Video Summary

Introduction

The evolution of SaaS embedded payments is the preeminent theme in merchant payments in North America and is also now increasingly in Europe. The U.S. market remains the clear bellwether of SaaS + payments disruption, but the U.K. and Europe are fast followers as the shift towards integrated payments gathers speed.

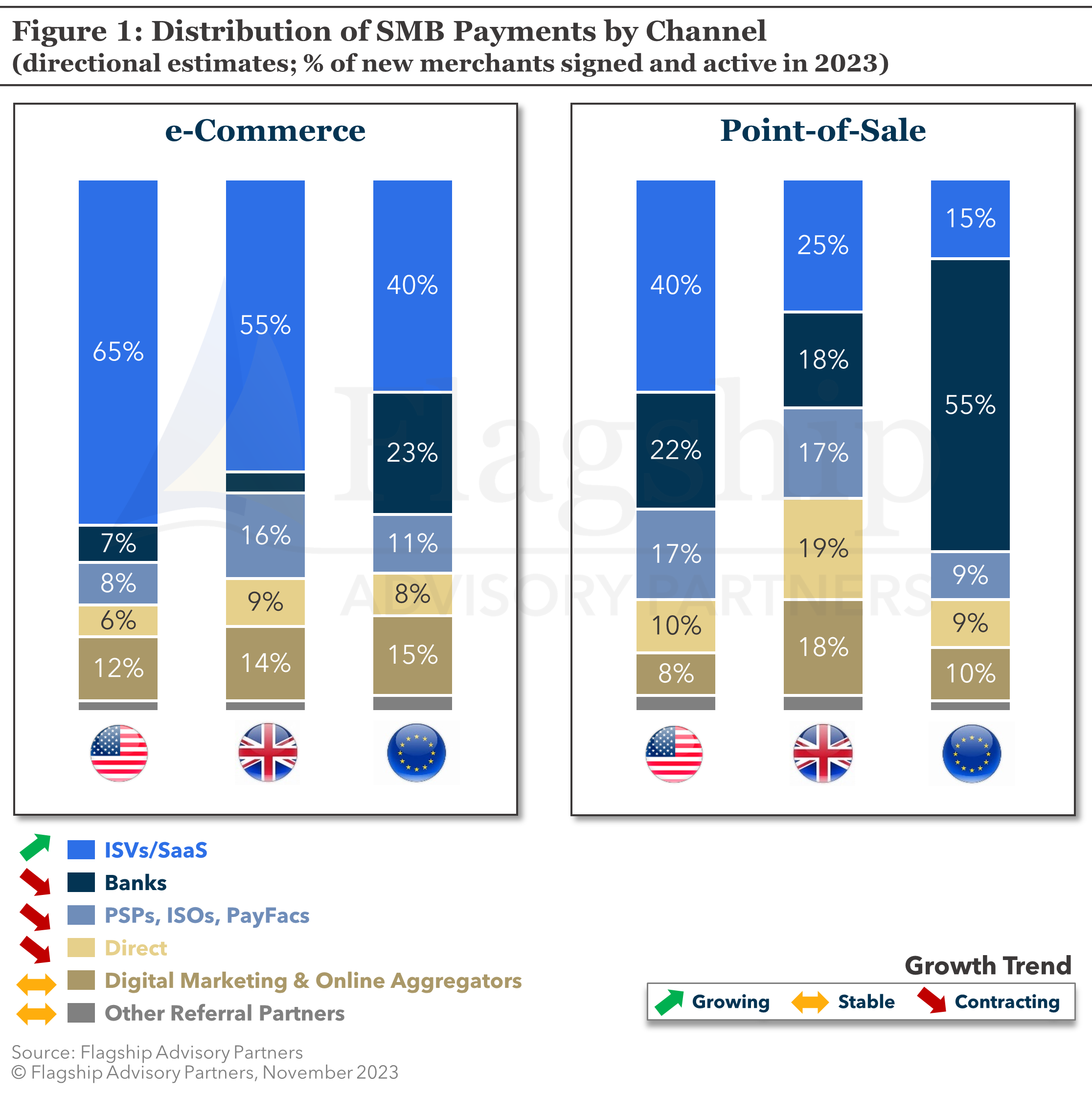

ISVs/SaaS are the leading and fastest-growing distribution channel for SMB merchants payments in the U.S. As shown in Figure 1, we estimate that c.40-65% of newly signed SMB merchants in the U.S. will source their payment acceptance/acquiring via ISVs. The ISV/SaaS channel is less mature in the U.K., and even less so in the EU, but this channel is accelerating rapidly in both markets.

The Rise of Integrated Payments in Europe

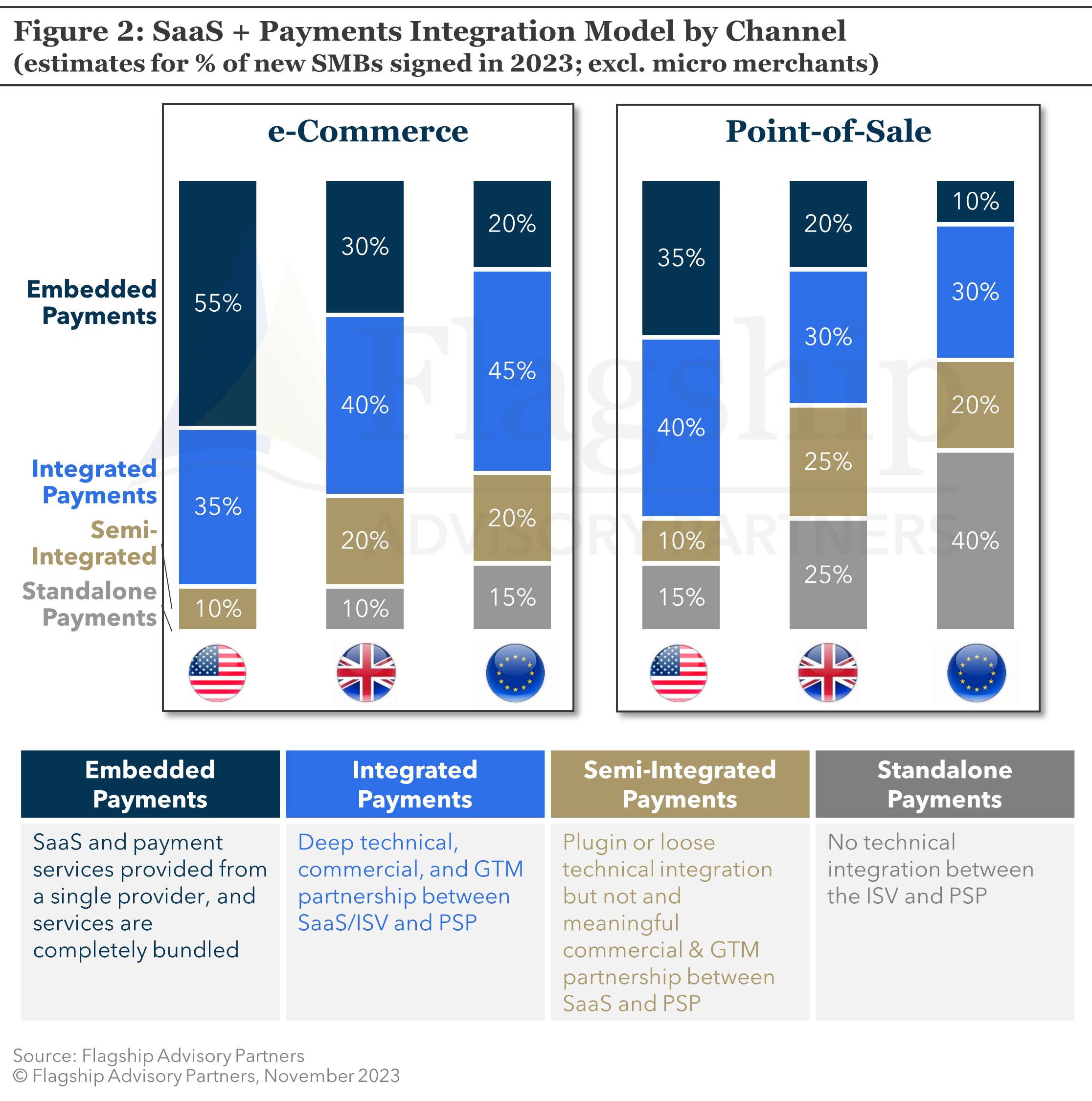

The market is moving towards deeply embedded payments, where software and payments are completely bundled and owned by either a single party or via tightly integrated software and payments partners. ISVs have proven to be a superior payments distribution model (as the business software is often the more critical and earlier lifecycle decision), but integrated or embedded payments are also a superior value proposition for merchants. An integrated software + payments platform becomes a one-stop-shop for merchants, with one single point of service, data, settlement, billing, and business insights.

As illustrated in Figure 2, the U.S. market also leads the world on product penetration levels for embedded and integrated payments (c.75-90% of SMB merchants are using embedded or fully integrated payments). U.K. and Europe are still years behind on the integration of software and payments @ POS, although e-commerce platforms are also generally deeply integrating payments in Europe. PSPs in Europe are rushing to develop ISV go-to-market strategies, knowing that global competitors such as Stripe have a head-start on ISV propositions and global partnerships.

SaaS + Payments Operating Models

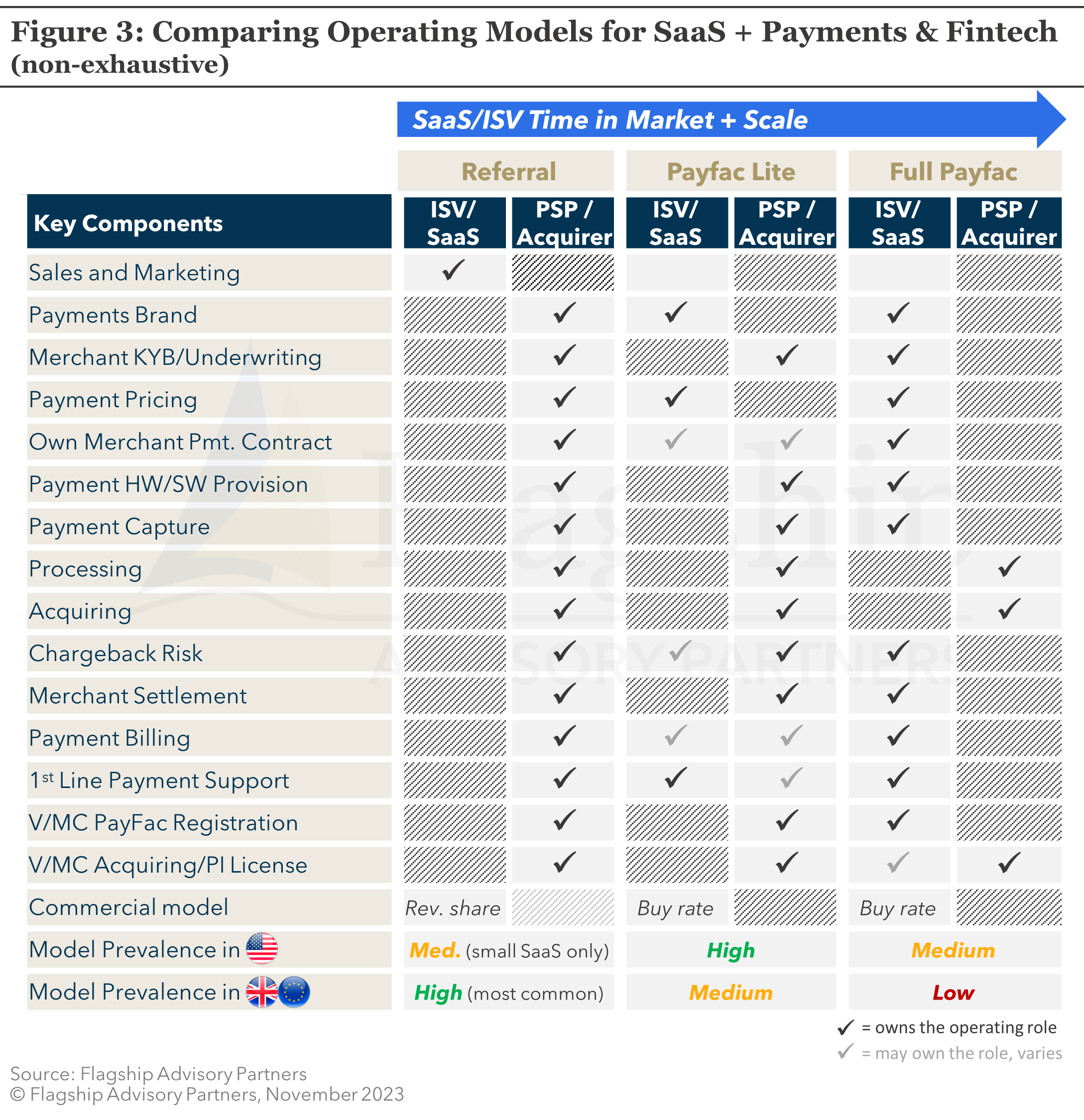

ISVs tend to evolve from simple referral partnerships to more complex integrated operating models as they scale. Larger SaaS in the U.S. are already generally leveraging Payfac Lite or Full Payfac operating models, though smaller ISVs still often use a referral model given the complexity of taking on more payments ownership.

Most European/U.K. ISVs still rely on a simple referral model for monetizing payments. But, we see a rapid rise of the deployment of Payfac Lite operating models where the SaaS are not in the money flows or licensed as payment institutions. We describe the functional differences of these various operating models in Figure 3.

The right operating model is a combination of various factors, but generally speaking, SaaS platforms controlling more than $1 billion of annual payments flows should seek an operating model that provides greater control and monetization (moving from left to right on Figure 3). A PayFac Lite operating model provides the platform with the ability to brand the proposition, to price the proposition, and to act as the primary UX for customer sign-up and servicing.

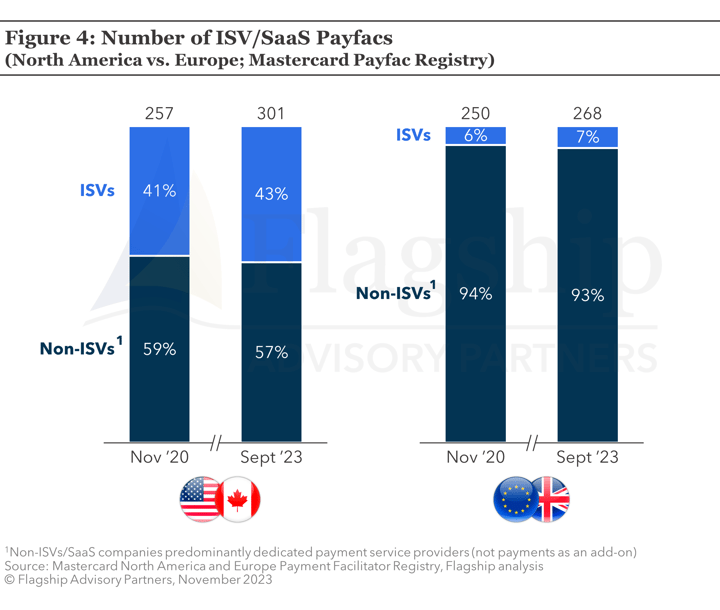

As shown in Figure 4, there are far more SaaS companies opting for a Full Payfac operating model in the U.S. vs. Europe. This is due to both scale dynamics, but more importantly, the requirement for a payment institution license in Europe for any platform wishing to intermediate money flows with its merchants/sellers. The additional burden of a lite banking license is significant vs. simply needing to remain compliant with card scheme rules as a registered PayFac in the U.S. Nearly half of all PayFacs registered with Mastercard in U.S. and Canada are SaaS companies.

Maturity of European SaaS Embedded Payments: Commercial Models

Maturity of European SaaS Embedded Payments: Commercial Models

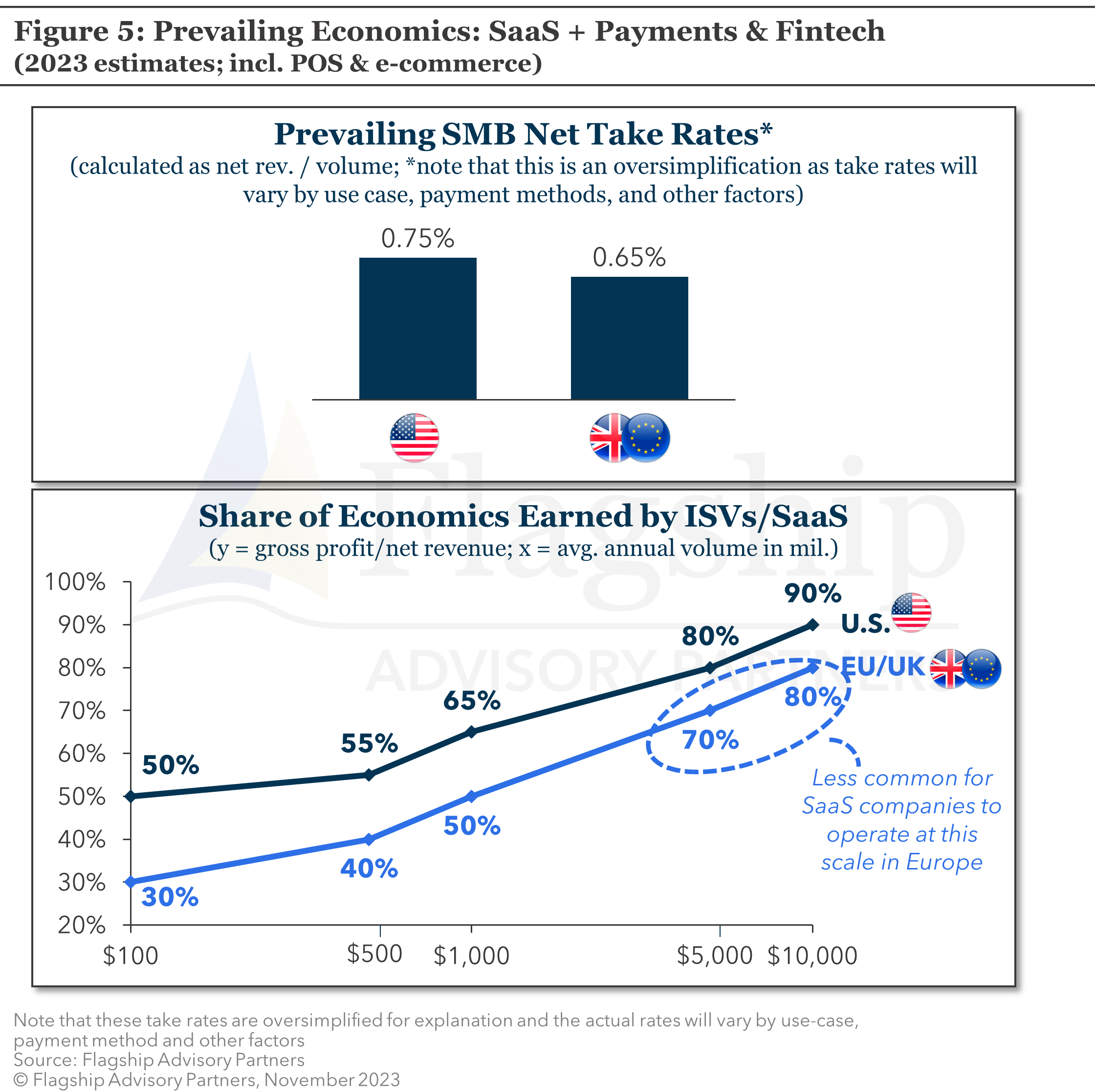

Payments are lucrative for software providers. It is not unusual at scale for a SaaS company to generate more than half of its revenue from payments. Large-scale SaaS companies often retain c. 80%+ of the net take rate from payments (the remainder flowing to the payments partner). The split of economics is mostly a function of scale. The larger the ISV, the larger the share of economics. SMB payments yield rich take rates in both the U.S. and Europe/U.K. The net take rate earned by ISVs has traditionally been less than those in the U.S., though this gap is closing as European platforms gain scale and the operating model matures. Figure 5 illustrates typical SaaS + payments economics in the U.S. and Europe (noting that these illustrative economics apply only to SMB-centric SaaS in mainstream C2B payment verticals such as retail).

Integrated Payments Across Verticals

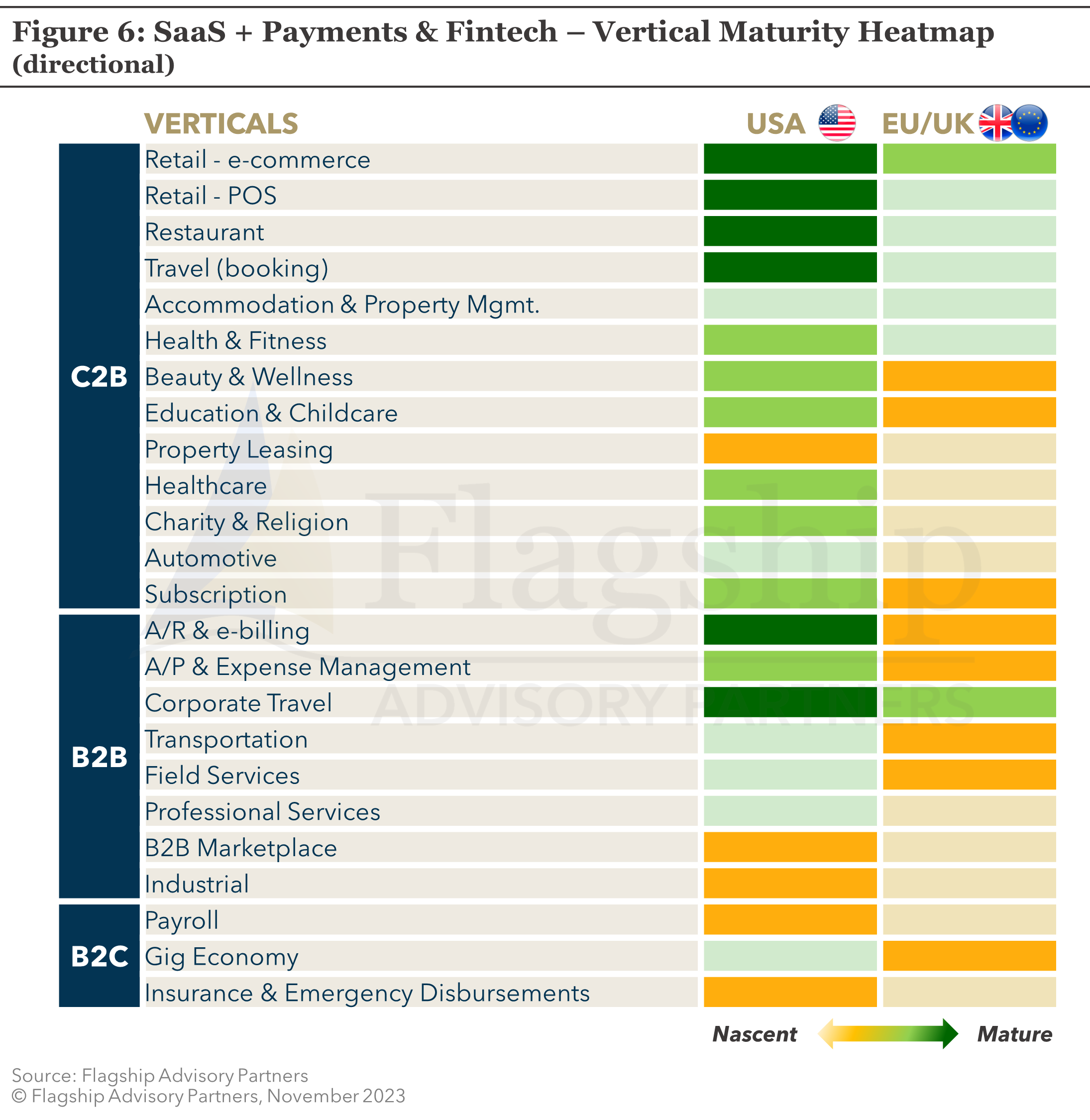

Most ISVs are vertically specialized, though some are functionally specialized (i.e., accounting or e-billing software). The vertical has a heavy influence on the availability and maturity of SaaS + payments opportunities. In Figure 6 we compare the maturity of integrated payments in the U.S. vs. Europe/U.K. across vertical and functional SaaS categories. Given its head start, the U.S. is almost always more mature, though Europe is following a similar evolutionary path with most commerce-centric verticals (e.g., retail, hospitality, etc.) adopting integrated payments first. B2B verticals in the U.S. are far more mature on monetization of payments as European SaaS are still learning how to monetize A2A payments.

Integrated and embedded payments are rapidly accelerating as the key force of disruption in European payments. Lessons from the U.S. provide us with a clear set of value-creation playbooks. European SaaS platforms and PSPs looking to thrive in 2024 and beyond must adapt clear strategies for integrated/embedded payments and then invest and organize to execute on these strategies.

Please do not hesitate to contact Charlotte Al Usta at Charlotte@FlagshipAP.com with comments or questions.