FreePik

Perspective on Key Events, Innovations, Compliance & Security

Perspective on Key Events, Innovations, Compliance & Security

Erik Howell, Andrej Gažo, and Claire Hoffman • 6 February, 2024

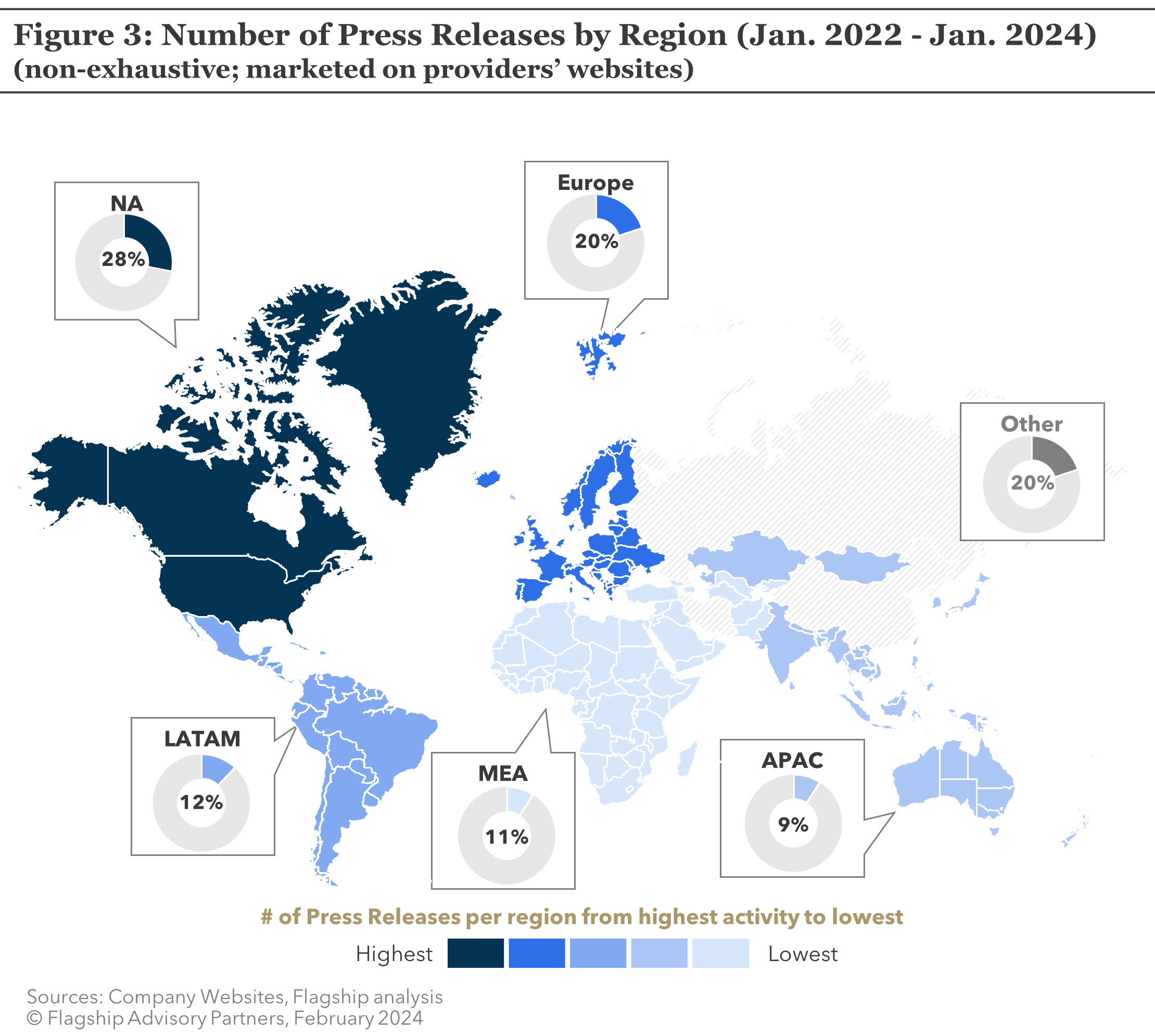

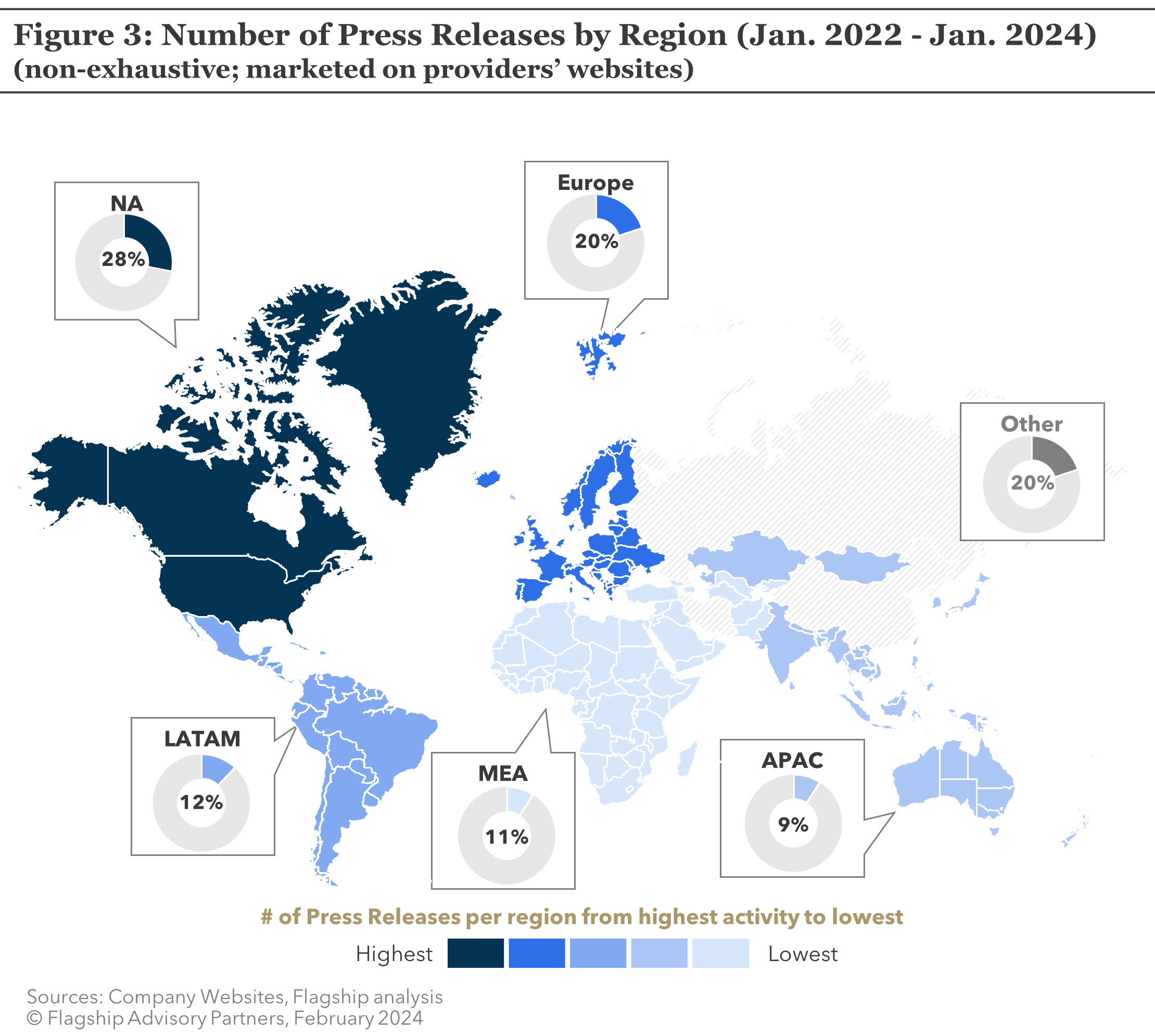

Regardless of the wide variance in definitions for the term “embedded finance” (which Flagship defines in detail in an article here), most market participants can agree on the need to quantify how big embedded finance actually is today, and what its trajectory is towards obtaining its (typically huge) theoretical market size. This article seeks to provide some quasi-quantifiable evidence for indicating the level of traction that embedded finance has in the market today by mapping the press releases of a key segment of embedded finance providers, next-generation card issuer processors, in 2022 and 2023. While there are obvious limits to the utility of press releases as a data source, they provide an instructive indicator of market activity levels because (i) providers have a natural motivation to issue as many press releases about their growth and success as possible, and (ii) typically only relatively significant items get announced in press releases.

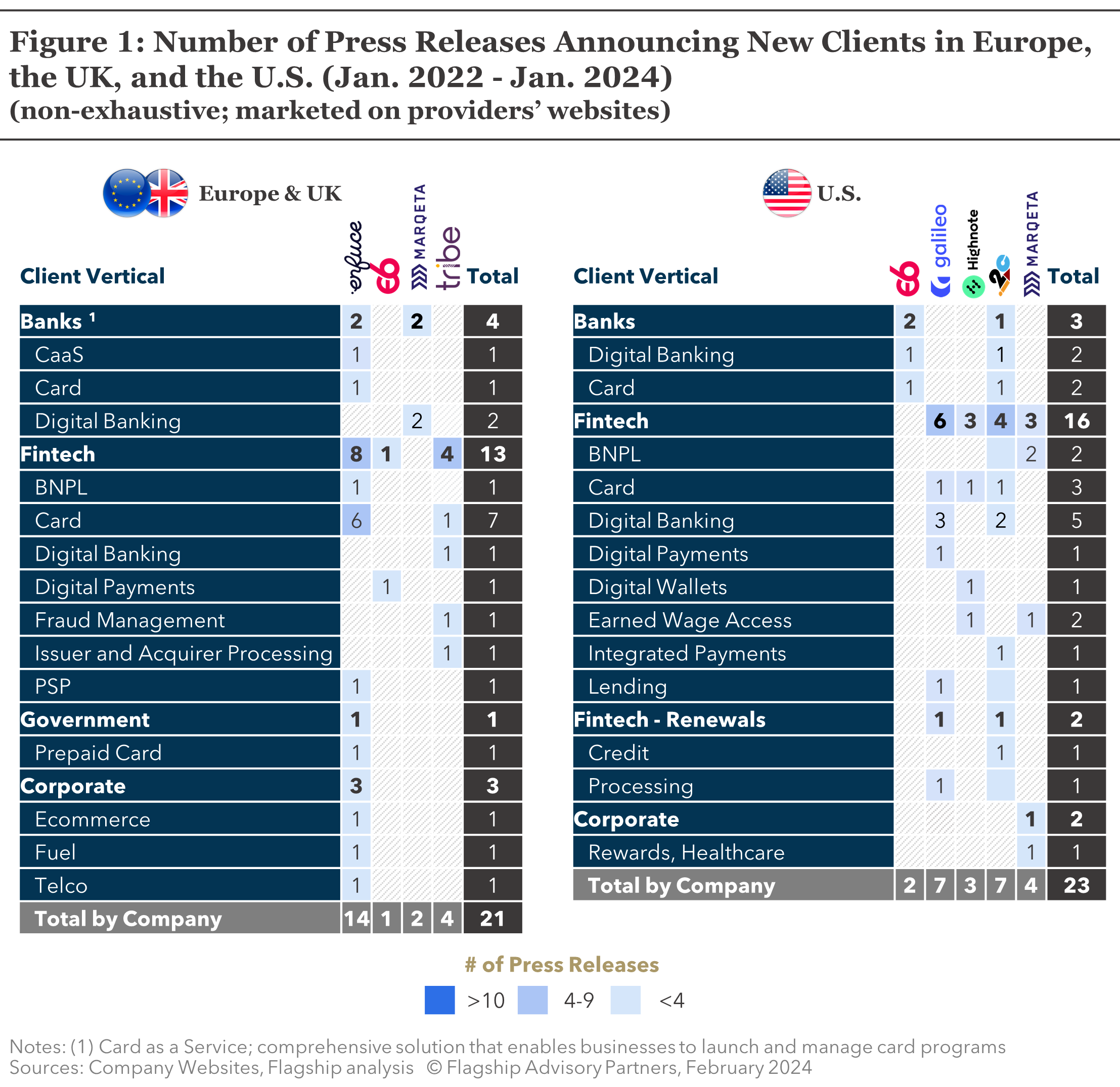

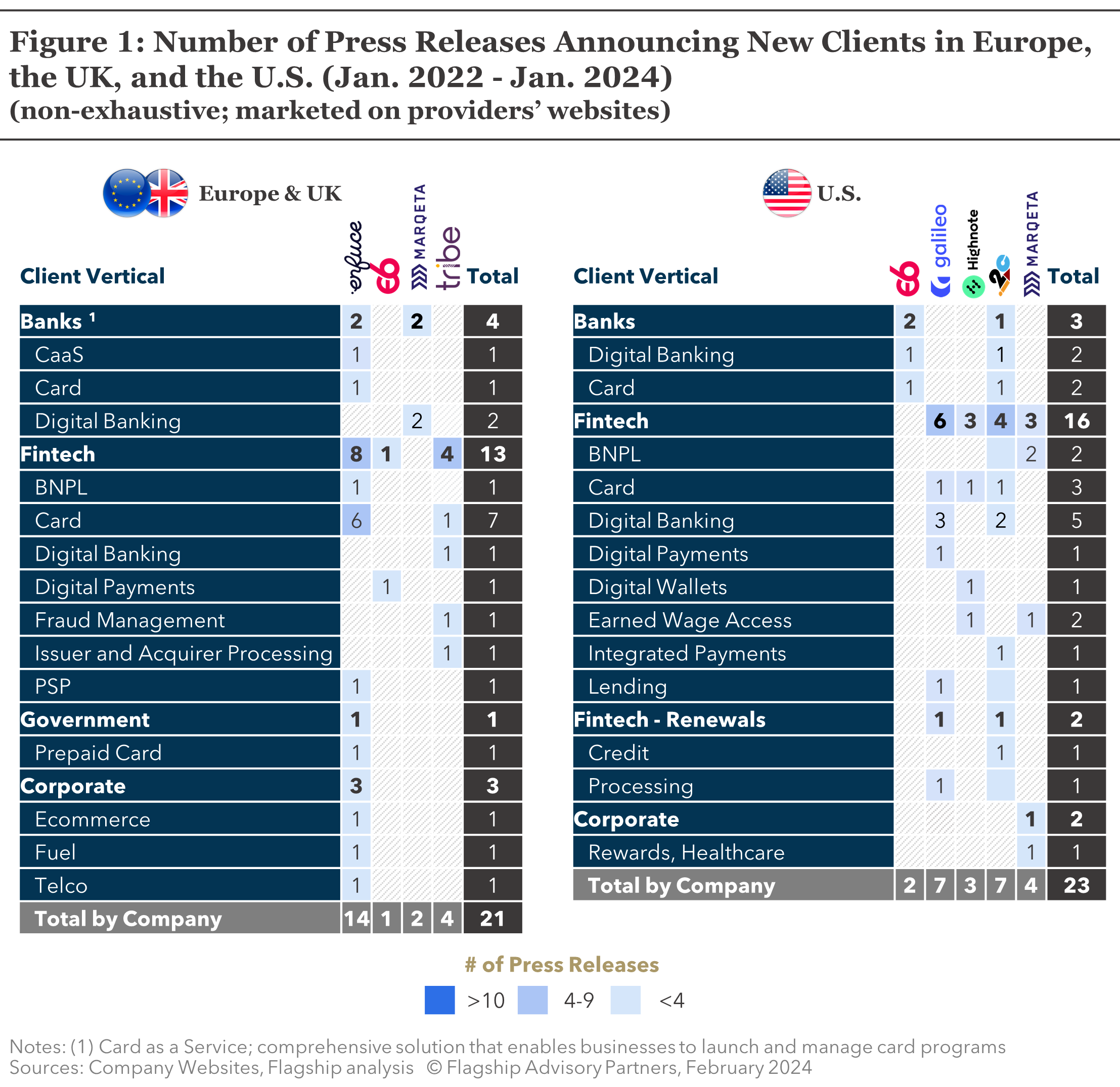

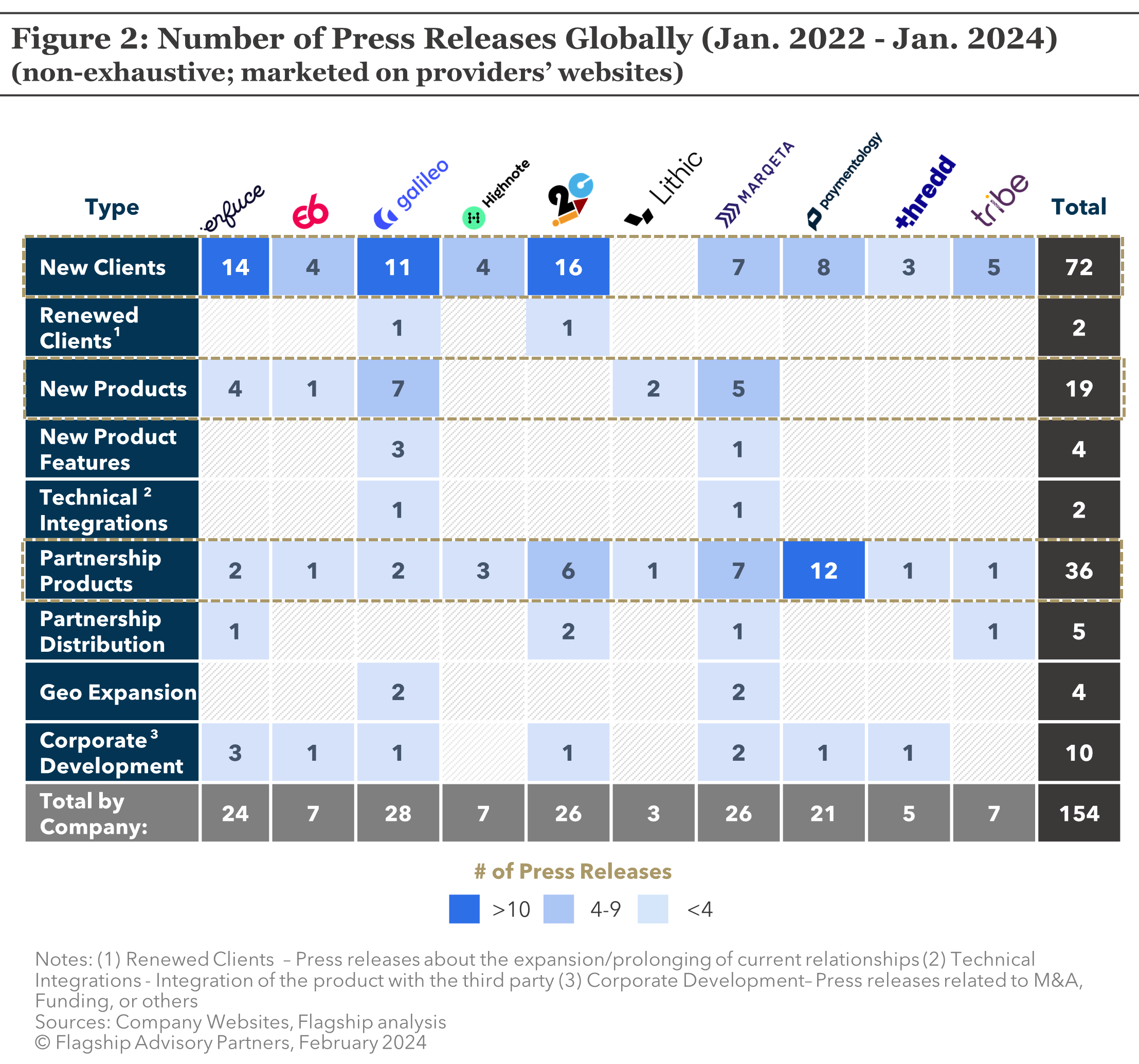

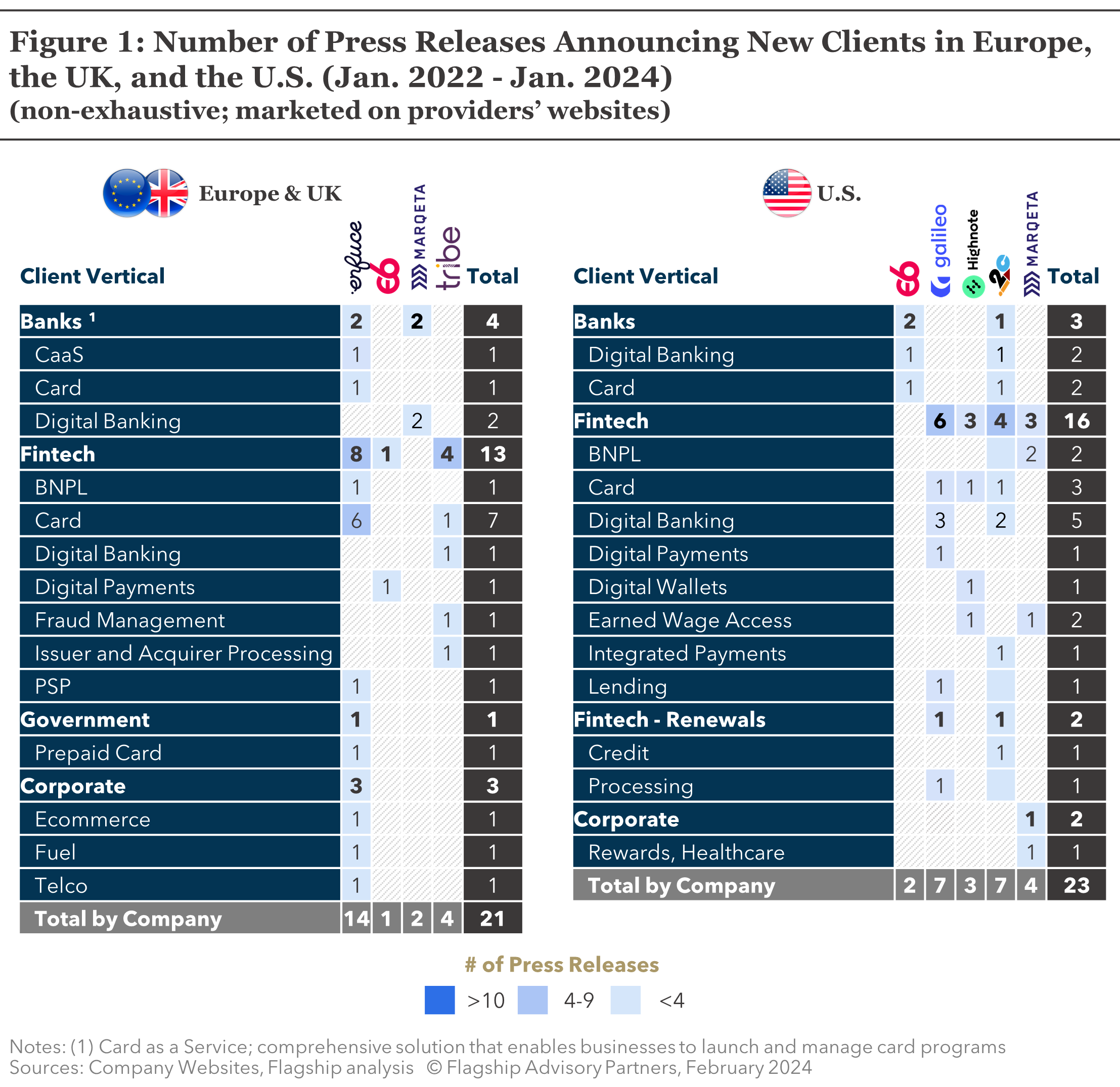

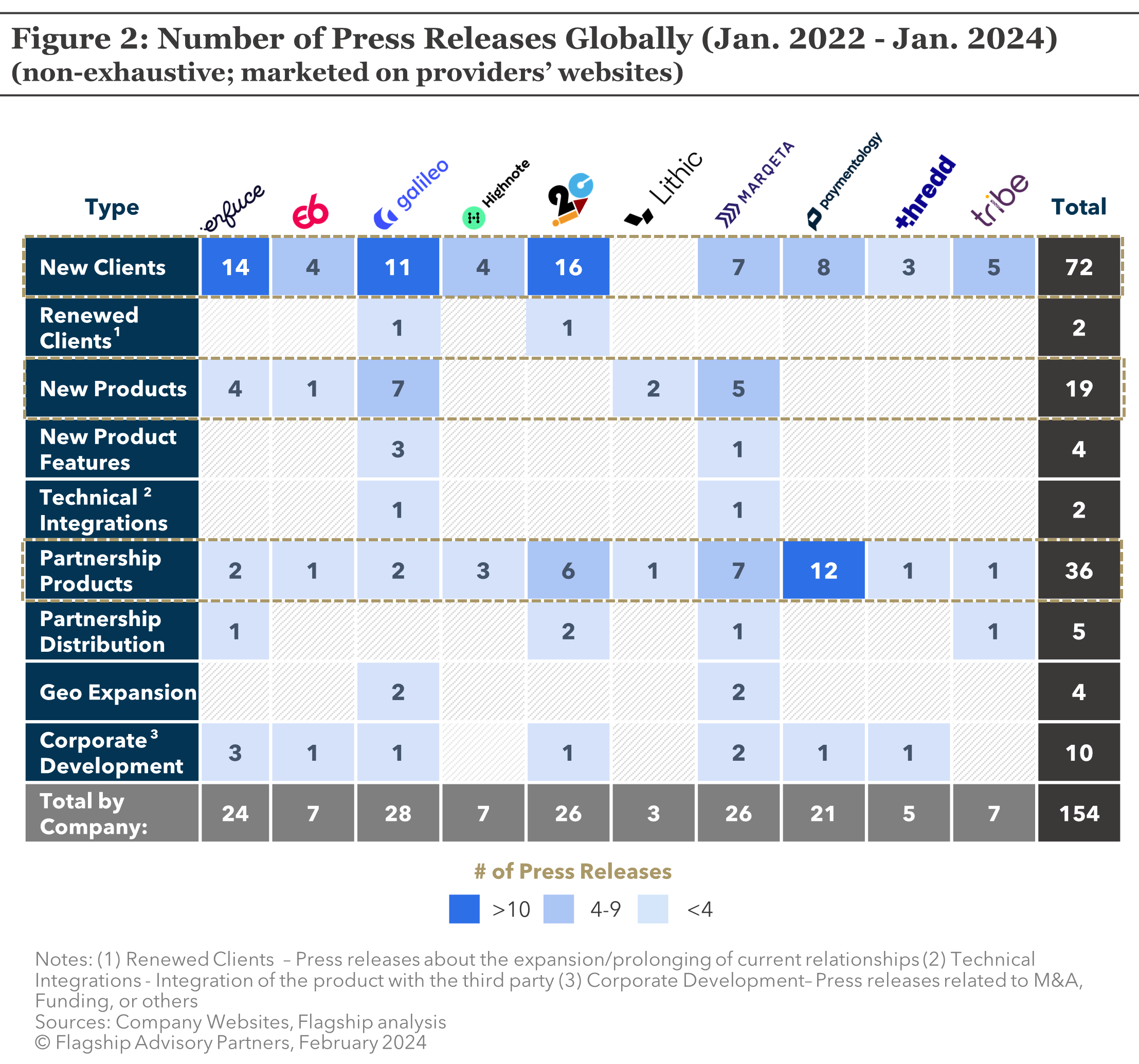

Based on this analysis, we found that the market traction of what Flagship defines embedded finance as (financial products embedded into non-financial use cases) is relatively modest (see Figure 1 below). Out of 44 new clients announced in North America and Europe, only 5 were with corporates (meaning non-banks and non-fintechs). Fintech clients represented the majority of new clients announced (29), followed by banks (7), and government (1). Arguably, some of the fintech clients announced by these next-generation card issuer processors can be providers of embedded finance, but in our experience, most large corporates typically evaluate utilizing a processor directly (although often utilizing that processor’s program management layer) rather than considering smaller providers. Other key observations include:

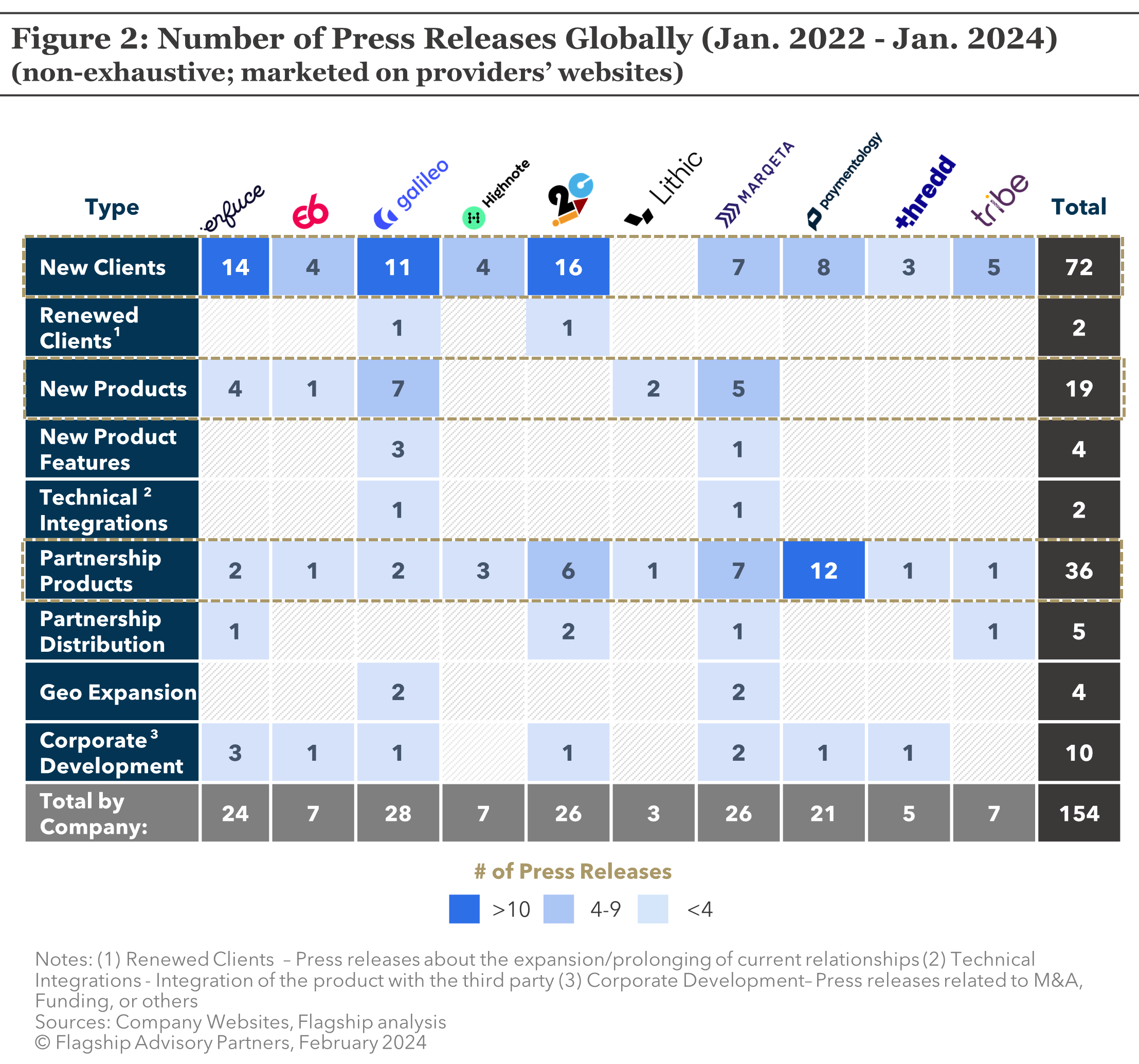

- Overall, new client announcements are relatively modest: 72 globally over two years for all 10 providers, or about an average of 3.5 new client announcements per provider per year (see Figure 2).

- There was little traction in the bank segment and most announcements were for relatively small pieces of business rather than converting banks’ primary portfolios (see Figure 1).

- Relatively high emphasis on product introductions and partnerships: 55 over two years for all 10 providers, or about an average of 2.75 new product announcements per provider per year (see Figure 2).

- Few announcements regarding feature/functionality upgrades (4 total) and technical integrations (2 total) (see Figure 2).

Although embedded finance has massive potential, it is clear that for next-generation issuer processors, that potential is still in the very early stages of being realized. In Flagship’s view as it pertains to card issuer processors, significant work still needs to be done to realize this potential. In particular:

- Corporates (non-banks and non-fintechs) are seeking end-to-end value chain coverage (e.g., white label end-customer front-ends, back office capabilities, etc.) at price points that work for their business case, and there is a gap in supply of end-to-end solutions today;

- Non-financial companies are often not looking to implement a “program” that takes several months and requires a meaningful amount of resources and subject matter expertise, and are not yet “developer-led” enough to simply work with APIs and a developer page; therefore the product offering and delivery model needs to change to meet these customers’ needs (often for a more basic product that can be MVP’d quickly, but with some hand-holding); and,

- Go-to-market strategies still need work, particularly around scalable, multi-geo sales, such as via focused targeting of use cases and verticals, and by leveraging distribution partners (e.g., local consultants and system integrators, etc.).

Please do not hesitate to contact Erik Howell at Erik@FlagshipAP.com, Andrej Gažo at Andrej@FlagshipAP.com, or Claire Hoffman at Claire@FlagshipAP.com with comments or questions.

Regardless of the wide variance in definitions for the term “embedded finance” (which Flagship defines in detail in an article here), most market participants can agree on the need to quantify how big embedded finance actually is today, and what its trajectory is towards obtaining its (typically huge) theoretical market size. This article seeks to provide some quasi-quantifiable evidence for indicating the level of traction that embedded finance has in the market today by mapping the press releases of a key segment of embedded finance providers, next-generation card issuer processors, in 2022 and 2023. While there are obvious limits to the utility of press releases as a data source, they provide an instructive indicator of market activity levels because (i) providers have a natural motivation to issue as many press releases about their growth and success as possible, and (ii) typically only relatively significant items get announced in press releases.

Based on this analysis, we found that the market traction of what Flagship defines embedded finance as (financial products embedded into non-financial use cases) is relatively modest (see Figure 1 below). Out of 44 new clients announced in North America and Europe, only 5 were with corporates (meaning non-banks and non-fintechs). Fintech clients represented the majority of new clients announced (29), followed by banks (7), and government (1). Arguably, some of the fintech clients announced by these next-generation card issuer processors can be providers of embedded finance, but in our experience, most large corporates typically evaluate utilizing a processor directly (although often utilizing that processor’s program management layer) rather than considering smaller providers. Other key observations include:

- Overall, new client announcements are relatively modest: 72 globally over two years for all 10 providers, or about an average of 3.5 new client announcements per provider per year (see Figure 2).

- There was little traction in the bank segment and most announcements were for relatively small pieces of business rather than converting banks’ primary portfolios (see Figure 1).

- Relatively high emphasis on product introductions and partnerships: 55 over two years for all 10 providers, or about an average of 2.75 new product announcements per provider per year (see Figure 2).

- Few announcements regarding feature/functionality upgrades (4 total) and technical integrations (2 total) (see Figure 2).

Although embedded finance has massive potential, it is clear that for next-generation issuer processors, that potential is still in the very early stages of being realized. In Flagship’s view as it pertains to card issuer processors, significant work still needs to be done to realize this potential. In particular:

- Corporates (non-banks and non-fintechs) are seeking end-to-end value chain coverage (e.g., white label end-customer front-ends, back office capabilities, etc.) at price points that work for their business case, and there is a gap in supply of end-to-end solutions today;

- Non-financial companies are often not looking to implement a “program” that takes several months and requires a meaningful amount of resources and subject matter expertise, and are not yet “developer-led” enough to simply work with APIs and a developer page; therefore the product offering and delivery model needs to change to meet these customers’ needs (often for a more basic product that can be MVP’d quickly, but with some hand-holding); and,

- Go-to-market strategies still need work, particularly around scalable, multi-geo sales, such as via focused targeting of use cases and verticals, and by leveraging distribution partners (e.g., local consultants and system integrators, etc.).

Please do not hesitate to contact Erik Howell at Erik@FlagshipAP.com, Andrej Gažo at Andrej@FlagshipAP.com, or Claire Hoffman at Claire@FlagshipAP.com with comments or questions.