Image Credit: Unzer.com

Introduction

For the better part of two decades, from c. 1995 to 2015, private equity investments into merchant payments were practically failproof. Deal after deal delivered solid, if not exceptional returns buoyed by strong fundamental electronic payment growth tailwinds, and a business model with naturally strong scale economies. By the late 2010’s however, valuations began to outpace fundamentals and in recent years, we observe an increasing rate of unsuccessful private equity investments in merchant payments. Private equity-backed, payment service provider Unzer is one such failed investment that we analyze herein.

KKR acquired a majority stake in Unzer from AnaCap for $668 million in August 2019, rumored to be backed by a loan of c.$230 million. After less than four years into the deal, the private equity firm announced plans to hand-over its majority stake in Unzer to its creditors including Alcentra Asset Management, Goldman Sachs Asset Management, and Partners Group. The agreement, which is still pending final regulatory approval, was made after the payment service provider failed to meet its financial covenants earlier this year. The current owner would retain a minority stake in Unzer. Lenders are expected to inject a “significant amount” of fresh equity. Discussions among the Management team, the private equity firm, and debt investors had already been going on since May 2023.

About Unzer

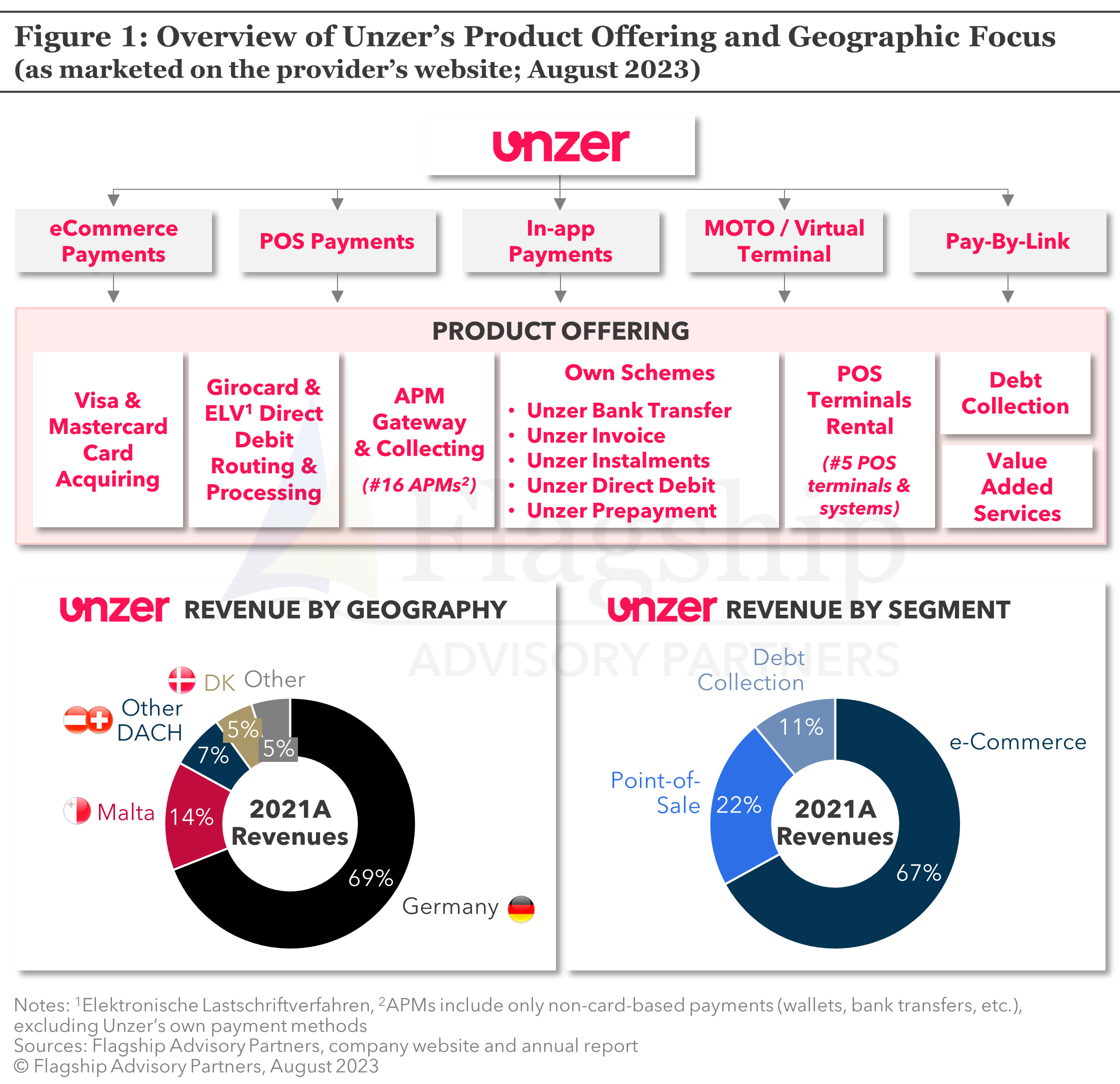

Founded in 2003, Unzer (formerly known as Heidelpay) is a Germany-headquartered, multi-channel, full-stack payment service provider, serving over 70,000 merchants. As shown in Figure 1, most of the group’s revenues in 2021 were generated from e-commerce payments. The majority of the revenues emanate from Germany, yet the payment service provider also generated c.14% of its revenues from crypto-related activities out of Malta through its Danish subsidiary and acquirer, Clearhaus.

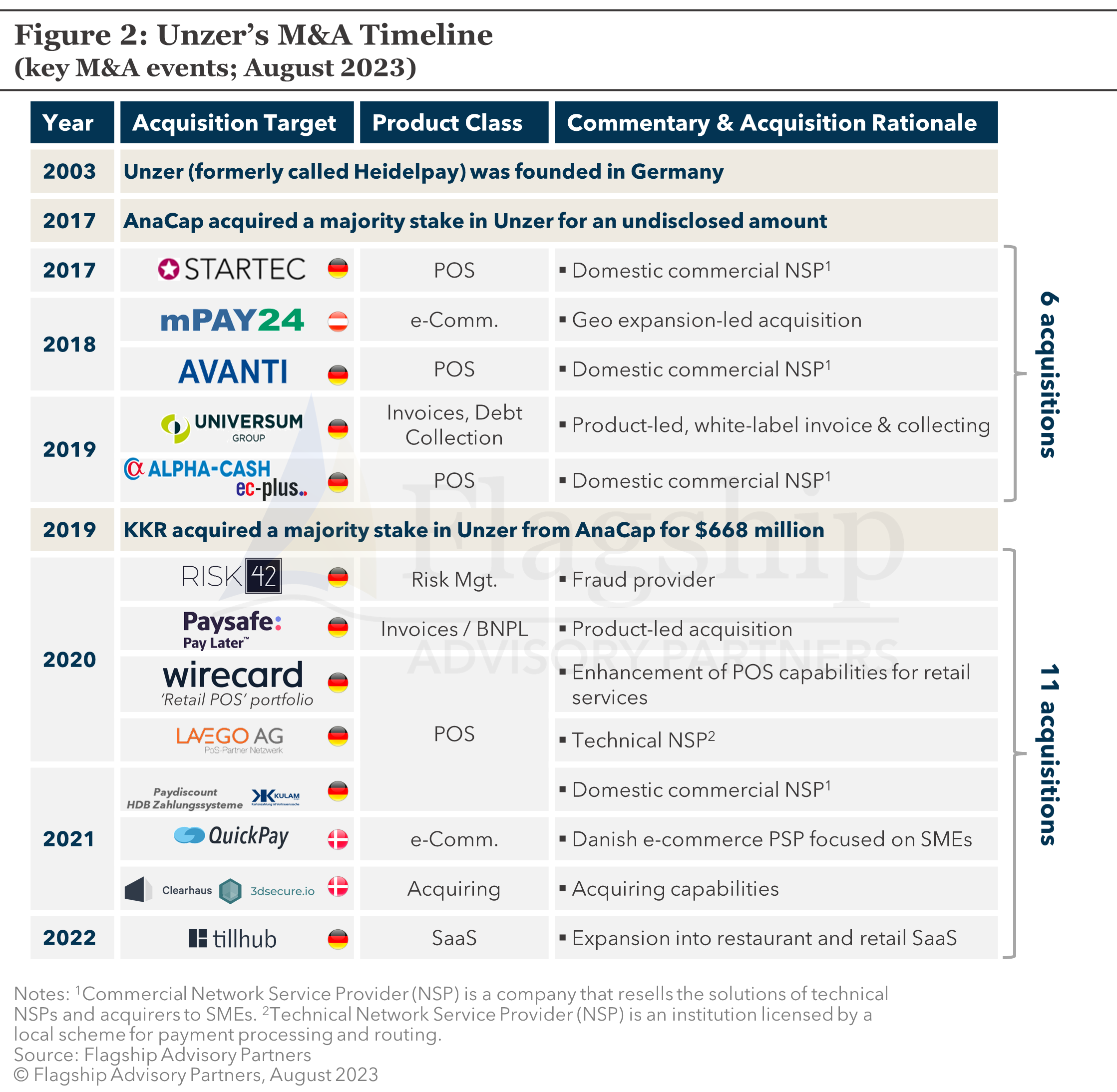

The group has been highly acquisitive ever since being under the private equity umbrella. As illustrated in Figure 2, Unzer bought over a dozen companies since 2017, expanding its geographic footprint, product, and distribution capabilities. Additional debt was injected into Unzer to partially finance the add-ons.

The group has been highly acquisitive ever since being under the private equity umbrella. As illustrated in Figure 2, Unzer bought over a dozen companies since 2017, expanding its geographic footprint, product, and distribution capabilities. Additional debt was injected into Unzer to partially finance the add-ons.

Under Regulatory Lens

Under Regulatory Lens

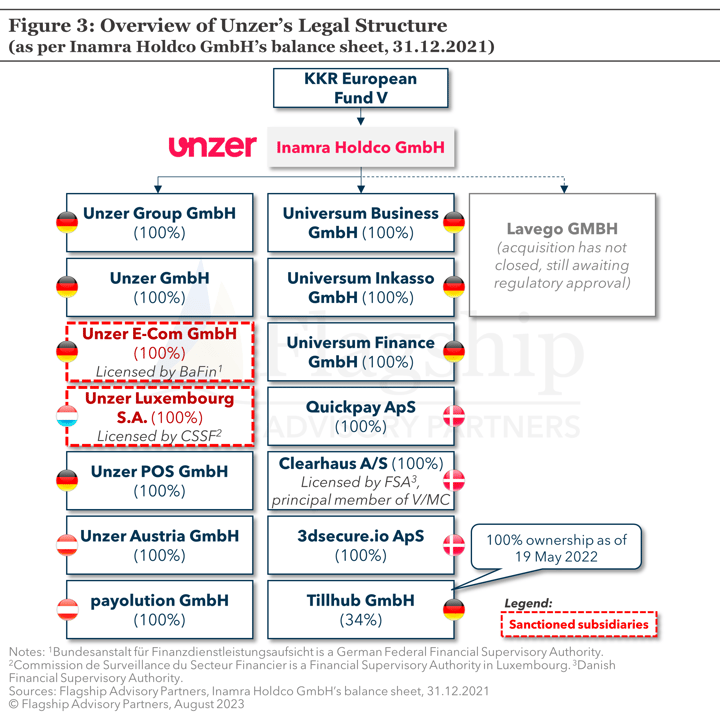

Unzer’s outlook started to sour on 18 June 2021 when the German Federal Financial Supervisory Authority known as BaFin informed Unzer’s German subsidiary (Unzer E-Com GmbH) that it had to undergo a special regulatory audit due to strong suspicions of lack of oversight of anti-money laundering between 2018 and 2021.

The audit, completed in July 2022, revealed “a large number of deficiencies” in onboarding processes, compliance, and money laundering prevention. The German regulator ordered Unzer to take immediate action, banned the subsidiary from onboarding new customers, and appointed a special representative to monitor the implementation of remediation measures. Additionally, Unzer was fined €350,000 by the BaFin on 7 September 2022. As of today, it is still unclear if the ban on new customer onboarding has been lifted by the German regulator.

Following the failure to properly regulate Wirecard, the German BaFin has exercised a high degree of scrutiny on payment service providers and fintechs. Yet Unzer was the only payment service provider that required a special audit, received a ban on onboarding new customers, and was fined.

BaFin was not the only regulator that scrutinized Unzer. Shortly after the completion of BaFin’s audit, on 12 August 2022 the financial regulator in Luxembourg (CSSF) imposed a fine of €145,000 against Unzer. The CSSF identified similar shortcomings and cited Unzer "for non-compliance with certain professional obligations relating to the fight against money laundering and the financing of terrorism" during an on-site inspection carried out in 2020 and 2021.

Unzer’s Financial Performance

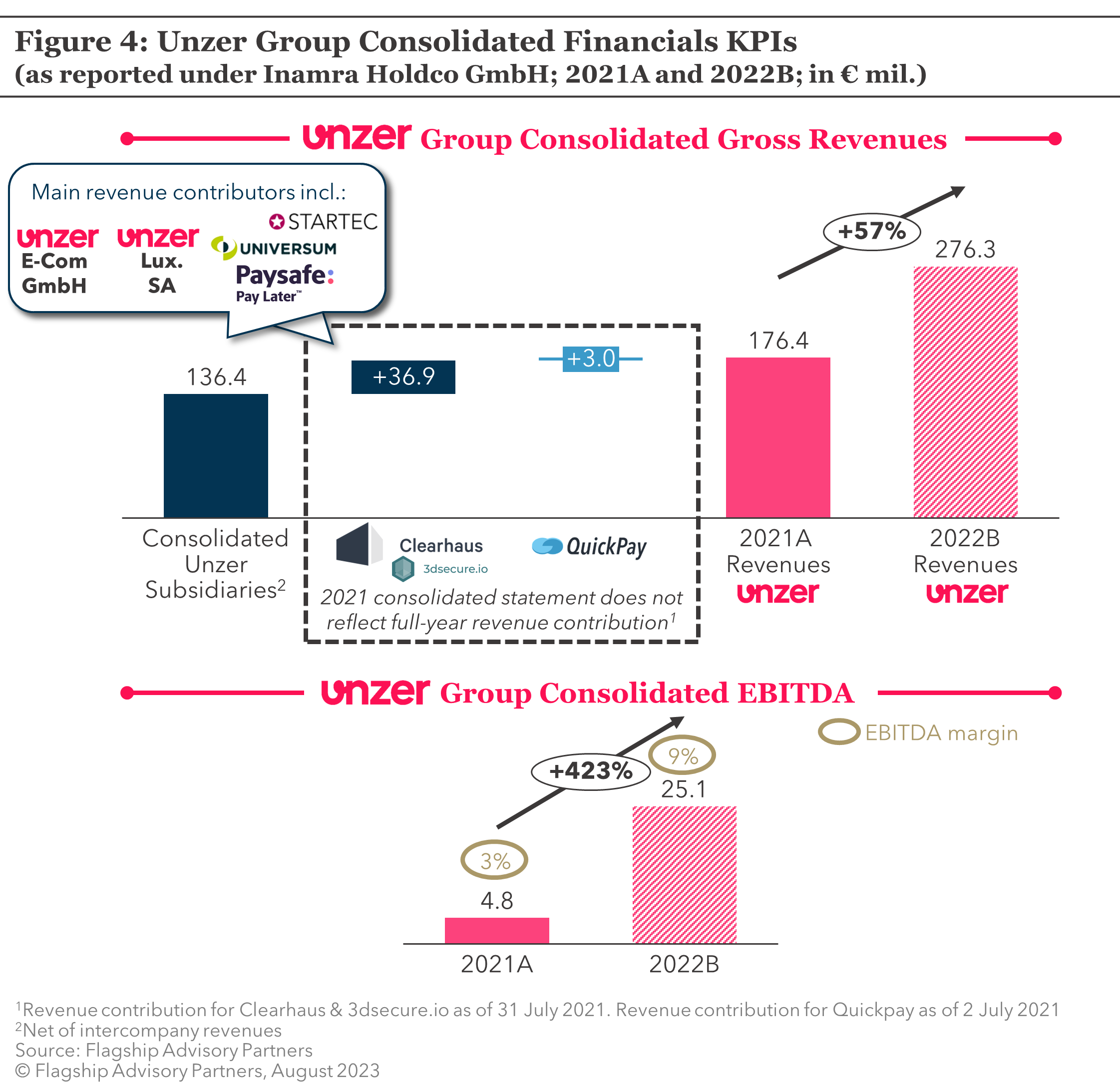

Unzer released full-year consolidated group figures for the first time in 2021 and reported revenues of €176.4 million in 2021, budgeted to reach €276.3 million in 2022 (Figure 4). The group generated a consolidated EBITDA of €4.8 million in 2021. It is worth noting that the consolidated financials do not reflect the full-year revenue and EBITDA contribution of Unzer’s 2021 acquisitions, namely Clearhaus, 3dsecure.io, and Quickpay.

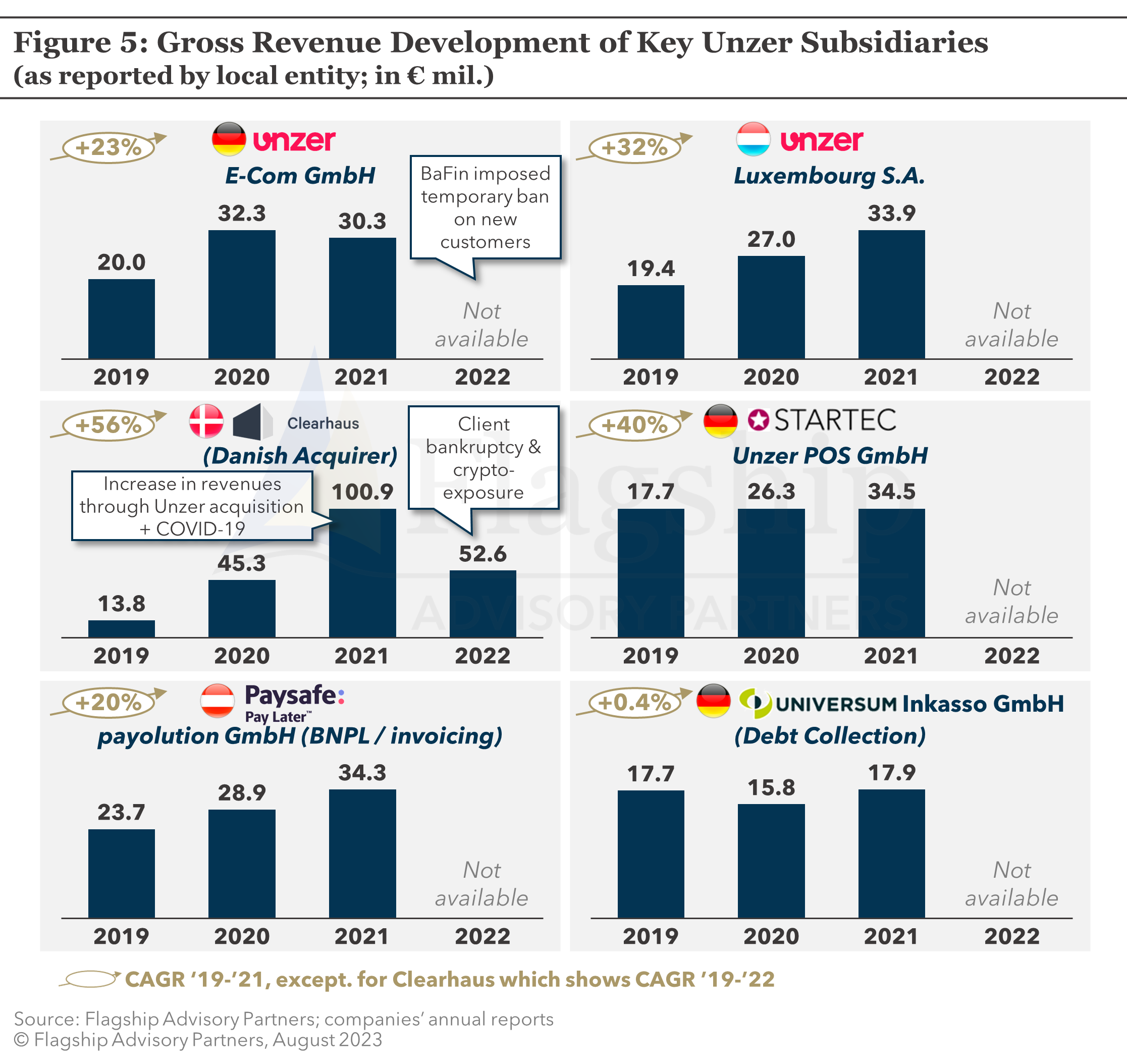

Six subsidiaries have been driving most of Unzer’s revenues, as shown in Figure 5. Their historical top-line performances up until 2021 are relatively strong. Financials for 2022 are not yet available, except for the Danish subsidiary, Clearhaus. The acquirer’s gross revenues decreased by 48% in 2022 vs. 2021, primarily due to the bankruptcy of one of its merchants. Additionally, Clearhaus has had strong exposure to crypto. Although Clearhaus decided to reduce the number of crypto merchants in its portfolio in 2022, the performance of its remaining crypto merchants was significantly impacted by market downturn.

Key Lessons Learned & Conclusions

Key Lessons Learned & Conclusions

The investment in Unzer reinforces a number of lessons learned for investors in merchant payments:

- Acquisition valuations must be reasonable, leaving room for equity returns as organic topline growth slows. The days of easy growth are over, and therefore investors must pay a fair valuation in order to generate equity returns. Even market leaders Stripe and Adyen have learned this lesson given steep declines in market value.

- Conglomerations of many small merchant PSPs acquired at full valuation is a challenging playbook for generating equity returns. Conglomerates of smaller PSPs too often underestimate the investment and hard work required to extract cost synergies (for example, full consolidation of technology, infrastructure, and business administration). A similar lesson can be gleaned from the steep fall in market valuation experienced by PayU prior to its recently announced acquisition by Rapyd.

- Compliance matters. Compliance in merchant payments is a far lesser burden than consumer lending, for example, but it remains an absolute business requirement in an environment of heightened regulatory scrutiny. Particularly on the back of Wirecard’s many failures, Unzer jeopardized its business with inadequate compliance controls.

- Risk-seeking in merchant payments often does not end well. Certainly, you can earn outsized margins in merchant payments by taking on reputational risk, excessive chargeback risk, and credit risk, but such risks often come back to bite you. ING’s failed investment in PayVision was also doomed by excessive risk combined with lax compliance controls.

Please do not hesitate to contact Joel Van Arsdale at Joel@FlagshipAP.com, Charlotte Al USta at Charlotte@FlagshipAP.com, or Aigerim Assembayeva at Aigerim@FlagshipAP.com with comments or questions.