It is a fool’s errand to forecast inflation under the uncertainty of today. But we will go out on a limb and predict that elevated inflation is going to persist for quite some time and likely will contribute to a recession. Payments and fintech executives are in for a crash course on the challenges of inflation, even stagflation, a challenge not seen in Western markets in 40 years.

Inflation is Here, Not Going Away Soon

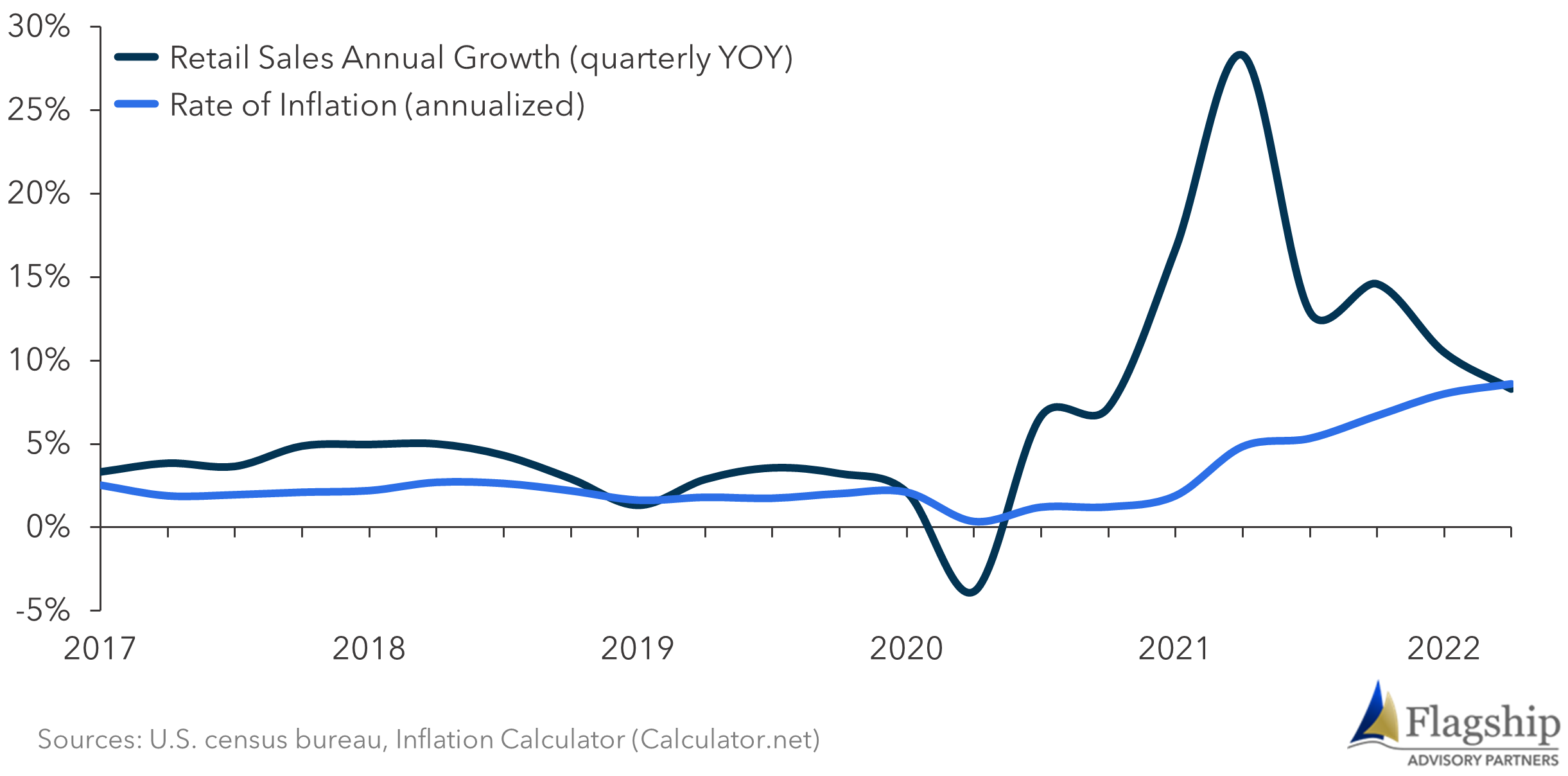

There are many reasons to expect inflation to continue. Notwithstanding the recent actions of the Fed and other central bankers, demand still seems quite robust. Even considering the recent dip, retail sales have held up nicely on the year, and this despite a year of negative real wage growth (see figures 1,and 7 below). The negative performance results announced on major retailer earnings calls (Walmart, Target), of late, were not driven by declining sales but by high inventories, staffing issues, and inflation particularly in transportation.

FIGURE 1: U.S. Retail Sales Growth vs. Inflation (quarterly, 2017- May 2022)

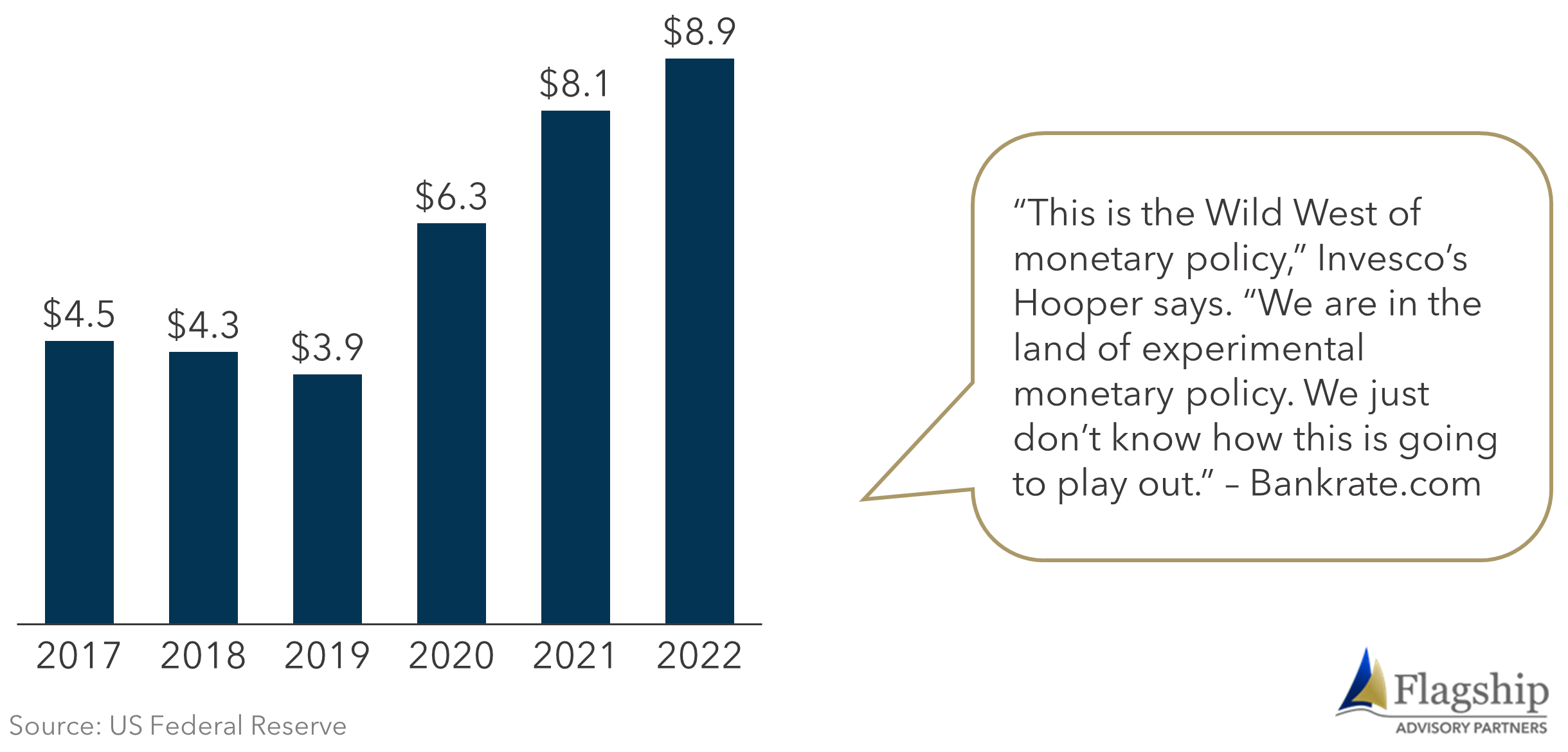

US consumer savings, bulked up by government transfer payments and pandemic buying behavior, are still high relative to historical norms. Consumer real earnings, as shown in figure 7 are also healthy on a historical basis, although trending down given the impact of inflation. The negative US GDP figure in the first quarter was heavily driven by an increased trade deficit: imports were up dramatically over exports, a phenomenon driven by strong consumer demand in the US. It is also important to note that despite the rate increases at the Fed, US real interest rates are still dramatically negative. As we write this, the 10 year T-note yield sits at 3.3% which, depending on which inflation measure you like, is c. 500 basis points underwater. Plus, the very recent reversal of the expansion of the Fed’s balance sheet (see figure 2) has an extraordinarily long way to go. The Fed is still stimulating the stuffing out of the economy.

FIGURE 2: U.S. Federal Reserve Balance Sheet (USD in trillions, 2017-2022)

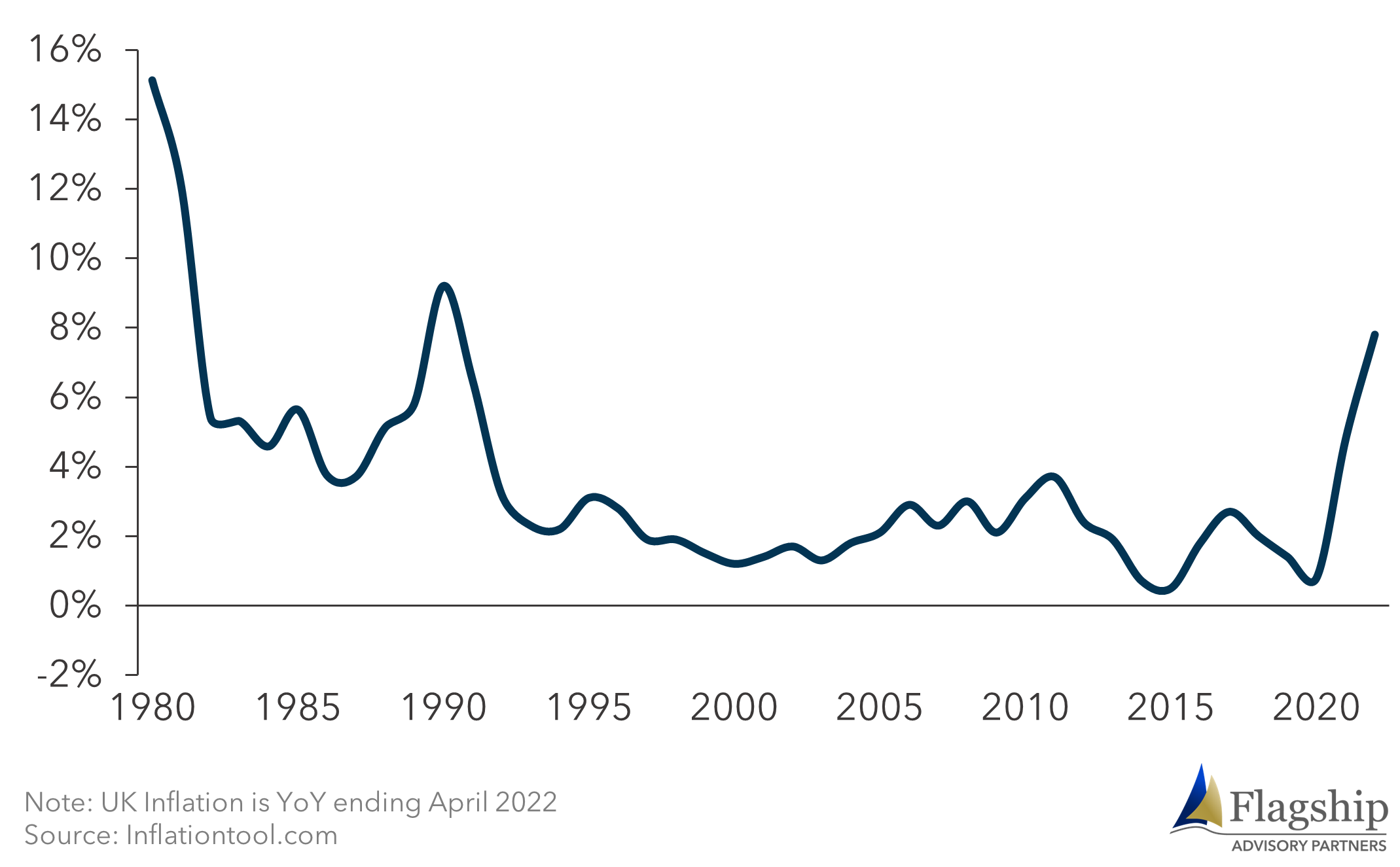

The macro-economic supply side remains constrained with no clear break on the horizon from current geopolitical risks and commodities disruption arising from the conflict in Ukraine and COVID lockdowns in China. Many non-US markets are facing some variant of the same set of issues. The UK, for example, is sporting the highest inflation rate that nation has seen in 40 years (see figure 4). There’s every reason to be a little reflective about inflation and its impact on the payment acceptance market.

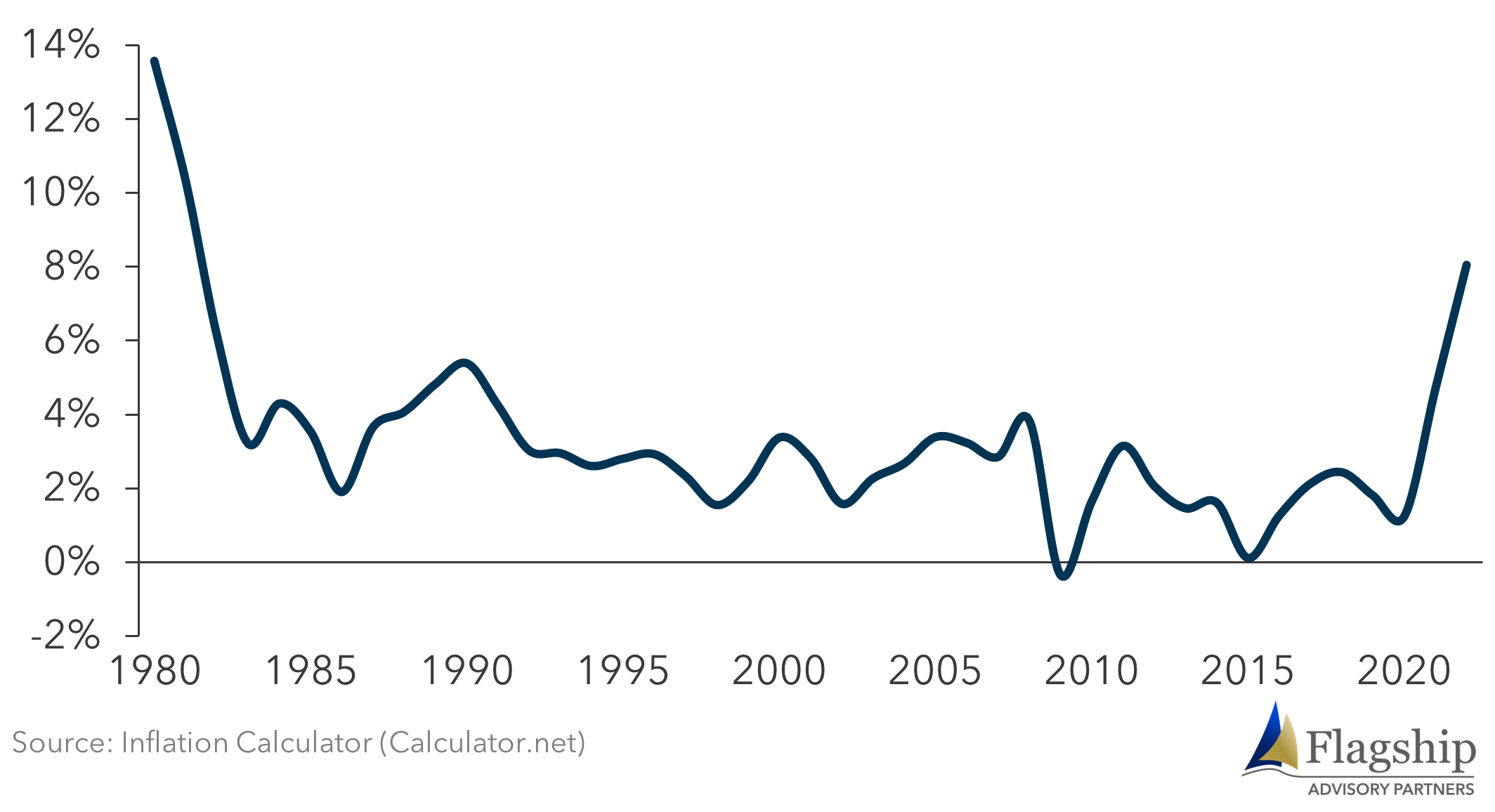

FIGURE 3: U.S. Annual Inflation Rate (1980-2022)

FIGURE 4: U.K. Annual Inflation Rate (1980-2022)

If Sustained, Inflation a Major Challenge

As shown in figures 3 and 4, it has been 40 years since we last saw today’s inflation rates. This means that virtually all fintech executives in western markets have never had to manage inflationary pressures. We expect inflation to impact the payments industry in several ways. Most fundamentally, buoyant consumer spending cannot persist in a protracted period of declining real incomes, even if we avoid a recession. We are likely to see all sorts of distortions starting with a substitution in what consumers buy, impacting discretionary categories and premium categories to the greatest degree. We will start to see the impact of declining consumer buying power in portfolios overweighted in these categories. Of course, the bigger risk is simply that consumers pull back, a possibility also tied to the actions of the Fed (and more on that later).

Despite a 30-year track record of declining unit expenses from scale and technology-related efficiency, payment processors will not be immune to the expense push of inflation, particularly as it relates to staff expense. On the revenue side, fee-based pricing and transactional pricing does not have the automatically adjusting quality of ad valorem pricing as dollar volumes rise artificially due to inflation, and fee and transaction pricing now represents a strong majority of revenue in the industry, vastly unlike the last time the economy had appreciable inflation (issuers characteristically remain well protected due to the high ad valorem components of interchange.)

Given this dynamic between ad valorem and transactional/fee pricing schemes, the purchasing power of revenue is roughly eroding at the rate of 4% a year at current inflation levels, which combined with inflation of, let’s say, 6% on the operating expense line, may equal a margin issue that will need attention in a few quarters. It will take a few quarters, though, for these downsides to be impactful. Ever the innovators in pricing, acquirers may have a shift in pricing strategy or structure if inflation does persist at or near current levels.

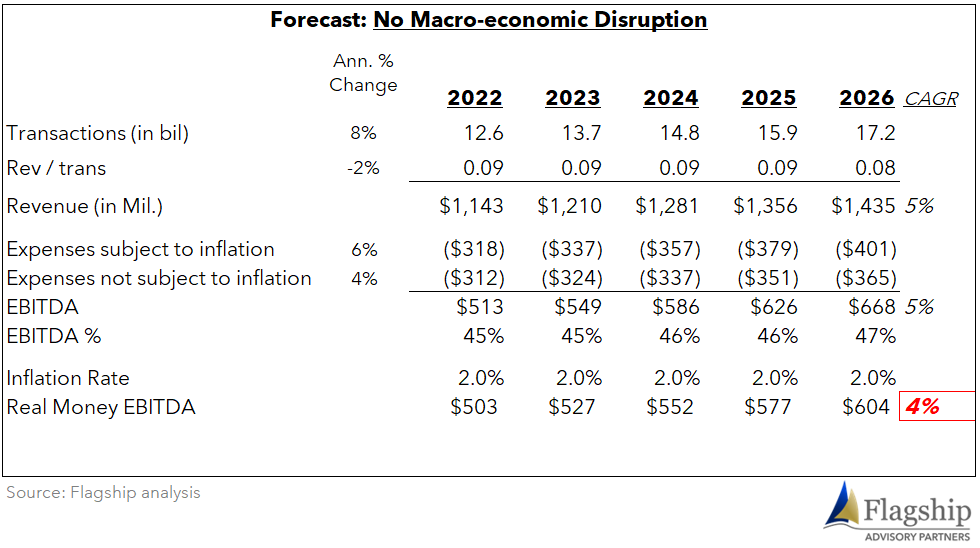

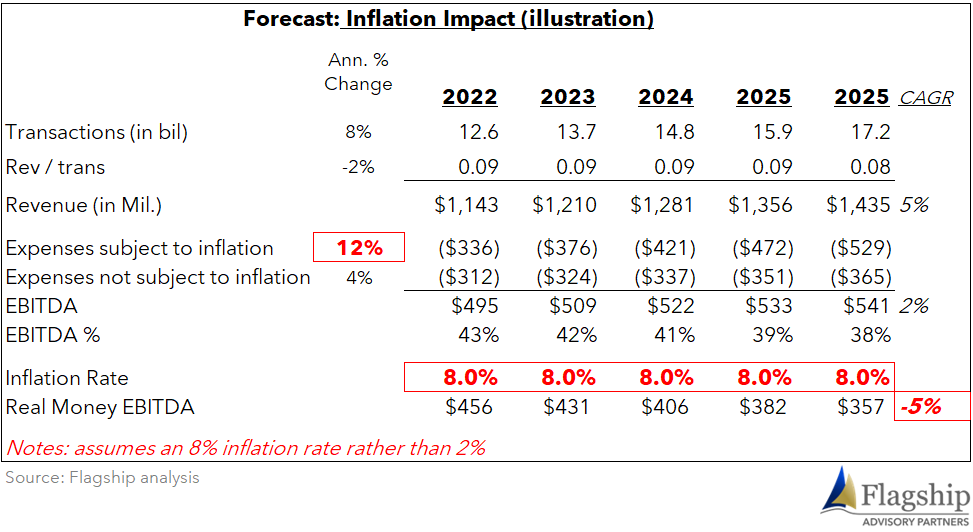

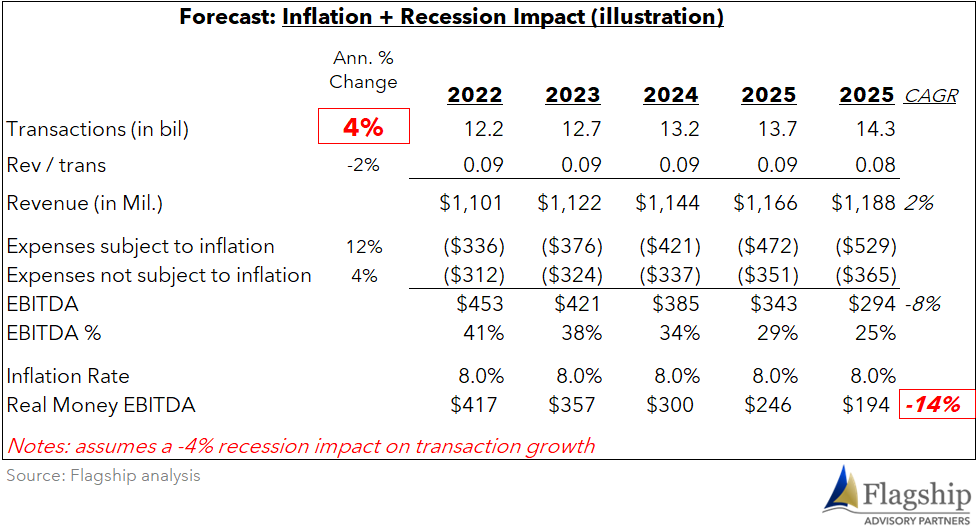

In order to illustrate the potential business impacts of inflation or stagflation, we created a theoretical payment processing P&L. Across figures 5a, 5b, and 5c, we walk through this business as it experiences hypothetical shocks of first inflation, and then secondly recession. This is admittedly an overly dramatic and overly simplistic analysis. We assume no ad valorem pricing with zero pricing leverage to pass on cost increase. We also assume no control or expense actionability. The theoretical executive of this business is purely along for a bumpy macroeconomic ride.

Figure 5a introduces our illustrative business, who is benefiting from scale economies resulting in high-single-digit EBITDA growth. Inflation is low, so real money returns are not substantially different from nominal returns (5% vs 4%).

FIGURE 5a: Illustrative Payment Processor P&L – Forecast, No Macroeconomic Disruptions

In figure 5b, we model our processor suffering from the impacts of 8% inflation. Our business is imagined to be locked-in on revenue with no ad valorem pricing upsides and no pricing leverage to renegotiate higher prices (-2% annual price pressure continues). Our analysis assumes that half of the processors’ costs are subject to inflation (growing at 12% after inflation), and half of the costs are not subject to inflation. EBITDA expressed in 2021 dollars are now negative with a -5% CAGR.

FIGURE 5b:Illustrative Payment Processor P&L – Inflation Impact

Finally, in figure 5c, the wheels are coming off the business now impacted by both 8% inflation and a reduction by half of topline growth due to headwinds from a recession. Again, our illustration simplistically assumes no way to improve the circumstances, for example, by taking fixed cost out of the business. Real-money EBITDA growth is now an ugly -14%.

FIGURE 5c:Illustrative Payment Processor P&L – Inflation & Recession Impact

While our hypothetical example is just that; this simple example illustrates the potentially dramatic impacts of inflation and recession, particularly without appropriate management actions.

Recession a Likely Result of Dramatic Interest Rate Increases

Many of the more significant risks arise from possible unintended side effects of the Fed’s actions. Let’s take the Fed at its word, assume other central banks around the world have a similar resolve, and assume that we’re in for a round of interest rate actions with the intent of throwing a wet blanket on demand. In business as in life, corrections are frequently over-corrections, and a recession in late 2022 or 2023 is a rising risk. We have ways to go before we are in real recession, but the probability of a downturn is certainly higher than it was in February before the current cycle of interest rate actions.

Payment card volumes in the 1990’s was relatively uncorrelated to the macro-economy given the heavy displacement of cash and check means of payment. Today, consumer electronic payment volumes are highly correlated to macro-economic consumption measures. If central banks crash- land their economies, consumer spending and payment card volumes will follow, impacting all in the industry to varying degrees.

Other economic ills caused by the Fed’s cure are already apparent. Asset values are repricing, clearly, and not just in equities markets (see ‘Infographic: COVID E-Commerce Bubble Has Officially Burst’).

A fair valuation of an asset in a negative 800 basis point real interest rate environment is going to be worlds different if and when interest rates approach par. Investors are also clearly rebalancing their investments away from risk assets and look no farther than Nasdaq for evidence. Cryptocurrencies are proving not only that they are correlated to other risk asset categories but also that they have a high Beta.

Of course, we also expect to see a pretty direct and observable impact on valuations in the private market, impacting mergers & acquisitions in our industry and adjacent businesses. As in past recessions, the biggest manifestation of this change in valuation may just be the deals that don’t get done, as buyers and sellers fail a meeting of the minds on value - failed acquisitions and transactions that don’t get to the starting gate. However, we may see transactions clear simply at less lucrative levels, from the seller’s point of view, than in recent years.

Another big impact on the acceptance industry of changing valuation and investor risk appetite will be in the funding environment, which is the life blood of so many of the fintechs who have been central to innovation and competition in recent years. Might we see a return to the vocabulary of the early 2000’s – cash balances and burn rates and all the rest?

Credit Backdraft an Inevitable Outcome of Recession

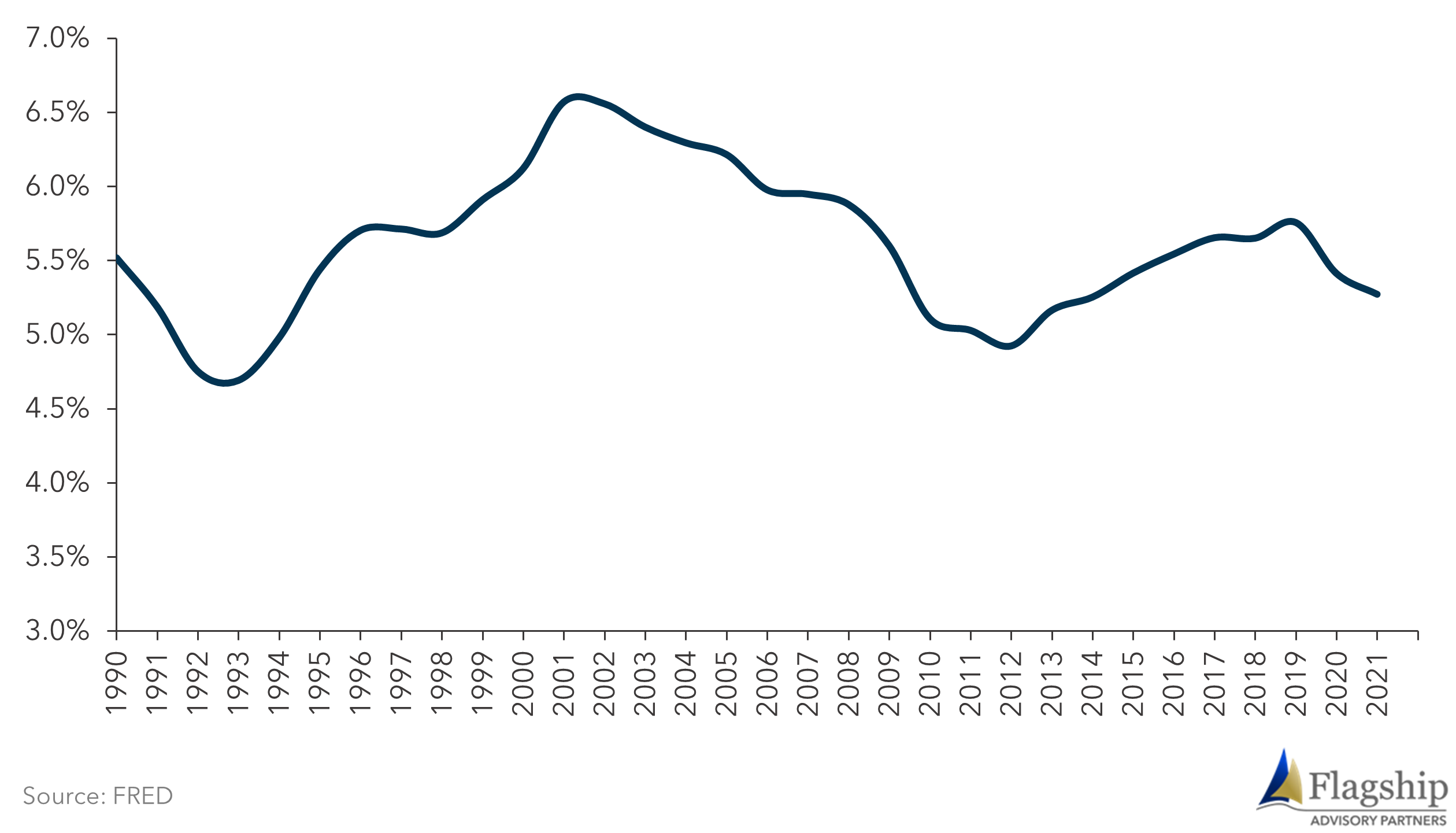

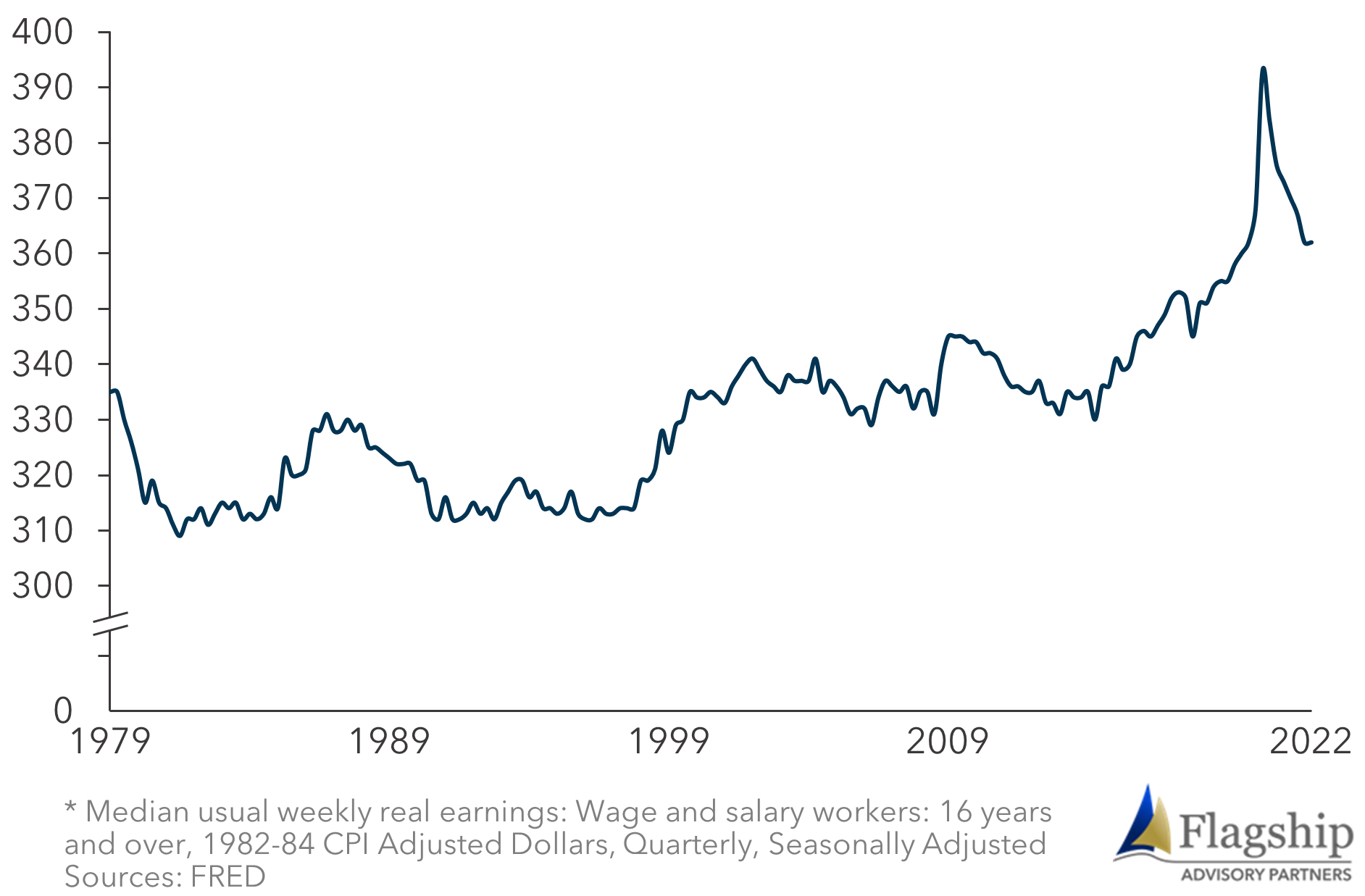

If we do arrive in a recession a few quarters from now, credit losses will follow. As shown in figure 6, consumers are not in an unreasonably bad position today, but this could change quickly with declining real wages as shown in figure 7. Credit risk already appears to be deteriorating by some measures, and a sustained decline in real wages will surely worsen the problem in coming quarters. It will be interesting to see how BNPL performs in a downturn; given that not all of these companies have experienced recessions in the past. Klarna’s announced 10% staffing reduction is evidence of hawkish expectations.

FIGURE 6: U.S. Consumer Debt as a Percentage of Disposable Income (1990-2021)

FIGURE 7: U.S. Median Weekly Real Earnings*

We will see elevated losses in small business lending as well, where fintechs have been gradually escalating scale since the massive pullback seen in 2008. Hereto, many of these companies have not been properly stressed having started business after 2008. Acquirers are also likely to experience elevated losses as recessionary and inflationary pressures drive increased business failures. Our last recession was 14 years ago, and in the past 14 years, a few things have changed. For example, the payfac phenomenon has created a material increase in settlement intermediaries and therefore, points of possible settlement failure. In a bad recession, it would be prudent to assume that some of these businesses go down (it is dead easy to find non-compliant settlement environments in the payfac world.)

Brace Yourself

Some of these risks feel common to recessions weathered in recent decades. The phenomenon that nearly none of us have seen, though, is the coincidence of high inflation, a truly wacko interest rate environment, and a recession. As with most stressors in business, by the time you can see the impact on your numbers, it will likely have been too late to take the easier corrective actions.

Please do not hesitate to contact Joel Van Arsdale Joel@FlagshipAP.com with comments or questions.