A decade ago, Value-Added Services (VAS) in the context of merchant payments were more aspirational than tangible. Today, we see merchant Payment Services Providers (PSPs) achieving lucrative success across a range of value-adds including software subscriptions, lending, multi-currency, card issuing, and others. Isolating Square, given that they are publicly listed, we see a healthy 28% of gross profit derived from VAS (not payments) in 2023. Given the range of proven VAS products now available, we believe that all PSPs should derive 15-30% of net revenues from VAS. Within this article, we examine the range and fit of VAS for different merchant segments, and we dissect Square’s and Adyen’s VAS profiles as an illustration of these segment-driven VAS outcomes.

VAS Heatmap – Where Are Your Best Opportunities?

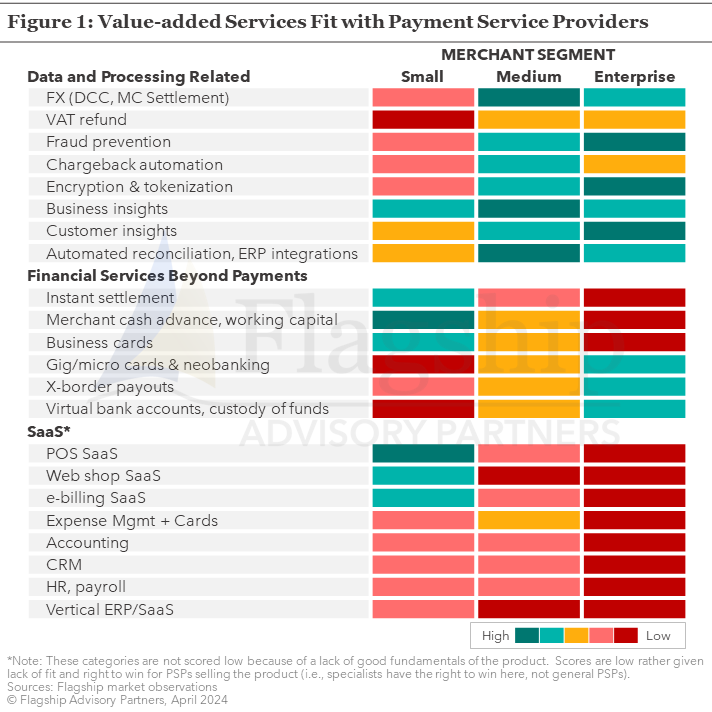

As shown in Figure 1, there is a broad menu of VAS available to merchant PSPs. Some of these VAS are more proven and lucrative than others. An optimal prioritization of VAS is segment, channel, and geo-driven. Within the enterprise e-commerce segment, multi-currency settlement is the biggest money maker, but fraud management, tokenization/vaulting, and chargeback services are also demanded and strategic. Within the SME segment, software subscriptions and lending are the big profit generators, but there is also a broader range of options given the natural success of bundling and cross-selling within the small segment. Well-established Dynamic Currency Conversion (DCC) and tax-free shopping VAS continue to be lucrative if your geographic and vertical footprint (i.e., foreign cardholders shopping and engaging in hospitality and entertainment) aligns well with these products.

Software Subscriptions and the Convergence of Payments and SaaS

Software subscriptions stand out as the most intriguing facet of VAS within the SME segment. However, categorizing software as VAS is somewhat misleading. Core business software, for example, commerce-enabling or ERP software, which is the operating system of the business for an SME business is the lead product; payments are a secondary buying decision in the merchant’s purchasing cycle.

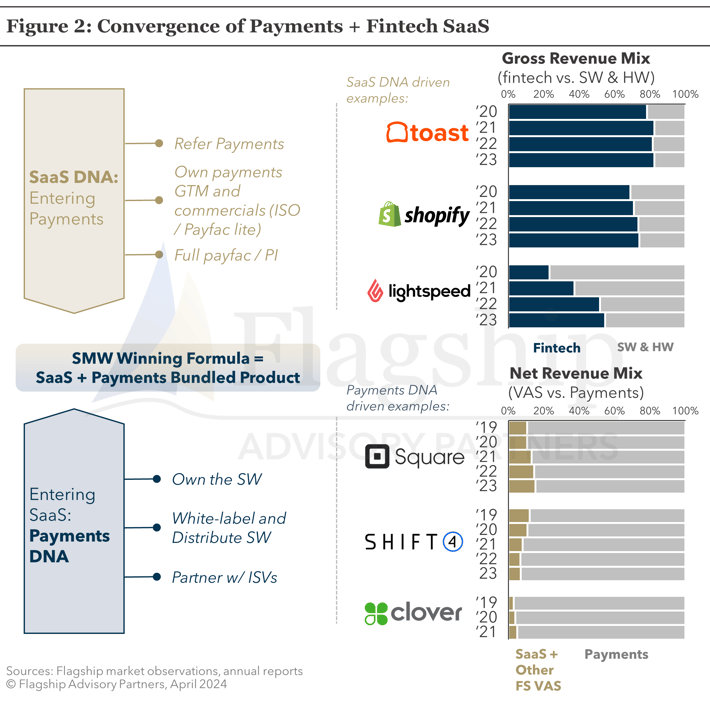

There is an ongoing convergence of software and payments/ fintech, which is reshaping each of these industries. In Figure 2, we illustrate this convergence, software companies expanding into payments and fintech and payments companies expanding into software. Both evolutionary paths have produced success, although the software companies are more advanced in penetrating the fintech revenue pool than PSPs are penetrating the software revenue pool.

While software, as explained above, is the primary purchase decision (vs payments) for small merchants, payment processing is a more lucrative driver of gross profit than software (at least in the small merchant segment, in mainstream verticals such as retail and hospitality). In these mainstream verticals, software and hardware tend to be a lower-margin (software) or no-margin (hardware) while gross profit and EBITDA margins are driven primarily by payments and fintech services. For example, only one-third of Toast’s gross profit comes from software and hardware, while two-thirds of gross profit comes from payments and other financial services (Toast being a software company at heart).

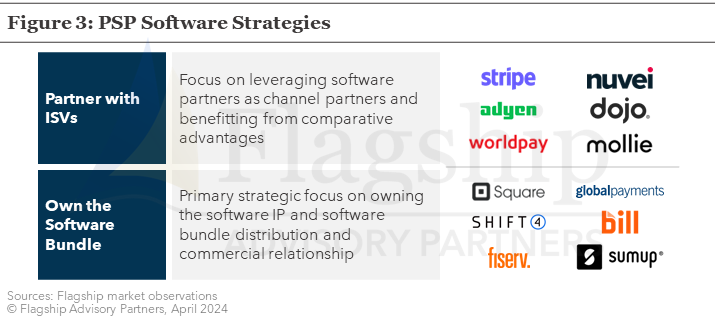

It is not an easy transition for merchant PSPs to learn how to market software. Fiserv is highly successful with its Clover platform today, but it took many years for the company to train its distribution channels to effectively sell Clover. Similarly, Shift4 delivers strong growth with its SkyTab and Appetize software products, but this success comes on the back of distributing restaurant software for many years. Our strategic viewpoint is that leading small merchant PSPs need to find success in at least one of two strategic paths as illustrated in Figure 3. Some PSPs manage to succeed with both product and go-to-market strategies (e.g., Bill.com, Fiserv, Sumup), but channel conflict is created when a company both owns and partners with software providers. Finally, rather than owning the software, some PSPs elect to white-label basic SaaS products, for example, as Worldpay does with GoDaddy.

We draw a strategic distinction between small merchant SaaS (the simplest, more generic SaaS) and more advanced, vertically specialized SaaS. We see PSPs as having a strong right to win with low-end software bundles for Point-of-Sale (POS), web commerce, or e-billing. But we see a more challenging right to win for PSPs owning/selling highly-verticalized software (which brings you upmarket into medium-sized and larger merchants).

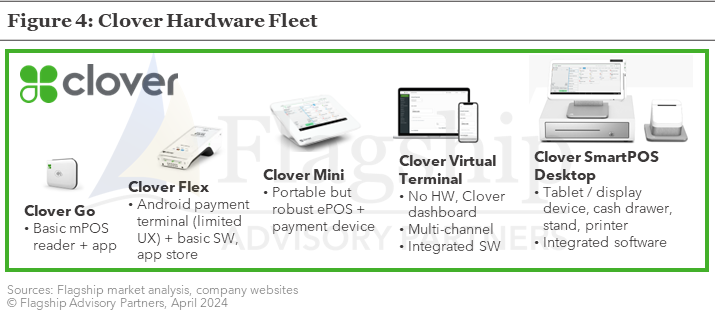

Before we move on to other specific VAS examples, it is also worth noting that hardware itself is a form of VAS in today’s market. Hardware is not a major contributor to gross profit, as it tends to be a loss-leading component of a fintech bundle, but it is the foundation for a broader POS kit. As a POS fintech, if your hardware is not elegant and does not deliver the range of use cases required, your go-to-market will suffer. In Figure 4, we illustrate Clover’s hardware range. This range illustrates the fundamentals of solving for the range of POS use cases 1) pure mobility payments, 2) basic terminal, 3) robust portable device capable of advanced interactions, 4) virtual terminal and 5) a full desktop station, noting that Clover’s hardware seems to satisfy basic elegance requirements.

Examining Square and Adyen’s VAS Revenue

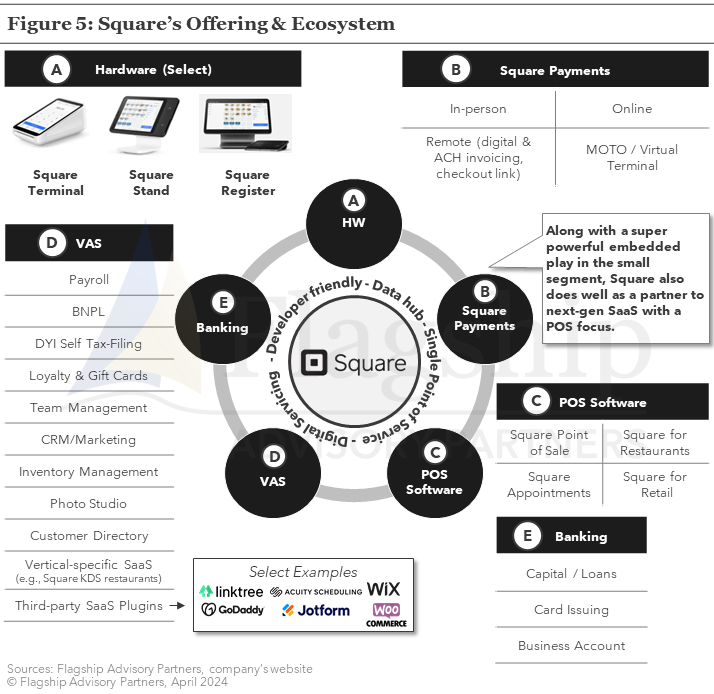

Square and Adyen are both publicly listed companies, and we use their data as proxies for VAS within the context of a small merchant franchise (Square) and an enterprise e-commerce franchise (Adyen). As shown in Figure 5, Square has one of the most diverse product menus in fintech, touching on many VAS domains. The sheer breadth is a testament to the possibilities. If you are the primary operating system of a small business, your right to win across the needs of that merchant is strong.

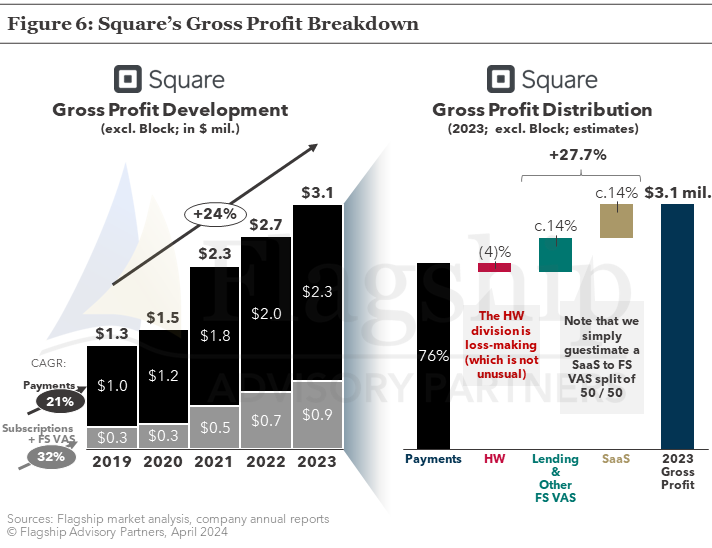

Square’s gross profit breakdown of revenues is shown in Figure 6. Here it becomes apparent that:

- Payment processing/acquiring accounts for 76% of the gross profit (after interchange, scheme fees, and processing fees)

- Hardware is a loss leader, generating negative gross profit (-3.5% of gross profit)

- Non-payment financial services and software subscriptions account for 28% of gross profit. Unfortunately, Square does not break this down further. Lacking more information, we assume this gross profit is roughly split 50/50 across financial services VAS and software subscriptions as shown in Figure 6.

Square is successfully expanding its VAS penetration. This is evident in the development of gross profits: ‘payments’ grew at 21% vs. ‘subscriptions and FS VAS’ grew at 32% between 2019 to 2023.

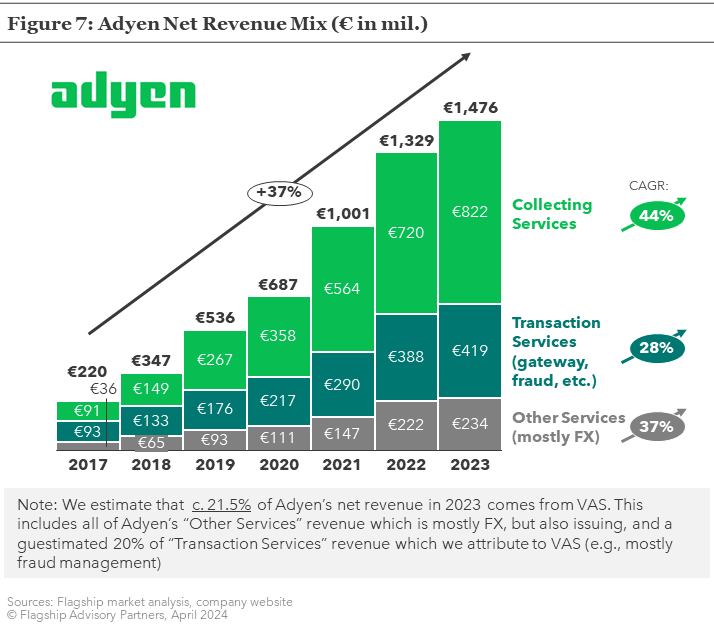

Adyen’s primary VAS are 1) multi-currency settlement, 2) fraud management and related services such as chargeback automation, 3) tokenization, and 4) card issuing. Adyen’s public financial data is not perfect for analyzing VAS as their VAS products fall across two of three reported revenue buckets. Thus, we make certain simple assumptions about what percentage of ‘Transaction Services’ revenue is VAS vs. core gateway revenue. On this basis, as shown in Figure 7, we estimate that Adyen’s VAS revenue accounts for 22% of total revenue, with multi-currency settlement as the largest of the VAS. Multicurrency settlement is a great money maker core to processing and ‘collecting’ payments for multi-national merchants. Fraud management, 3DS, and chargeback automation are also attractive VAS domains with solid growth fundamentals, albeit a more complex product area where specialists often lead.

Conclusions

VAS revenue on the back of merchant payments is no longer an aspirational upside, it has become an essential driver for growth. As the growth fundamentals of merchant payments mature and slow, driving topline growth and EBITDA is increasingly a function of VAS success. Fortunately, there is no mystery, the menu of available VAS is now well-defined. Capturing this opportunity, however, requires a focused strategy, strong GTM execution, and a well-chosen operating model (partner vs. in-house).

Please do not hesitate to contact Joel Van Arsdale at Joel@FlagshipAP.com or Peter Taylor at Peter@FlagshipAP.com with comments or questions.