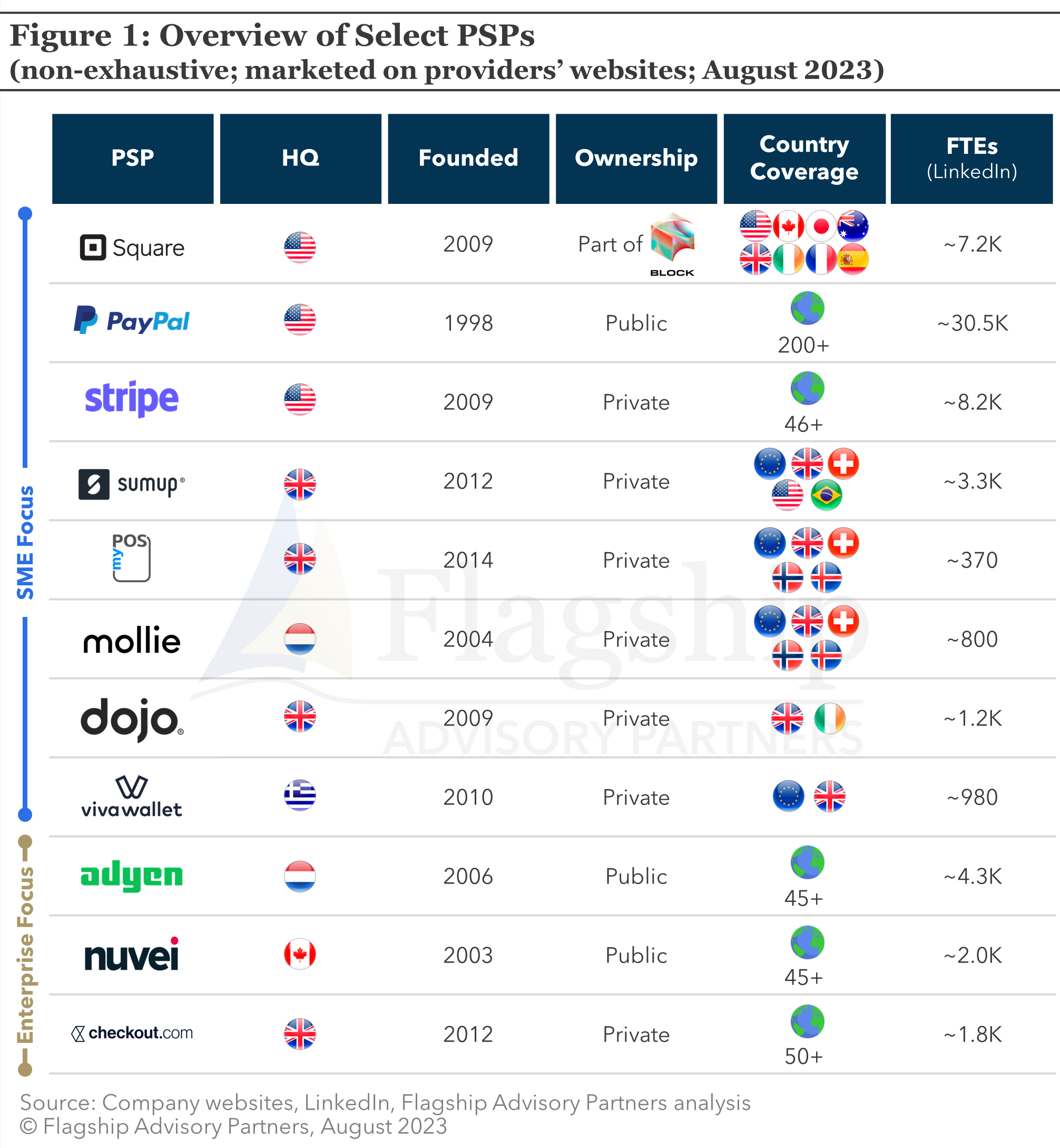

Over the past few years, several major payment service providers (PSPs) have expanded their product sets by introducing banking solutions such as cards, credit, and business accounts. In this article, we analyze the banking offerings of select PSPs across Europe and the U.S., listed in Figure 1.

Banking products present a natural cross-selling opportunity for merchant payment providers by helping them to differentiate themselves, strengthen their value proposition, and increase the stickiness of merchants.

Banking products present a natural cross-selling opportunity for merchant payment providers by helping them to differentiate themselves, strengthen their value proposition, and increase the stickiness of merchants.

Card issuing is often a space PSPs look to expand into due to attractive revenues earned from commercial card interchange fees and the relatively low operational complexity of introducing this offering (when leveraging vendors). Working capital lending is another area PSPs are increasingly expanding into, as there is naturally high demand from SMEs for lending, and a relative lack of supply by banks. When introducing a banking solution, some PSPs like Square (for issuing) partner with product specialists (i.e., Marqeta etc.) for faster go-to-market and lower complexity. Other providers like Adyen develop in-house capabilities and source their licenses to have full control over the product stack and user experience.

Regardless of the model chosen (partner vs. build), the development of a banking proposition comes with costs. For example, Stripe and Adyen have made a significant investment in building their banking proposition with little public evidence of reaching a meaningful scale thus far. Despite the lack of data and ability to fully assess the success of PSPs’ banking products, the number of payment providers expanding to banking for the past few years does tell us that there is a demand for such solutions and (presumably) attractive financial benefits.

What is clear is that any PSP that is considering introducing banking solutions should accurately pinpoint its proposition (product and geo focus), determine a precise distribution strategy, calculate the business case, and carefully choose its operating model (partner vs. build).

Key Observations: Card Issuing

Based on our observations on the current card products offered by select PSPs (Figure 2), we can summarize the following:

- Debit and prepaid cards are a staple banking product offered by PSPs across Europe and the U.S. that help merchants to access their accepted funds and manage business expenses.

- Only select PSPs in the U.S. offer credit cards (i.e., Square and PayPal).

- Virtual cards are still a nascent category, primarily addressed by enterprise-focused providers that offer their merchants a flexible way to pay suppliers and manage employee expenses.

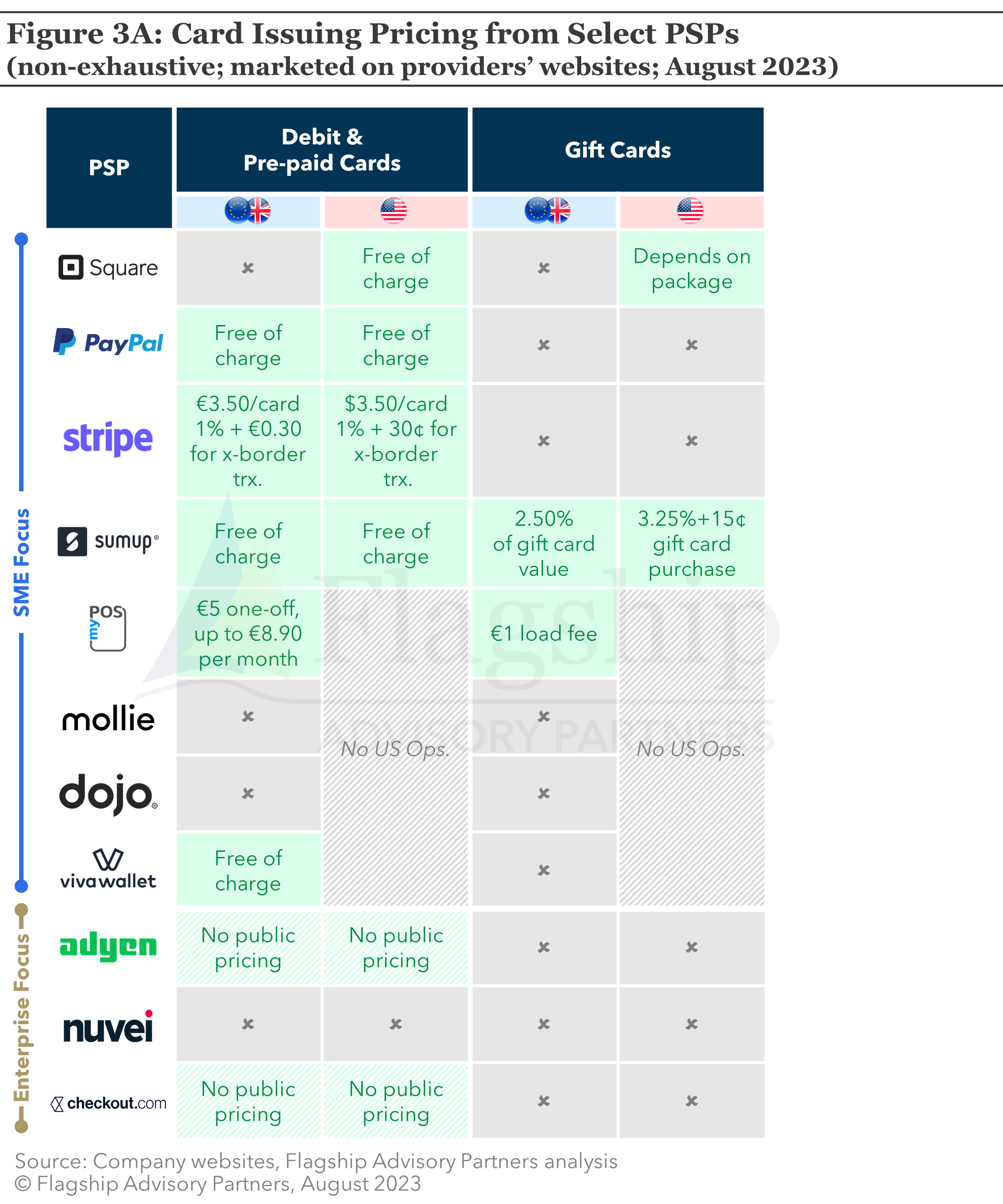

The pricing structure for card products varies across providers and card types. Based on available pricing information from select PSPs (Figures 3A & 3B), we can summarize the following:

The pricing structure for card products varies across providers and card types. Based on available pricing information from select PSPs (Figures 3A & 3B), we can summarize the following:

- Debit & prepaid cards: In Europe and the U.S., most providers offer debit and prepaid cards free of charge as value-added services to their merchants, except for a few providers (i.e., Stripe and myPOS), which charge a fee per card.

- Credit cards: A few providers offering credit cards often charge zero fees, though some set specific eligibility requirements.

- Gift cards: The pricing structure for gift cards varies between those that charge a fee per card (i.e., Square), while others apply a % fee of the gift card value and additional fees per purchase (i.e., SumUp).

Key Observations on Working Capital Offering

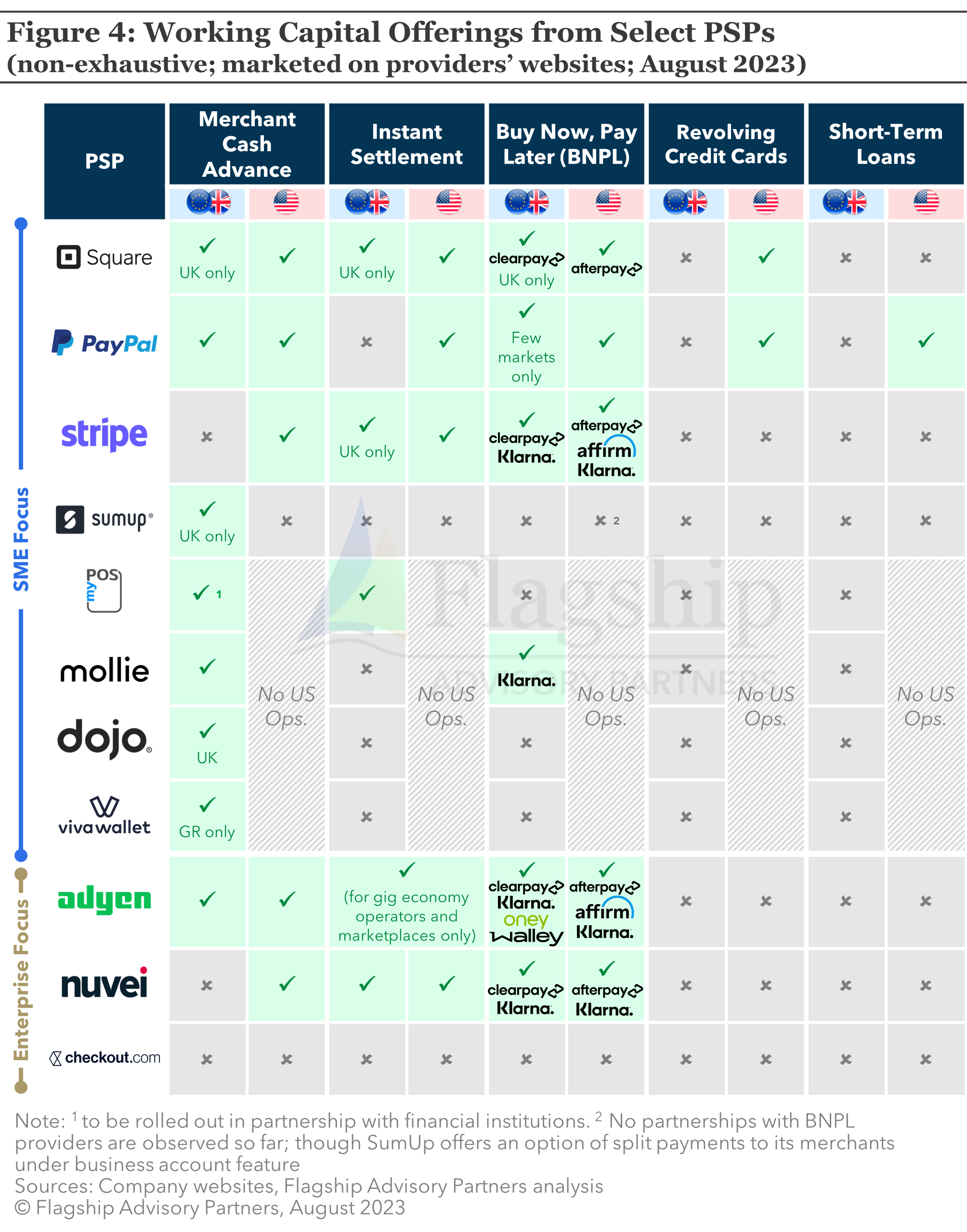

Based on our observations on the working capital products offered by select PSPs (Figure 4), we can summarize the following:

- Merchant cash advance and instant settlement are often offered as a value-added service as these products are highly demanded by merchants and relatively easily monetized.

- Only a few PSPs offer revolving credit cards and short-term loans, likely due to increased credit risk and balance sheet requirements.

- SME-focused PSPs operating in retail verticals tend to incorporate Buy Now Pay Later (BNPL) solutions via partnerships with third-party providers to offer more flexible payment methods for end-users.

The pricing structure for working capital solutions is mostly consistent across geographies amongst the PSPs who offer these value-added services to merchants. Based on available pricing information from select PSPs (Figures 5A & 5B), we can summarize the following:

- Merchant cash advance: In both Europe and the U.S., most providers charge a flat fee as a % of daily sales.

- Instant settlement: Fee structures vary between providers that pair instant settlement with a business account at no additional charge (i.e., myPOS in Europe) and providers that charge a fee per transaction (i.e., Square and Stripe in Europe and the U.S.).

- BNPL: The fee structure for BNPL solutions is inconsistent across PSPs primarily due to partnerships with third-party providers.

Please do not hesitate to contact Erik Howell at Erik@FlagshipAP.com with comments or questions.