Russia launched a full-scale military invasion of Ukraine on 24 February 2022 and with it triggered a new era of geopolitical tensions and economic repercussions. In response to Russia’s aggression, the West slapped Russian entities and individuals with a number of sanctions with unprecedented scope and speed. The payments sector became a tool used to punish Russia for its invasion of Ukraine. Russia’s exclusion from SWIFT and the suspension of operations by international card schemes have become a cautionary tale for the rest of the world. This event inevitably impacted the payment provider industry, yet not necessarily in obvious ways. In this briefing, we summarize the effect the War in Ukraine has had on the payments industry in Russia and across the globe.

Russia’s Exclusion from SWIFT

The first major payments tool used against Russia came in a form of exclusion from the global payment system SWIFT, cutting off Russia’s ability to trade in the international market. Prior attempts by the Russian Central Bank to create its own alternative to SWIFT, a transfer system called SPFS, has largely failed, with this network assembling only a small list of mainly Russian banks. Although Russia is working on a new blockchain payments system to replace SWIFT and attempting to establish a lifeline to China’s own SWIFT copycat, CIPS, there are no short-term solutions for the Russian government.

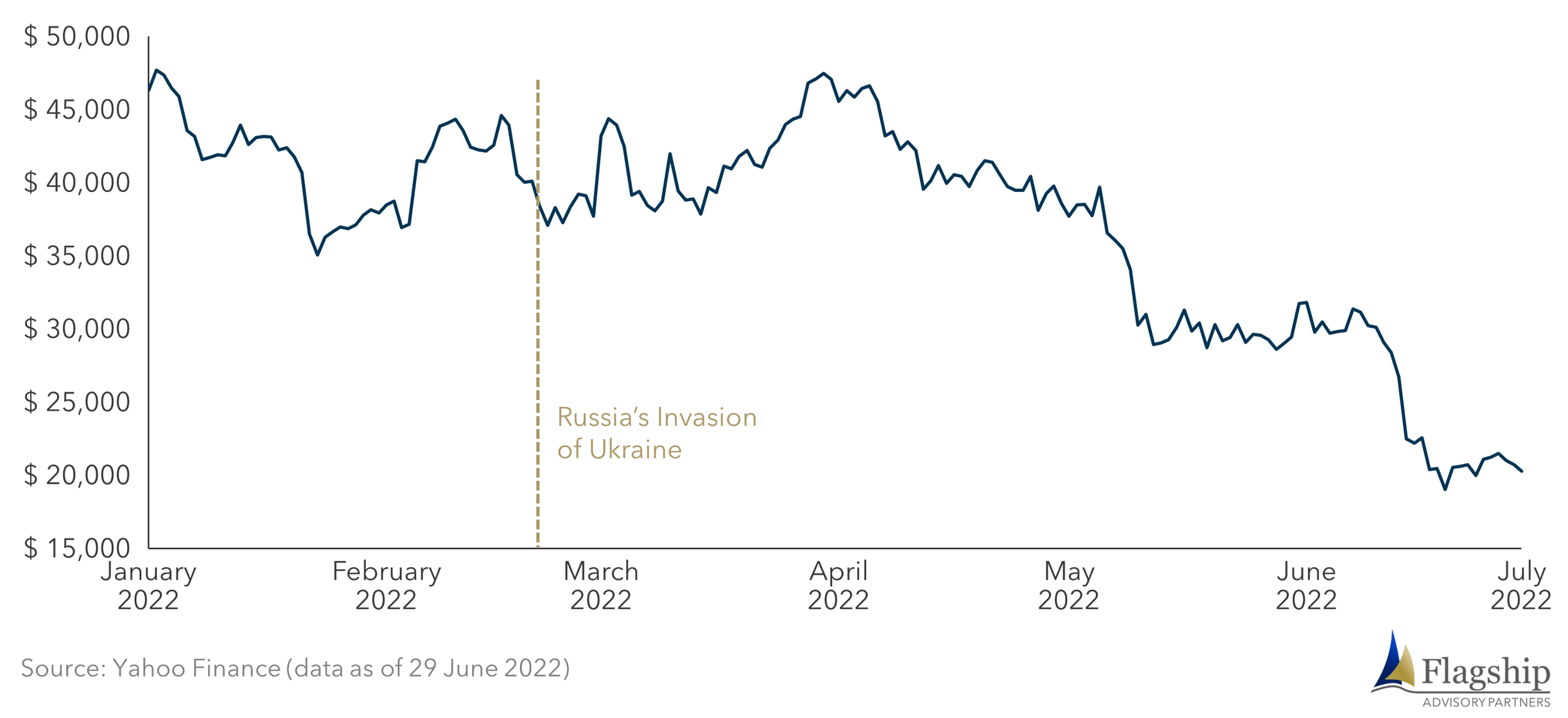

Crypto currency could eventually be an alternative to circumvent SWIFT. Crypto, however, is volatile (see latest bitcoin performance in the figure 1 below), and the Kremlin is unlikely to rely on a payment form that it cannot directly control. Other markets hit by high inflation or currency devaluations, such as Nigeria, have been seen to turn to crypto, although consumers are often risk-averse, crypto acceptance is still limited, and physically paying with crypto can be challenging.

FIGURE 1: Bitcoin to US Dollar Price (USD)

Suspension of International Payment Schemes in Russia

To comply with the sanctions imposed on Russian financial system, most international card networks suspended their operations in Russia. Giants including Visa, MasterCard and American Express no longer offer payment processing and support to Russian banks, and halted processing of transactions by Russian-issued cards, effectively disabling cross-border operations. The Russian Central Bank is now leaning on a politically friendly Chinese alternative, UnionPay, to help close the gap in international card payments. UnionPay would need to approach this relationship with caution, however, given that its system uses US dollars in its operations and its cooperation with Russian banks could be threatened with fines or worse.

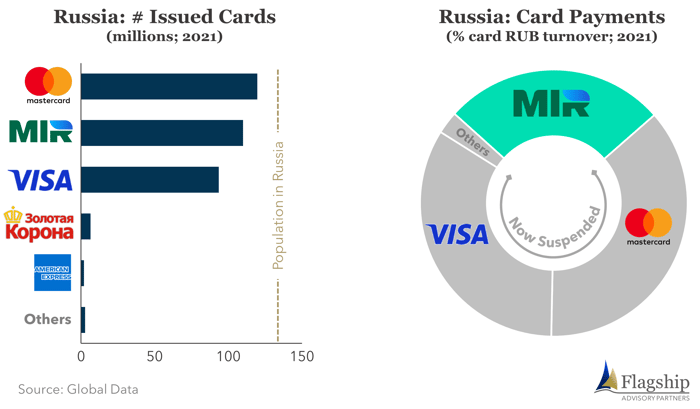

Domestically, the impact of suspended international schemes is limited as many Russian cardholders can simply shift to a local card scheme, MIR. This scheme was introduced by the Russia’s National Payment Card System following sanctions post Kremlin’s annexation of Crimea back in 2014. MIR is already the second largest card issuer in Russia and even before the war with Ukraine accounted for c. 37% of all card payments in the market (see Figure 2 below). The Russian Central Bank was ultimately successful in defending domestic digital payments, although outside of Russia, MIR has limited acceptance in only a handful of small neighboring markets such as Belarus and Armenia. Few Russians considered opening a card account in neighboring Asian countries to be able to continue making payments internationally, but for most this capability has been blocked.

FIGURE 2: Select Pre-War Card Payment Statistics in Russia

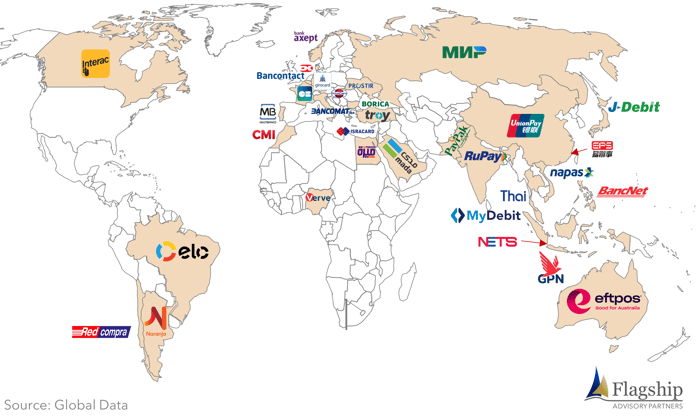

The magnitude and velocity of sanctions on the Russian payments system has left many nations concerned. Albeit not always politically motivated, many nations previously established local debit card schemes and interbank networks with local data autonomy and control (see Figure 3 below). Such a position de-risks dependency on global card networks, especially US-based international schemes including Visa and MasterCard. As result of sanctions on Russia and the relative success of Russia’s domestic card scheme, other governments, especially those unfriendly to the West, are likely to consider developing their own domestic payment systems. The emergence and development of local schemes and data sovereignty rules will certainly add complexity for multi-national payment providers.

FIGURE 3: Select Key Local Debit Card Schemes

Impact on International Payment Service Providers

With the suspension of Visa/MasterCard, the Russian payments market became inaccessible to cross-border payment service providers (“PSPs”), however, the damage to the international PSP community has been minimal. Even before the war, Russia accounted for only 1% of global digital payments. Restrictive local regulatory requirements and a long list of local alternative payment methods have also kept over 95% of Russian payments in the hands of home-grown providers. Furthermore, the Russian payments market lost appeal to multi-national PSPs due to the departure of many multi-national merchants, who were pressured by consumers and investors to unwind operations in Russia.

The challenges facing payment providers are not as obvious as they may seem. Not all PSPs have the necessary technical capabilities to react promptly when national governments call for action to enforce their sanctions. A large hidden impact is the increased prominence of rigid Know-Your-Customer (“KYC”) and Know-Your-Business (“KYB”) monitoring tools that many players do not have in place. As Western sanctions continue to expand, regulatory oversight will intensify, with a particular focus on Russian Ultimate Beneficiaries. These developments are likely to prompt adoption of digital KYC and KYB tools that many PSPs have yet to put on an investment agenda.

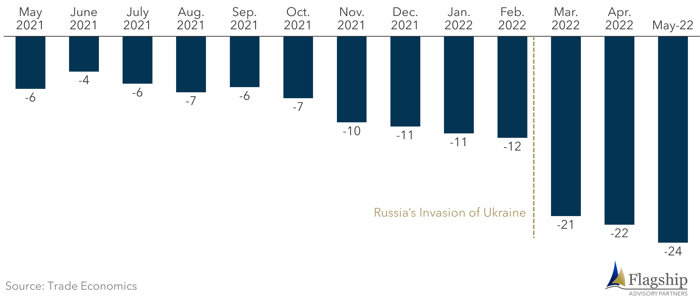

A more obvious impact the War in Ukraine will have on the PSP community is the deceleration of payments volumes, particularly in European markets. As Russia continues to use its energy supplies to apply pressure on Brussels, consumers throughout the European Union face rising energy bills and their confidence continues to decline (see figure 4 below). Many consumers are expected to cut down on spending in the near-term. Coupled with the recent rupture of the Covid e-commerce bubble (see Flagship’s infographic: COVID e-Commerce Bubble Has Officially Burst), payment providers are unlikely to see stellar performance in the coming months.

FIGURE 4: Consumer Confidence Index in the European Union

Key Observations

The most immediate impact on multinational payment providers from Russian’s war on Ukraine will be the resulting economic uncertainty and direct impacts on Western consumers and businesses. In the near-term, multinational payments providers are likely to speed adoption of more robust digital KYC and KYB tools to enable them to better comply with sanctions and track ultimate beneficiaries. Additionally, despite the current challenges in the crypto market, PSPs are likely to increasingly consider adding crypto acceptance to meet growing consumer demand.

The longer-term impacts of Russia’s invasion of Ukraine are likely to be the most meaningful. Russia’s rapid exclusion from the international payment system will prompt many governments and national banks to assess the extent of their dependency on global financial networks, particularly those that can be influenced by the US, and to reconsider the associated risks. The knock-on effect of domestic payments data sovereignty has already become a key discussion topic, and many national authorities are likely to build and promote the use of their own local card schemes and inter-bank networks, mandate connectivity to domestic switches, and increase data sovereignty requirements. As a result, international payment providers will face increased complexity demands on their product development roadmaps.

Please do not hesitate to contact Yuriy Kostenko Yuriy@FlagshipAP.com with comments or questions.