Introduction

The U.S. has the highest payment acceptance costs in the world despite being a large and mature fintech market (you can read our prior assessment of this topic here). This situation is ripe for disruption, the question is just when and how. Real-time A2A payments would appear to be the ‘disruption how’ given the ongoing development of real-time A2A clearing infrastructure.

FedNow, officially live in July of this year, is the latest A2A (bank account to bank account) clearing network built on modern, real-time infrastructure. FedNow is viewed by many as a potential catalyst for disrupting card scheme dominance in U.S. payments. However, as we explain in this article, clearing networks are just technology enablers, not disruptive products in and of themselves. Real disruption must come from products built and distributed to consumers, and here is where the uncertainty remains for the disruptive potential of U.S. A2A payments.

In this article, we take a closer look at FedNow in the context of consumer payments and examine what it will take to change the game for the U.S. consumer payments landscape.

What is FedNow Relative to Other U.S. A2A Initiatives?

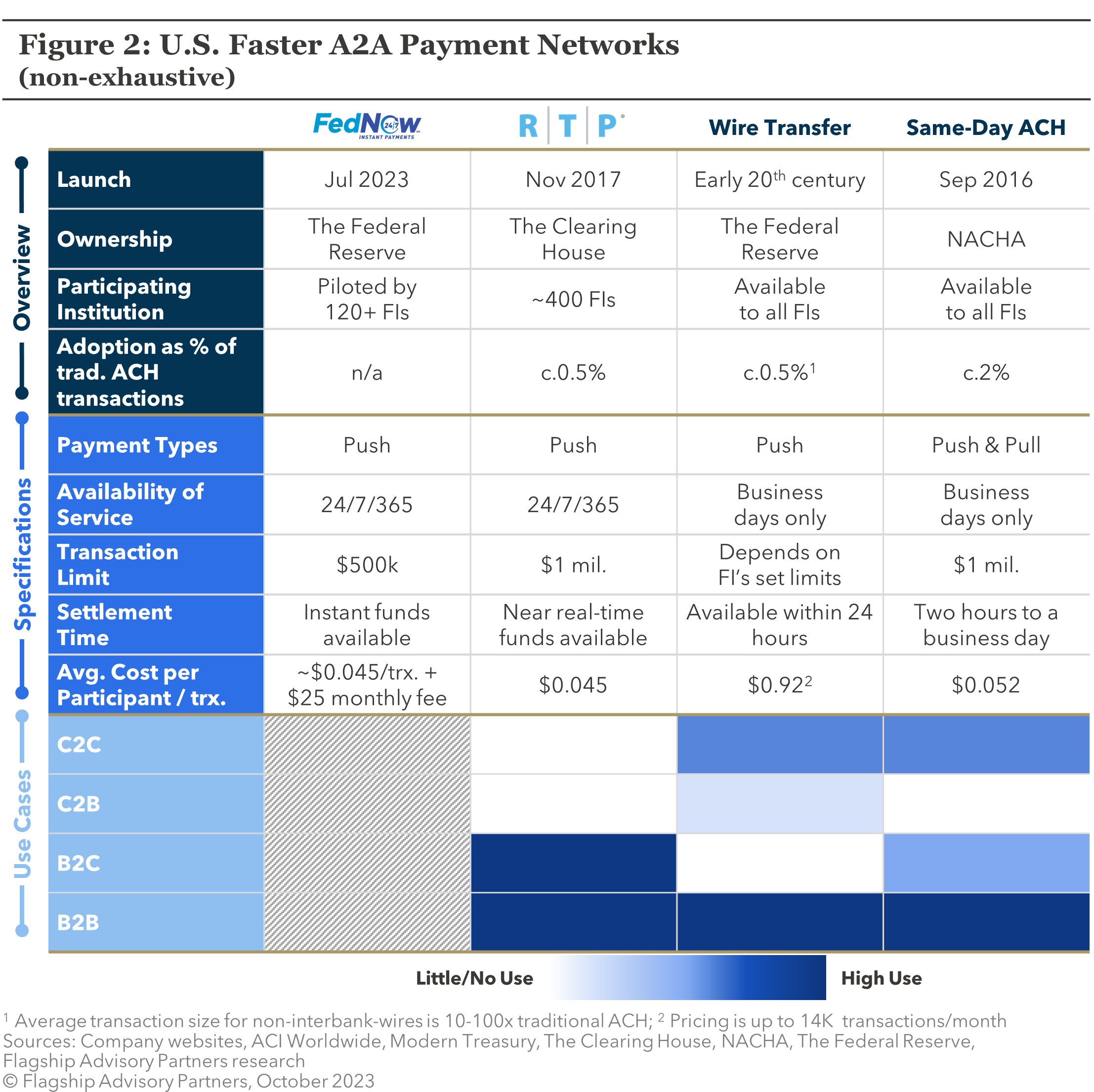

FedNow, launched by the Federal Reserve, is an A2A payments clearing network that allows financial institutions to move electronic payments in real-time, offering businesses immediate access to funds, 24x7, 365 days a year. FedNow improves upon the inefficiencies present in the traditional U.S. ACH networks which are driven by periodic batch processing.

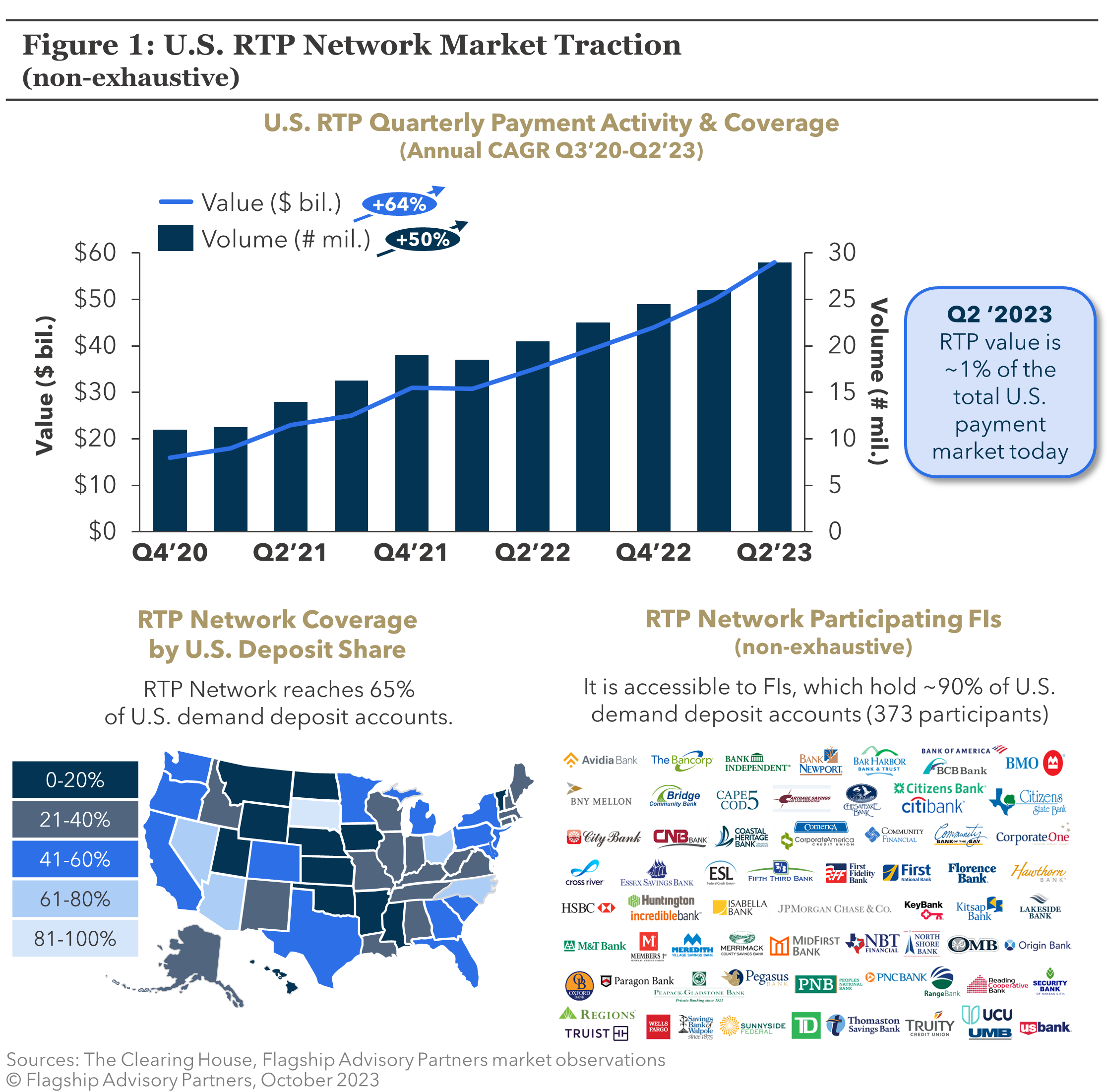

Faster A2A payments networks are not new to the U.S. The Clearing House’s RTP network, launched in 2017, was the U.S.'s first real-time A2A payments network. As illustrated in Figure 1, slow uptake among smaller banks and credit unions, coupled with the restricted range of use cases (i.e., RTP only enables push payments) have hindered RTP’s impact (accounting for less than 1% of U.S. A2A payments today). Prior to RTP, NACHA introduced a ‘same-day ACH’ product. None of the A2A clearing infrastructure upgrades have disrupted card usage or even significantly cannibalized traditional ACH.

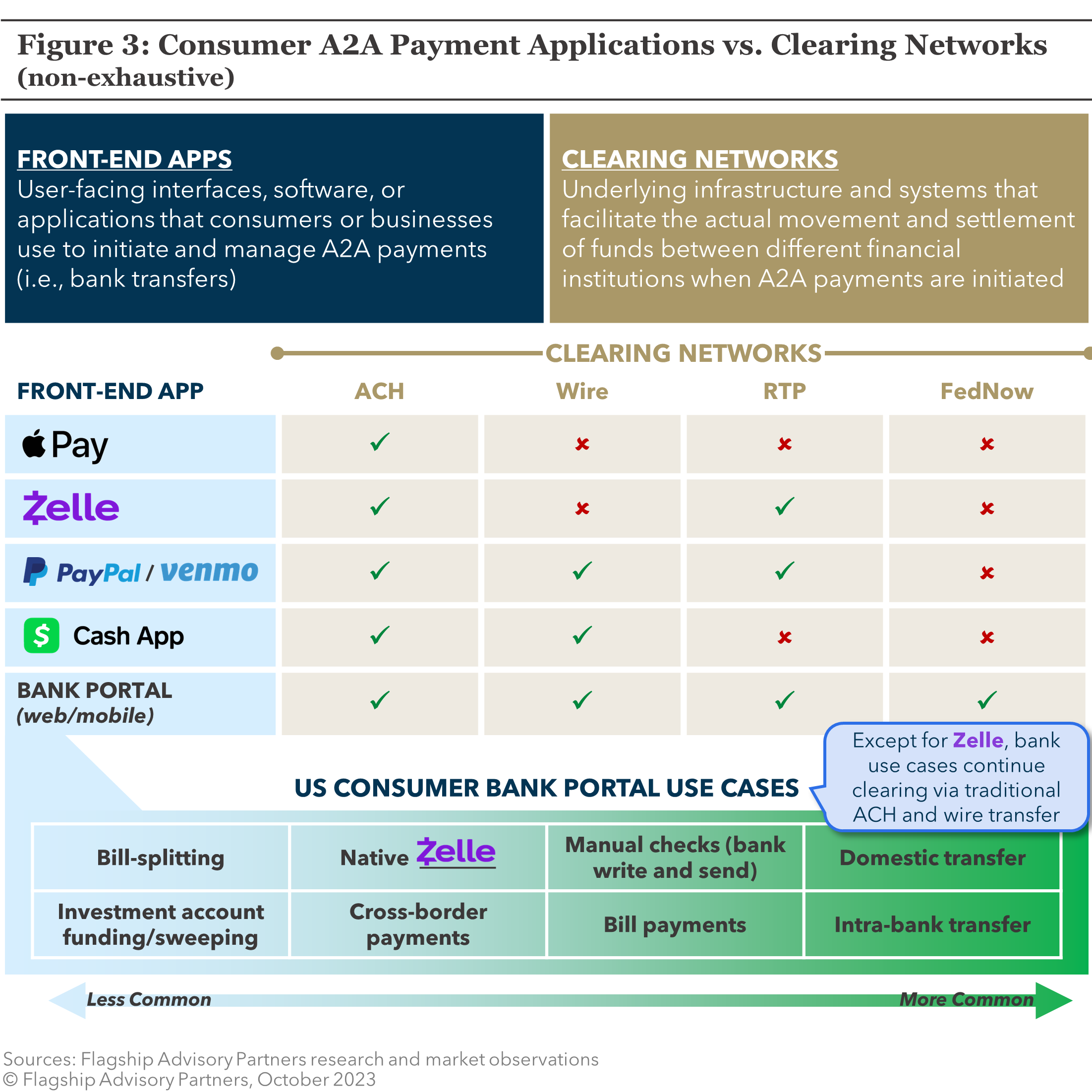

Clearing networks (U.S. faster networks summarized in Figure 2) serve as the foundational technology for A2A payments. Actual consumer use cases, such as consumer-to-merchant payments, must then be powered by products such as digital banking, fintech apps (e.g. CashApp), or forms of software-embedded payments. Supply of this consumer end product continues to lag in the U.S. market.

As illustrated in Figure 3, U.S. A2A bank services (i.e., via internet banking) are rather confusing, although Zelle has added focus. On average, U.S. banks have done a poor job delivering robust A2A use cases, leaving many consumers to use PayPal (Venmo) or CashApp for their P2P A2A payments. Cards and checks are still most frequently used for bill payments. Even the more successful consumer A2A products still often rely on traditional ACH for clearing, rather than RTP or the new FedNow.

Bank readiness is a challenge for payment networks in the U.S., given the ongoing fragmentation of an industry that includes c. 4,000 commercial banks and several thousand credit unions and savings and loans companies. RTP, launched six years ago, claims to currently reach 65% of U.S. bank deposit accounts (increasing to 90% if you count all potentially reached accounts via participating banks). There are reasons to believe that FedNow account readiness should move at a faster pace. For example, FedNow offers more elegant interbank settlement for member banks given the Fed’s longstanding interbank settlement role.

Are A2A Payments Disrupting U.S. C2B Payments? Why Not?

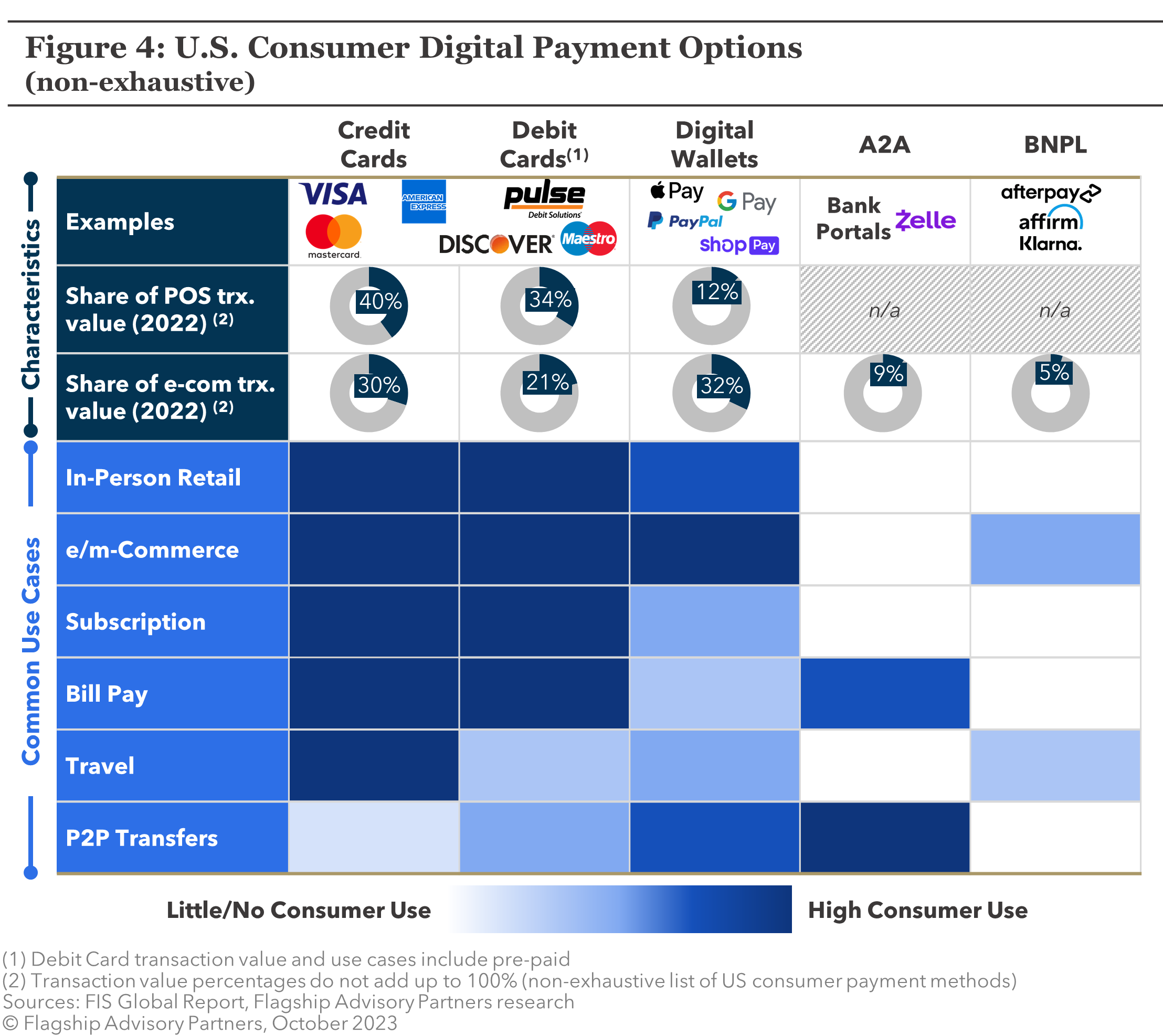

As illustrated in Figure 4, A2A payments, enabled via digital banking or wallets have struggled to gain relevance in a C2B payments landscape dominated by cards. There are four fundamental reasons for the persistence of cards in U.S. merchant payments, despite the high cost to merchants:

- Consumer demand: Simply put, U.S. consumers love card payments because they are incentivized to do so via cashback/rewards from their issuing bank.

- Reliability: Visa and Mastercard have spent decades building trust and dependability that payments will work.

- Speed: The card networks quickly settle with merchants and enable consumers to see their transactions in near-real-time.

- Lack of real alternatives: A2A and Buy-Now, Pay-Later (BNPL) have relatively low penetration and are not relevant for in-store transactions today while digital wallets (e.g., Apple Pay, Google Pay, PayPal, etc.) are primarily card-linked.

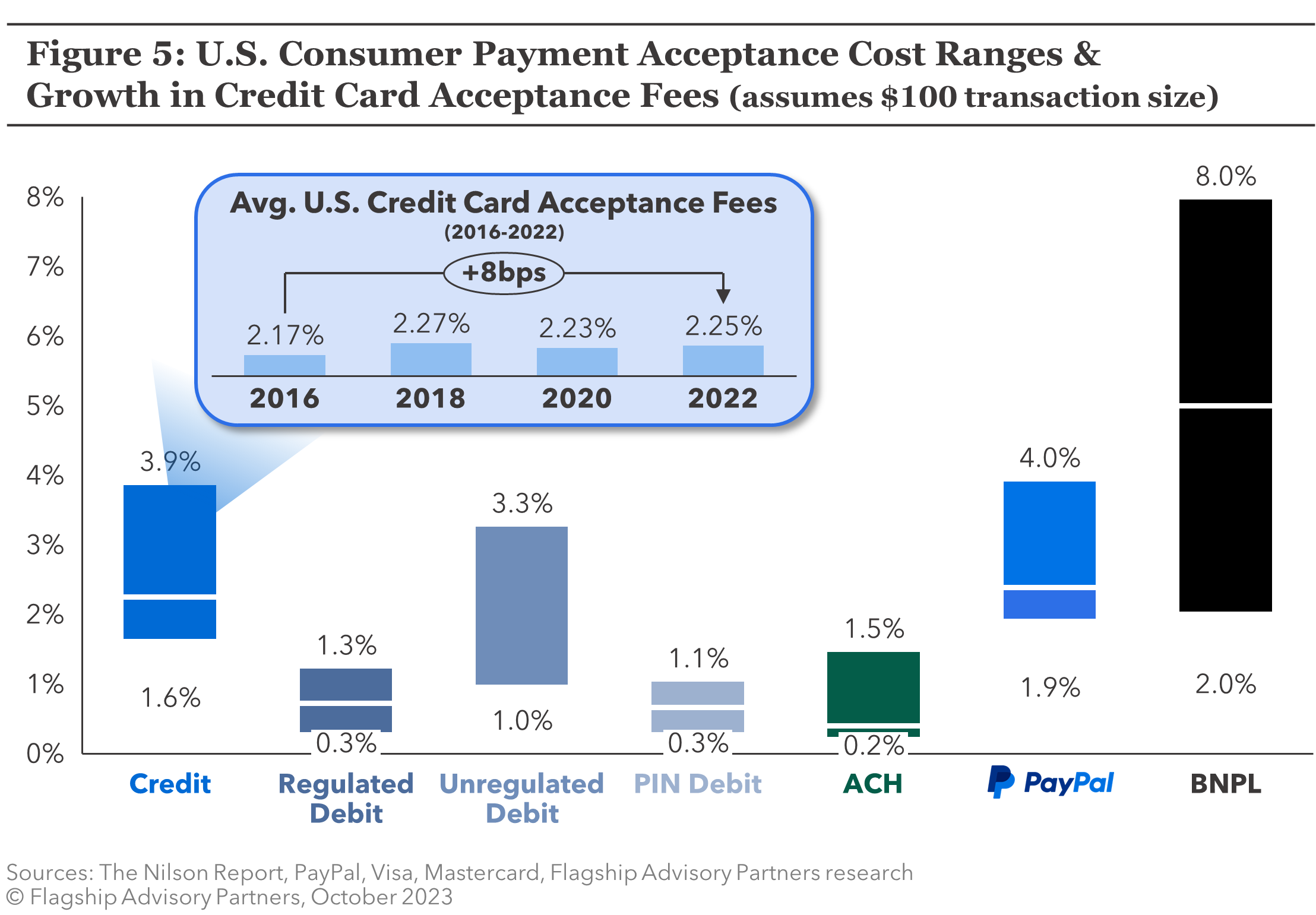

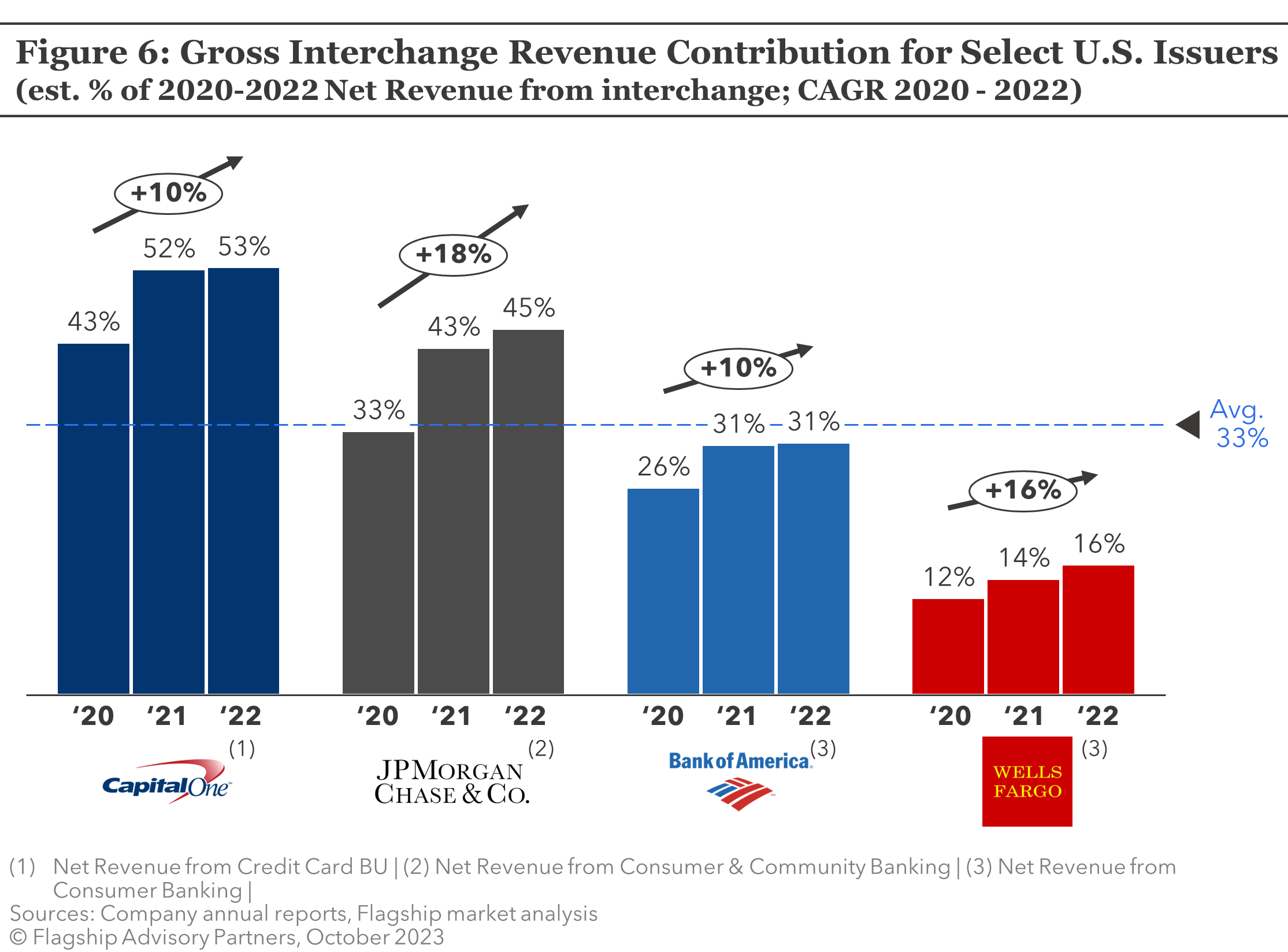

U.S. banks are mostly happy to support the persistence of cards as card interchange is the golden goose that keeps on laying. U.S. consumers love their credit card points and credit and U.S. banks love their interchange and card fee revenue. Figure 5 illustrates the relative cost of different consumer payment methods and how credit card acceptance costs have slowly increased since 2016. In Figure 6 we illustrate how these costs (primarily driven by interchange) make up a meaningful portion of issuer revenues today.

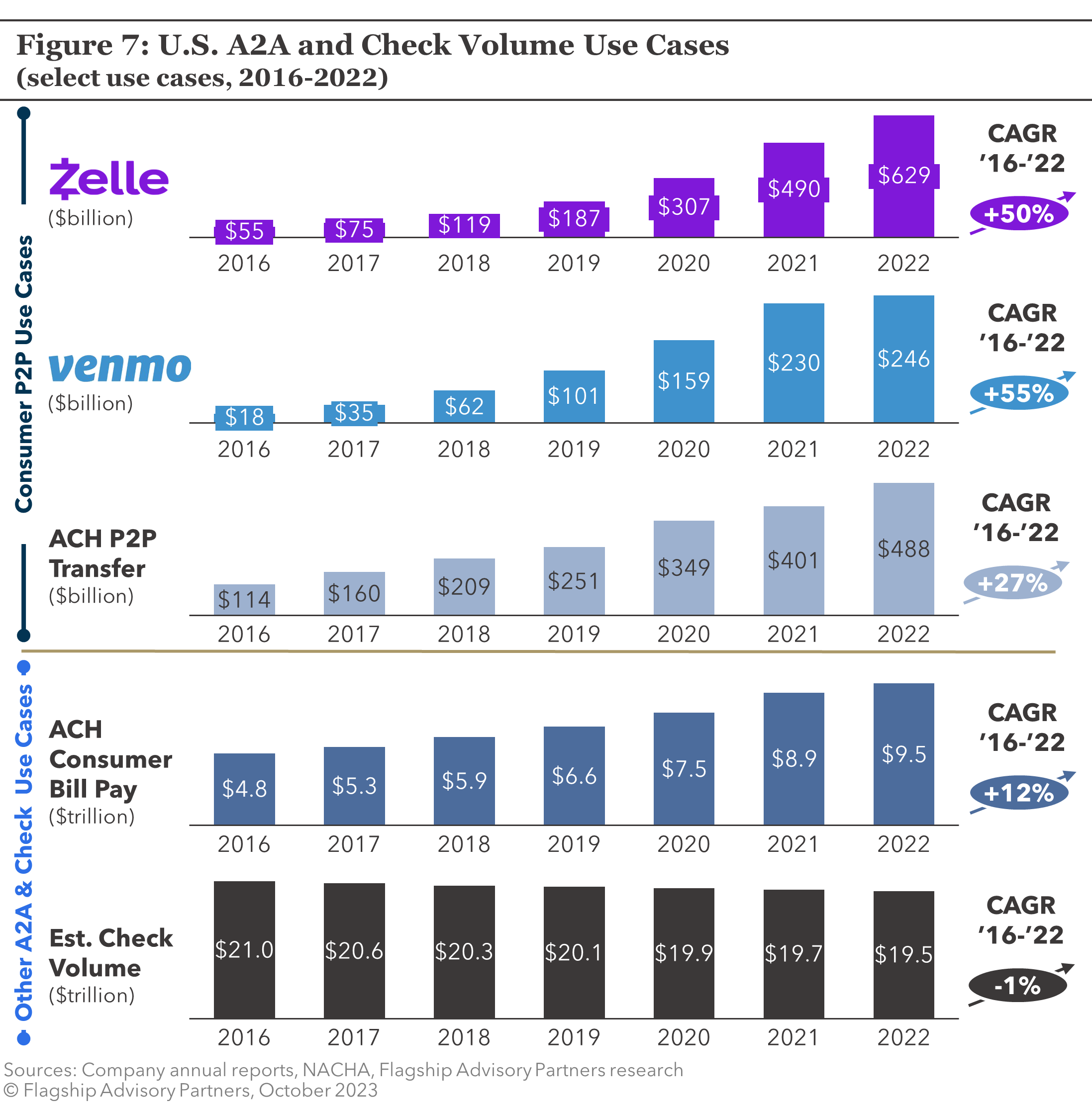

In summary, the status quo of reliance on cards persists in the U.S. because no one has created a superior A2A consumer value proposition and banks lack the incentive to cannibalize interchange. As illustrated in Figure 7, A2A payments have found most success in P2P payments use cases today, with Zelle and Venmo leading the way.

Realtime Clearing Has Proven Disruptive When Consumer Product Innovation is There

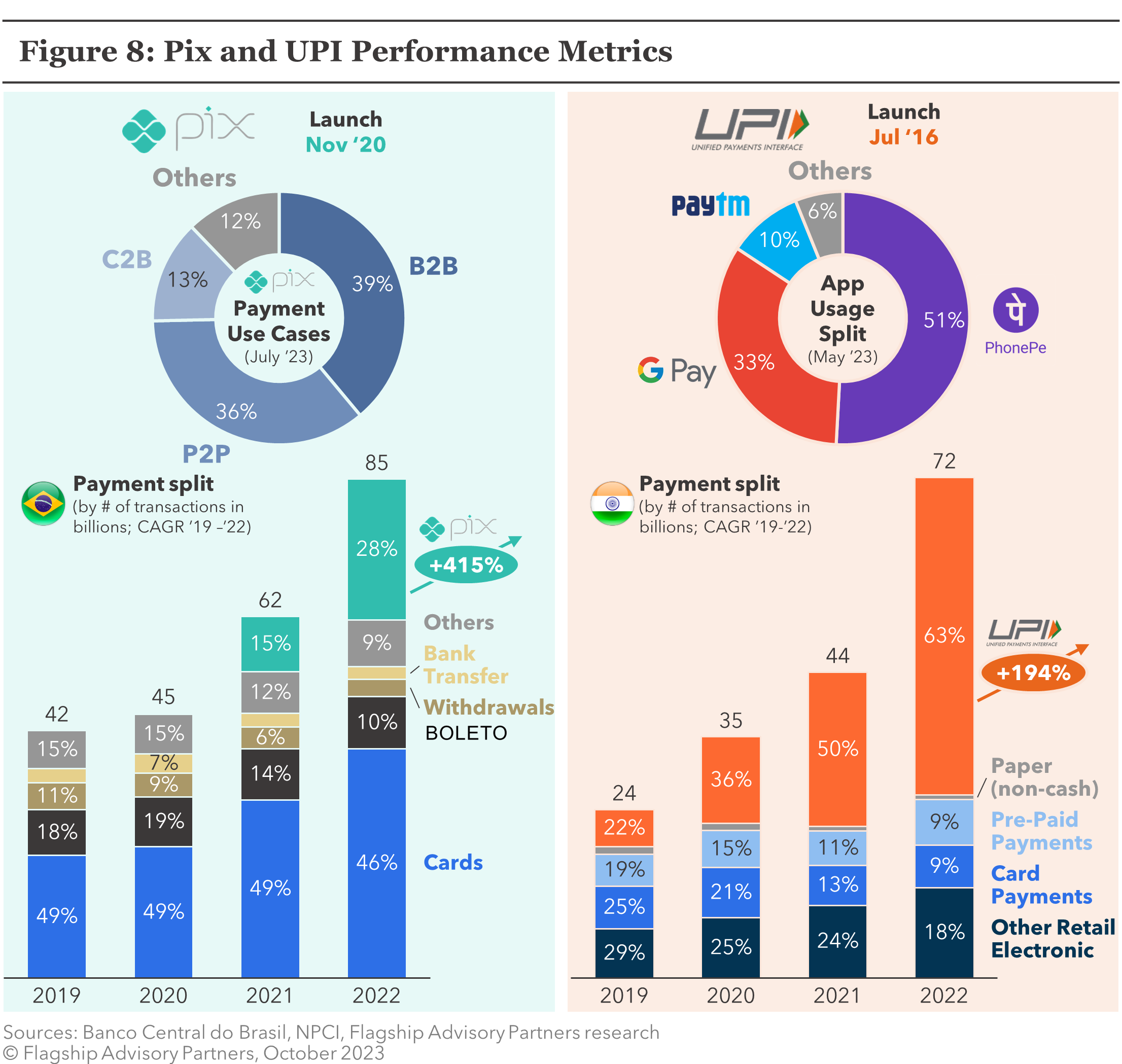

In other global markets, killer A2A propositions riding newly minted real-time bank clearing rails are disruptive. For example, in emerging markets like India and Brazil, governments’ desire to reduce cash and achieve a leapfrog effect in digital payments led them to introduce modernized A2A payment networks. Such A2A networks were created with an “open access” participatory network which, in turn, allowed large tech companies, mega merchants, and fintechs to develop mobile payment apps that run on these networks.

In Figure 8 we illustrate the adoption curve of PIX in Brazil and UPI in India, two highly successful A2A real-time payment networks that have grown rapidly as a result of increasing participation and innovation from such front-end mobile apps.

Can FedNow Break the U.S. Status Quo?

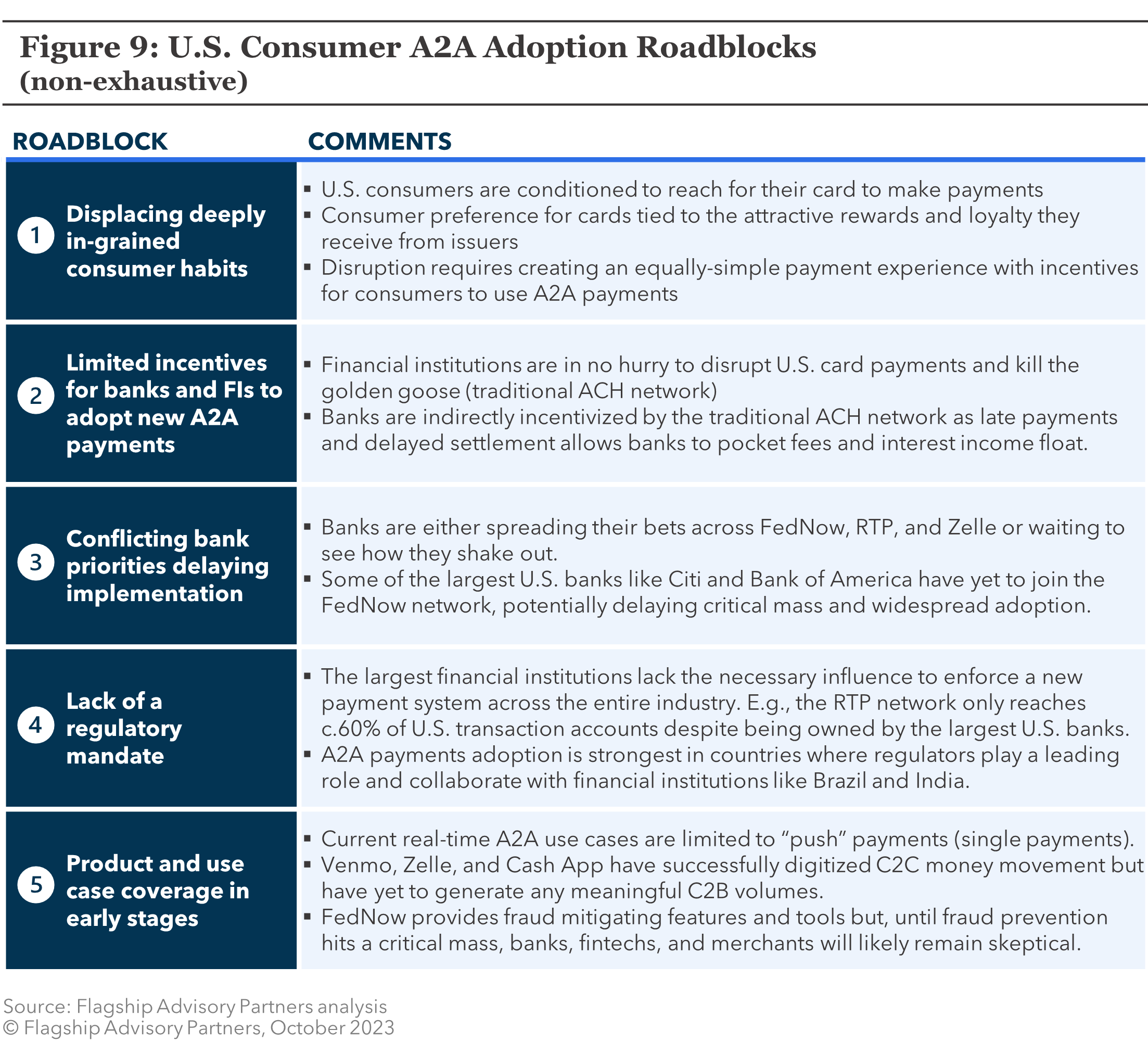

There are many roadblocks to FedNow being a major force of disruption in the U.S., which we highlight in Figure 9. In addition to competing against cards, FedNow must first foster bank/processor adoption of its network and then the banks must innovate their consumer A2A products and use cases. Given the fragmentation, atrophy, and opposing economic incentives, it feels farfetched to assume banks will lead an A2A disruption. If not banks, then who could dive U.S. A2A disruption?

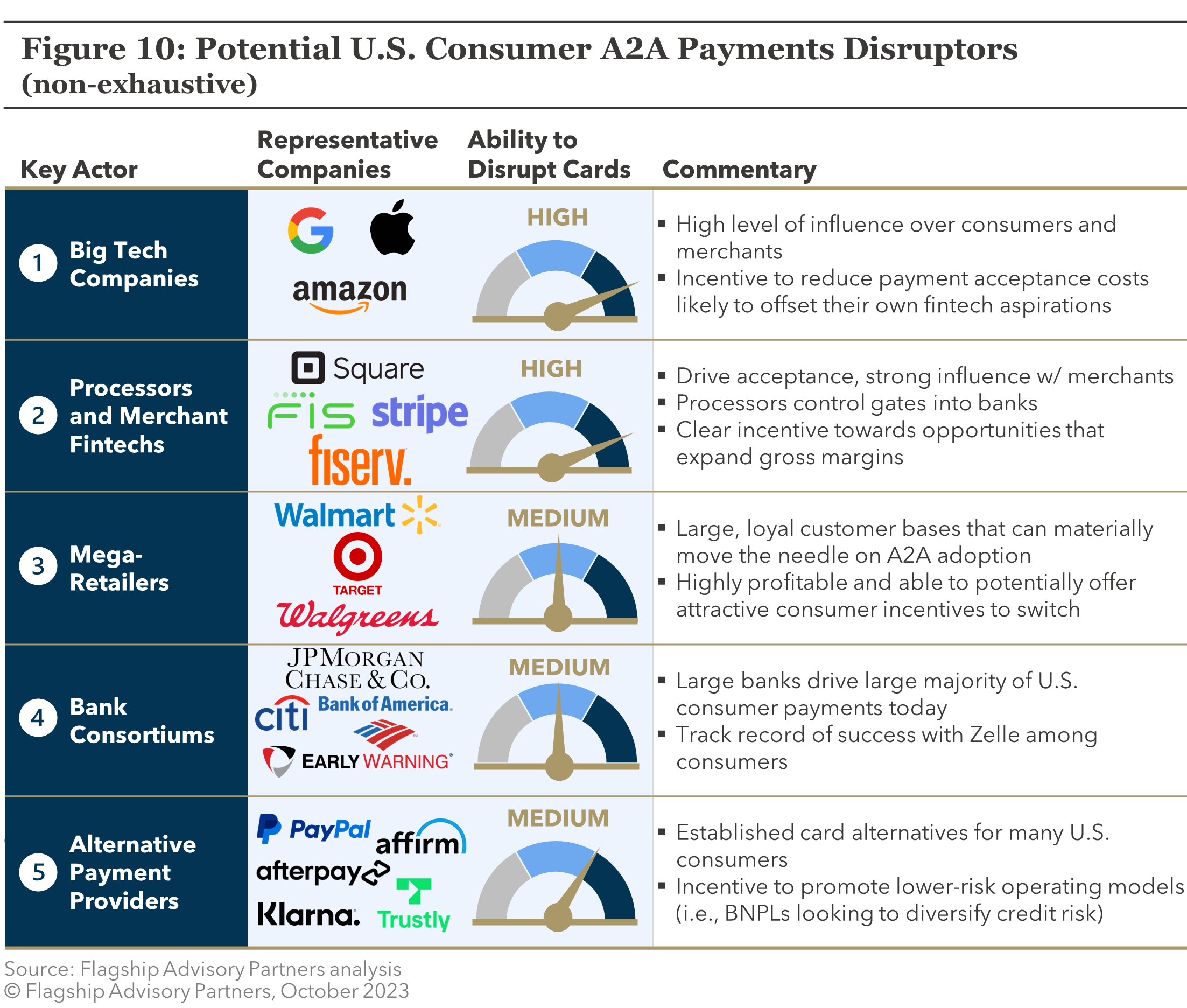

In Figure 10, we summarize our views on who could drive U.S. A2A payment disruption. Big Tech has some vested interest in bringing down payment acceptance costs, and the consumer platforms to drive use case innovation; thus it feels like Big Tech will certainly be an influence on any disruption. We also see fintech disrupters such as Square and Stripe as well as established APMs such as PayPal and Trustly as being relevant to a disruption story. While merchants must embrace A2A disruption for it to happen, we do not see them as the catalyst.

The acceptance (merchant) side of the disruption formula is not the roadblock. Clearly, merchants will steer customers to lower-cost payment options if they are viable. The roadblock comes from winning the consumer and changing their behavior. Technology companies such as Amazon, Square, and Apple would seem to hold the key to unlocking these consumers. But how do you incentivize an American consumer to abandon their beloved credit cards and points?

Conclusion

FedNow accelerates the potential for real-time A2A payment disruption in the U.S., offering another alternative to RTP for real-time bank clearing. The opportunity for C2B payment disruption is clear as U.S. cost of card payments is the highest in the world. There are many stepping stones to achieving A2A disruption, however. Firstly, bank accounts must be enabled for real-time A2A. Secondly, and most importantly, innovators must provide killer A2A apps with a clear incentive for consumers to use them. Thirdly, the merchant ecosystem must fall in line (which we view as the lowest hurdle). We see various technology companies as having the greatest potential to drive consumer innovation, but rather than one company soloing this outcome, we believe it will take several working in concert to drive real disruption.

Our best guess is that FedNow does not, in and of itself, significantly increase the disruption risk to cards in mainstream (retail) C2B payments. Clearing is just one, smaller piece of this complex A2A disruption puzzle. However, we do expect FedNow to potentially accelerate check displacement in alternative C2B use cases such as bill payment. We also expect FedNow to have a greater impact on B2B payments, which we will cover in Part 2 of this series on U.S. A2A payments disruption in the coming weeks.

Please do not hesitate to contact Anupam Majumdar at Anupam@FlagshipAP.com or Rom Mascetti at Rom@FlagshipAP.com comments or questions.