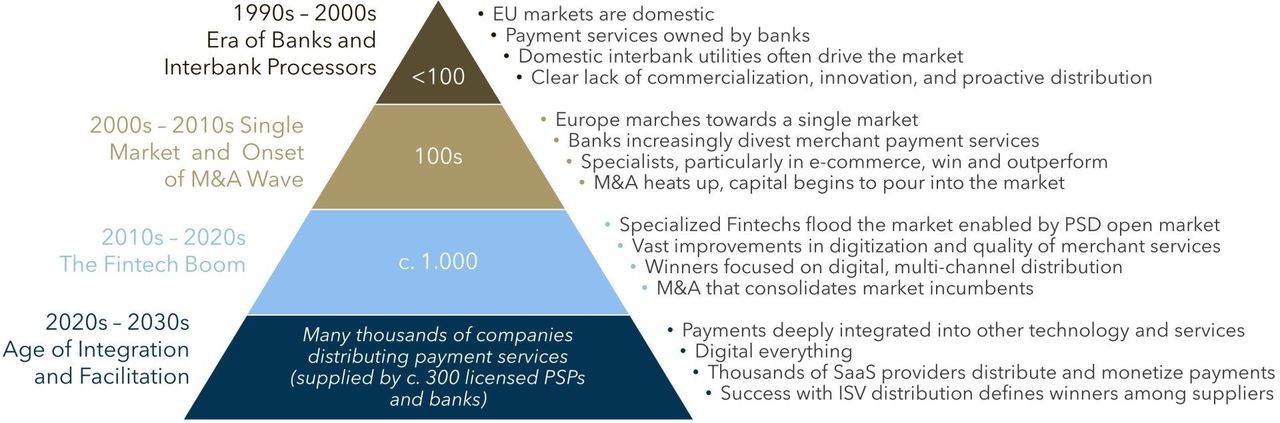

The marketplace for European payments has gone through a series of evolutionary waves, beginning in the 1990’s when the markets were domestic and owned by banks. The 2000’s was defined by the move to a single European payments market and a massive wave of M&A and consolidation. The 2010’s saw a boom in fintech, enabled by PSD market opening as well as the rise of cloud and mobile technologies. Today, there are c. 300 suppliers of merchant payment services in Europe and roughly 1,000 companies actively distributing merchant payments. The next decade will see an explosion of merchant payment services distributors as software and B2B service companies integrate and commercialize payments. By the end of this decade, payments will be completely interwoven into the software as a service (SaaS) landscape, and the winning payment services suppliers will be those who best address payment facilitators such as SaaS providers and marketplaces.

FIGURE 1: The Evolution of Merchant Payment Services Distribution in Europe

Payment facilitation and payment facilitators come in many forms. Taken literally, Visa and MasterCard define payment facilitators as third-party agents who can sign a merchant acceptance agreement on behalf of their sponsoring acquirers and receive settlement of proceeds on behalf of their sub-merchant clients. Taken more broadly, payment facilitators are essentially any non-licensed party that enables and distributes payments. This could include independent sales agents, marketplaces, booking engines, commerce platforms, and software providers (increasingly defined by SaaS cloud-based product and business models). Marketplaces and SaaS providers, most notably, are increasingly driving the growth in merchant payments.

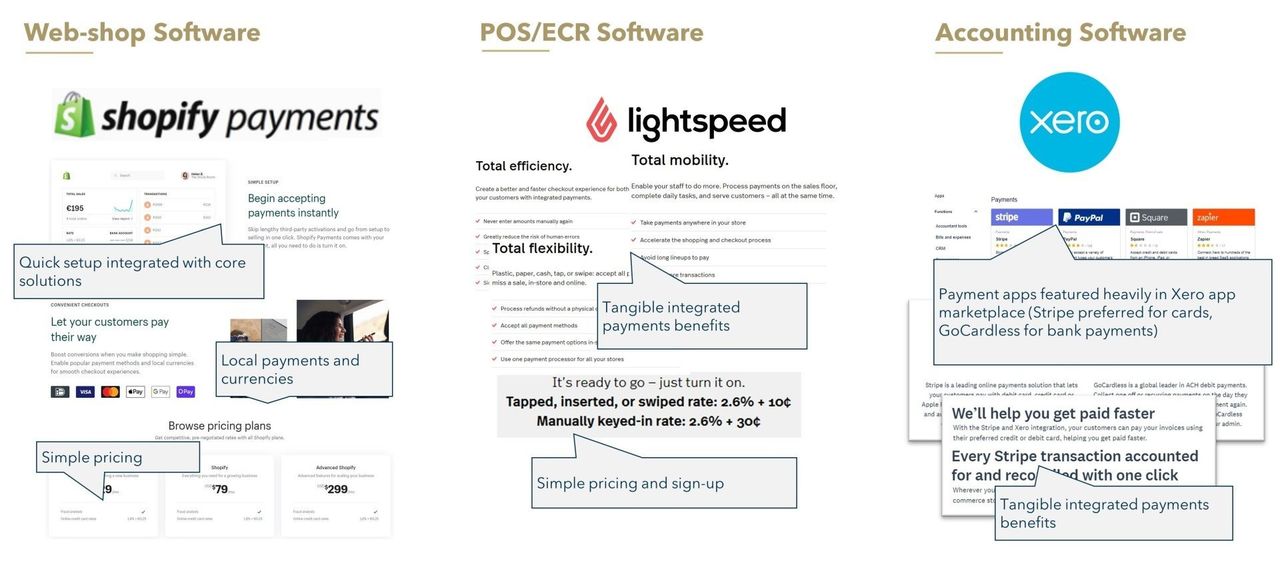

SaaS providers cover a broad range of software and services, including web shop software, ECR/POS software, accounting software, property management software, restaurant management software, travel booking software, and many others. Integrating payments deeply into these software environments creates tangible benefits for end-users as payments are easier to enable, simpler to understand, and more automated (reducing the time to service and reconcile transactions.) Integrated payments are also a great way for SaaS providers to make money, as SaaS customers are less price sensitive and highly likely to accept a service package that includes payments (resulting in low acquisition costs).

FIGURE 2: SaaS Payment Facilitator Examples

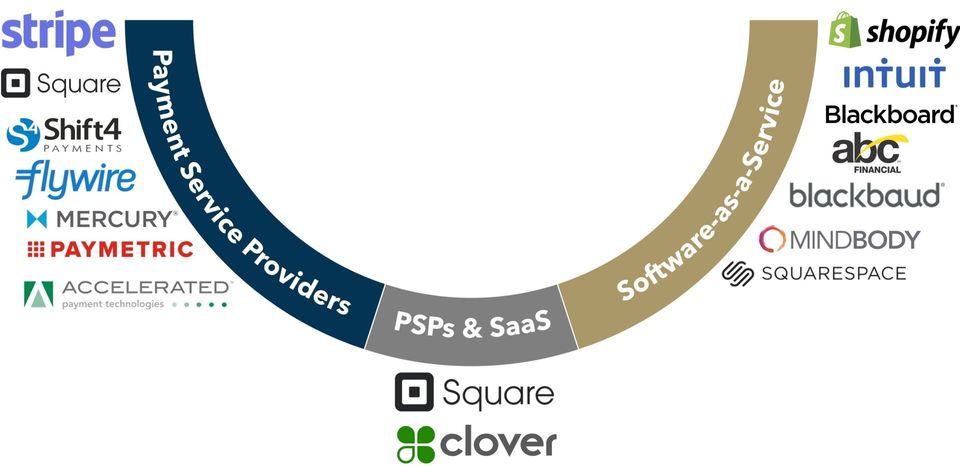

Prognosticating this decade in European merchant payments as the era of payment facilitation is not exactly a leap of faith as the same trend already played out in North America throughout much of the last decade. We simply see the same trend now accelerating and impacting the European market. As in North America, tremendous value will be created by those that embrace payment facilitation.

FIGURE 3: North American Payment Facilitation Winners (PSPs & SaaS)

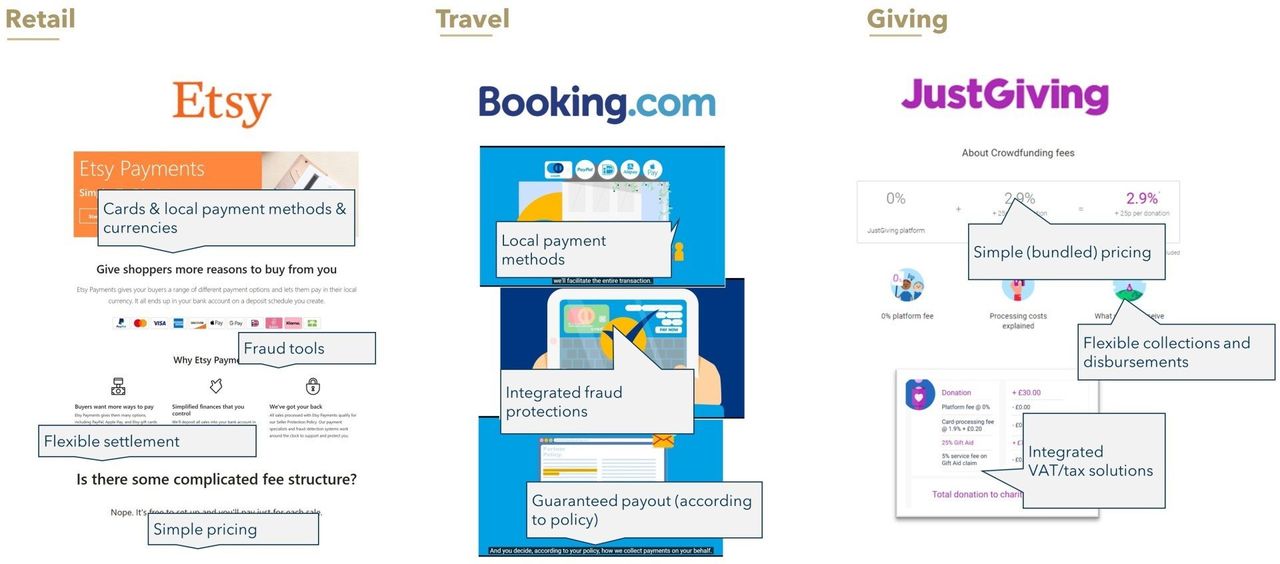

Marketplaces and other forms of aggregators are also a key segment for growth in merchant payments. In Europe, online marketplace turnover growth is now almost 2x non-marketplace growth (merchant-owned websites) and more than half of SME merchants trade online via marketplaces. Marketplaces also come in various forms and across sectors, such as retail/apparel, travel, digital media, gaming, and charity (among others). Marketplaces require unique and rich capabilities from their merchant payment service providers (PSPs) given the complexity of supporting hundreds or thousands of sub-merchants for pay-ins and payouts (for example, fully automated onboarding, servicing, and compliance). Supporting marketplaces also often requires PSPs to offer a variety of legal and commercial models based on their marketplace clients’ sales model, technology infrastructure, and payments licensing.

FIGURE 4: Marketplace and Aggregator Payment Facilitator Examples

There are relatively few PSPs who can fully and capably support merchants and partners in the SaaS and marketplace segments. Stripe, who is using both SaaS partners and marketplace merchants to drive its rapid growth in Europe, is clearly the bellwether for competitors to follow. European PSPs looking to outgrow the market must find ways to compete versus Stripe. Stripe’s success in the SaaS channel is driven by its rich integrated payments capabilities including robust technical integration toolkits, friendly and automated sign-up and servicing, and meaningful revenue share back to its SaaS partners. Stripe’s success with marketplaces is driven by its commercial and legal flexibility and also by its highly automated sign-up, compliance screening, and servicing platform capable of onboarding thousands of sub-merchants in a day.

As the M&A market for PSPs diminishes due to consolidation, smart payments investors will also increasingly look to SaaS companies as a channel for value creation in payments. Shopify typifies the potential for revenue generation in payments; the company made $936 million in merchant services revenue (mostly payments) in 2019, an increase of 54% from 2018. Similarly, Lightspeed (POS and e-comm SaaS provider) reported that in its most recent quarter more than 60% of new customers purchased Lightspeed Payments (formally launched only in 2019) in conjunction with their purchase of the core underlying commerce software. The value creation potential for payment services integrated with business software is enormous and still relatively untapped on a global basis across a broad range of software verticals.

We believe that the single most important theme for merchant payments in Europe will be the integration of payments into other SaaS services and facilitation (distribution) of payments via these SaaS providers. In parallel, we also see marketplaces acting as a form of payment facilitator increasingly outgrowing the broader e-commerce market. Suppliers of payment services in Europe must adapt to win in the SaaS and marketplace segments in order to outperform in the coming decade.

Please do not hesitate to contact Joel Van Arsdale at Joel@FlagshipAP.com with comments or questions.