FreePik

Perspective on Key Events

Perspective on Key Events

Rom Mascetti and Ben Brown • 27 March, 2024

General Commentary & Highlights

- Visa and Mastercard agreed to reduce credit card interchange fees and change some rules as part of a proposed antitrust settlement with U.S. merchants that could conclude 19 years of litigation and negotiation if approved.

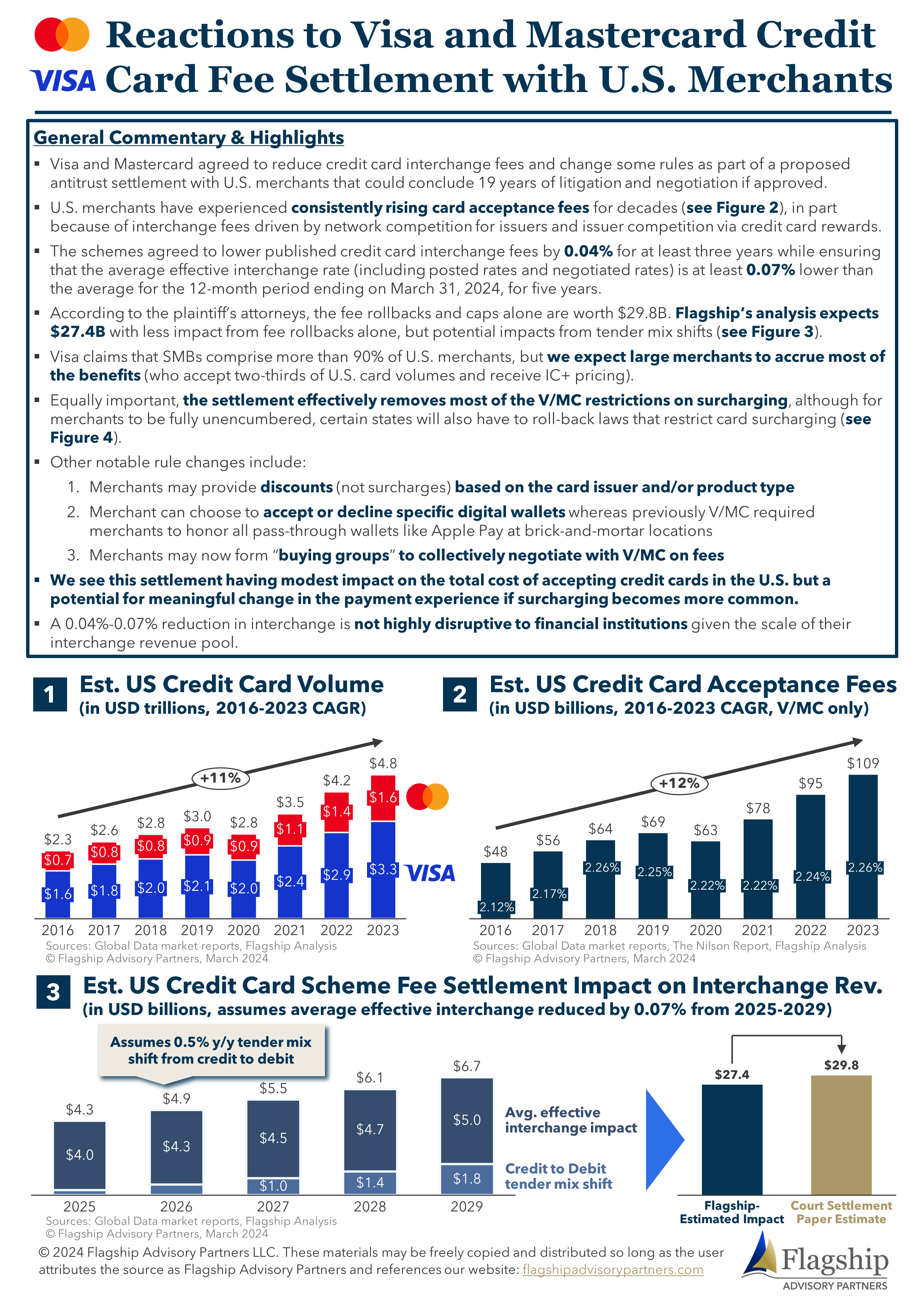

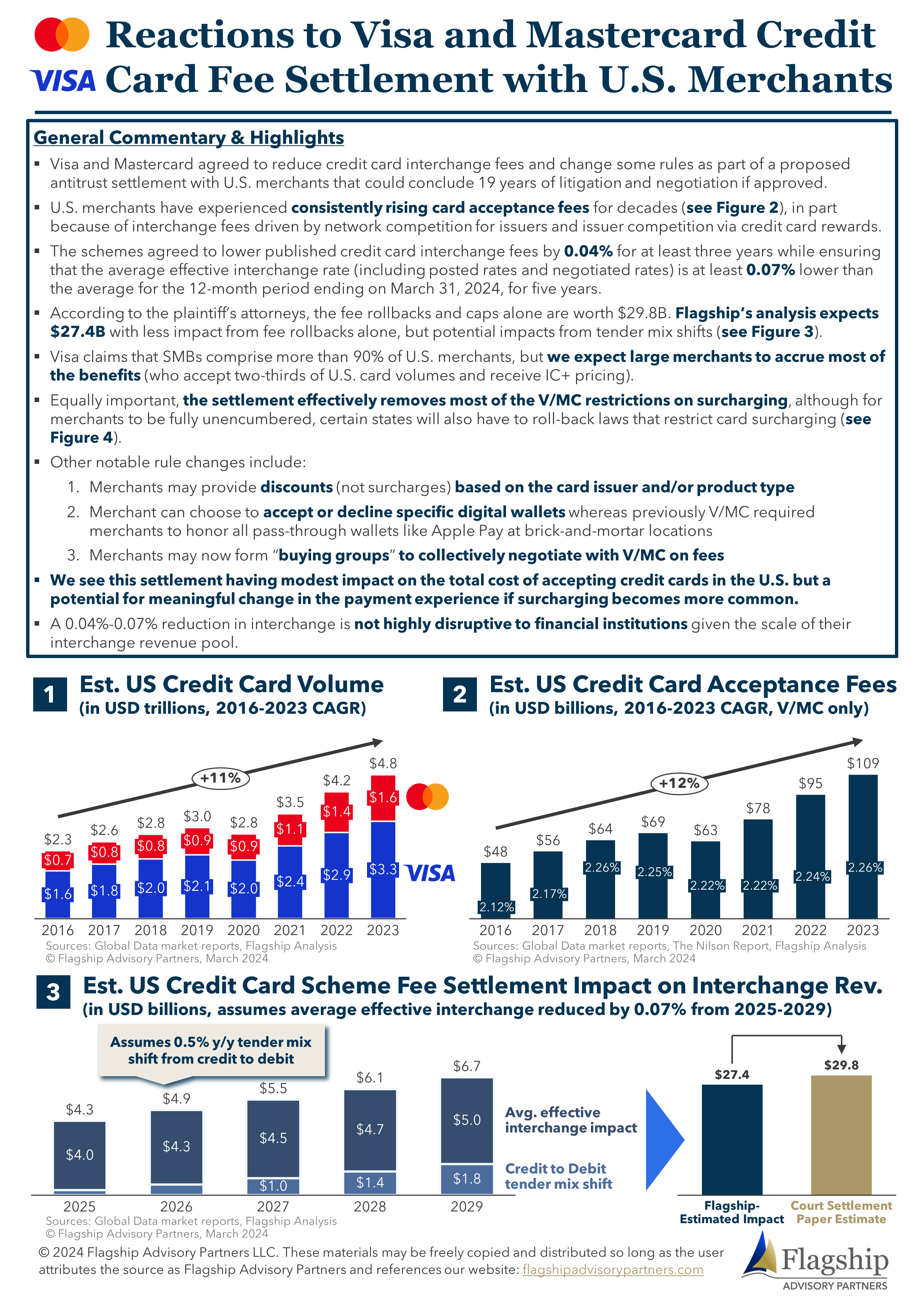

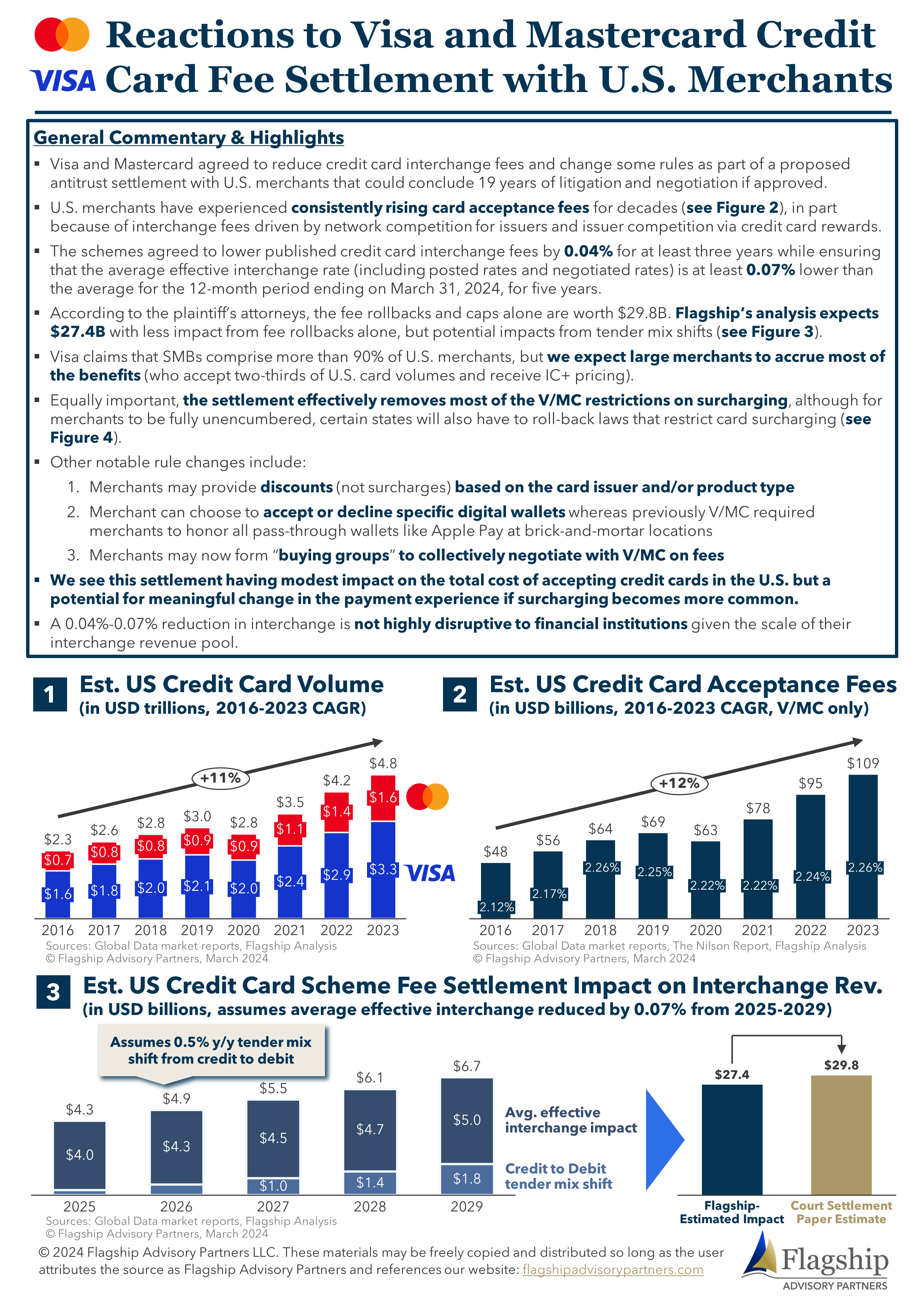

- U.S. merchants have experienced consistently rising card acceptance fees for decades (see Figure 2), in part because of interchange fees driven by network competition for issuers and issuer competition via credit card rewards.

- The schemes agreed to lower published credit card interchange fees by 0.04% for at least three years while ensuring that the average effective interchange rate (including posted rates and negotiated rates) is at least 0.07% lower than the average for the 12-month period ending on March 31, 2024, for five years.

- According to the plaintiff’s attorneys, the fee rollbacks and caps alone are worth $29.8B. Flagship’s analysis expects $27.4B with less impact from fee rollbacks alone, but potential impacts from tender mix shifts (see Figure 3).

- Visa claims that SMBs comprise more than 90% of U.S. merchants, but we expect large merchants to accrue most of the benefits (who accept two-thirds of U.S. card volumes and receive IC+ pricing).

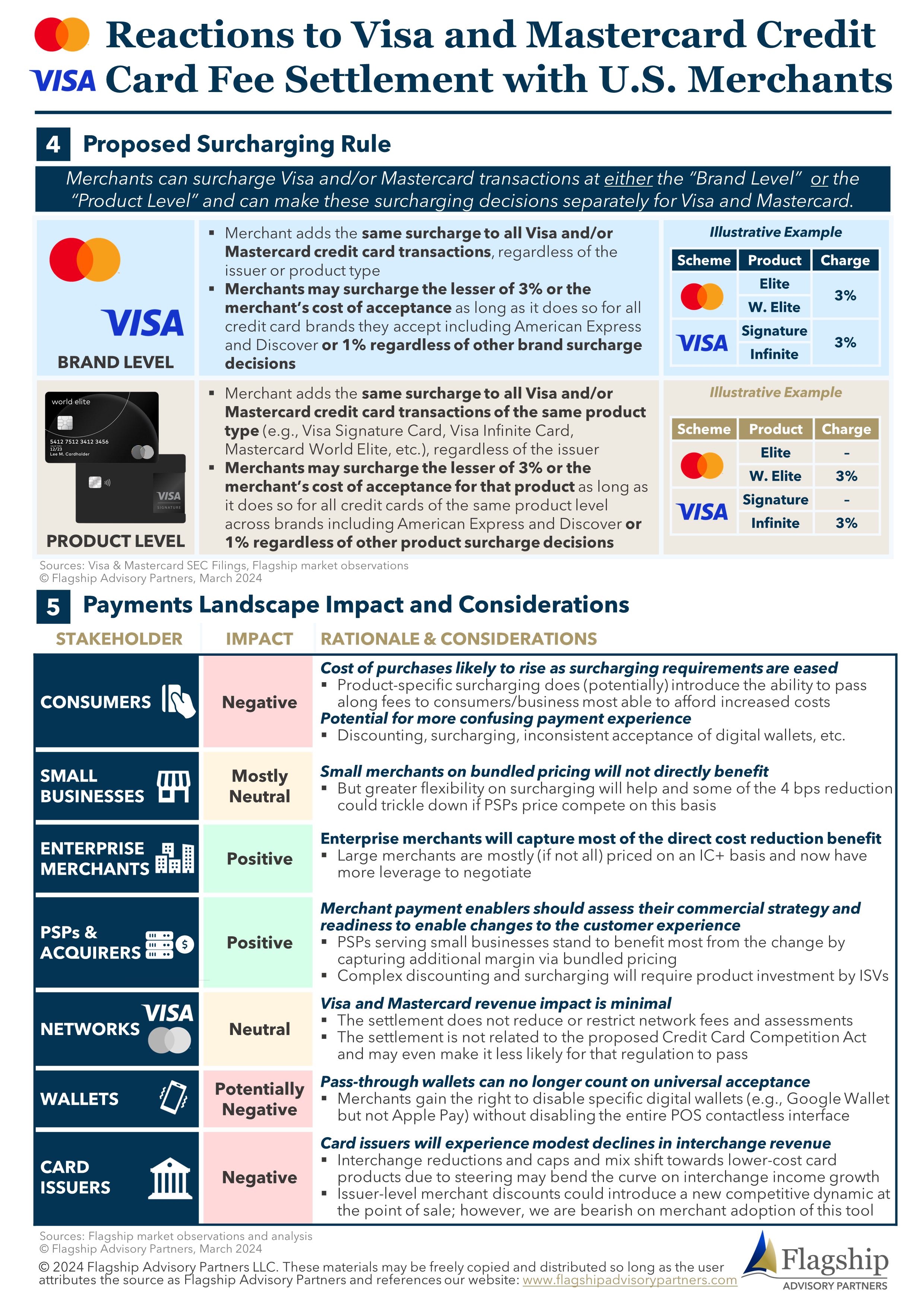

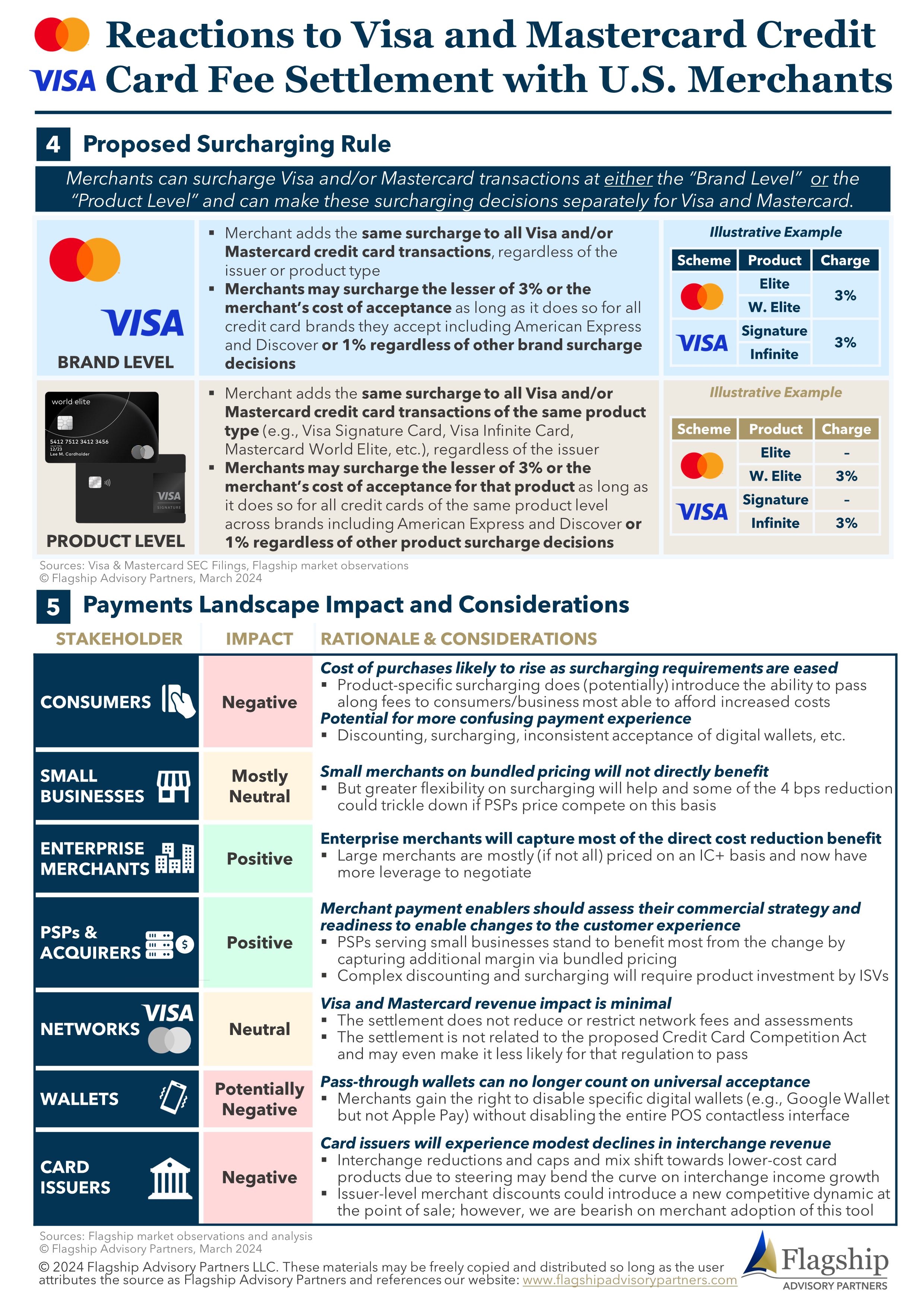

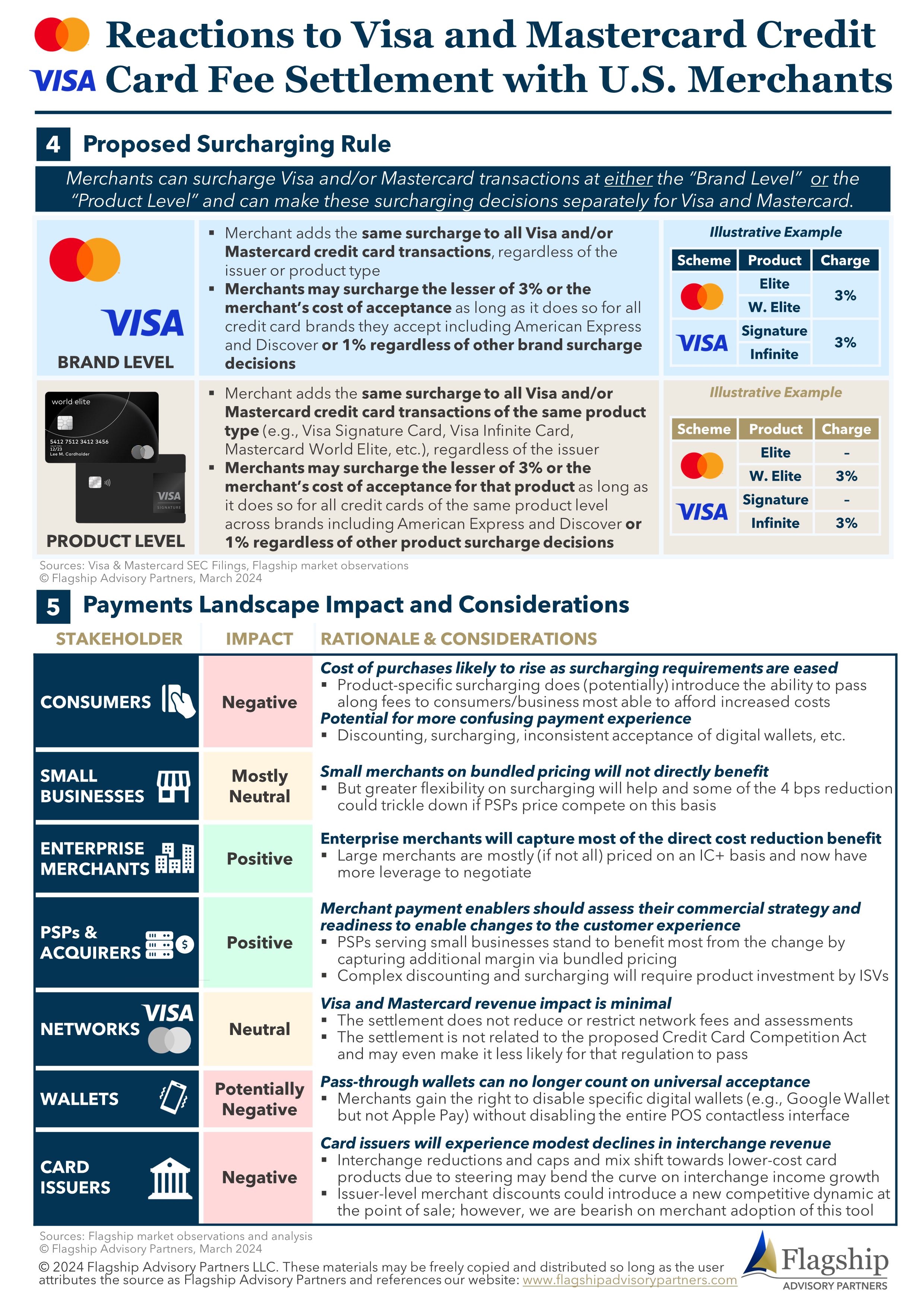

- Equally important, the settlement effectively removes most of the V/MC restrictions on surcharging, although for merchants to be fully unencumbered, certain states will also have to roll-back laws that restrict card surcharging (see Figure 4).

- Other notable rule changes include:

- Merchants may provide discounts (not surcharges) based on the card issuer and/or product type

- Merchant can choose to accept or decline specific digital wallets whereas previously V/MC required merchants to honor all pass-through wallets like Apple Pay at brick-and-mortar locations

- Merchants may now form “buying groups” to collectively negotiate with V/MC on fees

- We see this settlement having modest impact on the total cost of accepting credit cards in the U.S. but a potential for meaningful change in the payment experience if surcharging becomes more common.

- A 0.04%-0.07% reduction in interchange is not highly disruptive to financial institutions given the scale of their interchange revenue pool.

Please do not hesitate to contact Rom Mascetti at Rom@FlagshipAP.com or Ben Brown at Ben@FlagshipAP.com with any comments or questions.

Please do not hesitate to contact Rom Mascetti at Rom@FlagshipAP.com or Ben Brown at Ben@FlagshipAP.com with any comments or questions.

General Commentary & Highlights

- Visa and Mastercard agreed to reduce credit card interchange fees and change some rules as part of a proposed antitrust settlement with U.S. merchants that could conclude 19 years of litigation and negotiation if approved.

- U.S. merchants have experienced consistently rising card acceptance fees for decades (see Figure 2), in part because of interchange fees driven by network competition for issuers and issuer competition via credit card rewards.

- The schemes agreed to lower published credit card interchange fees by 0.04% for at least three years while ensuring that the average effective interchange rate (including posted rates and negotiated rates) is at least 0.07% lower than the average for the 12-month period ending on March 31, 2024, for five years.

- According to the plaintiff’s attorneys, the fee rollbacks and caps alone are worth $29.8B. Flagship’s analysis expects $27.4B with less impact from fee rollbacks alone, but potential impacts from tender mix shifts (see Figure 3).

- Visa claims that SMBs comprise more than 90% of U.S. merchants, but we expect large merchants to accrue most of the benefits (who accept two-thirds of U.S. card volumes and receive IC+ pricing).

- Equally important, the settlement effectively removes most of the V/MC restrictions on surcharging, although for merchants to be fully unencumbered, certain states will also have to roll-back laws that restrict card surcharging (see Figure 4).

- Other notable rule changes include:

- Merchants may provide discounts (not surcharges) based on the card issuer and/or product type

- Merchant can choose to accept or decline specific digital wallets whereas previously V/MC required merchants to honor all pass-through wallets like Apple Pay at brick-and-mortar locations

- Merchants may now form “buying groups” to collectively negotiate with V/MC on fees

- We see this settlement having modest impact on the total cost of accepting credit cards in the U.S. but a potential for meaningful change in the payment experience if surcharging becomes more common.

- A 0.04%-0.07% reduction in interchange is not highly disruptive to financial institutions given the scale of their interchange revenue pool.

Please do not hesitate to contact Rom Mascetti at Rom@FlagshipAP.com or Ben Brown at Ben@FlagshipAP.com with any comments or questions.

Please do not hesitate to contact Rom Mascetti at Rom@FlagshipAP.com or Ben Brown at Ben@FlagshipAP.com with any comments or questions.

Please do not hesitate to contact Rom Mascetti at Rom@FlagshipAP.com or Ben Brown at Ben@FlagshipAP.com with any comments or questions.

Please do not hesitate to contact Rom Mascetti at Rom@FlagshipAP.com or Ben Brown at Ben@FlagshipAP.com with any comments or questions.