It continues to be a rough ride for virtually all listed fintechs, large and small, although small cap fintech stocks are particularly challenged in today’s tough (and worsening) market conditions.

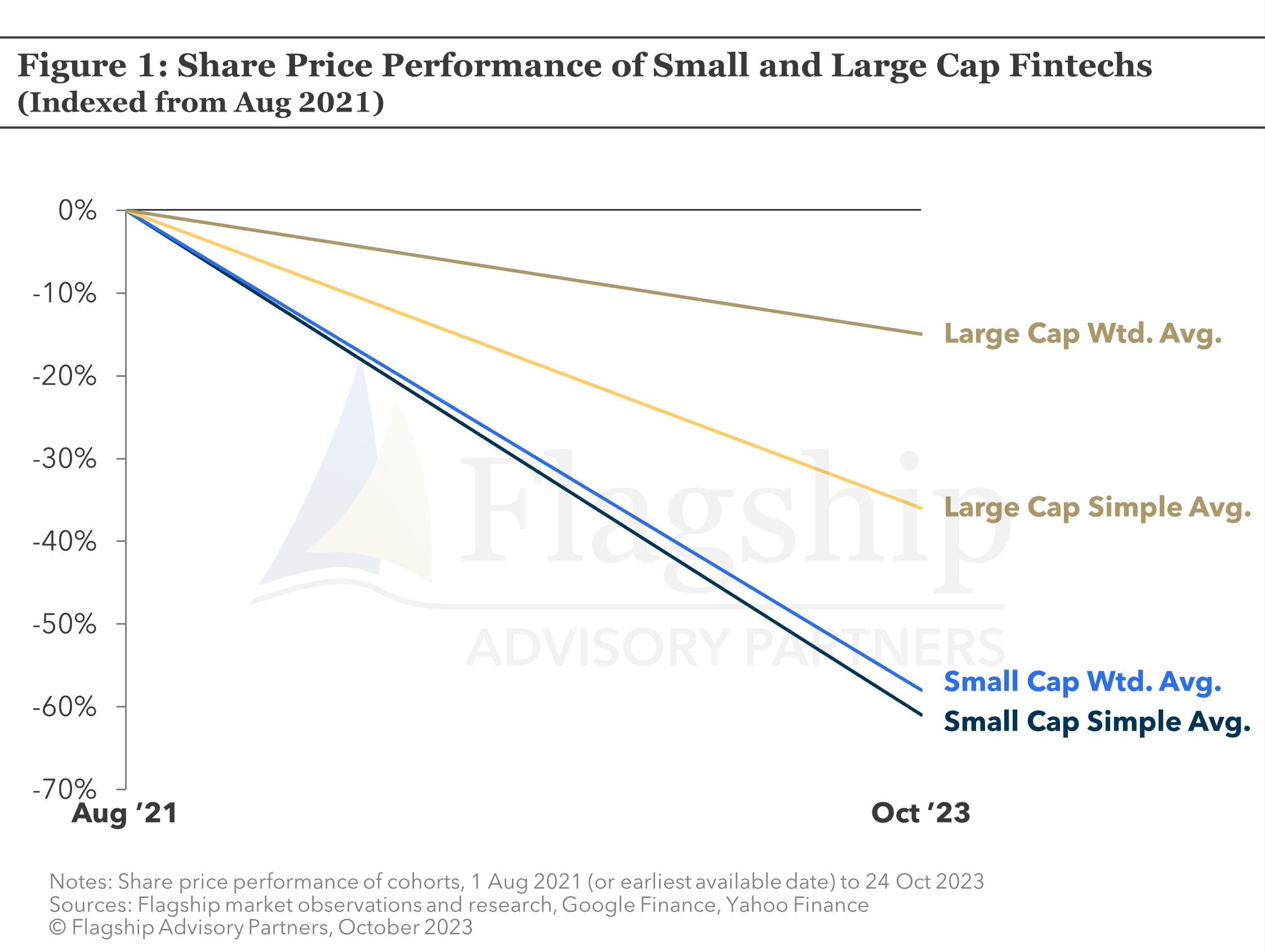

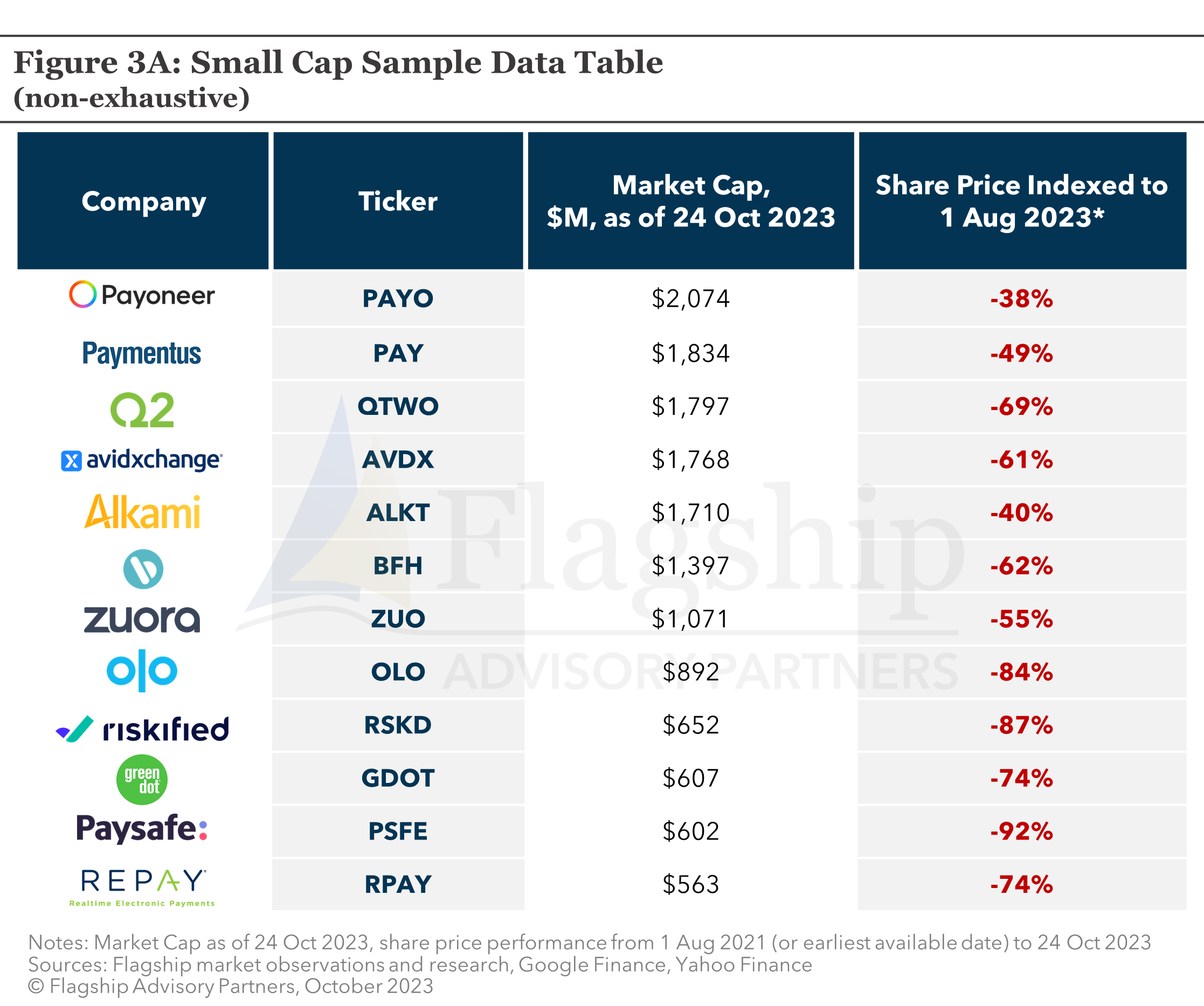

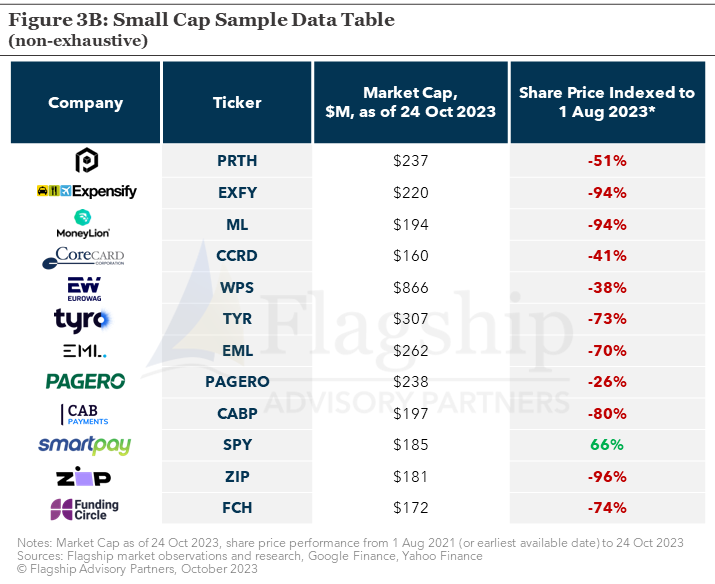

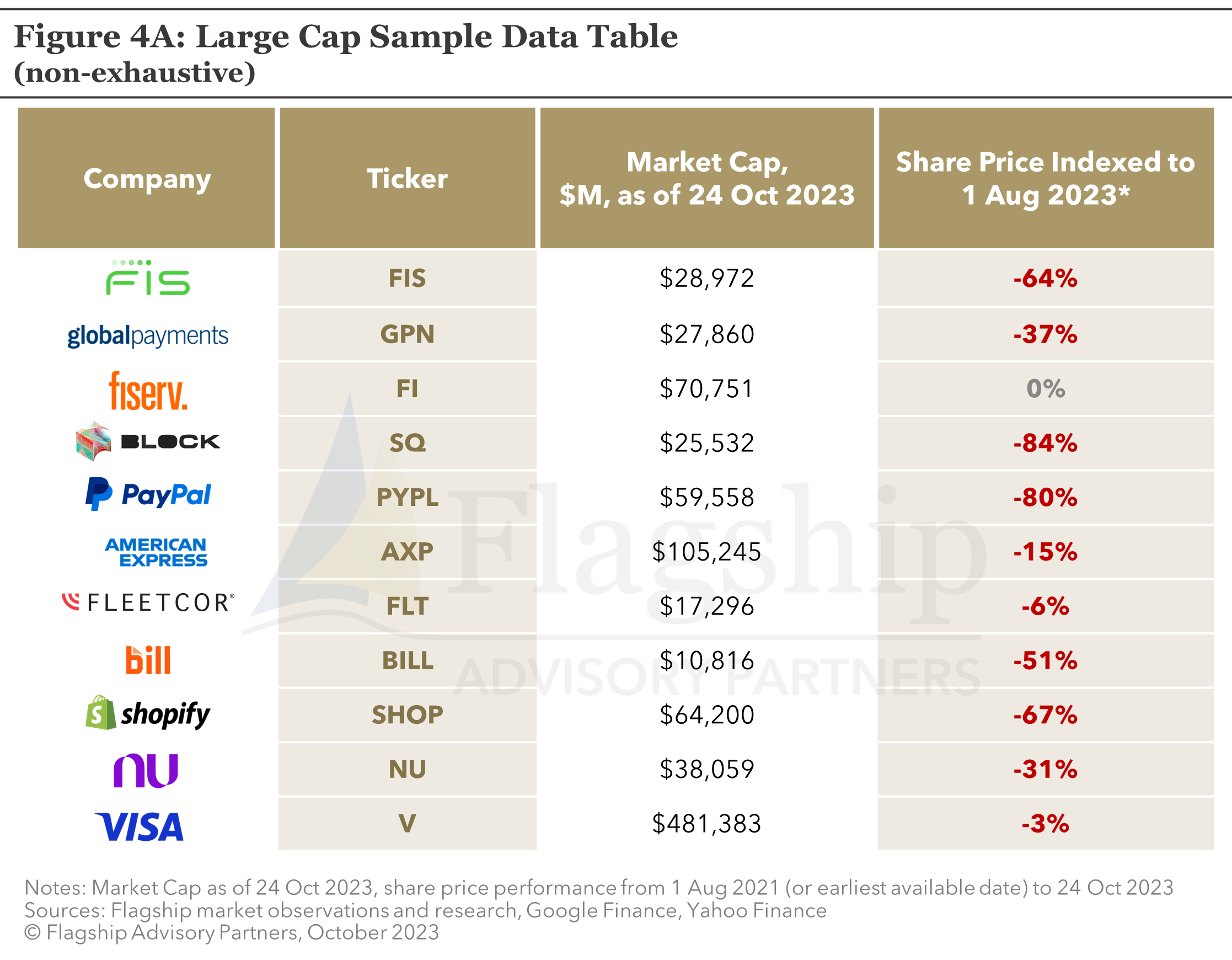

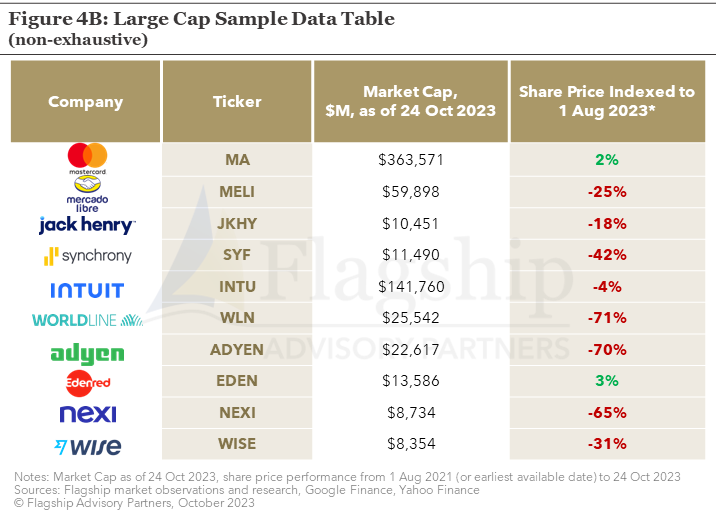

In Figure 1, we compare the relative share price performance of large cap fintechs (market cap >$10B) vs. small cap fintechs (market cap < $2B). Both cohorts declined as market conditions worsened, although the share price decline of small caps was significantly greater. On average, small caps declined by c. 60%, while large caps declined on average by 36% (and only 15% on a weighted average basis). Small cap fintechs thrived during the heady days of 2017-2021, when investors were anxious for growth and willing to bet on potential. Today’s investors have cast aside potential and are investing instead in value, as evidenced by cashflow. Markets are also now quick to punish any disappointment, as evidence by the recent steep declines in the shares of both Wordline (-57% share price decline on 25 Oct) and Crown Agents Bank (-72% decline on 24 Oct).

Small cap fintechs thrived during the heady days of 2017-2021, when investors were anxious for growth and willing to bet on potential. Today’s investors have cast aside potential and are investing instead in value, as evidenced by cashflow. Markets are also now quick to punish any disappointment, as evidence by the recent steep declines in the shares of both Wordline (-57% share price decline on 25 Oct) and Crown Agents Bank (-72% decline on 24 Oct).

We firmly believe that small cap fintechs are better suited to private, patient capital, at least as market conditions remain hawkish. Private money is simply more patient and focused on longer-term growth and earnings development. The public markets are now a brutal environment for growing into profitability. As valuations continue to decline, we expect numerous public to private transactions. Private equity is not without its own challenges, however, as rising interest rates are also exerting downward valuation pressure on private valuations.

Please do not hesitate to contact Joel Van Arsdale at Joel@FlagshipAP.com with comments or questions.