(Adapted from original publication in The Paypers)

In the last decade, the number of fintech startups exploded around the world. Europe, fueled by its market opening regulations, experienced meteoric growth in the number of licensed payment institutions (‘PIs’) and e-money institutions. We expect the brutal market conditions of 2020 to drive a Darwinian shakeout among this community as revenue expectations disappoint and growth capital tightens.

Flagship Advisory Partners recently examined the entire population of registered PIs and e-money institutions in the UK, which is one of Europe’s largest and friendliest market for fintech startups. We segmented and categorized the nearly 3,700 companies and within this article we analyze areas of the market where we expect the greatest shakeout.

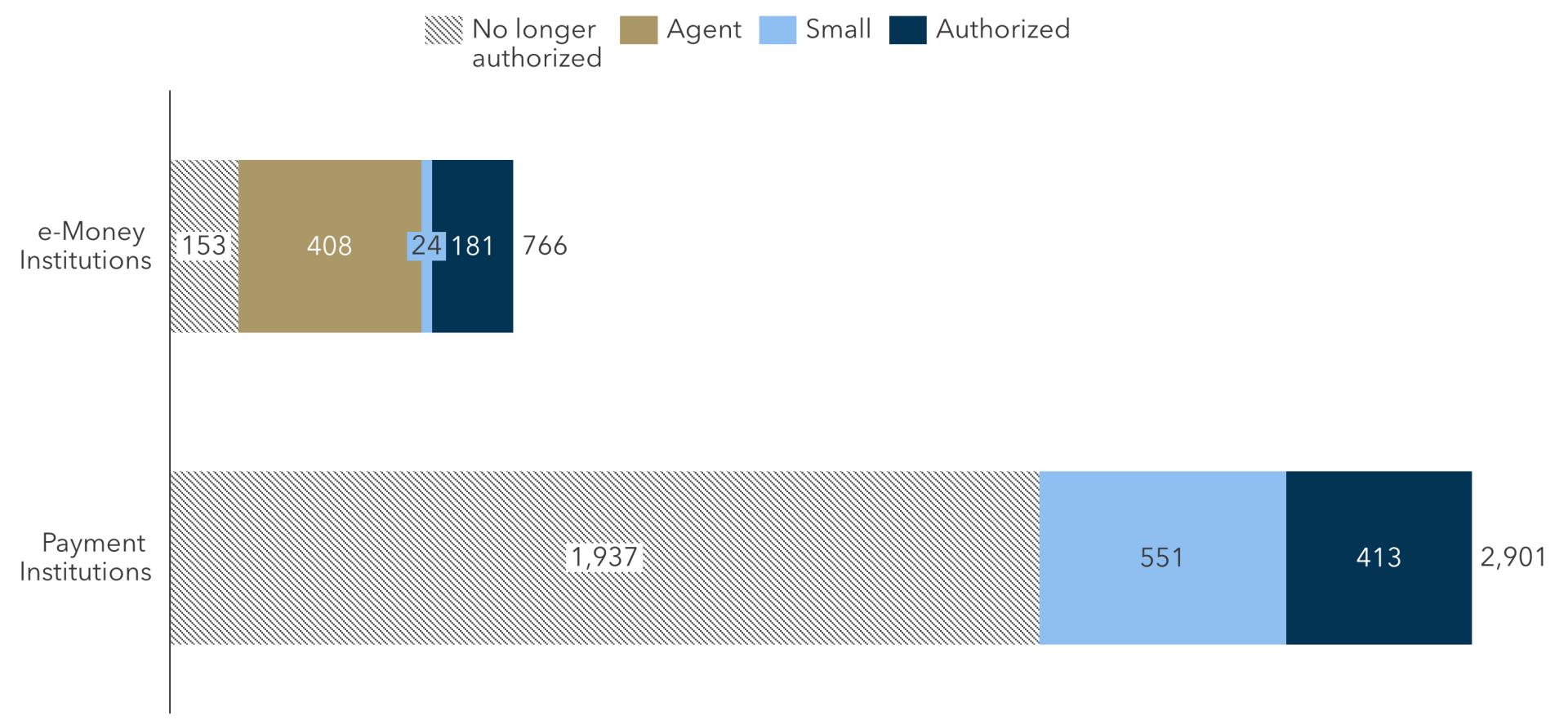

FIGURE 1: Status Distribution of Listed U.K. Payment and e-Money Institutions

(% of total registrations)

As of April 2020, there were 2,901 listed Payment Institutions in the UK, 67% of which were no longer authorized to provide the services permitted under the PI license. This already suggests relatively high rates of failure given that the Payment Institution license only became available in 2009 (noting that PSD2 required all UK PIs to re-register to be considered authorized). Among the 964 PIs that are still authorized, 551 are classified as ‘Small Payments Institutions’ by the UK Financial Conduct Authority (FCA) (small defined as less than EUR 3 million of monthly payments volume). Given that Small PIs are effectively micro-businesses, we did not conduct further analysis on this population, though we fully expect a high rate of extinction in this population. According to a survey conducted by Innovate Finance (as quoted in Finextra on 2 July), 70% of smaller UK fintechs have a cash runway of six months or less and most of these are rapidly trying to adapt in order to survive including 11% who already have plans to cease operations (link).

There were also 766 listed e-money institutions in the UK, 20% of which were no longer authorized. 53% of these registered institutions are certified as Electronic Money Services Directive (EMD) Agents, which are not themselves licensed as e-money institutions. We excluded these EMD Agents and the 3% of e-money institutions that are designated as ‘small’ from our further analysis.

As of April, there were 413 ‘Authorized Payment Institutions’ and 181 ‘Authorized e-money Institutions’. Flagship examined and categorized each of these 594 UK authorized payment and e-money institutions. This distribution by business type is shown in Figure 2 and Figure 3 below.

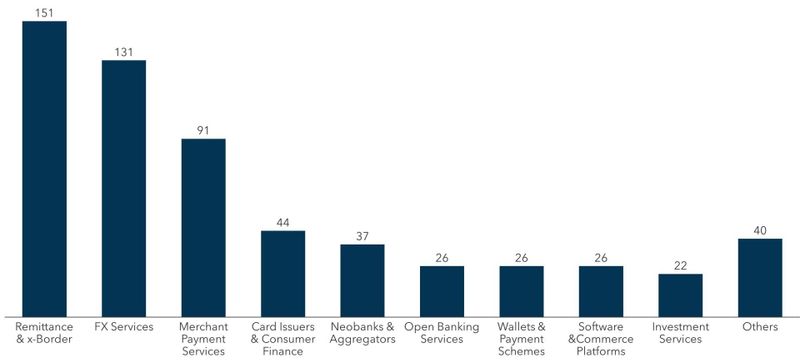

FIGURE 2: UK Payments & e-Money Institutions by Business Type

(total no of registrations, 594 in total*)

Source: UK Financial Conduct Authority

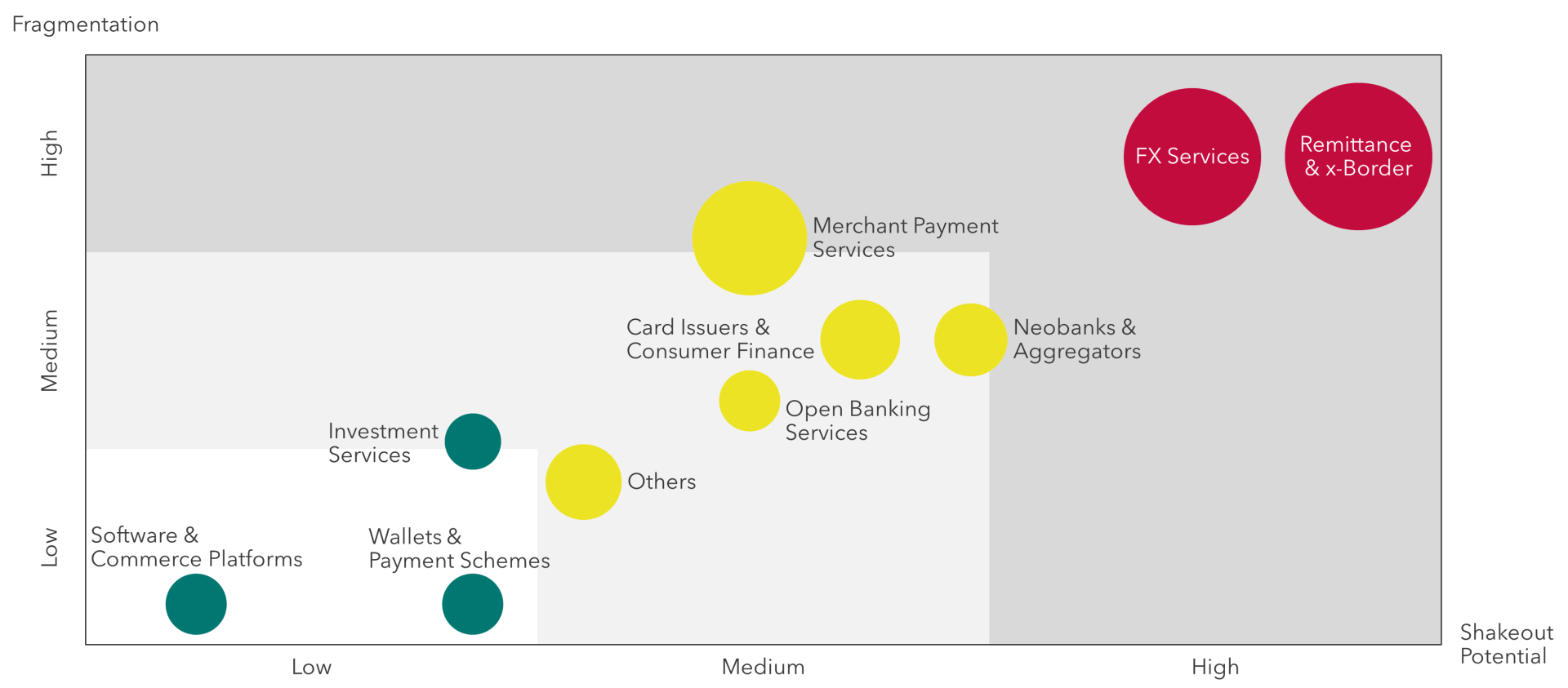

FIGURE 3: UK Payments & e-Money Institutions by Fragmentation & Shakeout Potential

(bubble size = no of registrations)

Money Remittance, FX, and x-border Payments

Population fragmentation

Population fragmentation

(282 institutions)  Shakeout potential

Shakeout potential

Almost half of the 594 authorized payment and e-money institutions focus on money remittance, cross-border payments, and foreign exchange services. Most of these providers are exceptionally small, often with less than EUR 1 million of revenue. The barriers to entry into these business segments are low, while gross margins are high, which has created a large population. We expect significant pressure on these small businesses in 2020 due to less cash usage and high rates of unemployment in the services sector, among others, which will drive a wave of exits. Traditional providers in this segment have already largely consolidated, including the recently proposed acquisition of MoneyGram by Western Union. Meanwhile, a small number of fintechs have achieved real scale and a path to meaningful profitability (eg TransferWise and WorldRemit). Finally, global digital payments champions are increasingly attacking this market (eg, Alipay’s acquisition of WorldFirst and PayPal’s acquisition of Xoom).

Merchant Payment Services

Population fragmentation

Population fragmentation

(91 institutions)  Shakeout potential

Shakeout potential

Among the 694 U.K. authorized payment and e-money institutions, there are 91 merchant service providers including e-commerce PSPs, acquirers, bank transfer providers, and other merchant providers (collectively referred to herein as “PSPs”). The PSP marketplace is increasingly mature, with increasing competitive separation of the global providers (e.g., Adyen, Worldpay, Stripe) from the smaller, domestic PSPs. Smaller PSPs now often struggle to grow revenue or to invest sufficiently into distribution or technology renewal and innovation. This market, considered highly attractive for investors, has seen significant M&A-driven consolidation in the last ten years. While we expect this M&A wave to continue, we also expect an escalating failure rate among PSPs who are too small to be attractive acquisition candidates.

Neo & Virtual Banking, Open-Banking APIs, and Banking Aggregators

Population fragmentation

Population fragmentation

(81 institutions)  Shakeout potential

Shakeout potential

There are 81 licensed institutions that focus on digital, virtual, and Open Banking, and the provision of technology and services underpinning these banking services. Most of these institutions are young and lack meaningful revenue scale; almost none are profitable. While there are good reasons to believe in the long-term value-creation potential of open/virtual banking, we do not expect Open Banking to drive a competitive revolution in which many startups succeed. Rather, we expect a small group of service and platform providers (such as U.K.’s token.io) to capture scaling momentum and move beyond basic open banking API access services to more lucrative value-added services such as authentication an verification services. For the neobanks serving consumers and small business directly, 2020 will surely be challenging as we are still waiting on that elusive data monetization revenue model and SME startups and customer bank switching will diminish. While clearly some consumer-facing fintech’s such as Revolute have achieved lasting scaling momentum, many of the fintech’s in this segment will never reach profitability and will fail as the supply of venture and growth capital tightens. The insolvency of Wirecard will also have an immediate and potentially deadly impact as some neobanks see their card programs fail (as many are issued by a now frozen Wirecard). Companies such as the U.K.’s Revolut that thrive in this segment will have proven revenue models and a sharp focus on specifically underserved customer segments.

Card Issuing and Consumer Finance

Population fragmentation

Population fragmentation

(44 institutions)  Shakeout potential

Shakeout potential

High in credit and travel, lower elsewhere

There are 44 UK authorized institutions that focus on card issuing or consumer finance. Clearly, the business of unsecured consumer lending is facing a reckoning in 2020 as unemployment reaches near historic highs. As with the economic crisis in 2008, this crisis will surely lead to more exits, with the smallest and newest being particularly vulnerable as their balance sheet comes under pressure. Many of these card issuers, however, focus on card products other than credit cards, including prepaid, fleet cards, commercial (charge) cards, and gift cards. These other classes of card issuers will face less macro-economic pressure, although those issuers specifically focused on travel will come under pressure as will those who are not digitally advanced (plastic to mobile accelerating rapidly).

Wallets and Payment Schemes

Population fragmentation

Population fragmentation

(26 institutions)  Shakeout potential

Shakeout potential

High in credit and travel, lower elsewhere

This group (26 institutions in total) contains both huge, lasting global companies such as Visa and Google, as well as start-ups. We see no threat to the well-established global companies who are generally winners in digital commerce and will sustain (or even thrive) through the challenges of 2020. For the start-ups, however, we do expect a shakeout as they will generally fail to establish revenue traction in an increasingly crowded market (e.g., big tech such as Google and Facebook, commerce apps such as Uber, ongoing expansion of PayPal and Visa/MasterCard, etc.). Successful challengers in this space will need large-scale distribution partners, which will be challenging for many of these early-stage wallets. A lack of revenue combined with scarcity of ongoing venture funding will doom some in this group to failure.

Software (“ISVs”), Commerce Platforms, and Business Services

Population fragmentation

Population fragmentation

(26 institutions)  Shakeout potential

Shakeout potential

Low for established, high for early-stage

There are 26 licensed payment and e-money institutions whose core focus is not payments or financial services, but rather software and business services (e.g., accounting/ERP software, payroll services, cash management, digital commerce platforms, etc.). These providers are increasingly expanding into payments as a revenue source and as a value-added service for their B2B customers. This trend will continue and even accelerate, regardless of the external market pressures of 2020. There is tremendous value to be created by better integrating payments and financial services into all facets of business management and technology. B2B customers also benefit tremendously from receiving more integrated software and services which combine business and payments/financial services use cases. There are thousands of companies in this group that are expanding into payments as a revenue source, but chose not to obtain their own payments licenses but instead partner with licensed providers. Note that we cover this topic in greater detail in this article Payment Facilitation: The Key Theme for the Next Decade of European Payments.

The ambition of the original Payment Services Directive to open access to payments marketplaces has been achieved, resulting in thousands of institutions becoming licensed over the last decade. We expect a Darwinian shakeout among this population due to the challenging macro-economic circumstances of 2020. Many of the smaller providers competing in highly fragmented markets such as FX and money remittance will be forced to exit as revenues fail to materialize and funding becomes more challenging to obtain. For winners, 2020 could provide an opportunity to opportunistically acquire smaller assets and to further distance themselves from lagging competitors.

Please do not hesitate to contact Joel Van Arsdale at Joel@FlagshipAP.com with comments or questions.