This article is part II of our Central Bank Digital Currencies series. For more insights, please refer to Part I: Demystifying CBDC (Central Bank Digital Currencies) here.

Central Bank Digital Currencies (CBDCs) have emerged as a pivotal topic at the intersection of finance, technology, and policy. As described in our previous article here, a CBDC is a digital form of a nation's currency created and overseen by its central bank. It is different from the existing type of "digital" funds (those that holders can see their bank balance online) as CBDCs are issued directly to holders by the central bank (as opposed to the holder's bank), and the funds held on the central bank's ledger (as opposed to the holder's bank's ledger). In this article, we outline the key characteristics of Digital Euro as proposed by the European Central Bank, and the anticipated impact on stakeholders in the European payment landscape.

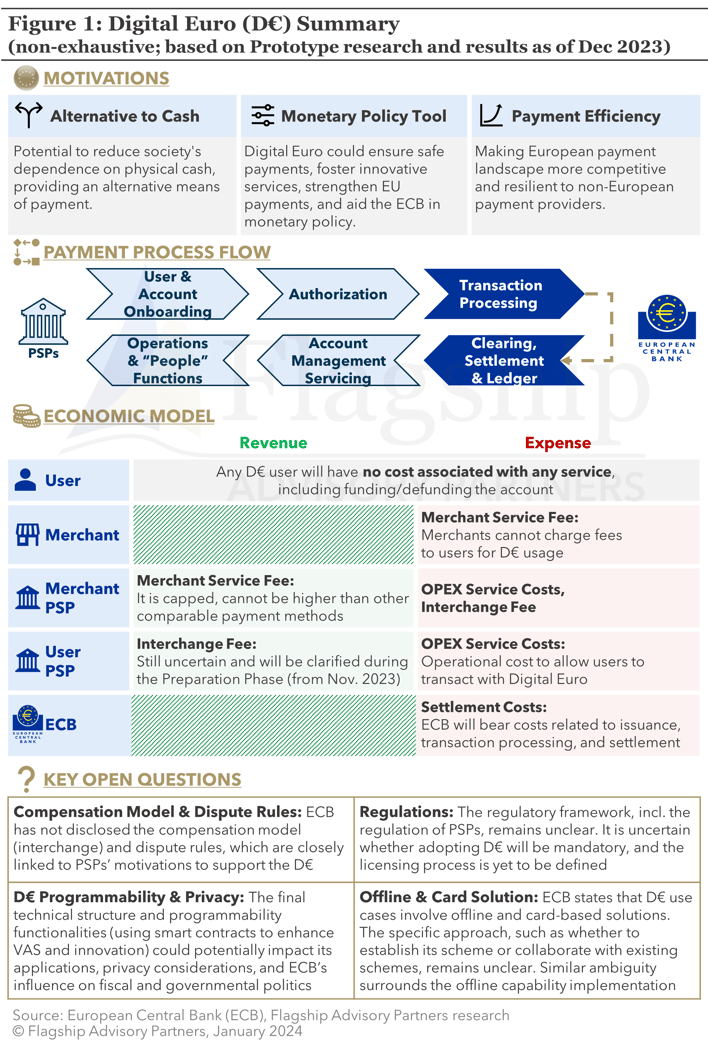

The European Central Bank's (ECB) proposal for the Digital Euro is positioned by policymakers as a revolutionary step in modernizing monetary policy, financial services innovation, and payments in the Eurozone (see Figure 1). As proposed by the ECB, it will be responsible for the back-end infrastructure and collaborating with banks and payment service providers (PSPs) to develop the market's most affordable and convenient digital payment solution. In our view, the proposed design leaves key questions unanswered regarding future functionality and design.

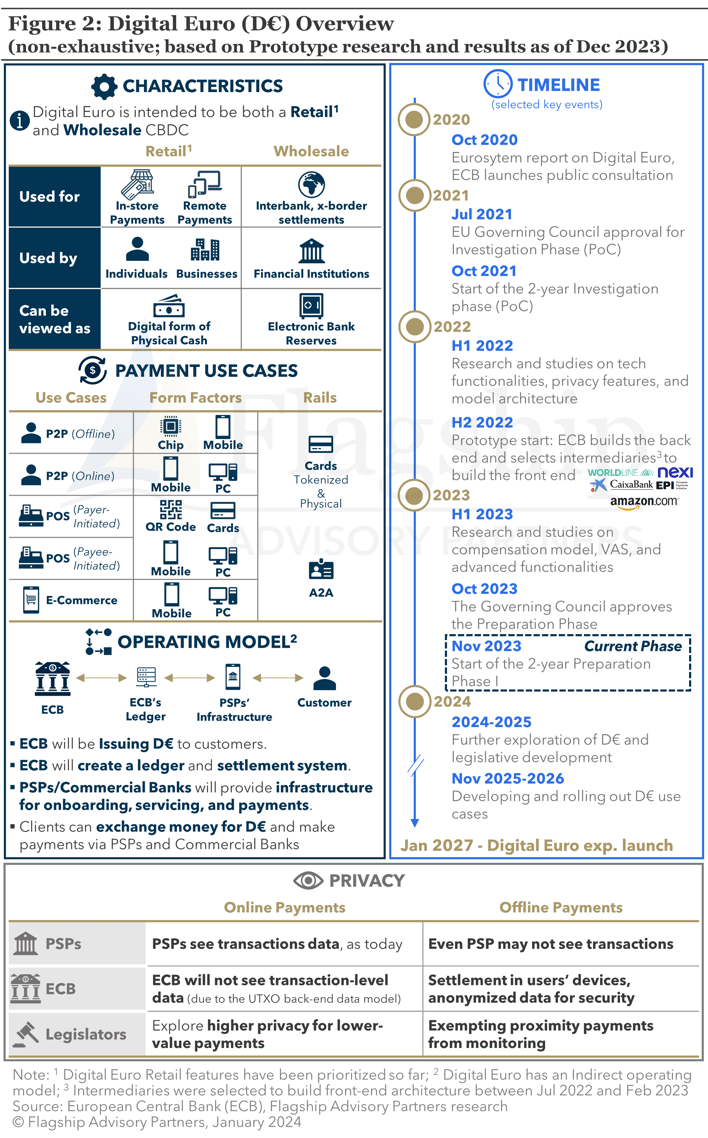

The proposed Digital Euro will be available in two types (see Figure 2):

- Retail: for public use, individuals and businesses access digital currency from the central bank, replacing cash and improving payments; and,

- Wholesale: for financial institutions and governments, used for interbank and cross-border transactions, settlements, and reserves management.

Since the origin of the concept in 2020, the ECB has explored and prioritized the retail application, working with intermediaries to build back-end and front-end prototypes. At the moment, wholesale applications of the Digital Euro have been sidelined since European banks can already use a 24/7 instant solution, such as the Eurosystem’s TIPS, for inter-settlement transactions in the Eurozone.

Due to its programmability and technological flexibility, Digital Euro is intended to cover multiple payment use cases and form factors. The ECB will be responsible for issuing, ledger management, and settlement processes, whilst participating PSPs and commercial banks will provide the onboarding, servicing, and payments infrastructure. One of the key priorities for the ECB is to build a solution that can guarantee a high level of privacy and usability equal to that of private digital solutions. After years of research, the ECB entered the Preparation Phase of the Digital Euro project in November 2023, and the Digital Euro is expected to actually launch in 2027.

Digital Euro Value Chain

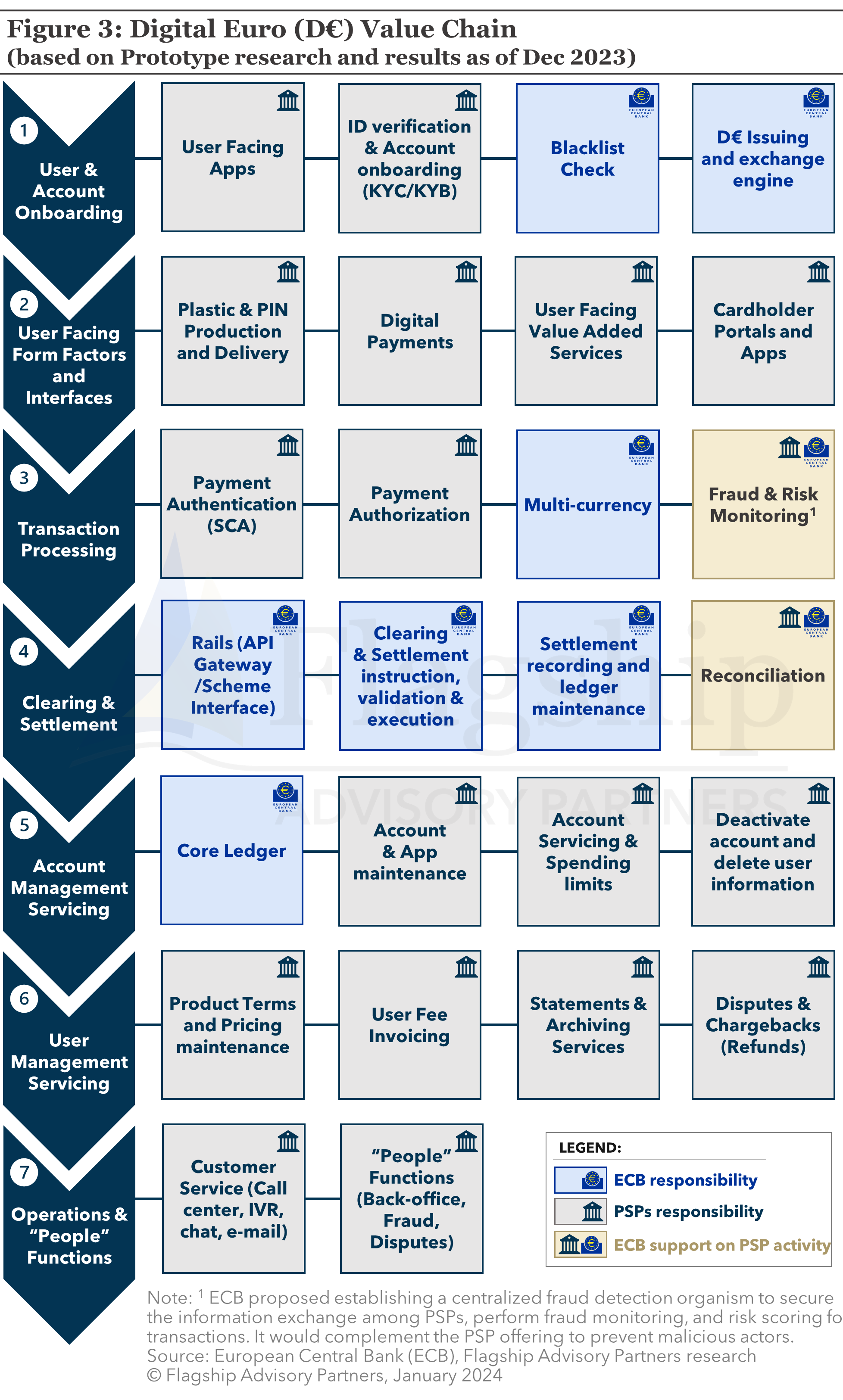

As proposed by the ECB, PSPs will play a critical role in distributing Digital Euro to users, and will have key operational responsibilities across almost all steps within the value chain (see Figure 3). In addition, the ECB is exploring the creation of a fraud detection system that will collaborate with PSPs to make the Digital Euro ecosystem more resilient to malicious actors.

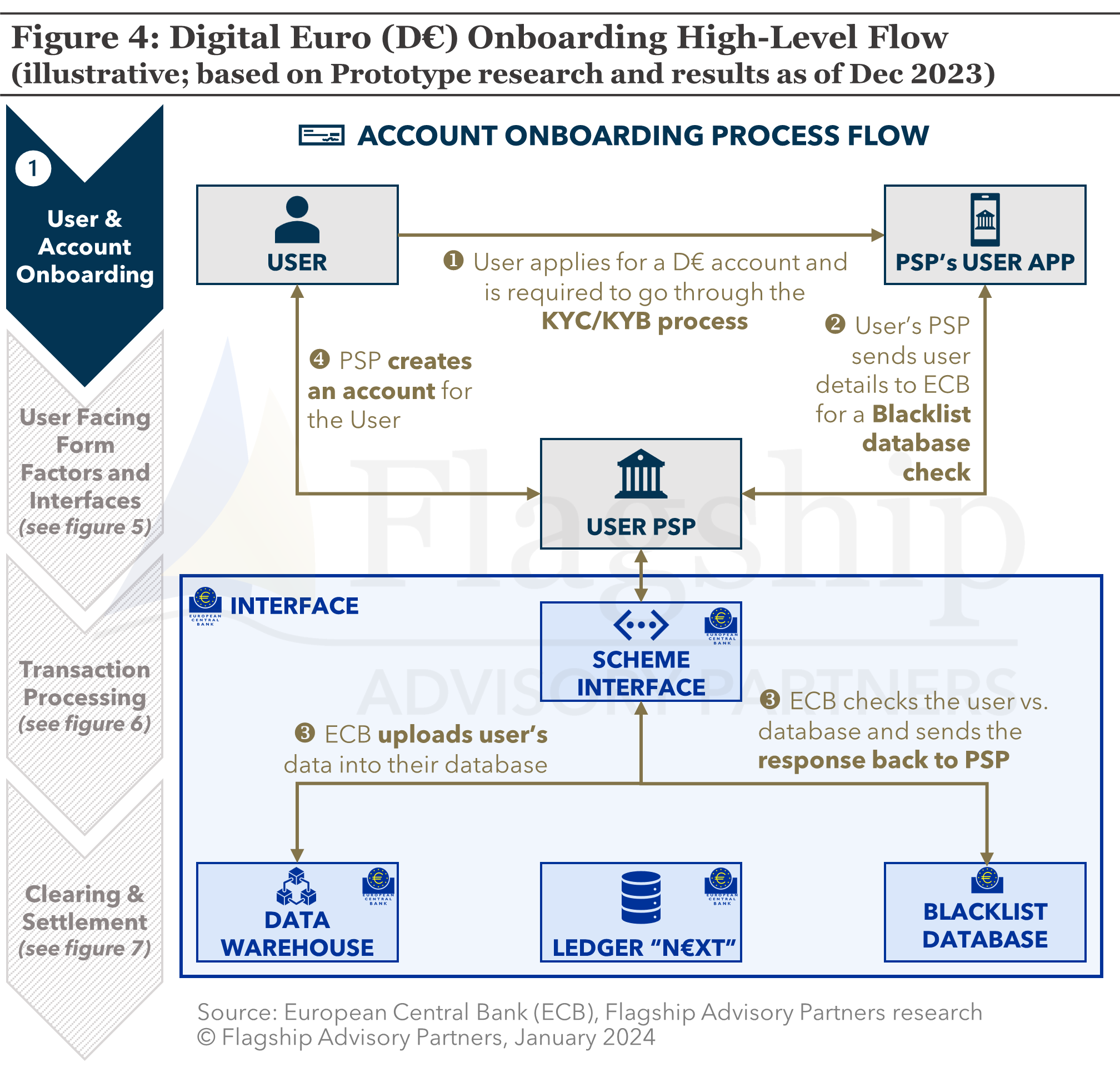

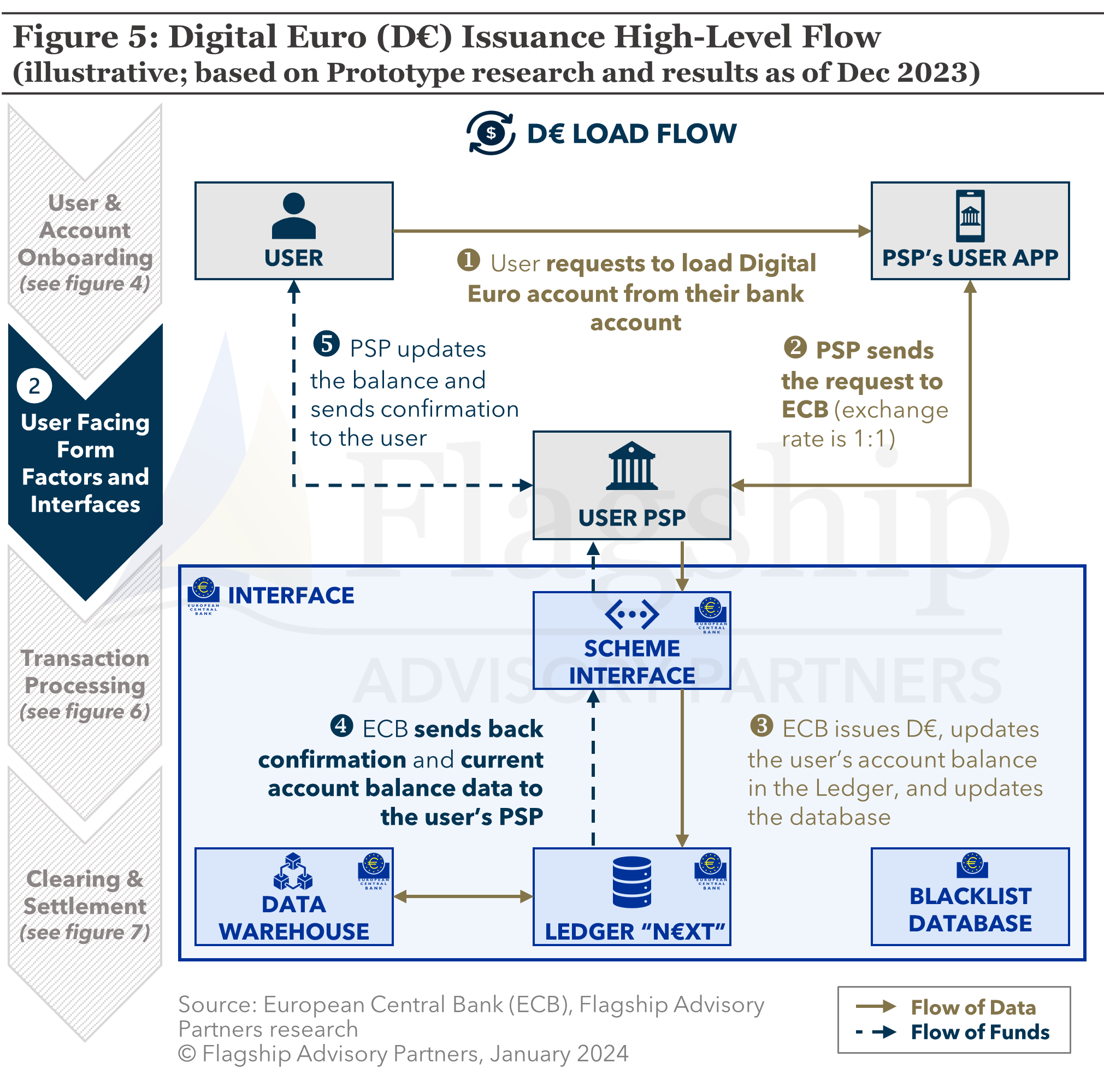

PSPs will onboard users in their Digital Euro account (see Figure 4), perform the required KYC/KYB processes, and communicate this to the ECB which will keep track of any account creation in its database. Users can load their accounts via their PSPs' app and exchange their holdings to/from Digital Euro. On the back-end side, the ECB will update the user's account balance on its ledger (called N€XT), sending confirmation to the PSP which will then update the balance in the PSP’s app that serves as the front-end app to end users (see Figure 5).

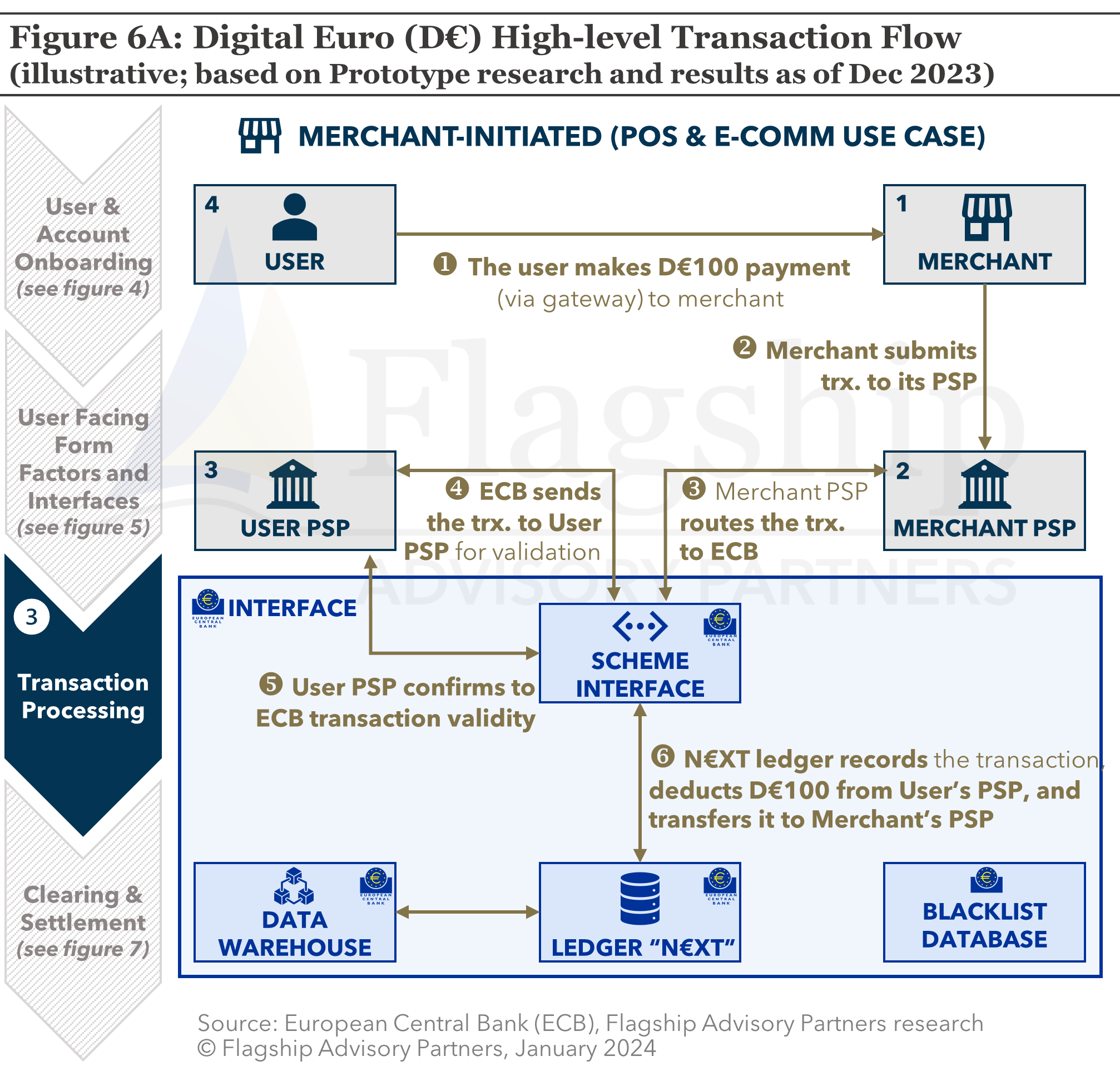

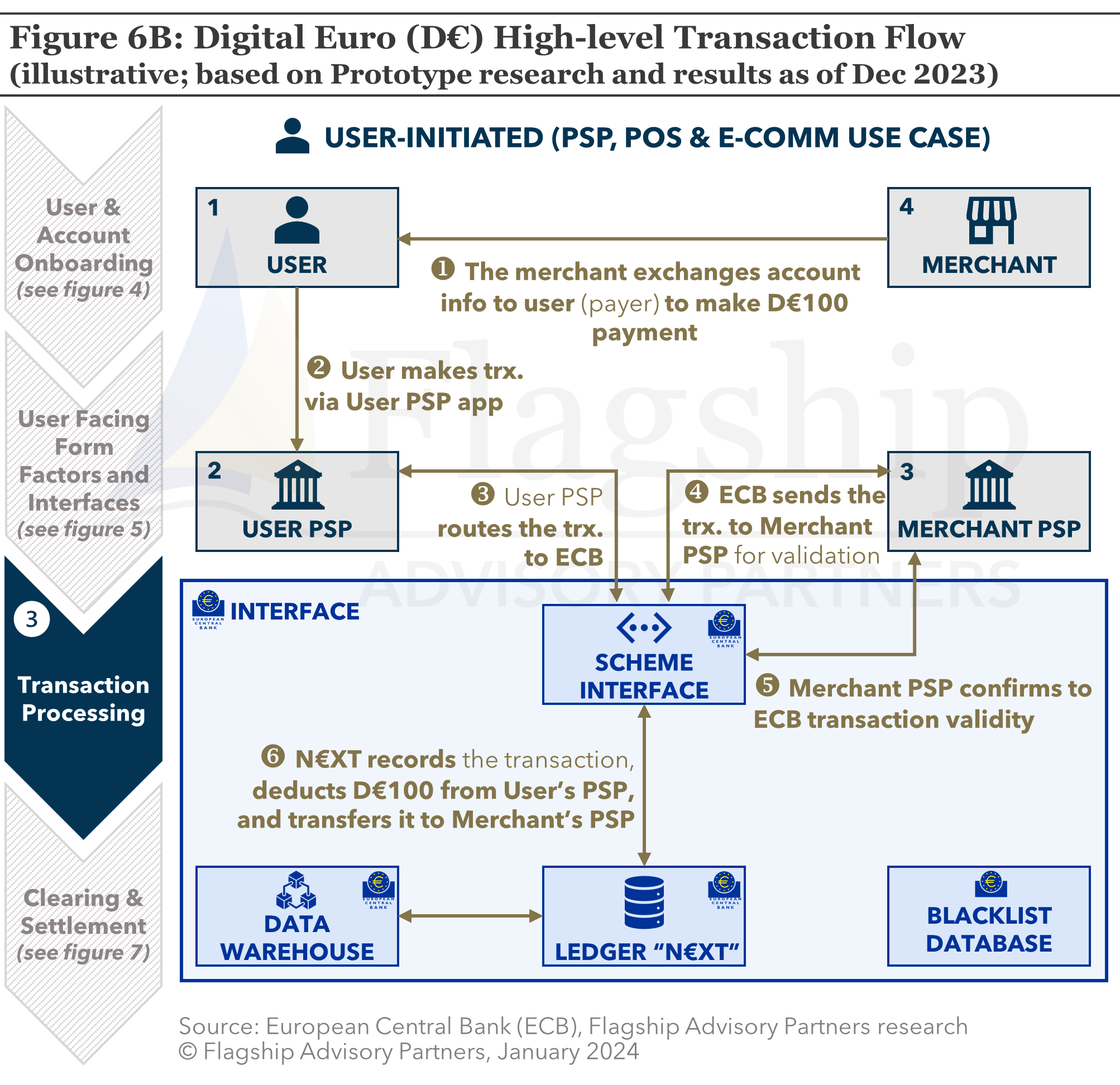

The ECB proposes that the Digital Euro transaction flow will be a four-party scheme, identifying two major payment types and use cases:

- Merchant-Initiated: As shown in Figure 6A, the data flow is similar to card payments at POS/e-commerce gateways, where the merchant submits the request to its PSP (acquirer). The user PSP (issuer) will confirm the transaction's validity to the ECB (scheme).

- User-Initiated: As shown in Figure 6B, the data flow is similar to account-to-account (A2A) payments, where the user transacts via its PSP app (issuer). The merchant PSP (acquirer) will confirm the transaction's validity to the ECB (scheme).

The ECB and participating PSPs will communicate through an API connection built by the ECB. N€XT (the ECB’s centralized ledger) will record the transaction, update its database, and start the settlement process.

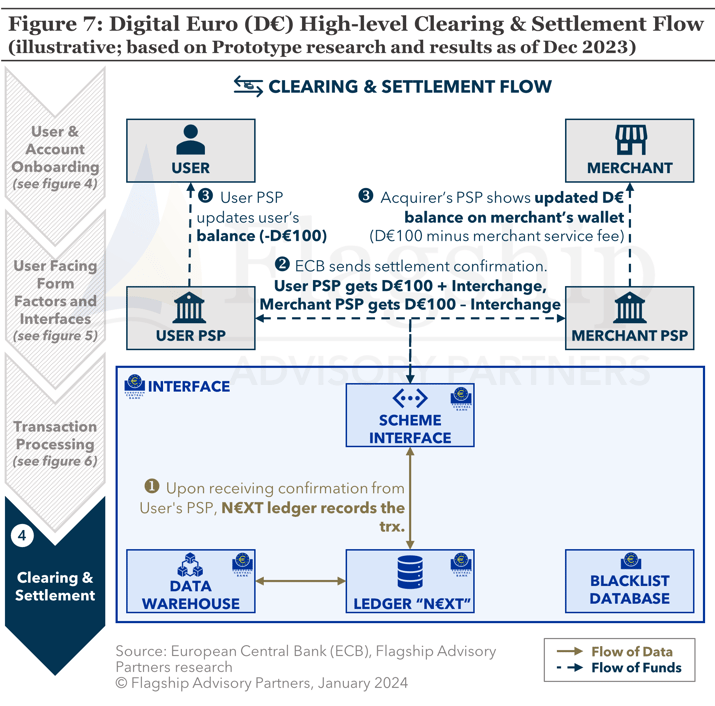

Next, the ECB confirms settlement, allocating the interchange fee (the level/amount of which has not yet been specified) to the user PSP (issuer) and the remainder to the merchant's PSP (acquirer) (see Figure 7). Finally, both PSPs update the user and merchant account balances, subtracting the service fee from the merchant's balance.

However, the operating model for the Digital Euro is still evolving. As an example, on January 3rd 2024, the ECB issued five calls for vendor applications to intermediaries for services relating to Digital Euro components:

- Risk and fraud management;

- App and software development kit (SDK);

- Offline solution;

- Secure exchange of payment data; and,

- Alias lookup (facilitate transactions by using simple aliases, such as phone numbers or email addresses, instead of long account numbers).

The allocated budget for these five components is €1.15 billion[1], and the ECB estimates that the contracts for these services will span four years, starting in January 2025.

Digital Euro Economic Model

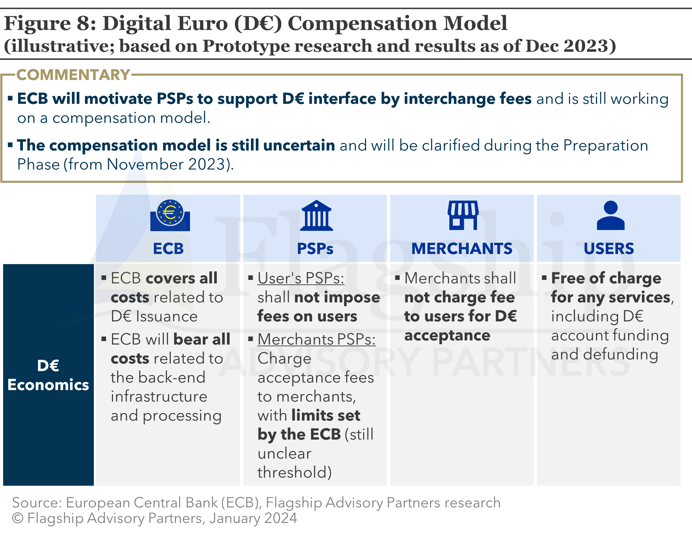

The Digital Euro economic model is structured as a four-party scheme (somewhat similar to the cards four-party model), but to date, only the conceptual pricing structure (not actual levels/amounts) has been proposed (see Figure 8). According to the first legislative proposal, the high-level economic model will be:

- The Digital Euro will be free of charge for end-users

- The Digital Euro is intended to be the market's most affordable and convenient digital payment method; hence, the ECB will set a cap on merchant service fees

- User PSPs (i.e., issuers) will receive an interchange fee, although the amount/level has not yet been determined

- ECB will bear costs (and presumably charge service fees) related to the back-end infrastructure, Digital Euro issuance, processing, and settlement

Overall, the incentives for PSPs to distribute Digital Euro and the supporting economics are still uncertain. The ECB is expected to provide further clarification during the current “Preparation Phase” (from Nov. 2023 onwards).

Impacts & Conclusions

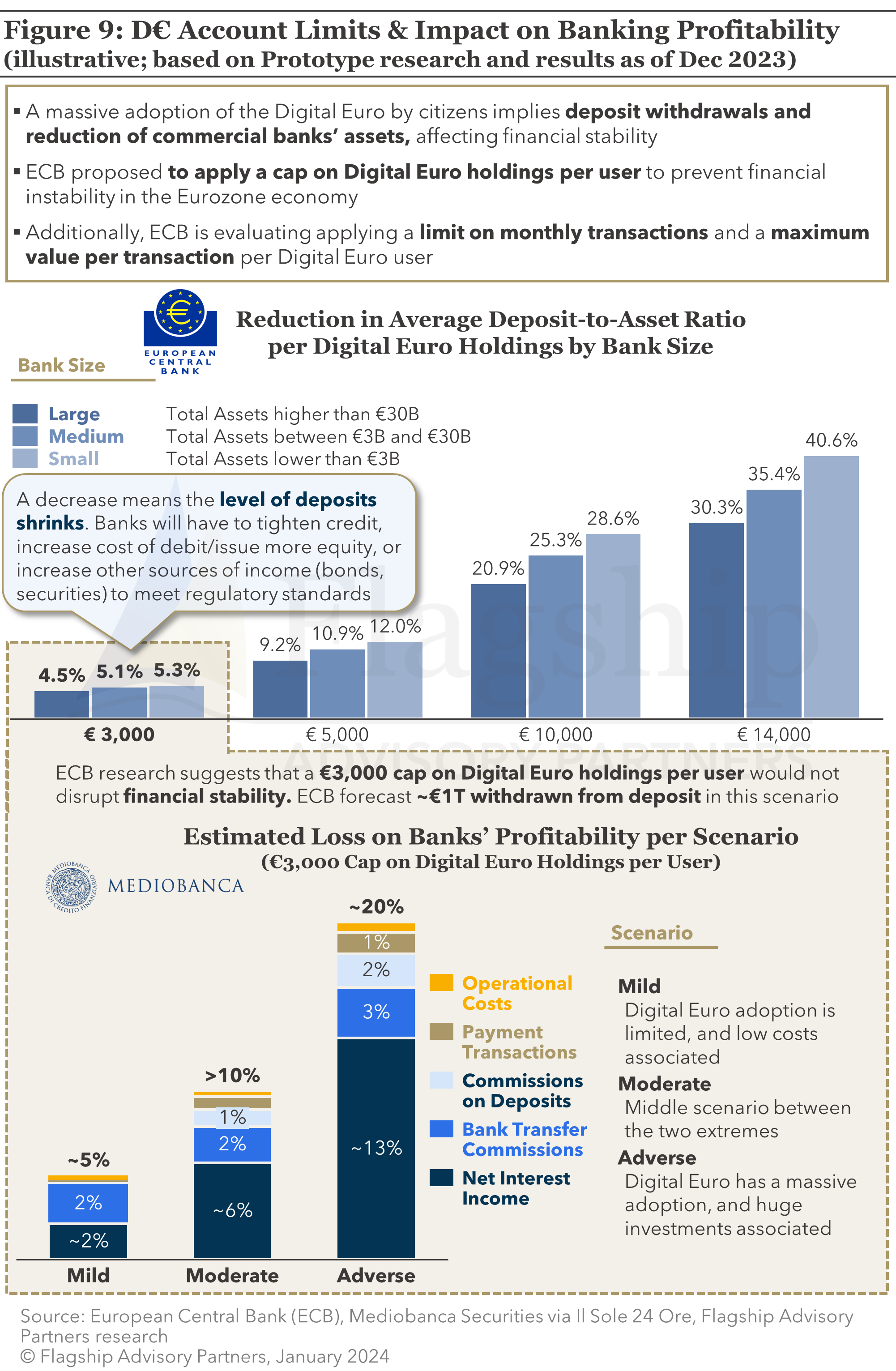

In theory, when customers fund Digital Euro accounts, they would be removing cash from their regular bank accounts at commercial banks, ultimately reducing banks’ deposits and liquidity, effectively shrinking banks’ balance sheets and, in aggregate, the entire financial system. This would generate a series of knock-on impacts, the most obvious of which is that banks’ ability to fund loans via low-cost deposits could be significantly reduced. As a mitigant, the ECB is considering limiting how much Digital Euros each person can hold. Capping Digital Euro holdings at €3,000[2] per person is viewed by ECB studies as balancing the objective of stimulating usage, without threatening the stability of the banking system (see Figure 9). The ECB estimates that approximately €1 trillion could be taken out of bank deposits without preventative measures and that this would negatively affect mostly smaller banks, as they have the highest reliance on customer deposits. According to analysts at Mediobanca Securities, with an increase in Digital Euro adoption, more money is taken out and put into these accounts, leading to a greater impact on banks' profits, estimating a loss between 5% and 20% (see Figure 9)[3]. However, it's important to note that the limit on Digital Euro holdings per person is not yet final, and the ECB is expected to detail its intentions further during this Preparation Phase.

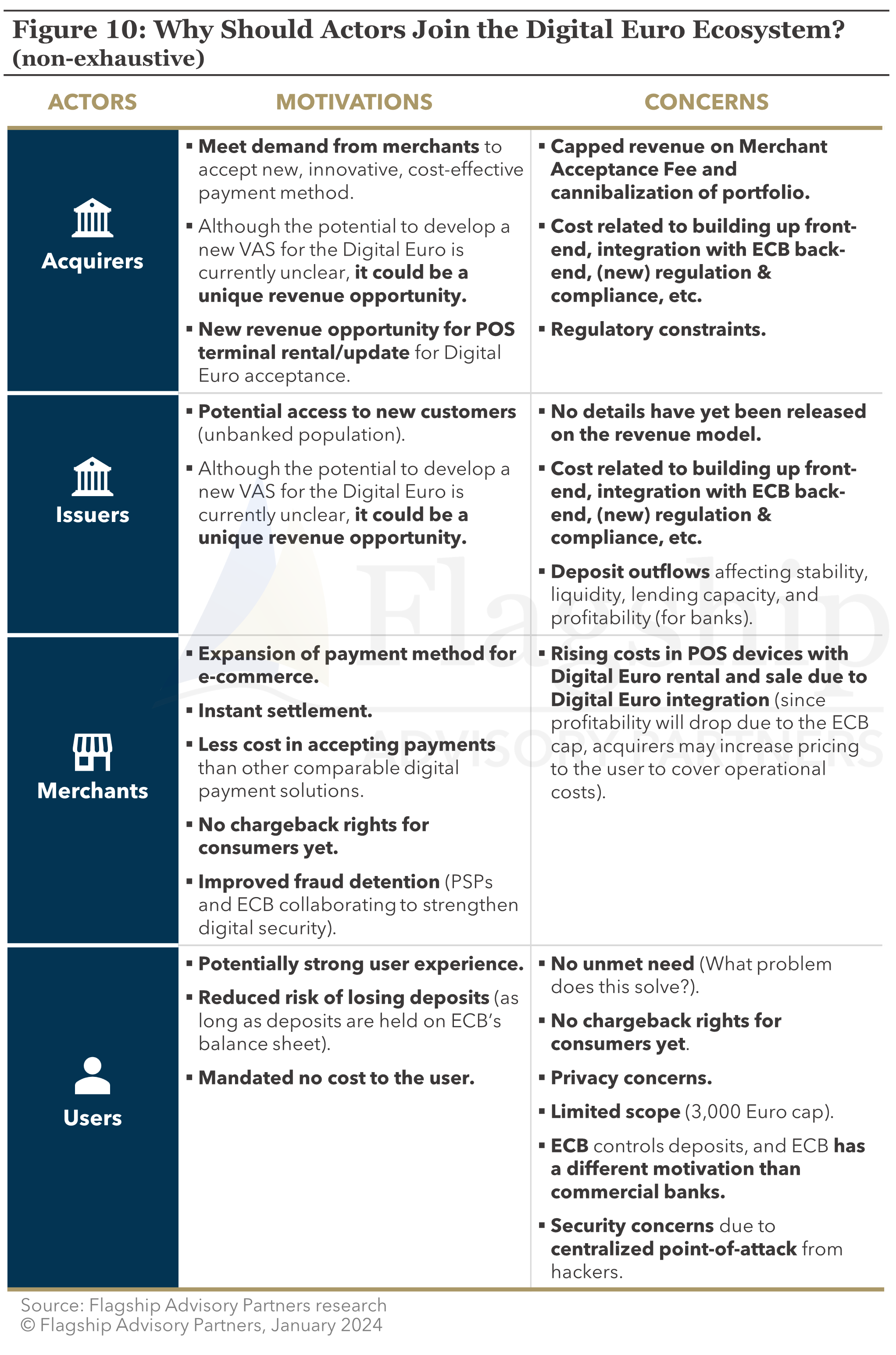

The advent of the Digital Euro presents an intriguing opportunity for the Eurozone. Its innovation potential, driven by its technological characteristics, hold promise yet remains ambiguous. The prospect of this new digital currency offers a new revenue stream for PSPs and could (per proponents) revolutionize the payment landscape for merchants, offering benefits like instant settlement transactions, reduced costs, and increased protection against fraud. The Digital Euro's potential to increase access to financial services inclusion is a key objective of policymakers, with the potential of free-of-charge account opening and seamless transactions at points of sale and e-commerce to drive broader financial inclusion and accessibility.

Despite these positive attributes, EU policymakers are navigating uncharted territory and have left critical questions unanswered (see Figure 8). The economic model remains vague, casting uncertainty over its viability, as the economic motivations for stakeholders to support the system (particularly user PSPs which will have many responsibilities) are unclear. In particular, acquirers' and issuers' revenue will apparently be capped, interchange levels are still unclear, and PSPs are expected to bear substantial costs of building front-end and ECB back-end integrations.

Moreover, limitations on Digital Euro holdings, coupled with privacy and security concerns regarding the technical solution (e.g., could the ECB’s central ledger be hacked?) underscore the need for careful consideration and robust solutions to mitigate potential risks.

In conclusion, while the Digital Euro as proposed by the ECB presents an intriguing vision for a technologically advanced financial ecosystem, future demand from end users and supply from PSPs hinges upon resolving these uncertainties and improving stakeholder motivations. Only through concerted efforts in addressing these challenges can the Digital Euro emerge as EU policymakers envision: a transformative force, unlocking innovation while safeguarding the integrity and security of the Eurozone's financial landscape.

In conclusion, while the Digital Euro as proposed by the ECB presents an intriguing vision for a technologically advanced financial ecosystem, future demand from end users and supply from PSPs hinges upon resolving these uncertainties and improving stakeholder motivations. Only through concerted efforts in addressing these challenges can the Digital Euro emerge as EU policymakers envision: a transformative force, unlocking innovation while safeguarding the integrity and security of the Eurozone's financial landscape.

Please do not hesitate to contact Erik Howell at Erik@flagshipAP.com, Stanislav Dubský at Stanislav@FlagshipAP.com, and Alessandro Mighetto at Alessandro@FlagshipAP.com with comments or questions.

[1] Calls for applications for digital euro component providers (europa.eu)

[2] A digital euro: gauging the financial stability implications (europa.eu)

[3] CBDC/digital euro: more than a token impact on banking profits (ft.com)