Webinar

16 Oct 2025

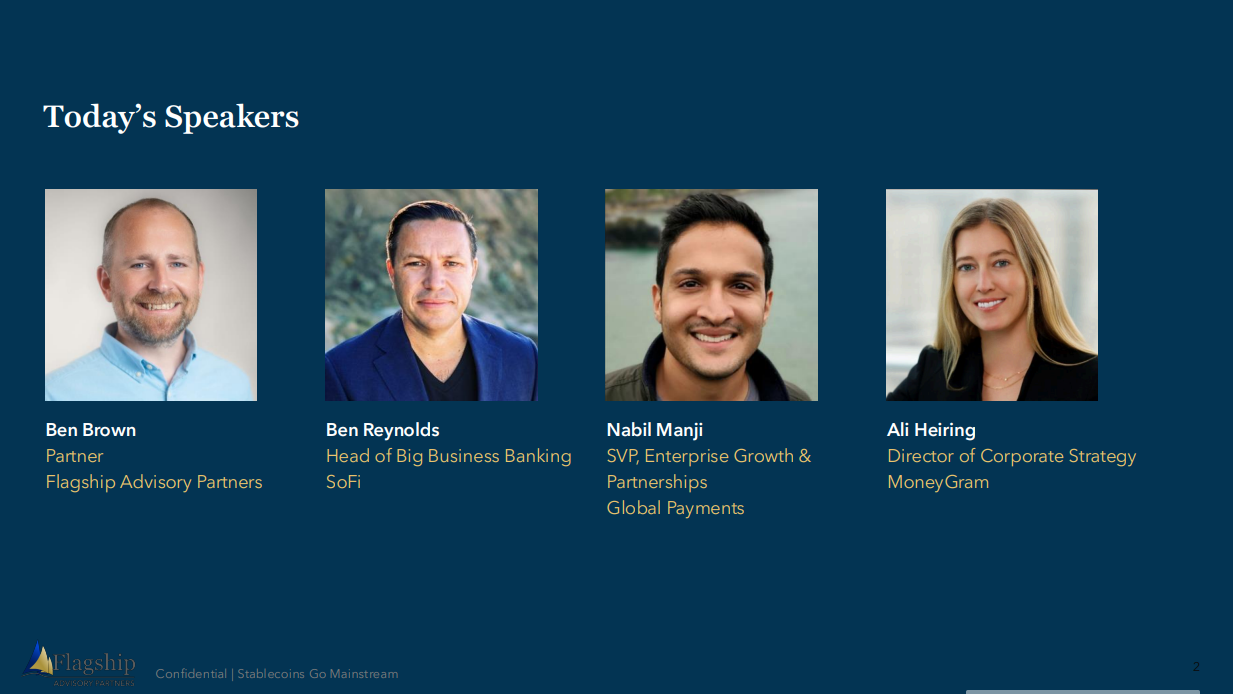

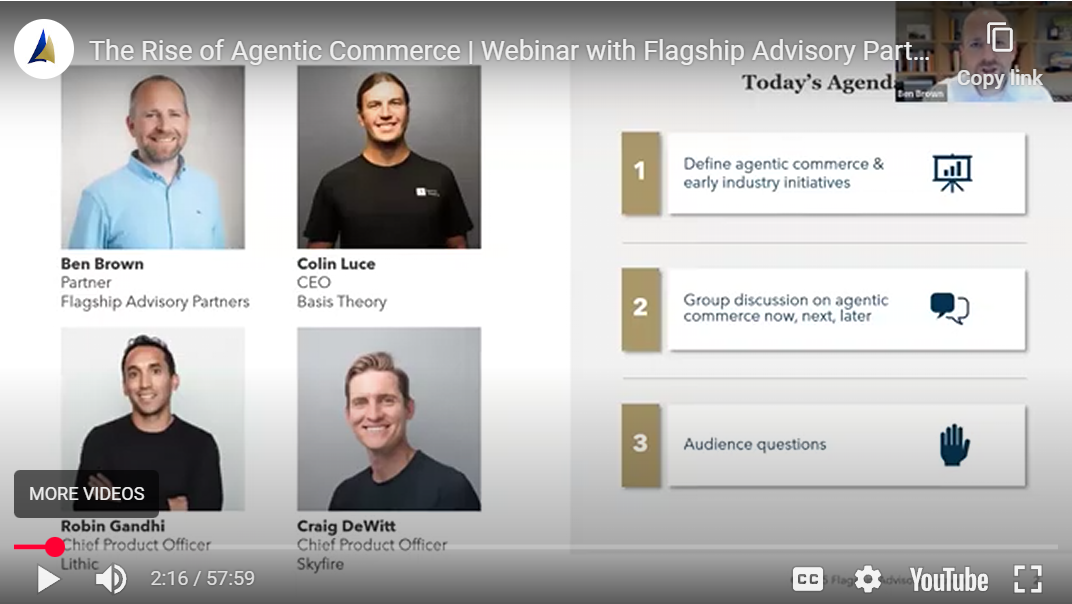

A panel discussion on the future of agentic commerce with Ben Brown (Partner, Flagship Advisory Partners), Craig DeWitt (Chief Product Officer, Skyfire), Robin Gandhi (Chief Product Officer, Lithic), and Colin Luce (Chief Executive Officer, Basis Theory). Together, we explored how agentic commerce could transform payments, digital identity, and risk, and discuss the opportunities and challenges ahead as this emerging landscape takes shape. The presentation is available for download by clicking the PDF button in the right hand side panel (desktop view) or below the post (mobile view). Please don't hesitate to contact Ben Brown at Ben@Flagshipap.com with your comments or questions. Transcript: Amilee Huang | 00:06 Okay! We have around 70 people right now in the attendee room. We'll go ahead and kick it off and let people join as people come in. Thank you, everyone, for coming. Today's event is a webinar and discussion panel on the rise of agentic commerce. Attendees, you guys are invited to submit questions through Zoom. We have enabled the chat function, so feel free. We are always good for engagement. We love to answer questions, of course, after giving our own opinions. Now we are recording this webinar, just to let everyone know. We will send around the recording afterwards, and it will be available on the Flagship website. Amilee Huang | 00:44 Your host and first speaker will be Ben Brown. He is one of the partners at Flagship so I'll pass it over to him. Ben Brown | 00:48 Amilee. Really appreciate the introduction and everybody for sharing their time today. One note. I don't know if everybody's Zoom looks the same as mine, but I see at the top there's a button for a webinar, and then Amilee's screen. On Amilee's screen... You'll be able to see the slides that we're going to present, but that might be easier for those of you in the audience. So, I think we can go to the first slide. Thanks everybody for joining. We'll kick off today's call with a short overview of what Agentic commerce actually means and how it works and the impacts on the payments ecosystem. Then, once I've set the context, we'll spend most of the time on a really good discussion with three innovators who are on the front lines of building new payments and structure infrastructure for Agentic commerce. On the title page, we have got Craig DeWitt at Skyfire, Colin Luce of Basis Theory, and Robin Gandhi at Lithic. A cross-section of companies that are building infrastructure for the Agentic commerce economy across things like... At the end of payments platforms for Agentic commerce, and digital identity for agents to virtual cards to supporting some of the cutting-edge evolution of network tokenization that we see. So, really appreciative for all the panelists for joining us today. I'll try to keep the flagship part of the discussion here as brief as possible because we just want to set some really good context for the discussion to come so that we can move forward. So, what place did you want to start? Thinking about does this matter and is this a real thing? Because we hear from our clients a variety of perspectives all the time. There aren't a lot of forecasts out on Agentic commerce at this point. The ones that do exist, though, very widely. Some say as high as 40% of all global transactions by 2030 in five years will be Agent influenced. Our point of view isn't that aggressive, but it's kind of like Bill Gates said: people tend to overestimate what will happen in a year and underestimate what will happen in ten years. To that end, we do think agents are likely to be meaningful and perhaps influence 20% of digital payments in the US, 30% of total payments in the US in 10 years. That means we're at the early stage of a once-in-a-generation emergence of a new form of commerce and payments. So, certainly, it's exciting to be here at the ground floor of this, and I think it should be exciting for everyone in the payments industry, even broader merchants and participants in the online advertising ecosystem, and companies building the AI future as well. So, moving on to the next slide, you know, while we're really early, we're seeing a constant parade of announcements from across the industry, and those announcements are coming from all kinds of different players. You've got merchants like Amazon and Walmart who have rolled out conversational shopping assistants inside their apps. Walmart has even rolled out that on the seller side with its Marty agent for marketplace seller onboarding, which isn't something we talk about a lot, but that's certainly a big potential impact of agentic AI, as it could expand the size of the pie in terms of who can participate in the digital economy. Smaller businesses, more custom goods, the circular economy. All these kinds of things that can be hard to put online agentic AI can help with that as well. We're seeing content delivery networks like Cloudflare and Akamai partner with companies like Tolbit or even Skyfire on who's with us today? So, publishers can authenticate and monetize that AI bot traffic, which is just increasing at an enormous rate. So, today, something like half of all web traffic is bots, half as humans. Of those bots, it's almost 50/50 between good bots and bad bots, which is one of the big impacts that we see affecting the industry. If you've had fraud models, for example, tuned to assume all bots or bad bots, then you're going to have a lot of false positives in the future as Agentic takes off. We see big tech companies like Google announcing protocols for agent-led payments with a long list of merchants and FIS and payment networks participating in that. Visa and Mastercard have both announced solutions to evolve tokenization for an agentic world. Even today, six hours ago, Visa announced its latest proposal for this space around agent identity, trusted agent identities. These early announcements are quickly turning into live experiences, such as shopping on Perplexity or buying from Etsy sellers natively within ChatGPT, which you can see as an example on the page. So moving forward, as this all comes together across the customer journey, AI promises to impact everybody. The search engines and social media platforms that drive digital advertising today, merchants, payment processors, and card issuers. Some of the impacts will be obvious, such as zero-click search and embedded buying, diverting some consumers from actually visiting merchant sites. Agents could confuse fraud tools that are tuned to recognize bot traffic, as we just mentioned. But some impacts are not so obvious, such as explicit agent consent trails could actually reduce certain dispute types if we can verify who authorized what, especially at the SKU level. At the same time, issuer costs for things like card benefits, extended warranties, price protection, and all the benefits that are bundled into most of the rewards credit cards we all carry in our pockets but rarely use could really change if you have agents who are systematically triggering things like price protection claims for dollar amounts that any of us wouldn't spend the time to really monitor. So, every company in the payments ecosystem, but really in the broader digital commerce ecosystem, whether that's a merchant or an online advertising commerce platform provider, et cetera, should think about second-order effects as well, not just those obvious ones that dominate some of the headlines. Moving forward, there are multiple ways that agentic commerce can happen in a retail context. And it won't all be shopping within the conversational interface of LLM. So, a few of these models are large merchants who are already actively evolving their on-site search into a more conversational experience, and platforms like Shopify are building ways that customers can create carts and buy goods across different sellers across the whole Shopify ecosystem rather than just staying within one seller's environment. In some cases, agents will help you find the item that you should buy, but then link you out to the merchant site, which doesn't really require any new infrastructure. They can monetize their role through preexisting affiliate commission platforms already exist out there, kind of a road to the personal shopper road. But where it starts to get interesting is when agents act as facilitators or aggregators, either initiating payments through the merchant's commerce and payments infrastructure or acting as the marketplace themselves and really owning that full customer relationship. Beyond these three models, we might see some more really interesting innovation in the future. Just a few early ideas in the bottom row there. But one example is you can see specialized agents that just take care of one part of the journey. So, for example, agents that take care of the checkout form for you, even if the rest of the shopping journey looks completely normal. This could be a solution so that every product page is a checkout page, and every merchant has one-click checkout. Even if you're not really known to that merchant yet, or even if you are and you just want to breeze through the checkout experience and not reconfirm shipping information, CVV codes, and everything, you just want to click a button and have it be magical checkout. There are ways that agentic AI can help with that too. It doesn't have to be just this experience of everything happening within the chat bot interface that we talk about a lot today, which is moving forward. We're payments people here at Flagship, and so we think about things through that payments lens. So we ask ourselves, how are payments working in these scenarios? We see four primary models. First, agents might simply auto-fill checkout forms, which can work but is brittle and hides that an agent-based experience is happening. It looks like a normal e-commerce experience from the perspective of everybody sitting behind that merchant and maybe the merchant themselves. The second column... Agents might collect funds from the end user and use virtual cards to make the payment to the merchant. That's pretty similar, actually, to how platforms like DoorDash work today. That's one way to think about the early days of agentic commerce: it's really just digitizing the human agent relationships that we already use and already trust. When you use platforms like Uber, Etsy, or DoorDash, you're asking somebody to place that order and pick up that food or pick up that item and bring it to you. Agentic AI is really digitizing some of those relations that exist, which exists in the B2B space as well. We'll talk about that a little bit later. The third column... Agents might use tokens that carry more information on digital identity, delegated authority. You know what you're able to, what they're allowed to buy, and limited use credentials. This is the way the networks are really steering things into the future, which we'll talk about soon. Then the last one we see emerging in some cases live, in some cases still experimental is machine-native settlement rails. So, examples are the Cloudflare-Coinbase partnership around the X42 foundation repurposing HTTP402 calls for on-chain stablecoin micropayments, which is relevant as a way to monetize things like API calls and content access and potentially even pay-per-use bot traffic between agents and publishers. I think I saw a stat that Cloudflare says they send out a billion HTTP402 payment-required responses every day, and those are largely ignored today because there isn't really the infrastructure to pay for those things. But in the future, as that infrastructure starts to become available and it starts to become even more important with the rise of Gen-Z, we may actually see that new form of monetization happen on the web. So, moving forward, we said that the networks are trying to steer things towards this agent token model. And you know, we do see a range of protocols and frameworks that have already been announced. So across all of these, we don't have the time to go into the details, but I think across all of these, a point of commonality is that they are focused on how do we use that tokenization infrastructure that's been used for billions of tokens so far in the last ten years or so and really underpins a lot of the digital wallet solutions that we use today? How do we evolve that token infrastructure for an agentic world and add more data to those things? While there are commonalities, there are some differences, especially in how those digital identity and intent signals will work. These aren't the only solutions either. This is just a sample of them from some of the biggest companies. But just as an example, Worldpay recently announced a partnership with Trulioo on a Know Your Agent framework. Then, some of the panelists I'll introduce in a moment have built solutions in this very space. So I think a lot of proposals and a lot of early-stage work is going on to build the future, but it's not certain exactly what that will look like. But if we want to double-click and just look at one of those examples to go past the press releases on the next page, taking a look at the Google API 2 agent payments protocol, you'll hear terms like intent mandates, cart mandates, and payment mandates that are not familiar in the payments world today. The way to think of those is that they're almost like notarized breadcrumbs of who asked for what, what items and prices were approved, whether a human was present or not, and what payment method is supposed to be used. That trail of breadcrumbs will be a goal for the future for issuers, acquirers, and merchants as they look at how to tune fraud models and how to adjudicate disputes that might pop up. Those things will create impacts for every player in the ecosystem. Four merchants, four payment processors four issuers if they really want to make use of those signals. So, with that, you're just seeking to give a foundational understanding of the space so that everybody is on the same page. But, you know, would love to do two things: one, just summarize the implications of what I just said there. So, I think there are three takeaways for those of you in the audience. One is to figure out ways to not fight good agents but actually authenticate them and embrace them. The second is that there's going to be a lot of changes around digital identity, consent, and skill-level data that might happen in the industry. So, starting to tinker with that stuff and learn about that stuff now is going to be useful in the future when you need to move those things into production or you see volumes start to scale up, already have those capabilities in production, and then you know it's a good time to pilot the stuff while volumes are low. With that, I'd like to shift gears and move into our discussion panel with people who are not necessarily prognosticating on the industry from an arm's-length perspective but instead, hands-on, out there, building the future. So, with that, I'd love to bring in Colin from Basis Theory, Robin from Lithic, and Craig from Skyfire. You guys are all on the chat already. I think we could take down the slides, and I'll come on video. It'd be awesome to just have each of you introduce yourselves, what your company is doing in the agentic commerce space, and what makes you most excited about this space? Robin Gandhi | 17:01 You gonna popcorn this or are you gonna just go for it. Ben Brown | 17:03 Yeah, you should go for it, Robin. Last to join first to speak, there you go. Robin Gandhi | 17:08 You know, I get it, but the garbage goes out first. All right, so yeah, my name's Robin. I run product at Lithic. Lithic is a next-generation, modern processor, similar in vein to your Marqetas of the world. We issue cards. We've been around for, well, in many iterations for the last 10-12 years, but in this last iteration, selling infrastructure for the last four. I would say, when it comes to agentic commerce, we've been dabbling in a whole bunch of stuff to try to make it work, especially with the folks that are here on this call. Where we as an issuer really play is in the, what Ben talked about, around virtual cards. So, where we've experimented so far, really is how can you take what we think are very controlled virtual cards that we can generate and then how can you give them to an agent to be able to actually buy them? I think we're in early days of experimenting on this, and I think we've started. We're pushing hard because we do believe that cards, virtual cards, is the way that we can solve this in one way. I think, as we go through this discussion, we'll talk about other payment mechanisms that can help, but virtual cards are really easy. I think, to your point, Ben, this is probably step one. Anyway, right, I'll save it for the discussion, but hopefully, that's helpful to give some background. Yeah, I'll call you and take the next one, maybe. Colin Luce | 18:56 Sure, thanks. So, I'm sure I know a bunch of you, but Colin, this cofounder and CEO of a Basis, our core platform is all centered around putting merchants and platforms back in control with the underpinning technologies being vaulting and tokenization. So, I'm sure you can imagine how that translates into our foray into agentic commerce. I think a lot of the use cases we've enabled over the past three or four years have been around these distributed, embedded, shopping experiences. Agentic shopping or commerce is just the next evolution of that. We've been in the midst of this shift towards more social shopping over the past five years, right? You look at TikTok Shop, Instagram Links, and all of that. ChatGPT is just the next medium by which that's going to occur. Or maybe put it another way, shopping is moving closer to where attention lives. I think that's the angle we come at this from: what are the dynamics at play to facilitate or enable commerce and transactions where attention lives today? So, I think Ben will get into some of the big use cases today. But I think the reality is that a lot of the in-production use cases today are non-AI agentic commerce experiences, and we're just at the precipice of moving into the agent-based AI stuff, but we can get into that more. So, last but not least, Craig. Craig DeWitt | 20:39 Thank you. My name is Craig DeWitt. I'm the co-founder of Skyfire. So, Skyfire is an agentic commerce platform. We serve both the AI platforms, AI agents, as well as merchants to accept them. On the AI platform side, really, what we provide is identity and the capability of using payments to go out and buy the things that are necessary for both stablecoins and now, with the advent of what the card networks are bringing to market, tokenized cards for purchase. On the merchant side, we allow merchants to identify bots, to identify not just the agents themselves but the principal behind that, the agent that's the user or business, and then to actually accept them as paying customers. Both through the website today, which is where we see the primary amount of our volume, but helping merchants with this explosion of protocols to be ready to accept agents in a headless fashion via a variety of API approaches and protocols we'll talk about. That's Skyfire. Ben Brown | 21:39 Awesome. Thank you all three for taking the time out of your busy schedules. I love that we have this really complementary panel. So, I've got this cross-sectional view of the industry. We're talking to big merchants. We're talking to the networks. We're talking to acquirers and issuers and wallets. But you guys are going deep on Craig, all in on the agent tech AI world with the end of platform, helping to enable the tokenization that underpins a lot of this, and I know it's evolving, Basis theory into broader solutions as well. Then Robin and the Lithic team from the cloud-based issue processor perspective. Those are all components that come together to make this future happen. So, I think this will be fun. So, let's jump into it with that. I think the first place, Colin, you said, we're not really seeing a lot of agent experiences out there quite yet, but what are the most mature agent-based commerce experiences out there today? There are certain verticals or apps or merchants, and I asked this question to a friend at one of the big tech companies the other day, and they said it's the wrong question for this point in time right, because we're still building the infrastructure for the future. What we should all take celebrate the winds around is putting in place the building blocks of how this works and the components of that infrastructure for the future. It's not about whether Walmart has gone live, but at that said, it seems like Shopify, Walmart, and Amazon all have gone live in some ways with some version of this. So, yeah, I'd love to just hear from you guys in terms of spending all this time, all your time in the space, what do you think are some of the most interesting experiences out there? Colin Luce | 23:35 Well, I'll start by saying I love that take by your friend. I'll admit, it sounds a little bit like a participation trophy award, though. I don't know if we should pat ourselves on the back for just putting building blocks in place, but I hear that point. Look. Ben Brown | 23:49 I do think it's the startup world, right? Colin? We just... Revenue will come later. Let's Like. Colin Luce | 23:55 I can play the game. I know. Ben Brown | 23:57 The game well. Right. Colin Luce | 23:58 Yeah, no, look, I do think it is these non-AI-agentic commerce experiences, right? For example, one of the first use cases we enabled three and a half years ago was Roku's Choppable ads platform. If you think about what that is, it's enabling a one-click buy experience directly from your Roku device. That's exactly what I was talking about in terms of delivering a seamless commerce experience where attention lives. A lot of that is predicated on the backend around tokenization, checkout APIs, a lot of the stuff we're contemplating here, there's just no AI involved in it. I think there's an important nuance for us to separate here between agentic commerce and agentic payments. I think a lot of the use cases, even the ones that are super early, whether it's the chat GPT ones or the Perplexity ones, I'm comfortable saying they're agentic commerce. I'm not necessarily comfortable saying they're agentic payments because the value that AI is providing in those is the accelerated efficiency. The discovery, the comparison aspect again, the payment aspect is all existing infrastructure and flows that we've had in place for a long time. I think there's another aspect to that, which is this carte blanche statement by people like, "What about the risk? What about the fraud?" It's like, "Whoa!" But the payment flows are identical or exactly what we have in place today. So if we have tools to mitigate risk and fraud in those scenarios, shouldn't those apply here? I think so. So that's what I'd say. Look, I think what ChatGPT is doing with ChatGPT Commerce and what Perplexity is doing, it's super interesting, but it's super early. I mean, I don't know any of the specific numbers. But I've heard Perplexity is in the... Ten of transactions a month or maybe hundreds or something, but we're talking about very early in terms of true agentic AI commerce. Ben Brown | 26:09 At least we'll talk about the dispute and chargeback impact of agentic AI, and how do we know the legal frameworks around that? It reminds me of what people said about self-driving cars, right? Who's responsible when a self-driving car gets into an accident? We're five years, ten years, and having self-driving cars in some form, and self-driving cars have had accidents, but people haven't stopped using them. It hasn't been super widespread. So these things will matter, but they'll matter maybe over the long arc of time right? Colin Luce | 26:42 And its kind of amazing that we can take a fully autonomous self-driving car from one end of San Francisco to the other, but we can't autonomously book an airline ticket today, right? So there's always this debate and tech about atoms versus bits, and it feels like atoms are ahead of bits in a lot of ways when it comes to this stuff, which is interesting. Ben Brown | 27:07 Robin, what do you think? Robin Gandhi | 27:09 What I was going to say is that I think Colin and Craig have probably seen more real-world examples. I think we can see it with a lot of the consumer use cases. I think in the grand scheme of things, the B2B use cases are going to be the more interesting ones. Again, we're early days, so it's hard to say, but if you think about it, people like buying stuff. So like removing the person from the buying experience. I think it's sexy to talk about. I'm going on a trip to Bali. What if somebody could just book the whole damn thing for me? But you kind of want to see the hotel. You kind of want to see all this stuff. But I think it's easy for us to grasp it's the stuff that people hate buying that is going to really be transformative from agentic perspective, right? So I mean, a lot of people talk about the marketing example: I need to have a budget of ten grand or a hundred grand, and I want to spend it across these platforms. This is what I'm looking to do. But that's stuff like that or a lot of the supplier payments that we're talking about. I think that's where we're going to see the most traction. So I think you're going to start getting... If we start talking about trust, that's where there is a small enough ecosystem that you can build trust, and you can essentially just have these buying decisions made because you just don't care. It doesn't really matter. When you need to get an extra few yards of pipe or pencils or whatever it might be, that's the kind of stuff that we're going to really see enable through agentic. So for me, I think that would be the really interesting piece of it. But again, it's early days, we have to figure out a lot of this other stuff. Craig DeWitt | 29:02 Yeah. So what we see at Skyfire, at least on the thing that people think about when they think of agentic commerce, is really e-commerce use cases where there's this new third party, a different interface of people interfacing with that to make a purchase. The closest case I've been closest to is what Consumer Reports is working on. They already have millions of users, they already get reviews of products within their interface, just have a button to go and buy it. So it's like, "Okay, do you want a toaster?" Like, "Unlike your Bali hotel room for your honeymoon." It's like, "This is the highest-rated toaster. Do I really want to find the right merchant and make sure the SKUs match? Just click by it." What Consumer Reports do is they'll spin up this browser, they'll navigate to that site, they'll find the right product, and then they'll put the credit card details in the checkout UI and then click "buy" on behalf of the user using the card tokenization stuff. But I think what we found is that the hard part of that, so far, is how does the agent get access to the site in the first place? When you talk about those four or two errors that are getting thrown out, four or three errors are going through the roof as well. Four or three errors just... "Hey, I identify programmatic access. I don't want bots on my site, and a big part of our business." This ties into what Robin was talking about on the B2B use cases. A lot of what powers commerce in general are these programmatic accesses to websites. Those drawbridges are getting put up right now because of the increase in AI traffic. A big part of our business is yes, these payments, but the other big part is agents just needing to identify themselves to get access to a website in the first place. We've seen a ton of B2B-type use cases explode there. Because the way the Internet has historically worked is changing as the bots have flooded the Internet, to where now it's a lot harder to get access to these sites and services than you could have even two years ago. Ben Brown | 30:58 That's interesting. Sometimes I'll get Cloudflare, making sure you're human, and sometimes a lot. I get that. So maybe I'm not using the internet the way normal people do. I'm your agentic AI here at Flagship. Craig DeWitt | 31:11 Yeah, those are the false positives, through the roof, by the way. That's a big fundamental change in terms of how these bot blockers and agent detection services are protecting traffic. So, you're going to see a lot more of those. Ben Brown | 31:24 I think that's a really interesting use case, right? Access. We've talked about digital identity access for the payments moment, but we have to remember we're part of a much bigger journey, right? There are all the ways that people figure out what they want to buy, where they want to buy it from, making sure they have the right prices, but even getting the web pages to load right, there's things that happen there. There are fraud detection services that look kind of similar to the ones in principle that we're using at the payment moment, but they're far upstream. That probably creates other opportunities. As you talked about micropayments that might go around, paying tolls for access is an interesting area to watch for sure, but let's talk a little bit about where this might move faster or slower. I think the folks over at Andreessen Horowitz recently wrote about agentic commerce, and they talked about how it could play different roles for different kinds of transactions, like impulse buys, routine essentials, lifestyle purchases, things like that. For them, it was less about which of these is a better fit and more about how will AI play different roles? In some cases, it might be built into the algorithm on TikTok, just steering impulse purchases and putting it in front of our face so we click that button. In other cases, it might be price trackers. I imagine in the future, I could probably walk around to Best Buy and say, "I'd like to buy that TV." But me again, I don't know, maybe I'm a normal person, but I'm not just going to buy the TV. I'm going to Google: "Where can I find prices? Is this a good price? What are some reviews?" In the future, you could just take a picture of that and all of that price comparison, all that assurance of, "Yeah, go ahead and buy it here. This is a good model, and it's a good price." All that could happen right there automatically or to more interactive AI coaches, right? If you're getting a mortgage or buying a car or something like that. Again, maybe it's not the checkout or the payment experience that they're part of that made it a lot more upstream, but it does. Even though there are different ways AI could be used in those different use cases, it seems inevitable that some sectors will move faster than others. So, we're sitting here in a year or in two years. What do you think will move the fastest? I know, Robin, you said that B2B might be one of those places that moves faster. I tend to agree with that. I think companies have long been comfortable getting comfortable with outsourcing their procurement operations. They do that with really big BPO systems integrators, and they've written down all the rules that go into what they'll buy, who their vendors are, and what the processes are. Then, they have people offshore in India, the Philippines, or other markets taking care of that. Same way, we trust doordash couriers here to pick up food or iPhones or whatever for us. Big corporations are trusting people offshore to run their B2B procurement operations. I think that's something that could probably be either pretty easily lifted and shifted into an agency model or what we see is that human plus machine pairing is always really powerful. So maybe it's not about getting rid of the outsourcing but it's about radically shrinking the headcount of that and using AI tools as your first line so that every human is the manager of something, right? The AI agent. But outside of B2B or specific places in B2B other sectors. Where do you guys think that in a year or two we'll see the fastest traction. Colin Luce | 35:11 So I think the procurement one is a good example. The way I think about it is I think it depends on who can get the most context right. Ultimately, the value of the AI here is how much data it can consume to facilitate this. I think that boils down to context, right? So, to your point about procurement, they've written down all these rules, they know what they want. There's context, right? Craig's example about consumer reports, there's very acute context. I'm looking for this microwave. Tell me the best ones, et cetera. It's why, again, I think this shift towards social shopping has occurred. These big tech companies have so much data on us, right? Which we've willingly given them. But it's why I think ChatGPT and Perplexity are so well-positioned, right? They have context around the conversation. Your objectives are you, a value buyer? Are you searching for discounts? Are you looking for loyalty? What is the context around the transaction? I think, look, having started my career at Yodle back in the day, I can tell you, the Transaction Description Data side of all of this is still a very much an unsolved problem, right? It was a problem 15 years ago and it's a problem today. So, when I hear people talk about the networks being able to provide this context, I say, maybe. But just because you see that I spent $3000 at United Airlines, that doesn't tell you whether I'm just super bougie and like to buy business class or I have a family of seven and we fly in the very last row of economy. It just happened to cost $3000, right? Those are two very different contexts about me that I think could be interpreted very differently, right? Or the... Hey, book me a flight to Miami sometime in the next two months. What if my plans change? What if the flight price dips below this price? Right. So if you don't have the context of my calendar and my travel schedule, that's a pretty moot use case in my mind. So I don't know whether it's B2B, B2C, or even if that's the right binary question. There are probably use cases within both of them, but I think it's wherever the agent or agentic experience can get the most context. Ben Brown | 37:40 Yeah, I mean, it seems like it could take hold in various different places, but maybe the really interesting question for our audience is how it's working and how it's going to work and how it will impact each of their businesses. If you're in the audience and you work at Best Buy, you're not going to change the business. Best Buy is then you just have to prepare for when it comes to your sector. So maybe we talk a little bit about that. I thought calling your point on data was really interesting. The metadata around all of that. So what do you think the single biggest blocker is today for agentic commerce to happen? Do you think it's the payment plumbing or digital identity for agents or data quality, like you just said? Consumer trust, merchant willingness to engage, or something else? Craig DeWitt | 38:37 Yeah. So maybe going across those three at least what we've seen. The procurement use case is actually one of the first things we did with a large partner, OEM stuff for auto manufacturing. It was a really simple use case. They had to go out and buy a specific type of resin and they wanted to automate that process. So the identity and the payments aspect worked great for it. It was all the other stuff internal to both the businesses that really made that use case super difficult. Like a lot of the internal use cases and procurement require human beings sending wire transfers, and that connects into how they're doing their ERP systems. There's a guy who manages the CDS, that CSV file. You know, it's like all those other things have to change for the procurement you use case. So I think there's internal holdbacks on procurement. I think the biggest blocker to e-commerce right now is customer adoption of it, user adoption and user experience. I think that'll come. But right now, for a lot of merchants, they're figuring out how big of a risk this is. Is it a vitamin versus an aspirin to allow this on B2B? Interestingly enough, I think the biggest blocker now is really just on the acceptance side. When we see B2B, you look at the places where there's the most pain right now, and the most pain is in content publishing. Those folks are getting hammered because the search aspect has changed so much that the ads model is breaking. You have well-known publications whose ad numbers are down 70% this year, right? So the big hurdle there is them understanding the protocols that they can use or the services they can use to start agents' access and accepting payments programmatically. So I guess to sum that up, Agentic Commerce is this massive umbrella of things. I think there are individual stop GAAPs or individual hurdles across each of the use cases that aren't specific to all of Agentic Commerce. Ben Brown | 40:48 And you're getting that kind of negative impact, it'll be natural to react and just say, "You know, shut it down." You can see some banks doing that, you can see content publishers doing that, you can see merchants doing that. Right now, I think large merchants are generally like, if you want to send me free traffic, whatever. But if you start to put in place monetization frameworks and open AI and Perplexity and all these guys start to try to create the next Google, you'll see enterprise merchants really react to that. I think one of the interesting things to watch for will be, do you just see this big reaction, or is there going to be this willingness to endure some transitionary phase that's painful while you put in place the new infrastructure? Because if it is a turn it off and then what will turn it back on once we have all the right infrastructure? That could create this sort of chicken-and-egg scenario: "Well, do we build the infrastructure? Because the volume's not there, but the volume is not there because you don't have the Right? Robin Gandhi | 41:58 No, I think... Look, merchant acceptance is at least in my mind the biggest piece of the whole puzzle. I think that a lot of us here on the panel are building things that can enable everything. In general, we're trying to build everything that can get up to the merchant. I think the merchant being okay with the transaction is where things are falling apart. I think that has to do with B2B and it has to do with B2C. In general, across the board, we just haven't... There's no mechanism, and this is what we're working on. I think this is... There's no clear mechanism to tell the merchant or whoever's accepting the payment that it's a good transaction. We've captured intent, and we know the agent. I think everyone's trying to put those pieces together, but the biggest piece is going to be great. Now what do I do with it? As a merchant, how do I get that? So I think once we've established some level of protocol that everyone is generally comfortable with, I think you're going to have to get the acquirers in and be like, "All right, this is what we're enabling." I don't know if I was telling you this story, but... As we were experimenting with how we could get an agent to buy something using one of our cards, we thought, "Okay, great. Let's go find an easy merchant that we can go to." We even thought, "Let's try to see if we can make a donation at the San Mateo Library." Even the San Mateo Library rejected the transaction because it thought it was fraudulent. So, I mean, it just means that there's this level... There's this level that we've already just need to get past where there's this surface level of, "Hey, we're protecting all traffic against bots." The fact that the San Mateo Library can't take it to me that that's a pretty overarching thing. That just means that if we can get into acquirer PSPs, once we have the right protocol, I think you can solve it. So, it's not that hard, but I think we just need to agree on something to begin with. Ben Brown | 44:19 I mean, there's a lot of frameworks and protocols that have been proposed over the last few weeks, and it seems like these things are being built in real time, which is fascinating, right? You can look at the GitHub for AP2, and you can see three weeks ago, somebody on their team said, "We don't have a model for human-not-present transactions. We should build one." There we go, we built it, and we announced it a week later. So, that's the kind of stuff that's fascinating to see it come together. We've seen proposals from Visa, Mastercard, Google, Stripe, et cetera. Is there anything fundamentally different between all these standards? Are they really all anchoring to the same core concepts, but just with slightly different flavors? You guys have surely gone deep on some of these standards. You're members of some of these networks. So, what are you seeing as you unpack these different standards? Is there a choice to be made there by the merchant ecosystem or by acquirers on what they'll support? Or is it really different flavors of vanilla that are all going to converge together into one approach Forward. Colin Luce | 45:33 Yes, I was going to bring this up as probably one of my biggest concerns or risks in all of this, right? I mean, I think there are inherently technological problems to solve around authentication and identity and all the stuff we talked about. But the other aspect here is just the competitive dynamics and the age-old thing of incentives. I think what worries me about this proliferation of protocols is that it is going to require collaboration amongst natural enemies in the market, and I don't know how that'll play out. I mean, if you look at AP2 being pushed by Google, you compare that with who arguably has the biggest advantage or the leader is positioned best here, being Chat PT. Who's their biggest competitor? Google probably, right? So, is OpenAI going to play nicely with AP2 given those competitive dynamics? I don't know. To Robin's point, I think it's going to be critically important that the PSP and acquirers get involved here. Well, what's the leading protocol being pushed on that side? Well, it's ACP with Stripe behind it. So, the question is, will Audion check out be comfortable supporting that with arguably their biggest competitor in the market being behind this? I don't know. If you look at the details of the specs, yes, it's open, right? And so in theory, they should be able to. But it's not always a rational decision based on the tech, the intricacies of the spec. There's this other dynamic at a more corporate level that I think is what worries me. So to answer your question, yeah, I think there are different flavors of vanilla. Yes, there are nuances around exactly what some of these different protocols do. But ultimately, again, as a merchant or platform, unless everyone converges around one, you're going to have to think about how I integrate into twelve different protocols, right? That alone is just going to stop any sort of adoption out of the gate, right? I think we're seeing this even more acutely within the network-specific offerings, right? If you look at Visa and agent pay, the issuer adoption or support just isn't there yet. Right? Mastercard, as of right now, I think has two issuing banks that are supported. So what is a platform supposed to do? Build some sort of UI orchestration layer upfront that asks the consumer, "Hey, who's the issuing bank behind your credit card?" Before you proceed, get out of here. Right? They asked my mom who the issuer behind her card is. She'd say, "United." No, it's not United, it's JPMorgan. She doesn't know that stuff. So I think we see this inside of each of these. But then I think if you upgrade it, we're going to need collaboration amongst all these, and that's going to be tough. Craig DeWitt | 48:36 Yeah, I'd say what these things have in common is they have in common there has to be a way of exchanging identity between the parties, and there's some concept of payment there beyond that, like the Colin’s Point. I think a lot of this, a lot of these have been written, in terms of who actually gets power in this new scenario, just look at AA and AP2 from Google. Like Google wants to collect the mandates there, right? The whole concept of the sharing of mandates. If you look at what the card networks have put forward, it's like, no. We're on the hook for chargeback risk. We get the mandates. And if you look at ACP, it's like, "Hey, don't worry about that. You just integrate into OpenAI." We'll take care of all these things. So I think at the core, there's an identity issue, there's a payment issue, but you have these big folks coming out and trying to put themselves in a position, of course, where they can control it and monetize it. So I agree with Colin. It's not great for the industry. It has been helpful, at least to Skyfire, just because you have a lot of confusion with merchants. It's like, "Hey, I don't want to pick, just give me a platform where I can be future-proof for these things." That's why I think there's a startup opportunity to come and hate you. Don't worry about it. We're on top of this at all times. We have a solution that will get you future-proof for all these things. Ben Brown | 49:52 And of the things that I think is interesting in some of the specs is that they ask for item-level data. That has been a really strategic thing. Merchants have been unwilling to share for a long time. So I'm interested in whether you guys are hearing merchants out there saying, "Hey, to enable Agentic, I'm willing to populate that SKU-level data into a message." Or is it that I get it that's big, but over my dead body? Will anybody ever get my item-level details? What are you seeing out there? Craig DeWitt | 50:28 So response that I've seen to ACP or essentially OpenAI integration, which essentially is asking the agents, "Hey, give me an API to your entire product catalog and pricing at the SKU level data." The answer there from big merchants that have actual brands is no way. I cannot just become a fulfillment center for e-commerce. What we have seen is that, "Hey, I am interested in accepting agentic commerce, but I still have to have a direct relationship with the end user, and I want to know exactly what that end user is looking at when their agent is accessing my site or accessing my APIs." So, I think there are two sides to this. One is just turning it off, which I think some folks will do, but you're going to lose sales on that. The other is just completely giving it away to the LMS, which I don't see happening. I don't think it's a surprise that... It's... Etsy and Shopify, I think, are good examples of companies that would lean into that just because of the nature of the merchants that are behind those. When I look at something like, I don't know, as an example, as an example, Home Depot, they do want that contractor agent to come in and buy those ten feet of pipe to Robin's Point earlier. But they don't just want to see the agent platforms crawling that site and then facilitate a checkout. They need to know who that contractor is. So, they have a relationship there and they're able to track history. That's again, Ben, I don't want to beat this point to death, but a big blocking piece is that identity exchange is so critical because it's what solves this problem that scares a lot of folks about risk maintaining a brand and a relationship with the principal who that agent is working on behalf of. Ben Brown | 52:03 It makes sense. Colin Luce | 52:05 I think we're seeing them ask the question that you alluded to earlier, Ben, which is what's the tax right? What's the business model here? So, inherently, all merchants and platforms face some sort of tax today, whether it be advertising, the cost to acquire traffic via advertising being the tax or the take rate from the e-commerce platform or the marketplace or whoever. Right. And so is that tax from these agent-based shopping platforms, LMP providers going to be 2% or 20%? And you said something earlier about free traffic, and I draw the analogy to us in the social world. We were very willing to give up all of our data and information for a free service. So maybe the merchants will be willing to provide skew and item-level details if the tax is zero, and they get free traffic, right? Maybe that's the trade-off. But the merchants we talk to, they're asking that question before deciding whether they want to participate or not. What's the tax. Ben Brown | 53:18 And that value doesn't have to be really complicated. We've worked with big tech companies in the past. You know what some of them say? What's the little blue dot? Because the little blue dot in your map application unlocks a whole bunch of data for the companies that are behind those apps. It's not a complicated idea. I want to know where I am, and I want to have directions to places, and there's a value exchange there that maybe some people don't appreciate the full value exchange going on, but I see we're pretty close to time. Maybe one thing. Just with a couple of minutes left, what's one piece of advice that you give to companies out there in the ecosystem on what they should do tomorrow on this topic? Maybe I can ask each of you to talk to a certain part of our audience. We have merchants out there, we have acquirers, we have issuers, and we have investors, for sure. So, Robin, why don't you? What do you have in your mind in terms of what issuers should do since you guys are spending all your time in the issuer space? Colin, what's something that you'd encourage PSPs and acquirers to do since you're sitting right adjacent to them? Craig, what should merchants out there in the audience think about doing tomorrow? Robin Gandhi | 54:44 Easy enough. I think on the issuer side, there's less that we play in general, right? I think the reality is what I would encourage most issuers to do is figure out how you're going to contribute to some of the things that we're talking about in terms of protocols and where issuers play in that, working with the card brands and figuring out how you can support some of the token framework that they're talking about. I think most modern issuers already have the ability to spin out virtual cards that are reasonably highly controlled, so I think we just... From an issuer perspective, where I think others should be is really just being in the conversation. I mean, I think we know that this is where things are going. We don't know exactly where it's going to go, but the reality is makes a ton of sense that you would connect the dots and issuing a payment mechanism is the way to go. So yeah, that's kind of where I think. Ben Brown | 55:52 Colin. What should acquirers and PSPS do tomorrow? What's the kind of first step for them? Colin Luce | 55:58 Yeah. look, I think in a lot of ways, they're the gatekeepers to all the merchants they have behind them. So, I think they sit in a unique part of the stack whereby the more work they can do to make this as seamless to adopt on the merchant side, the better. So, I would say if they could start to think about this as the new Google Pay or Apple Pay, and all merchants have to do is flip a switch or as close to flip a switch as possible to participate, the better. So, I would say, PSPs and acquirers should just think about how they can, given their mini nature, take on the initial lift or work here and then enable all the merchants behind them. Ben Brown | 56:49 Yeah, sometimes acquirers and PSPs are frustrated by rising complexity in the industry, but actually, complexity is good for them because they can help simplify it for their clients. Craig, why don't you wrap us up with thoughts on what merchants out there in the audience should think about doing in the near term? Craig DeWitt | 57:05 Yes, super easy. Just reach out to Skyfire and we'll take care of all this. Thank you. Yeah, I'm glad I got merchants. Thank you, Ben. Ben Brown | 57:14 I think it's called Flagship for figuring out your strategy. But with that, thank you to everybody in the panel for joining us. I know you're all super busy. Thank you to all in the audience for joining. I know we didn't have time to go live through some of the audience questions, but we've collated those and we'll follow up directly with some of you that asked questions out there and we'll put the recording up on our website if anybody wants to replay, as well as distributing some of the slides. So thanks again, everybody, for joining today. Craig DeWitt | 57:45 Awesome. Thanks, everyone. Thanks, everybody.

aiartificialintelligence,fintechsaas,perspectiveonkeyevents

psps

webinar

.png)

.png)