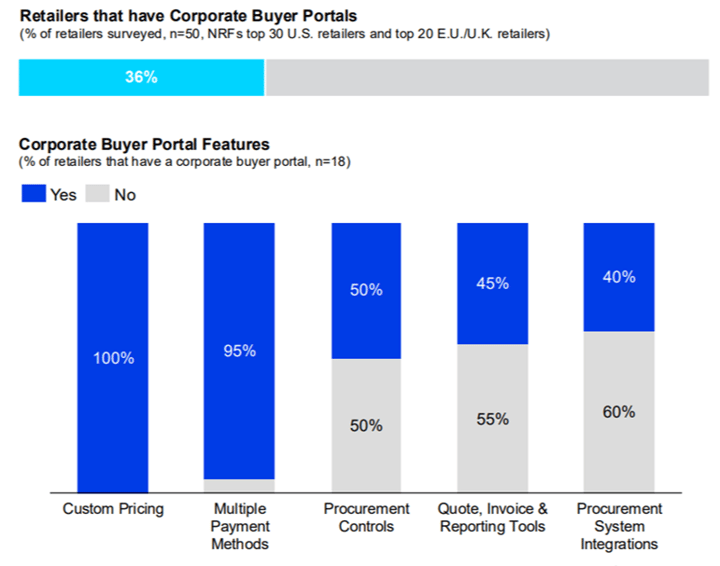

Observed Adoption of Corporate Buyer Programs in Global Retailers

Flagship utilized public data to analyze the NRF Top-30 U.S. retailers and Top-20 E.U./

U.K. retailers and assess their current offerings for corporate buyers. Corporate buyer

programs are becoming increasingly prevalent, though their maturity levels widely vary.

Some retailers have developed sophisticated, tailored solutions for business customers,

while others continue to treat corporate buyers much like consumers, overlooking the

demand for AR/AP workflows and the nuances that they introduce.

4. Global Corporate Buyer Portal Capabilities

Source: Flagship Advisory Partners

Buyer and Seller Benefits of B2B Pay by Invoice ( and the Automation Flywheel)

Across industries, the buyer value proposition is consistent: SMBs gain working capital flexibility by using net terms as a financing tool, while large enterprises consolidate many purchases into a single monthly payment, simplifying approvals and reconciliation. For sellers, credit-based purchasing lifts conversion and basket size while signaling trust that strengthens long-term relationships. Net-net: Pay by Invoice enables larger AOV, faster cash collection via lower DSO, less friction across the O2C (order-to-cash) cycle and tighter buyer–supplier bonds.

Corporate Buyer Program Maturity Assessment

Included in this report is a maturity assessment which breaks down how advanced each corporate buyer program is across onboarding, payment methods, procurement controls, reporting tools and integrations. It gives organizations a clear view of what it takes to build a strong B2B portal.

Download the report here to see how these top 50 retailers are maturing their B2B capabilities, what those trends mean for your buyer program and how Pay by Invoice can support a stronger, more efficient payment strategy.

Please do not hesitate to contact Rom Mascetti at Rom@Flagshipap.com with comments or questions.