Navigating fintech innovation

Flagship Advisory Partners is a boutique strategy and M&A advisory firm focused on payments and fintech. We serve clients globally and have a team of 40+ professionals who have a unique depth of knowledge in payments and fintech.

Latest Insights

Filter by

Topics & Themes

Topics & Themes

Apply

Clients

Clients

Apply

Type

Type

Apply

Topics & Themes

Clients

Type

Selected:

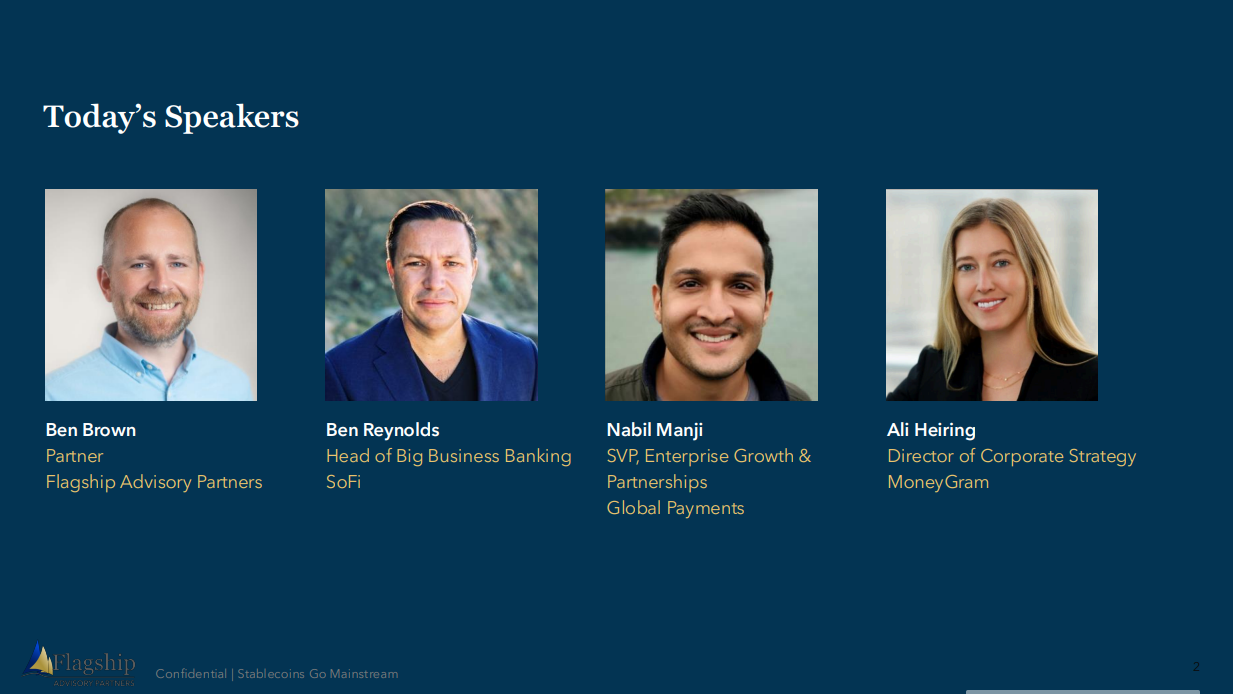

A panel discussion on the stablecoin landscape with Ben Brown (Partner, Flagship Advisory Partners), Nabil Manji (SVP, Head of Fintech Growth &...

Webinar

3 March 2026

Most Read Insights

Yuriy Kostenko and Alessandro Mighetto

Recent Posts

Q2 2024 Global Fintech M&A Sees a Surge in Deal Volume

Slide Presentation

24 Jul 2024

Global fintech M&A deal volume rose by 20% from Q1 2024, growing at 2x compared to last year's 10% increase for the same period. In Q2 2024, the fintech M&A landscape was characterized by strategic consolidations and a strong focus on integrating advanced technologies such as AI. This sector remains dynamic and attractive for strategic buyers and PE investors. We advise viewing the slides via the "PDF" icon button. General Commentary & Highlights North America Fintech M&A Growing Coming Out of Q2 2024 In Q2 2024, North America witnessed a notable increase in fintech M&A, fueled by heightened investment in new domains and PEs targeting public-to-private buyouts. This resurgence in deal flow is indicative of the growing confidence in the fintech sector, as well as the strategic importance of technological innovation in financial services Europe’s Fintech M&A Activity Rebounding in Q2 2024 European fintech M&A still somewhat subdued in Q2, but momentum appears to be picking up heading into Q3. Activity still mostly smaller deals including capability acquisitions and some increased activity in growth equity. Fintech M&A in APAC Accelerating Through Q2 2024 In Q2 2024, fintech M&A deal activity in the Asia-Pacific (APAC) region experienced a notable surge, marking a 6% increase compared to the same period in Q2 2023. During Q2 2024, APAC fintechs secured significant funding, raising over $3.3 billion—a 40% increase from the prior quarter—which fueled much of the M&A activity in the region. Modest Uptick in Fintech M&A Activity in LATAM and MEA Regions in Q2 2024 In Q2 2024, fintech M&A in both the LATAM and MEA regions saw a modest increase, driven by a rise in foreign investment and continued maturation of the fintech ecosystem. This increasing activity reflects the growing interest of venture capitalists and PE funds, who are attracted by these large underserved markets and promising fintech startups. Fintech M&A Deal of the Quarter: Advent Acquired Nuvei in a $6.3B Deal Advent acquires an asset with strong growth performance at a reasonable valuation. Public valuation hindered by 2023 short-seller activity and company’s reputation for serving higher-risk verticals. Nuvei’s c.40% YOY growth is impressive given the c.10% growth in the underlying revenue pool, the company is clearly winning share. The Advent – Nuvei acquisition is one of few public-to-private transactions in payments in recent years, despite steep declines from valuation peeks in 2022. Please do not hesitate to contact Yuriy Kostenko at Yuriy@FlagshipAP.com or Alessandro Mighetto at Alessandro@FlagshipAP.com with comments or questions.

ma

financialinvestors

slidepresentation

Q1 2024 Report: Global Fintech M&A Poised for Rebound in 2024

Slide Presentation

19 Apr 2024

A cautious but optimistic sentiment is prevailing in the Fintech and Payment sector. Despite a subdued start in 1Q 2024, investors anticipate an uptick in M&A deal flow throughout 2024. General Commentary & Highlights Global: Fintech M&A and Fundraising Poised for a Rebound from Q1 2024 Deal volume of global fintech M&A deals remained subdued in Q1, with the number of deals dropping 15% in 1Q 2024 (compared to 1Q 2023). We expect an acceleration of deal activity through 2024 and we are already seeing evidence of this acceleration in North America and Europe. North America: Evidencing Expanded Fintech Deal Flows in Q1 '24 North America rebounding from a market low in fintech deal activity in Dec 2024. We expect growth momentum established in Q1 to continue through 2024 culminating in growth vs. 2023. Europe: Also Showing Signs of Rebound with Q1 Ramping up from 2023 Trough 2024 deal activity trending on similar levels to 2023. But we expect an acceleration of activity in rest of 2024 as buyers and sellers align to a new normal of valuation. APAC: Fintech M&A Remains Somewhat Subdued Thus Far in 2024 Fintech M&A deal activity remains subdued in the Asia Pacific, including a 25% decline in number of transactions in Q1 2024 vs. 2023. China macro challenges expected to drive ongoing conservatism in this market, although markets such as Japan could see an increase in deal activity. LATAM & MEA: Fintech M&A Remain Subdued, Facing More Macro-Headwinds Fintech in rest of the world (LATAM and MEA regions) is muted by macro headwinds including political instability and armed conflict, which is likely to continue in 2024. But the attractive fundamentals of these high-growth markets remains and a return to higher deal volumes will come quickly if the market reaches greater stability. Fintech Deal of the Quarter: Capital One Acquires Discover Capital One + Discover will become the largest credit card issuer in the US market, accounting for 19% of the US credit card market. The acquisition will generate expense synergies of ~$1.5B in operating expenses and ~$1.2B in network expenses by 2027. The acquisition will drive cost of funding efficiency, cross-selling opportunity, and create an appealing opportunity for innovation by owning a national payment network that also has a strong international presence. Please do not hesitate to contact Yuriy Kostenko at Yuriy@FlagshipAP.com or Alessandro Mighetto at Alessandro@FlagshipAP.com with comments or questions.

ma

financialinvestors

slidepresentation

No results found

Topics & Themes

A2A Payments

AI Artificial Intelligence

B2B Payments

Best Practices & Toolkits

Card Issuing

Compliance & Security

Credit

Embedded Finance & BaaS

Fintech & SaaS

Innovations

M&A

Open Banking

Payments Acceptance

Payments Orchestration

Perspective on Key Events

Processing & Technology

SaaS

X-Border Payments