Navigating fintech innovation

Flagship Advisory Partners is a boutique strategy and M&A advisory firm focused on payments and fintech. We serve clients globally and have a team of 40+ professionals who have a unique depth of knowledge in payments and fintech.

Latest Insights

Filter by

Topics & Themes

Topics & Themes

Apply

Clients

Clients

Apply

Type

Type

Apply

Topics & Themes

Clients

Type

Selected:

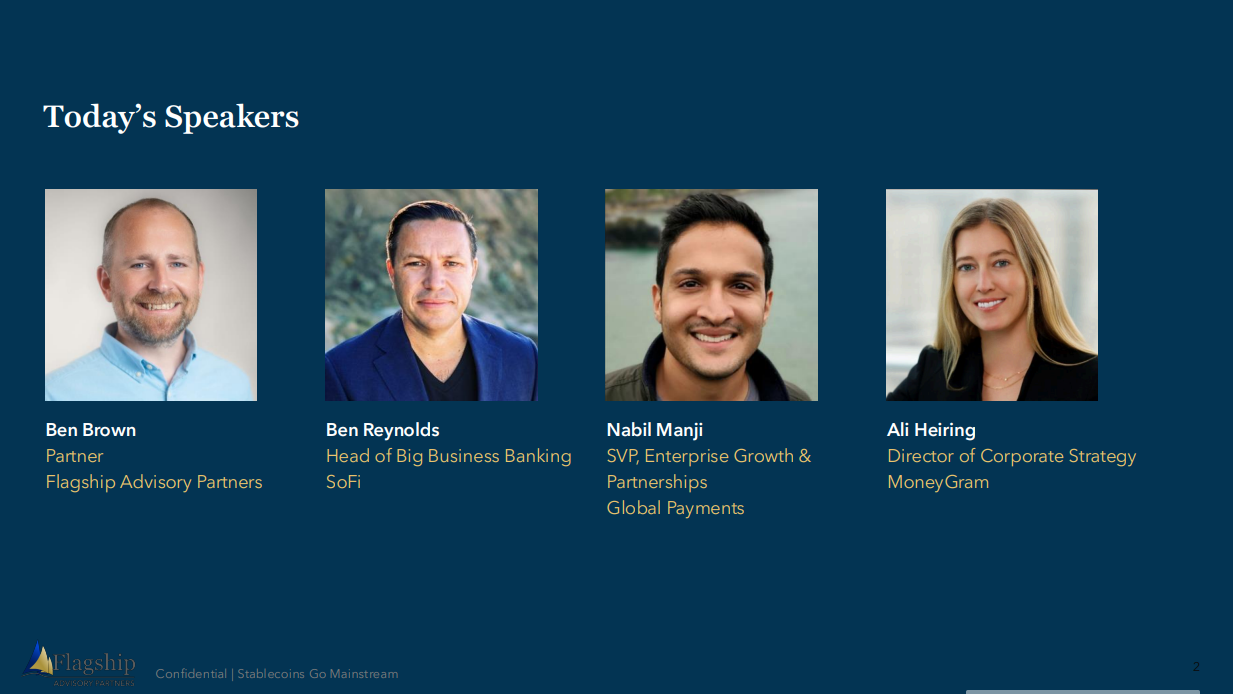

A panel discussion on the stablecoin landscape with Ben Brown (Partner, Flagship Advisory Partners), Nabil Manji (SVP, Head of Fintech Growth &...

Webinar

3 March 2026

Most Read Insights

Rom Mascetti and Salvatore LoBiondo

Recent Posts

Global Card Scheme Performance FY 2023

Infographic

8 Feb 2024

General Commentary & Highlights Visa and Mastercard both had another year of strong performance on the back of healthy growth in consumer spending and cross-border volumes. Cross-border continues to drive volume growth, though growth slowed from 22% to 16% for Visa and 31% to 18% for Mastercard between Dec.’22-23 and Dec.’21-22, respectively. Visa and Mastercard card counts grew 6% and 9% respectively. Average spend per card also grew 2% for both companies after experiencing declines between Dec.’21-22 (-5% and -1%, respectively). Visa and Mastercard revenue grew 9% and 13% Q/Q, respectively. Both companies continue attributing success to cross-border spending, but cross-border revenue growth slowed. International transaction revenue growth for Visa and cross-border revenue growth for Mastercard slowed from 29% to 8% and 30% to 23% between Dec.’22-23 and Dec.’21-22 for each company, respectively. Client incentives continue growing faster than net revenue on a dollar basis for both Visa and Mastercard. Visa’s client incentives as a % of GDV grew 12% Q/Q versus net revenue growth of 1%. Similarly, Mastercard’s client incentives as a % of GDV grew 8% versus net revenue growth of 1% over the same period. Key partnership wins and relationship expansions were a key talking point during earnings calls for both companies. Visa’s highlighted partnerships were heavily focused on fintechs (47% of logos mentioned), while Mastercard’s highlighted partnerships were more heavily focused on banks (50% of partnerships). Visa announced large strategic investments in payment processing (Prosa and Pismo) and A2A payments platform Form3. Mastercard’s investment activity was spread across a variety of payment use cases (international money transfer, open banking, cybersecurity, etc.) Please do not hesitate to contact Rom Mascetti at Rom@FlagshipAP.com or Salvatore LoBiondo at Slavatore@FlagshipAP.com with comments or questions.

processingtechnology

processorssolutionproviders

infographic

Infographic: Card Scheme Performance, 2022-2023

Infographic

11 May 2023

Image and Logo Credits: FreePik, Visa, and Mastercard General Observations Visa and Mastercard continue demonstrating strong performance. Cross-border is a key growth driver, significantly outpacing domestic volume with management citing travel and B2B as key drivers While card counts have grown for both Visa and Mastercard (7% and 5%, respectively), average spend per card has declined Visa and Mastercard both grew at approx. 11% quarter-over-quarter, again due in large part to cross-border related revenue growing 25% and 33%, respectively North America continues to represent a significant portion of revenue for both card schemes Client incentives as a % of GDV and net revenue as a % of GDV are headed up, but on a dollar basis incentives are growing at a faster rate than revenue Please do not hesitate to contact Rom Mascetti at Rom@FlagshipAP.com or Salvatore LoBiondo at Salvatore@FlagshipAP.com with comments or questions.

credit,processingtechnology

processorssolutionproviders

infographic

No results found

Topics & Themes

A2A Payments

AI Artificial Intelligence

B2B Payments

Best Practices & Toolkits

Card Issuing

Compliance & Security

Credit

Embedded Finance & BaaS

Fintech & SaaS

Innovations

M&A

Open Banking

Payments Acceptance

Payments Orchestration

Perspective on Key Events

Processing & Technology

SaaS

X-Border Payments