The newest edition of the Global Overview of Payment Providers 2024 – Key Players and Trends in B2B/B2C Ecommerce is designed to help you stay up to date with key trends, investment patterns, mergers and acquisitions (M&As), innovations, and emerging technologies – and gain insights into the capabilities of the top companies in the payments industry. Additionally, the report features four comprehensive infographics detailing the strategic M&As and the main investments in the payments industry in Q3 and Q4 of 2023. Download the full report at The Paypers here.

The newest edition of the Global Overview of Payment Providers 2024 – Key Players and Trends in B2B/B2C Ecommerce is designed to help you stay up to date with key trends, investment patterns, mergers and acquisitions (M&As), innovations, and emerging technologies – and gain insights into the capabilities of the top companies in the payments industry. Additionally, the report features four comprehensive infographics detailing the strategic M&As and the main investments in the payments industry in Q3 and Q4 of 2023. Download the full report at The Paypers here.

Introduction to the Evolving World of Payments – Global Overview of Key Industry Themes in 2024

The fintech hype bubble burst in 2022, leading to a reset of expectations and objectives in 2023. Thus, 2024 marks the beginning of the new normal for the payments industry. The once irrational exuberance in payments is gone. To make it in today’s payments industry, you need to have a strong product, business model, strategy and leadership, and capital backing.

The current shakeout will prove hygienic, contributing to a better payments industry, in which hundreds of fintechs thrive. Product and go-to-market innovations in payments continue unabated, helping to improve the lives of consumers and businesses. If you think about your own day-to-day life, it becomes clear that commerce has never been easier, and payment innovation plays a large part in this advancement. Payment companies also continue to improve business models, finding new ways to create value. For example, a decade ago, payment value-added services that discrete revenue at scale were mostly a thing of fantasy. However, in 2024, these services have become a reality.

Within this introduction, I plan to focus on the most interesting and impactful areas of market development, by covering the following themes:

1. Maturity and competitive intensity in payment acceptance;2. How technology platforms in the US are thriving with embedded payments, and how this phenomenon is also ramping up in Europe;

3. The acceleration of growth and scale in cross-border payments and payouts;

4. How B2B fintech is reaching its potential in the US and emerging in Europe;

5. How wallets and A2A payments are thriving globally, but not everywhere;

6. Insights into how a crowded field of fintechs is stepping into the massive need for trust and security;

7. How investors are adapting to a more challenging investment environment in payments.

I. Merchant payment acceptance is now an industry of haves and have-nots

In merchant payments (payment acceptance), double-digit growth used to be a foregone conclusion. For decades, the displacement of cash-powered card usage surged, while card acceptance grew towards ubiquity. In 2024, these tailwinds are now mostly played out for much of the Western world. At present, acceptance is effectively saturated in mainstream verticals (retail, hospitality, etc.), and little cash remains. Additionally, the competitive landscape is more crowded than ever, also as a result of competition from software companies that are marketing embedded payments. Achieving 10% topline growth as a merchant franchise is now a challenge.

Within this environment, we see an increasing separation between winners and losers (growth laggards). Market leaders, some of whom are listed below, continue to thrive. For example, in the case of point-of-sale (POS), great companies such as Square, Shift4, SumUp, Clover (part of Fiserv), Dojo, and others continue to grow, often well above 20%. Similarly, in ecommerce, market champions such as Stripe and Adyen and challengers such as Nuvei, dLocal, Mollie, and BlueSnap also continue to capture over 20% of growth. While ecommerce went through a rationalisation of growth expectations in 2022, 2023 saw a return to strong results from market leaders. Some of these payment service providers (PSPs) such as Adyen and FreedomPay are also rapidly closing the competitive divide between POS and ecommerce, growing at high rates based on their ability to solve omnichannel needs.

For many others, growth has become more challenging. PayPal, for example, an ecommerce payments champion across many global markets, has come under significant growth pressure, particularly due to the cannibalisation effect of Apple Pay (a topic that we will return to later).

Figure 1: Select leading fintechs in merchant payments

II. Technology platforms are thriving with embedded payments and finance

There is no bigger category of winners in fintech than software platforms that are monetising embedded payments and other forms of Embedded Finance at scale. This trend is most visible in the US, where there are now thousands of technology platforms monetising payments as a meaningful portion of their revenue mix. Software and fintech monetisation tends to start with payment acceptance (payins), but payouts, lending, and card issuing are all now lucrative for some of these platforms. The US market’s propensity for cards and comparatively lucrative card economics make issuing and card-based payouts particularly interesting. This development is visible across dozens of different verticals in the US, beyond the headlines – such as education, childcare, charity, field services, and professional services, among many others.

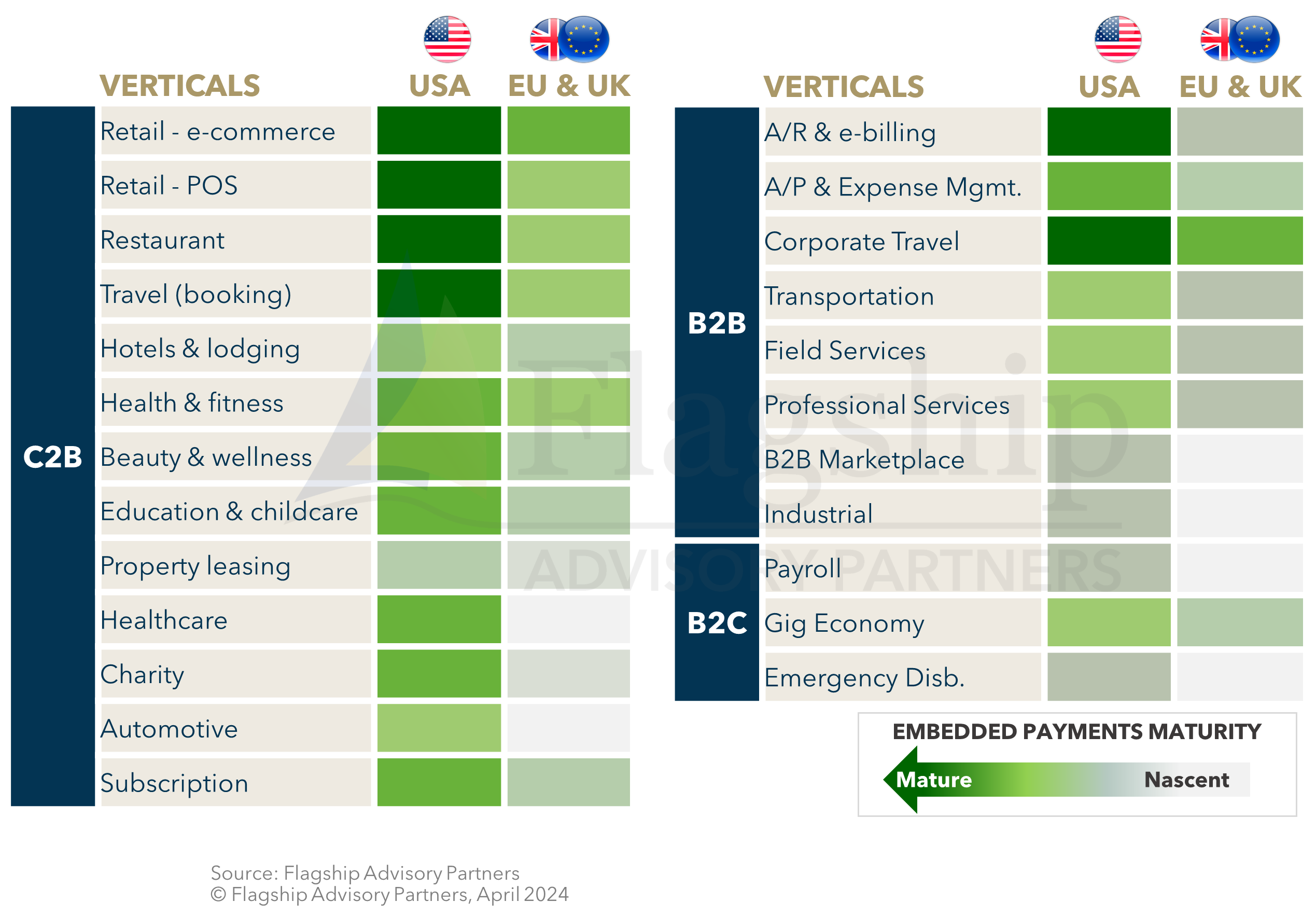

Figure 2: Relative maturity of select embedded payments verticals, US vs. Europe

In Europe, the adoption of Embedded Finance across different verticals is less mature, as illustrated in the above figure. Some of this nascence is simply a reflection of timing, as European software platforms are smaller and more fragmented, and therefore naturally slower to focus on Embedded Finance. But the monetisation of Embedded Finance in Europe can be more challenging if the embedded use cases are already well served by low-/no-cost account-to-account (A2A) payments. We remain highly bullish on Embedded Finance across use cases and verticals in Europe, but some of these developments will require patience. Part of our optimism is based on the value creation of workflow automation. Even if a bank payment is digital and free, it is still too bespoke, resulting in exceptions and requiring manual effort. The software and fintech community will solve these needs (more so than banks) and establish new monetisation models as a result (e.g., a willingness to pay BPS for a SEPA instant transaction).

Figure 3: Select examples of platforms thriving in embedded payments and finance

III. Payouts, especially cross-border payments, are realizing impressive growth and scale

As merchants become more ecosystem-based, payout fintechs are thriving, particularly those with strong positions serving the cross- border needs of marketplaces and gig economy platforms. These platforms operate complex networks of buyers and sellers, often around the world. They require not only global payment acceptance, but also global payouts to their sellers and gig workers. Both the platforms and specialised fintechs, such as Payoneer, have come to realise that they can also provide a broader range of services to these gig customers – for example, card issuing and neobanking.

Beyond supporting platforms, payout specialists continue to chip away at market share from banks and traditional money remittance providers. Modern technology allows these companies to move money faster and cheaper than ever before including digital user experience (UX) on both the initiation and receiving end of the transaction. Given that cross-border digital commerce grows at 1.5-2x the rate of domestic commerce, we expect cross-border fintechs to continue thriving.

Figure 4: Select leading fintechs in cross-border payments

IV. B2B fintech achieving its potential in the US and emerging in Europe

The powerful story of software plus Embedded Finance is highly visible in B2B commerce. In B2B verticals, there is massive fintech value creation in the US, but not yet in Europe. In the US, companies such as Bill, Tipalti, Brex, Coupa, Inuit, and others thrive serving the B2B financial services needs of small and enterprise businesses across a range of use cases, including, among others:

1. Working capital lending;

2. Trade finance (financing transactions on terms, factoring, purchase finance, etc.);

3. End-to-end automation of corporate payments (invoice-to-cash, procure-to-pay);

4. Expense and accounts payable (A/P) management and card issuing;

5. E-billing and accounts receivable (A/R) and embedded payments.

Some of these same embedded payment product innovations are also growing rapidly in Europe (e.g., expense management and payments, working capital) while others are not yet breaking out (e.g., corporate payments, trade finance). However, we believe that it’s only a matter of time before the latter become more prevalent. B2B spend will reach approximately USD 140 trillion in 2024, two to three times bigger than consumer-to-business (C2B) spend. Banks still process and hold most of this spend, but fintechs will continue to find proposition and GTM advantages to chip away.

Figure 5: Select examples of leading B2B fintechs

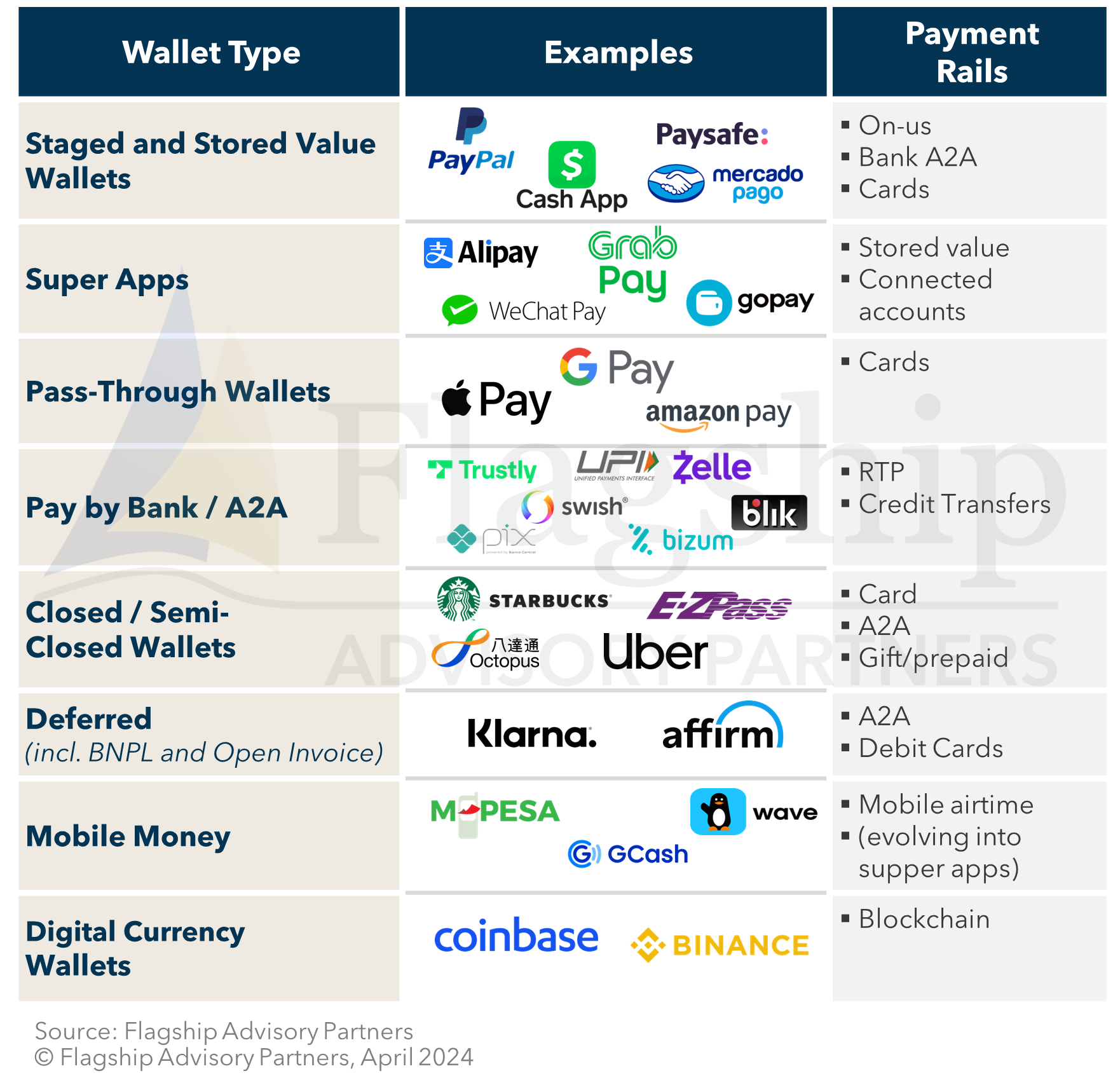

V. Wallets and A2A payments are thriving around the world, but not everywhere

Wallets, in various forms, continue to thrive in 2024. Apple Pay, for example, has achieved scaled success around much of the world in both face-to-face (F2F) and digital payments. While Apple is notoriously tight with data on Apple Pay, their wallet is clearly thriving, and it is a primary contributor to PayPal’s growth struggles.

Success for wallets elsewhere tends to be more domestic, and often A2A driven, rather than the Visa and Mastercard (V/MC) rails that power Apple Pay. From developing to developed markets around the world, the real-time A2A banking infrastructure has been a massive catalyst for the scaling of mobile payments. A2A payment schemes, built to power mobile and digital payments, are achieving rapid growth and success around the world. Most of these are national initiatives, supported by the local banks (UPI in India, Pix in Brazil, Blik in Poland, etc.).

Across markets in Asia, we also see the development of wallets as part of broader ‘super app’ platforms designed to enable many day-to-day use cases. Telco or mobile money-based wallets are also thriving in developing markets such as Southeast Asia (SEA) and Africa – for example, GCash (the Philippines) and M-PESA (Sub-Saharan Africa), among others.

Of course, not all forms of wallet or A2A payments are thriving. We are still waiting for scale in Open Banking payments and the development of potential A2A payments disruption in the US. And while I won’t hold my breath on these disruptions, there are visible ripples. US consumers are increasingly accepting of Open-Banking opt-ins (where Plaid is becoming ubiquitous in the US as an access enabler). Moreover, some of the vertical A2A disruption use cases, such as those pursued by Trustly, are quite interesting as a precursor to a broader disruption

Figure 6: Types and examples of leading digital wallets (or wallet backbones)

VI. Identity verification, trust, and security are critical in a digital world

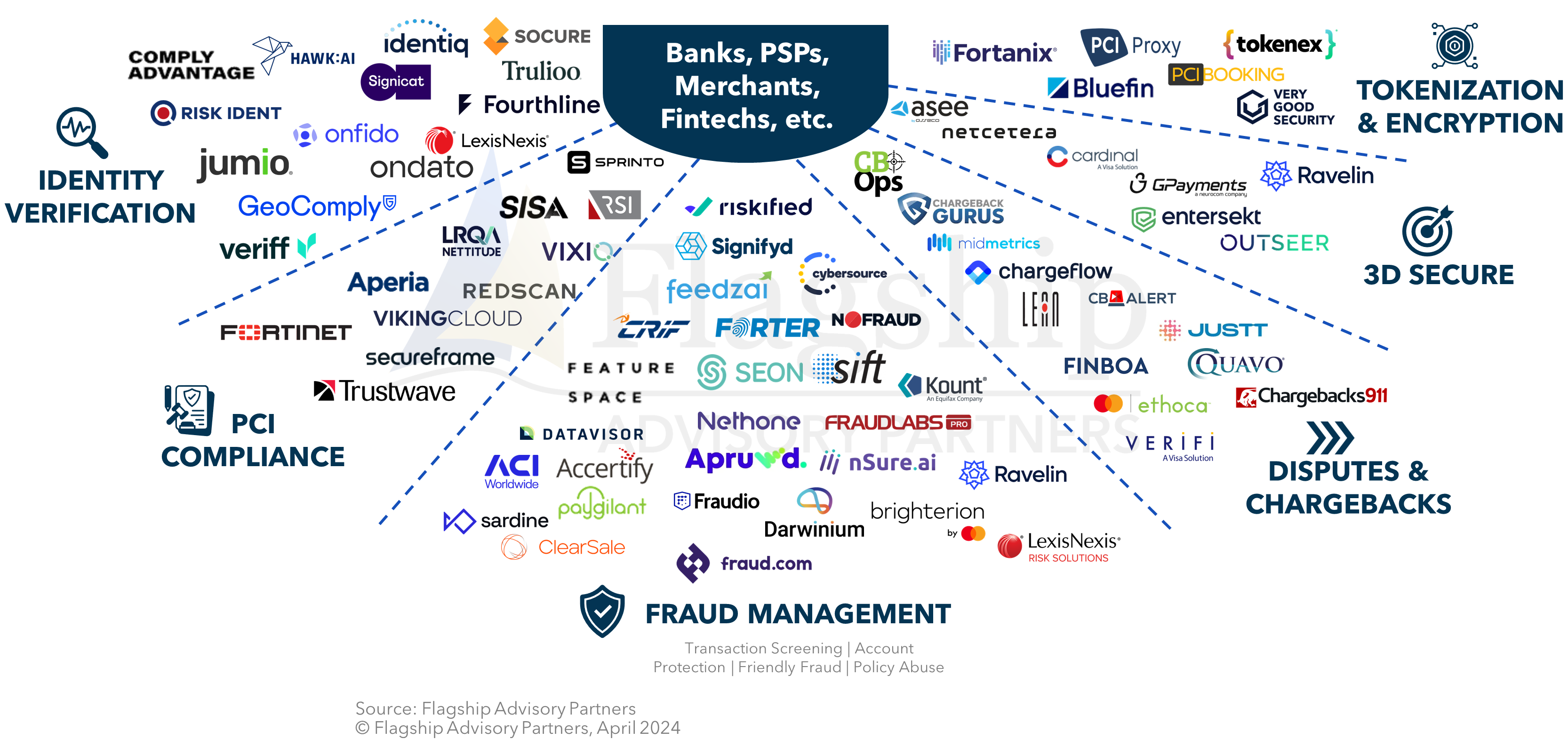

In a world in which digital commerce is booming and payments are smarter than ever (i.e., embedded, via wallets, etc.), one would hope that we were making progress in tackling fraud issues. Unfortunately, fraudsters are talented and motivated, continuing to find ways to exploit the payments ecosystem. For every door that technology closes to fraudsters, another is open by our constant need for more frictionless use cases. Payments and identity fraud is still growing and evolving. For example, counterfeit card fraud is down significantly, but account takeover fraud continues to grow.

There is a massive and relatively fragmented community of fintechs positioned to solve the needs of identity validation, payment, and account security. This vast community tends to be product-specialised, as shown in the figure below. We expect consolidation and breakouts from this group of fintech in the coming years.

Figure 7: Landscape for identity, trust, and security fintechs

VII. Fintech investors adapting to a payments industry with tightened fundamentals

Fintech investors had it easy for the better part of three decades, starting in the early 90’s. This easy road ended in 2022. Fintech remains a great place to invest, but the arbitrage is gone. For investments to thrive looking forward, investors must pick the right companies and leaders – and make investments at the right valuations. We expect some of the private equity investments made from 2019 to 2022 to generate negative equity returns, as the valuations outpaced future cashflow potential. We already see a shakeout happening at the lower end of the market as venture capitalists (VCs) pack up and exit deals that lack a clear path to profitability. We will see a similar shakeout among larger private companies over the next several years.

In summary, there remains much to be excited about in the world of payments. But there is also a new dose of reality and focus on building great businesses, not just innovation for innovation’s sake.

Read the full report by The Paypers here. Please do not hesitate to contact Joel Van Arsdale at Joel@FlagshipAP.com with comments or questions.