Perspective on Key Events

Perspective on Key Events

Rom Mascetti and Salvatore LoBiondo • 8 February, 2024

General Commentary & Highlights

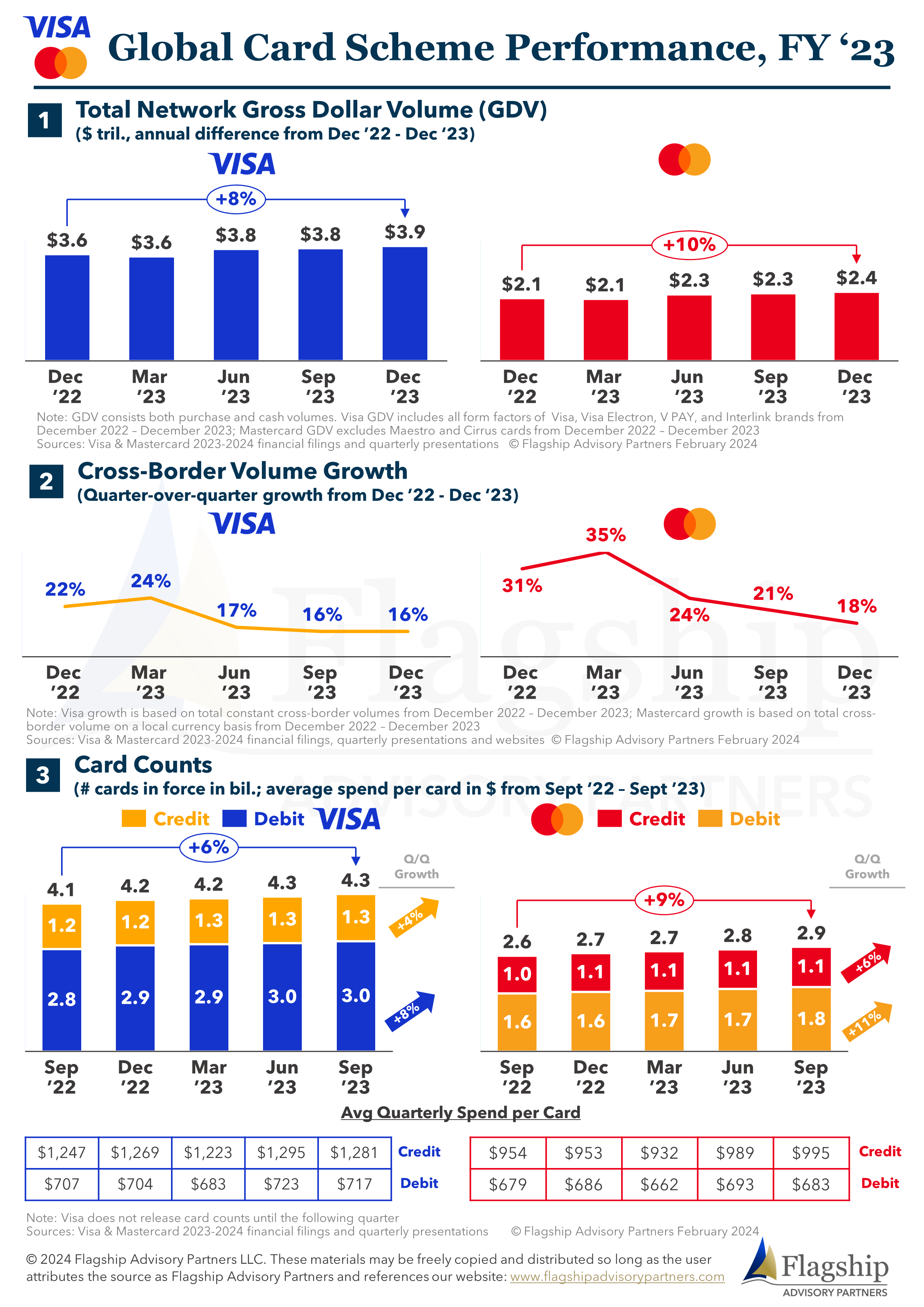

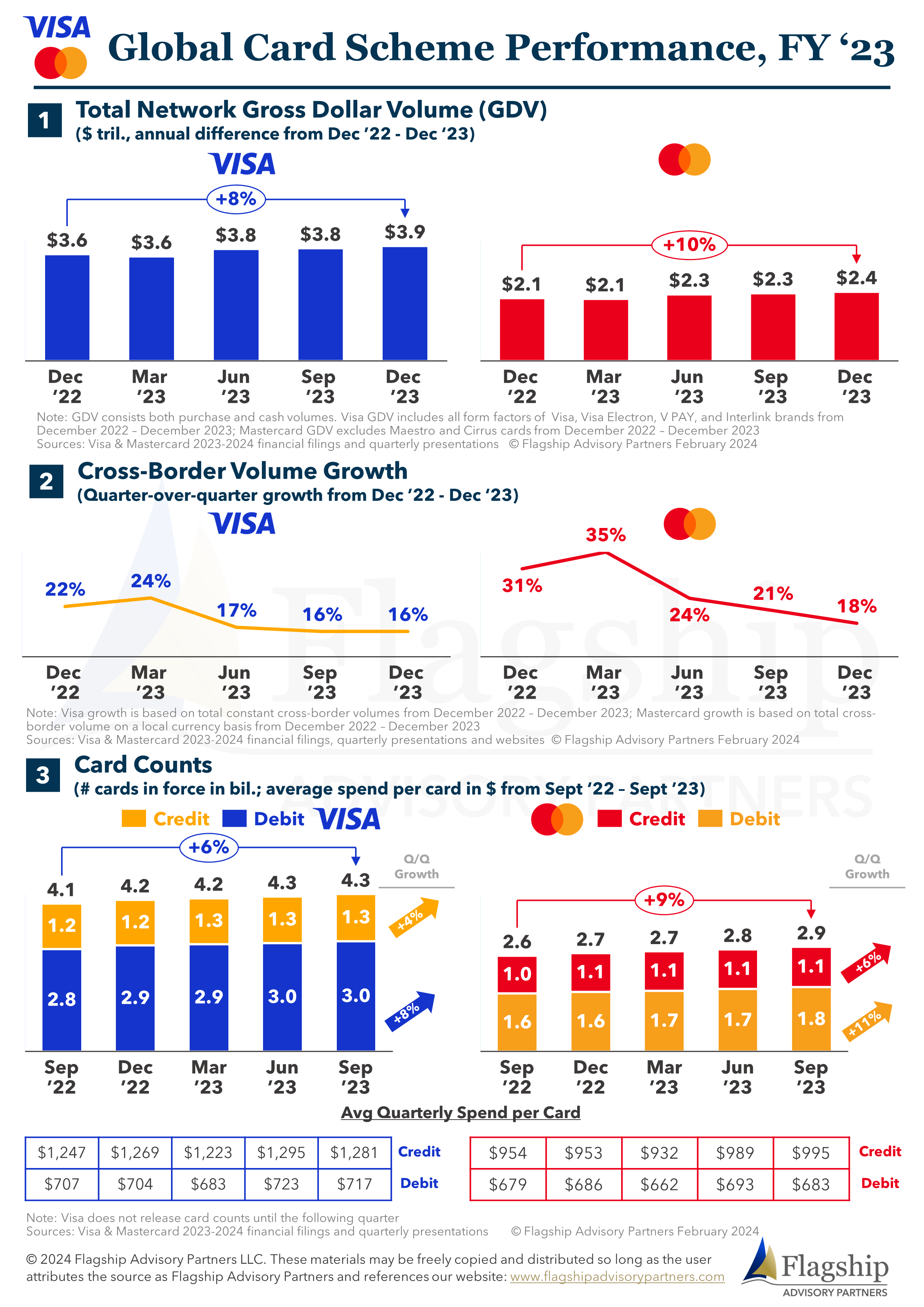

- Visa and Mastercard both had another year of strong performance on the back of healthy growth in consumer spending and cross-border volumes.

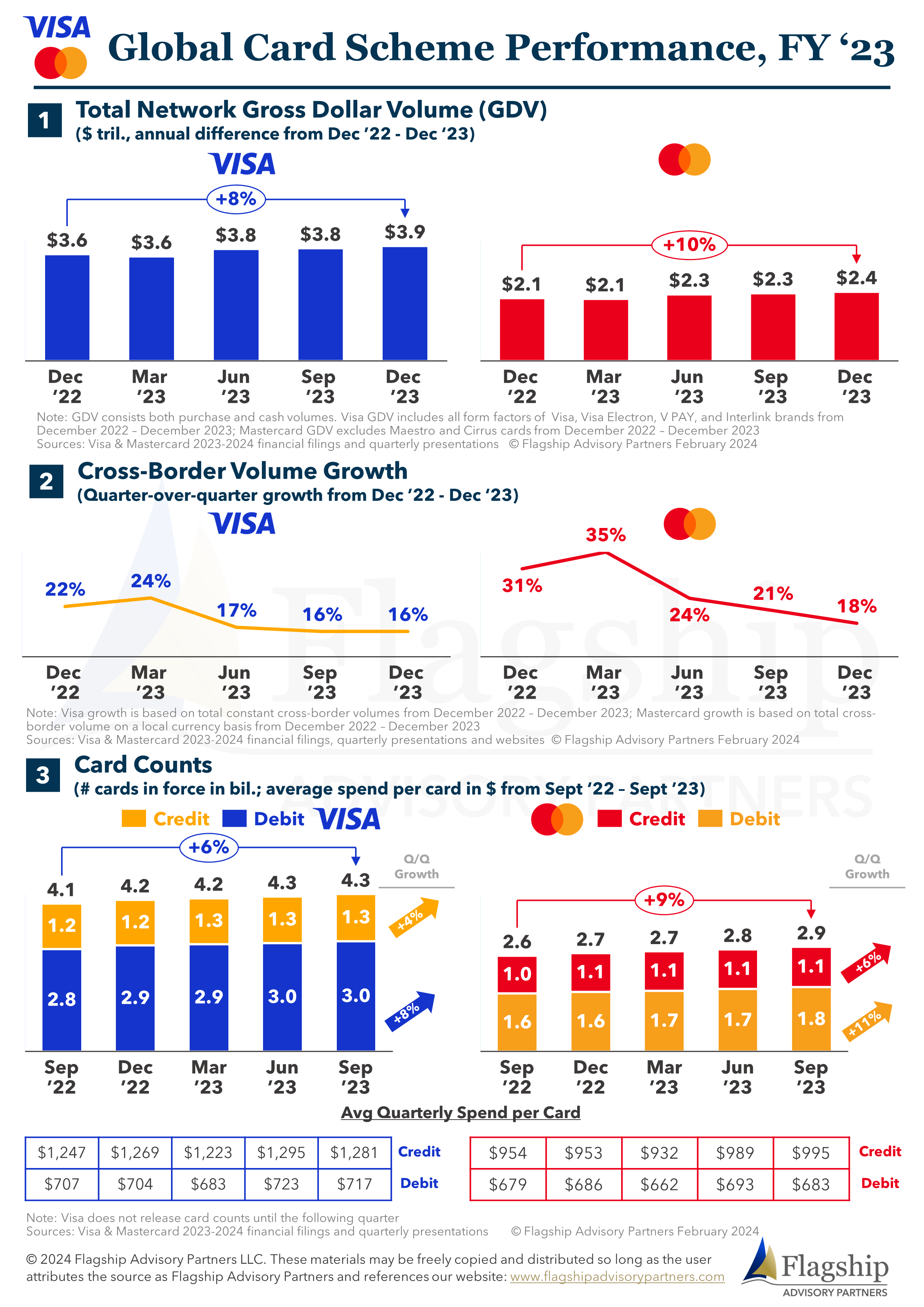

- Cross-border continues to drive volume growth, though growth slowed from 22% to 16% for Visa and 31% to 18% for Mastercard between Dec.’22-23 and Dec.’21-22, respectively.

Visa and Mastercard card counts grew 6% and 9% respectively. Average spend per card also grew 2% for both companies after experiencing declines between Dec.’21-22 (-5% and -1%, respectively).

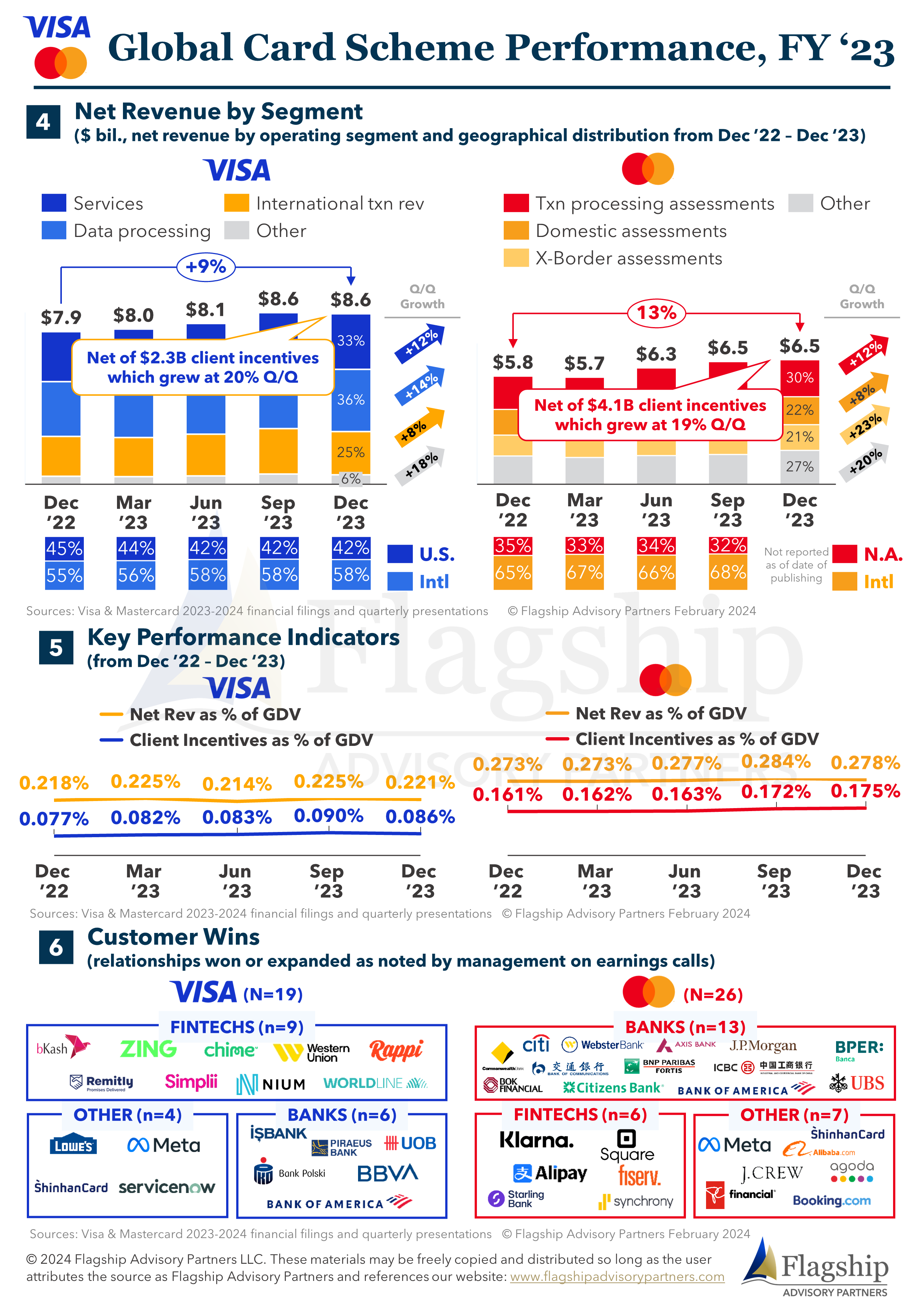

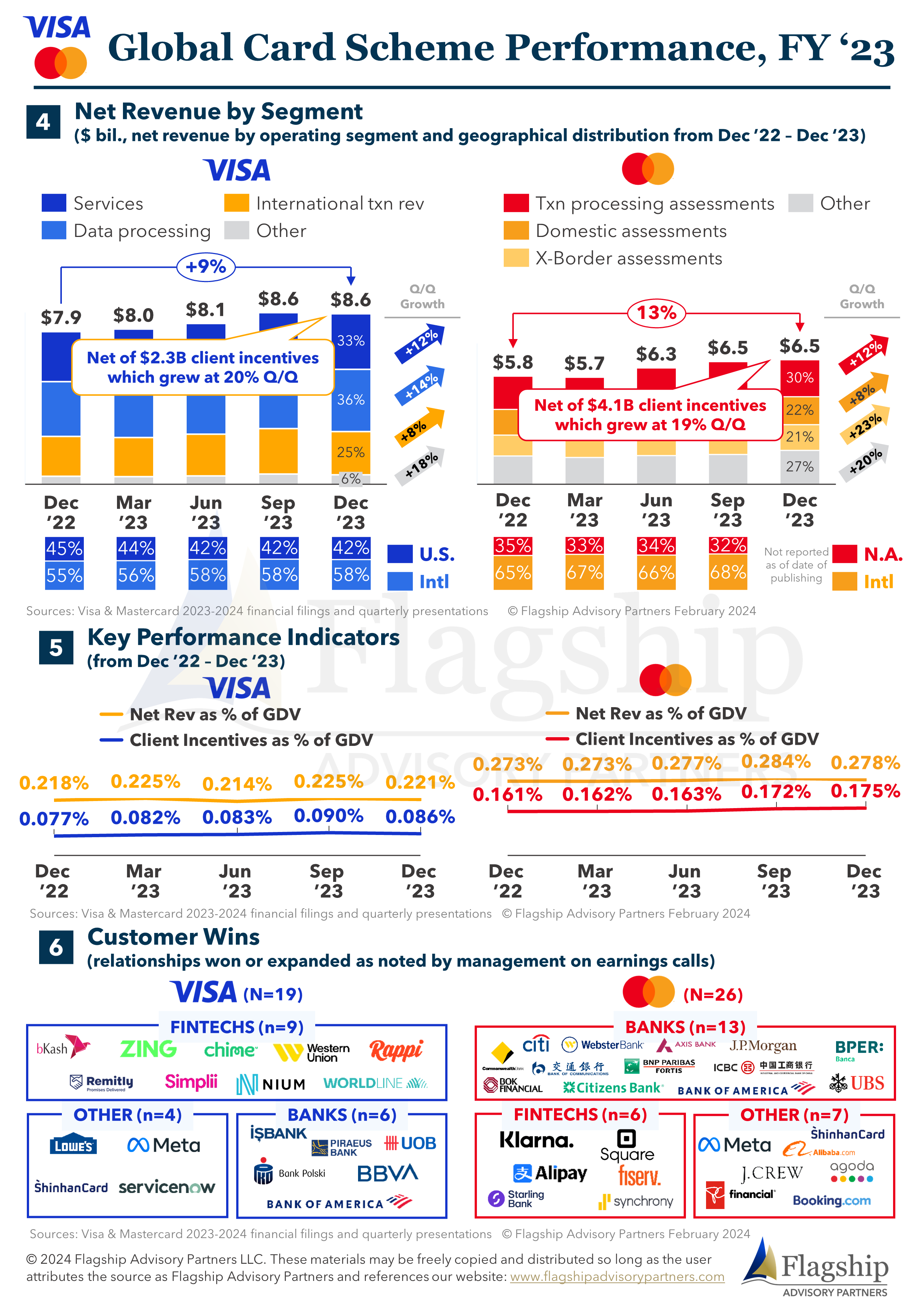

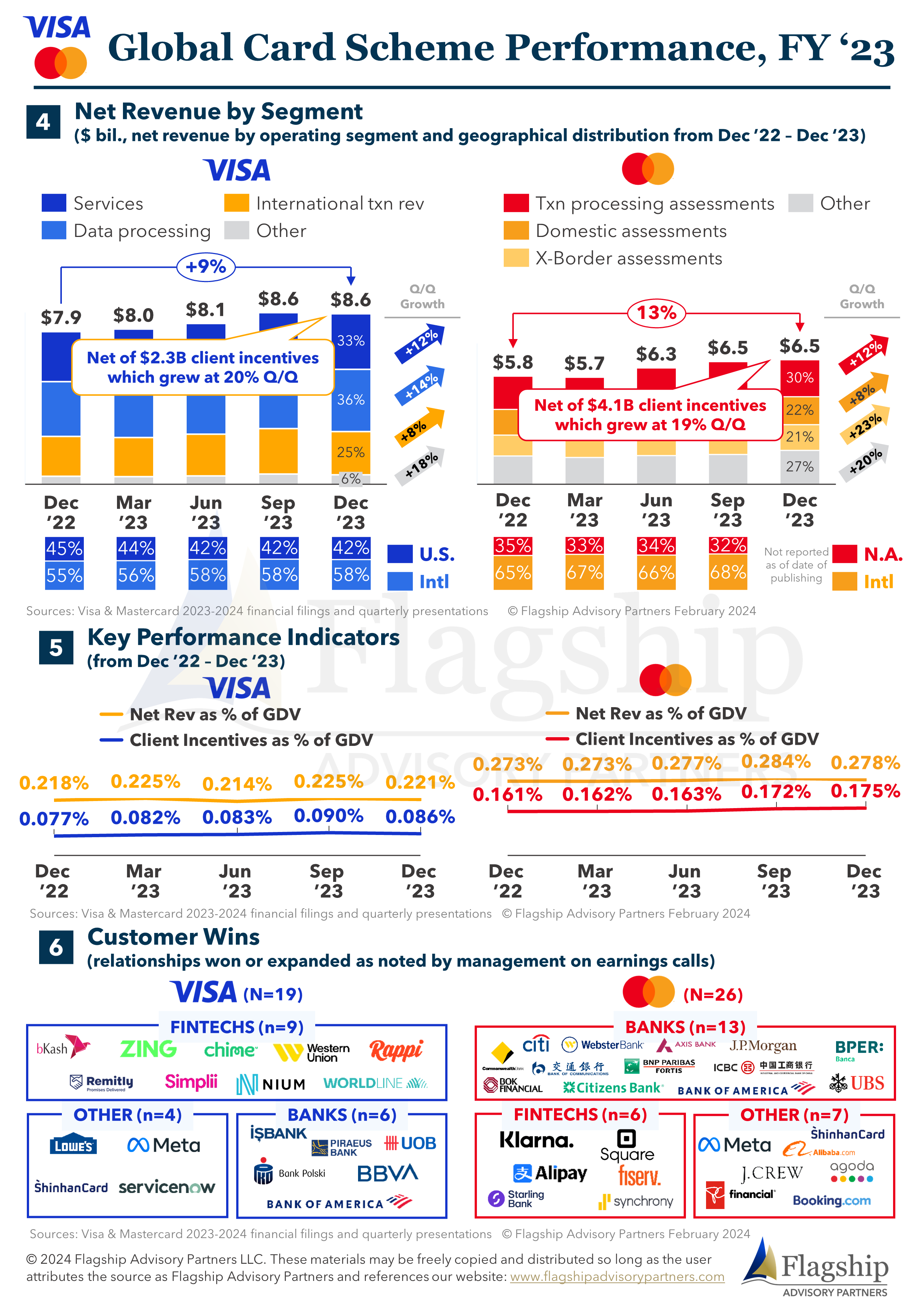

- Visa and Mastercard revenue grew 9% and 13% Q/Q, respectively. Both companies continue attributing success to cross-border spending, but cross-border revenue growth slowed. International transaction revenue growth for Visa and cross-border revenue growth for Mastercard slowed from 29% to 8% and 30% to 23% between Dec.’22-23 and Dec.’21-22 for each company, respectively.

- Client incentives continue growing faster than net revenue on a dollar basis for both Visa and Mastercard. Visa’s client incentives as a % of GDV grew 12% Q/Q versus net revenue growth of 1%. Similarly, Mastercard’s client incentives as a % of GDV grew 8% versus net revenue growth of 1% over the same period.

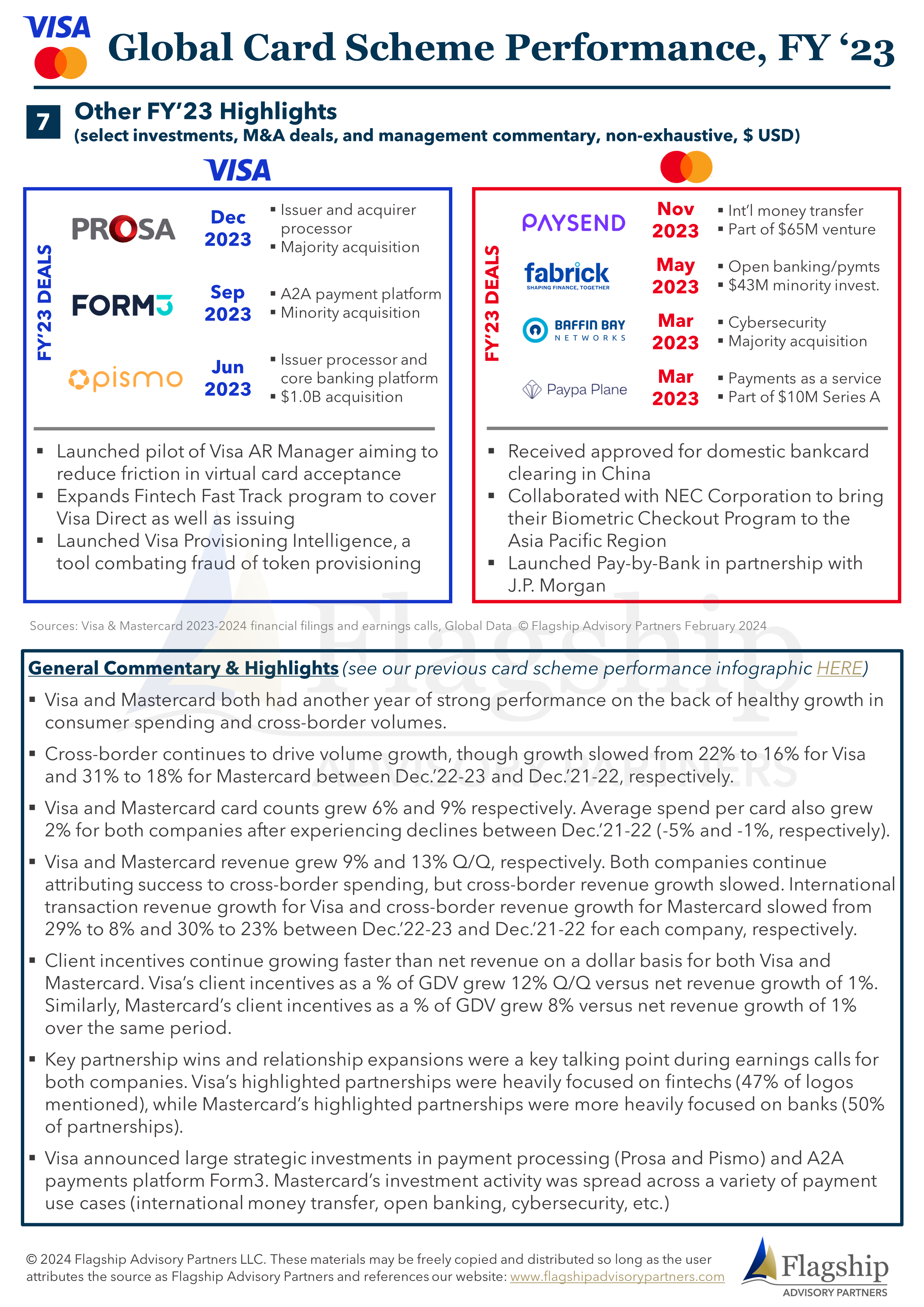

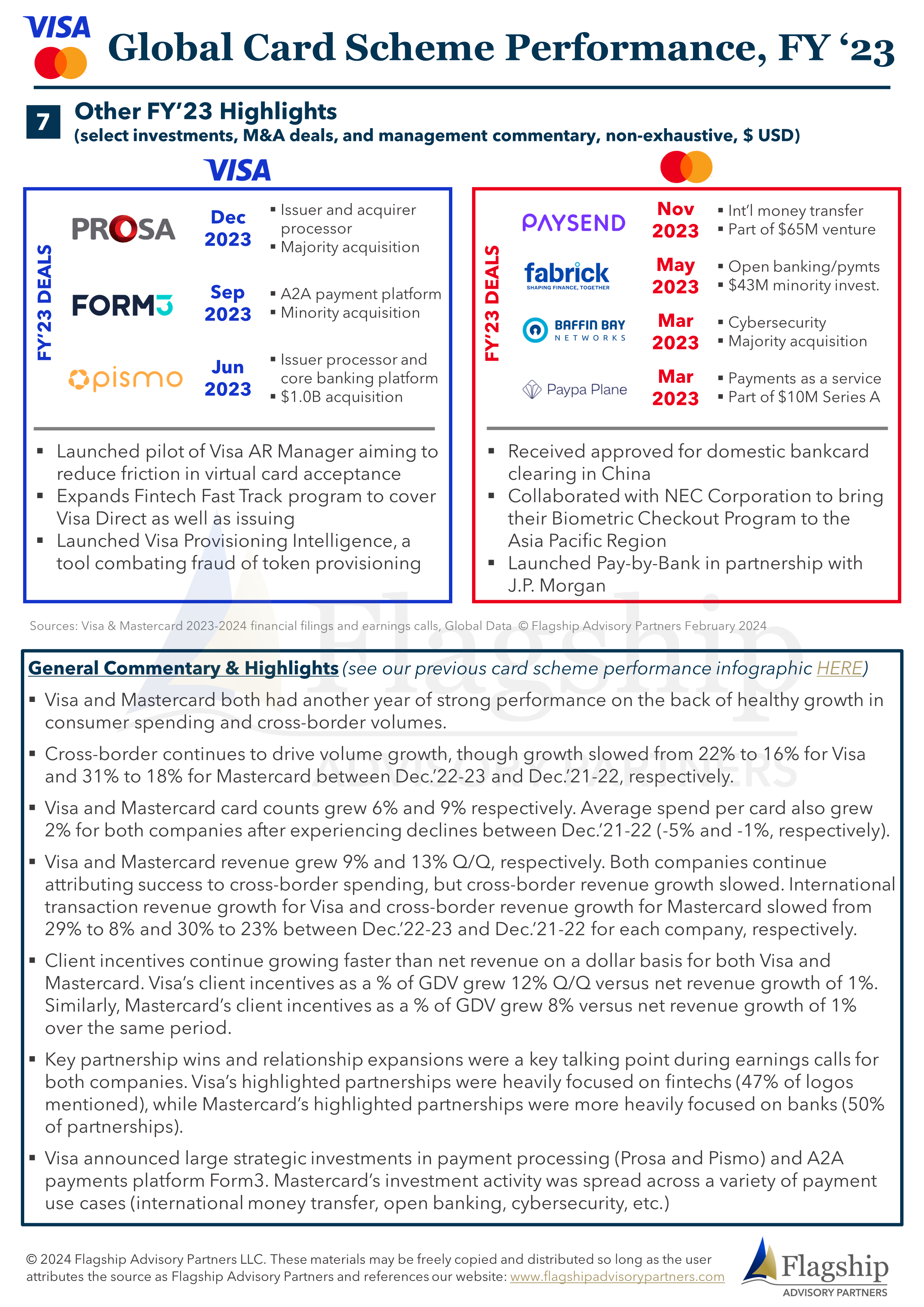

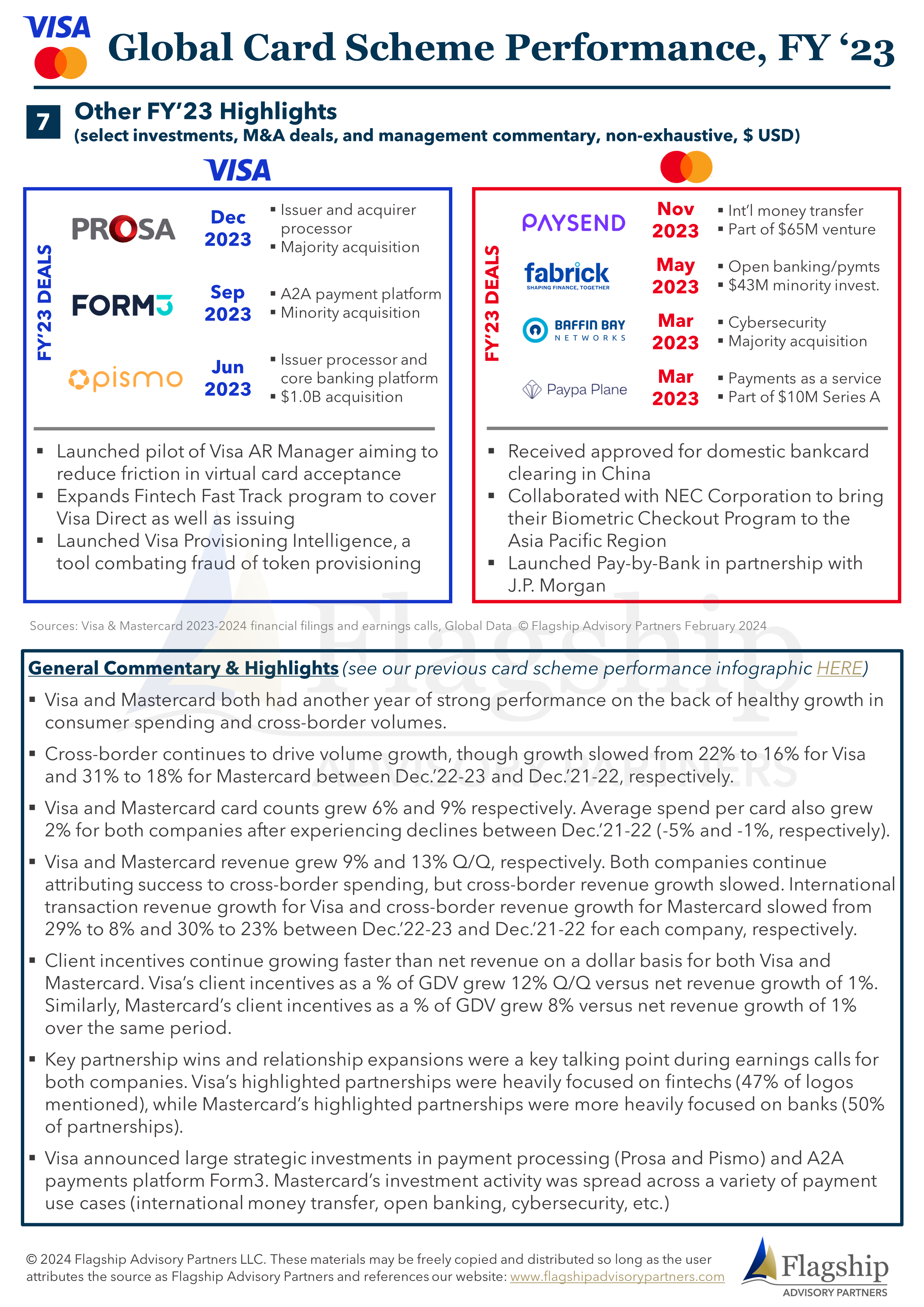

- Key partnership wins and relationship expansions were a key talking point during earnings calls for both companies. Visa’s highlighted partnerships were heavily focused on fintechs (47% of logos mentioned), while Mastercard’s highlighted partnerships were more heavily focused on banks (50% of partnerships).

- Visa announced large strategic investments in payment processing (Prosa and Pismo) and A2A payments platform Form3. Mastercard’s investment activity was spread across a variety of payment use cases (international money transfer, open banking, cybersecurity, etc.)

Please do not hesitate to contact Rom Mascetti at Rom@FlagshipAP.com or Salvatore LoBiondo at Slavatore@FlagshipAP.com with comments or questions.

General Commentary & Highlights

- Visa and Mastercard both had another year of strong performance on the back of healthy growth in consumer spending and cross-border volumes.

- Cross-border continues to drive volume growth, though growth slowed from 22% to 16% for Visa and 31% to 18% for Mastercard between Dec.’22-23 and Dec.’21-22, respectively.

Visa and Mastercard card counts grew 6% and 9% respectively. Average spend per card also grew 2% for both companies after experiencing declines between Dec.’21-22 (-5% and -1%, respectively).

- Visa and Mastercard revenue grew 9% and 13% Q/Q, respectively. Both companies continue attributing success to cross-border spending, but cross-border revenue growth slowed. International transaction revenue growth for Visa and cross-border revenue growth for Mastercard slowed from 29% to 8% and 30% to 23% between Dec.’22-23 and Dec.’21-22 for each company, respectively.

- Client incentives continue growing faster than net revenue on a dollar basis for both Visa and Mastercard. Visa’s client incentives as a % of GDV grew 12% Q/Q versus net revenue growth of 1%. Similarly, Mastercard’s client incentives as a % of GDV grew 8% versus net revenue growth of 1% over the same period.

- Key partnership wins and relationship expansions were a key talking point during earnings calls for both companies. Visa’s highlighted partnerships were heavily focused on fintechs (47% of logos mentioned), while Mastercard’s highlighted partnerships were more heavily focused on banks (50% of partnerships).

- Visa announced large strategic investments in payment processing (Prosa and Pismo) and A2A payments platform Form3. Mastercard’s investment activity was spread across a variety of payment use cases (international money transfer, open banking, cybersecurity, etc.)

Please do not hesitate to contact Rom Mascetti at Rom@FlagshipAP.com or Salvatore LoBiondo at Slavatore@FlagshipAP.com with comments or questions.