The proposed (but not yet voted on) U.S. Credit Card Competition Act of 2023 continues to make headlines, most recently on the back of The Wall Street Journal’s report that Visa and Mastercard will raise card fees in October 2023 and April 2024 and Congress’ visceral reaction to the news.

According to Senator Dick Durbin’s website, “The Credit Card Competition Act of 2023 would enhance credit card competition and choice in order to reduce excessive credit card fees.” But will the proposed legislation have the desired effect on the U.S. payments landscape? In this article, we take a closer look at the proposed legislation, the current card network landscape, and provide our view on potential outcomes.

What is the Credit Card Competition Act of 2023?

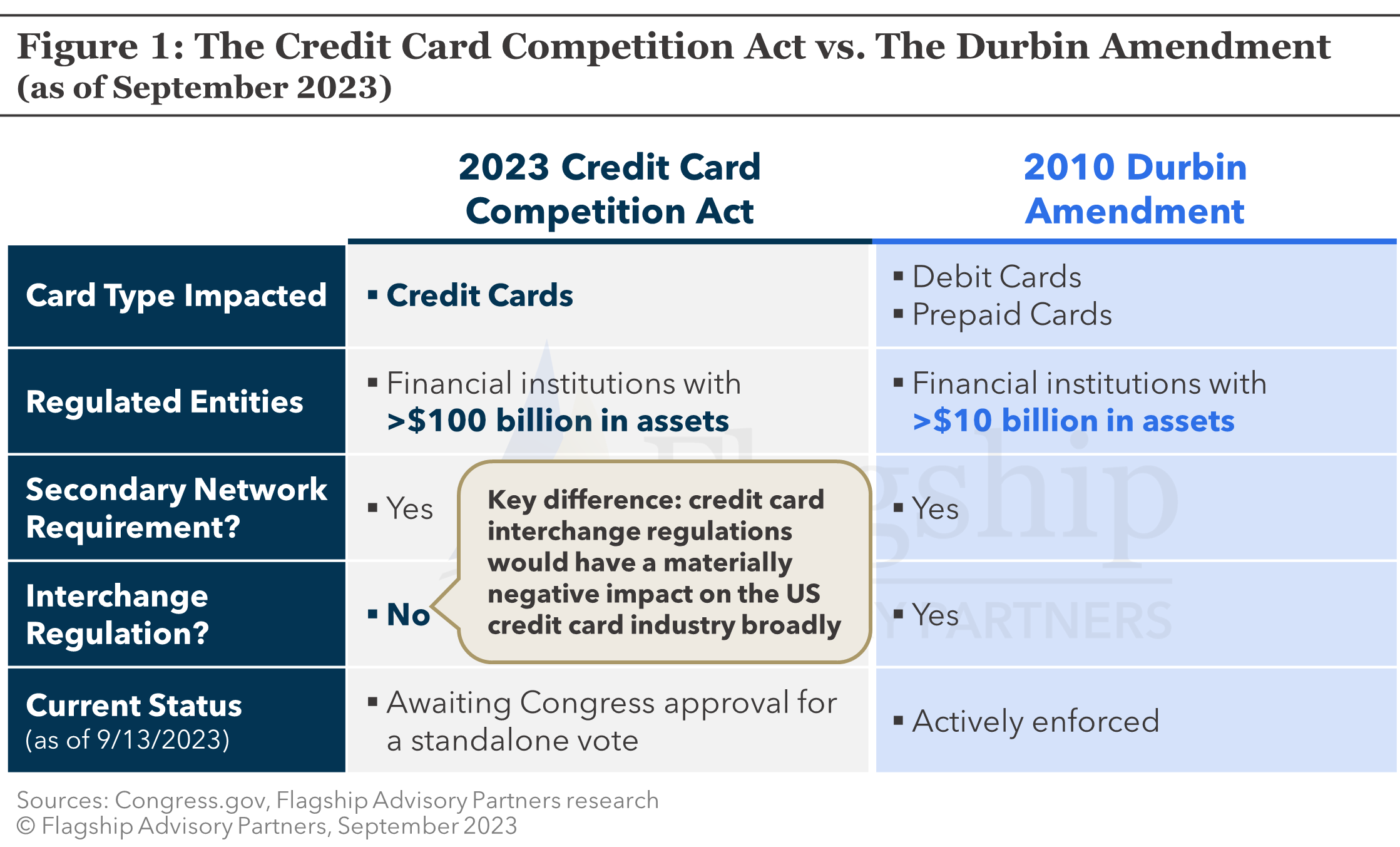

In Figure 1 we compare the Credit Card Competition Act of 2023 (‘CCCA’) to its predecessor bill, the Durbin Amendment, which was passed as part of the Dodd-Frank Reform and Consumer Protection Act in 2010. The Durbin Amendment requires issuers to have two unaffiliated networks on debit and prepaid cards, and caps interchange at banks with over $10 billion in assets. The Durbin Amendment successfully reduced the cost of debit card acceptance for merchants, largely due to the existing alternative debit schemes in the U.S. (more on this later).

The CCCA is seen as the reincarnation of the Durbin Amendment but for credit cards. Specifically, the CCCA stipulates that issuing banks with assets over $100 billion (of which there are approximately 30 in the U.S.) are required to offer a secondary network to process credit card transactions (beyond Visa and Mastercard). The CCCA is still held up in Congress after failing to be added as an amendment to the National Defense Authorization Act for the second year in a row. There is no scheduled vote for the CCCA, but sponsors are still hopeful the legislation will get a standalone vote before Congress adjourns at the end of 2023.

The key difference between the CCCA and the Durbin Amendment is that the CCCA is not trying to regulate interchange. Interchange regulations would have a materially negative impact on the U.S. credit card industry broadly, as we witnessed in Europe. The impact would be exacerbated by U.S. issuers' reliance on rewards to drive usage which are funded through interchange. This is an important distinction as we describe the current state of affairs and our view on the impact of the CCCA.

Current State of Affairs in the U.S.

The U.S. consumer payments market is largely card-driven, with more than half of domestic transaction volumes come from credit or debit cards (Worldpay from FIS 2023 Global Payments Report). According to a recent report from The Wall Street Journal, Visa and Mastercard (‘V/MC’) were planning to increase interchange and scheme fees this fall and next year. On the heels of this news, the sponsors of the CCCA have ramped up their push for the passing of the bill and have called for V/MC to withdraw any plans to increase their fees. Visa responded to the report in an email statement, explaining that it hasn’t notably increased fees and has cut fees for some businesses. Mastercard said that it is not increasing interchange or network fees associated with processing transactions but will increase ‘authorization optimizer service’ fees.

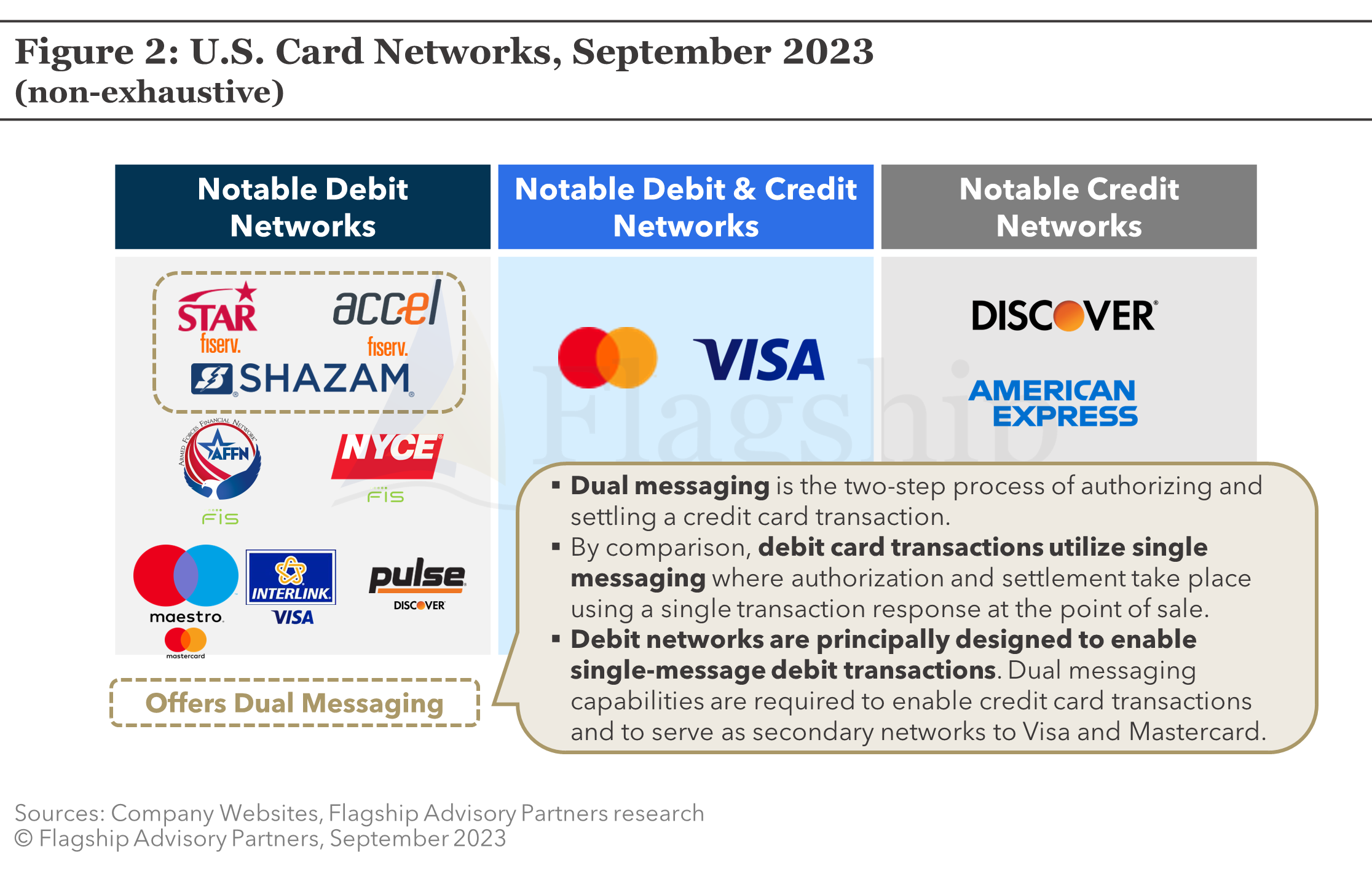

Potential V/MC rate increases are exactly what the CCCA attempts to mitigate for credit cards. To do so, alternative credit card networks are required. Figure 2 illustrates the various credit and debit networks in the U.S.

American Express (‘AmEx’) and Discover are the only other standalone U.S. credit networks. Some domestic U.S. debit networks (i.e., Star, Accel, Shazam) offer dual messaging, a core requirement for credit card transaction processing, versus single messaging which is the basis for debit and prepaid card processing. But how likely are these networks to compete for Visa and Mastercard volumes, and how will it impact merchant acceptance fees? We discuss this matter in the following sections.

Likely Outcome #1: Little Impact on SMB Merchant Acceptance Fees

The CCCA can only be effective if other networks make themselves interoperable with V/MC. The likelihood of AmEx and Discover investing to support V/MC transactions and win business seems low, as investing the resources to act as “secondary” options to V/MC may not be worth the cost and/or effort.

Despite some being dual messaging enabled, secondary debit networks are not interoperable with V/MC because of the lack of standardized messaging in the U.S., and, unlike Europe, there is no mandate for interoperability (although notably in Europe, despite an interoperability mandate, neither Visa nor Mastercard process each other’s transactions as there is no commercial driver to do so). The technical requirements for these secondary debit networks or any new entrants into the market would require substantial investment and potentially many years to launch.

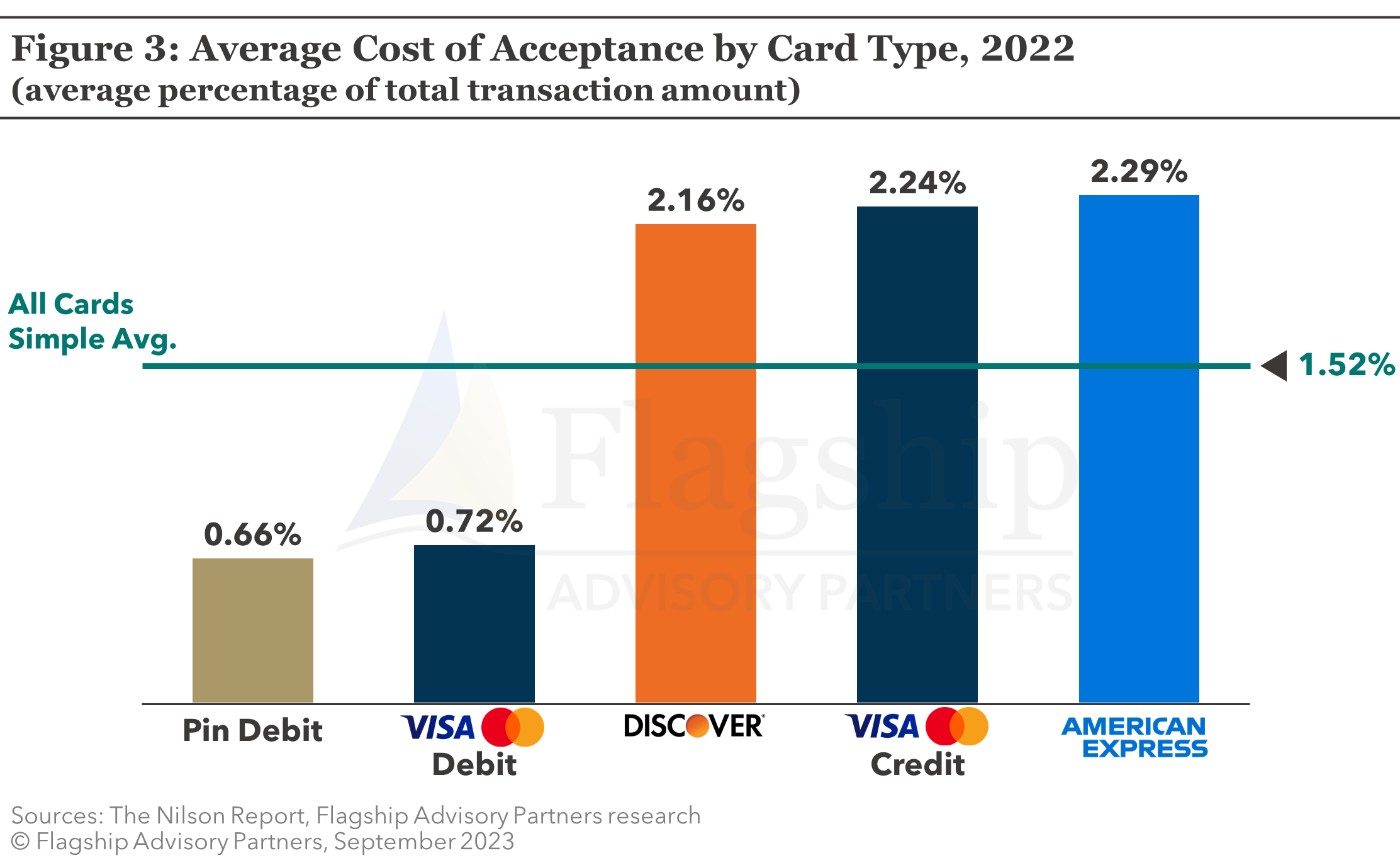

Even if both AmEx and Discover decided to invest, it would not have a material effect on merchant acceptance costs. As illustrated in Figure 3, AmEx’s average cost of acceptance is more expensive than V/MC, while Discover’s is slightly lower but not materially different.

This is because there is a fundamental difference between “networks” for routing and “networks” for interchange. In other words, as long as a Visa card is run as a “credit” transaction at the POS, the transaction still accrues Visa interchange fees from the card’s issuing bank which make up c.70% of card acceptance costs in the US (we further discuss the high cost of US payments here).

Likely Outcome #2: Enterprise Merchants Uncover New Cost-Saving Tactics

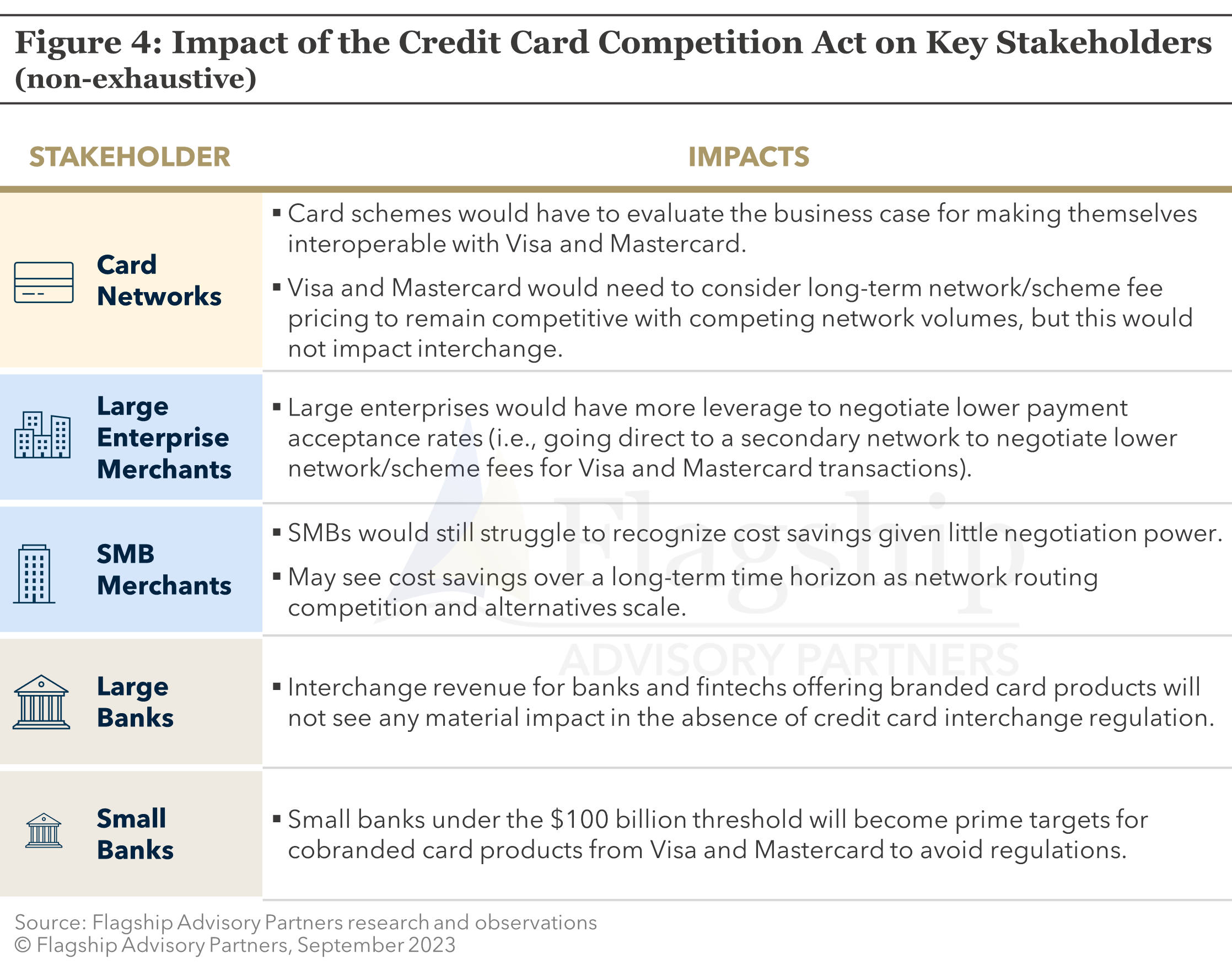

While the CCCA will have little (if any) impact on SMB merchant acceptance fees in the near future, the more obvious opportunity for cost savings sits with large enterprise merchants. Companies like Amazon, Walmart, and other mega merchants could negotiate custom routing deals with secondary networks (e.g., Discover/Pulse) which, given their market weighting, could shift portfolio average acceptance costs.

Future Outlook

We summarize our view on the likely outcomes in Figure 4. Even if the legislation is passed, we would not see material impacts on interchange revenue or merchant payment acceptance costs for multiple years. In the long term, in the absence of interchange regulation, the U.S. credit card industry should continue along its current trajectory, with an emphasis on credit card rewards funded by issuer interchange.

On the card issuing side, future secondary networks will need to compete to win business from the issuers, which could equally drive interchange rates up close to or level with that of V/MC. Stakeholders should continue monitoring the CCCA voting situation as it is only the first domino in a long string of events that would impact the U.S. payments ecosystem.

Please do not hesitate to contact Erik Howell at Erik@FlagshipAP.com or Rom Mascetti at Rom@FlagshipAP.com with comments or questions.