B2B employee spend and expense management (‘spend management’) is often a complex workflow of interactions across multiple actors (employees, functional business departments, etc.) and several adjacent software services and vendors (travel booking, spend administration, expense management, procurement, etc.). The use of corporate and personal employee payment cards has remained a critical component of the B2B spend and expense management process, although these payment vehicles remain largely separated from adjacent software services. The emergence of a new breed of B2B spend management fintechs that integrate spend management software as a service (SaaS) with payment capabilities is disrupting this space.

Current Pain Points in Employee Spend Management

Companies have historically relied on different software or SaaS platforms to manage employee spend and expenses at different points in the value chain. For example, specialized travel and expense (T&E) booking software for reconciling company T&E expenses, expense administration software for managing employee expense claims and reimbursements, HR software for managing employee spend policies, and accounts payables software for managing procurement. Different departments within larger organizations have traditionally managed these disparate software packages (e.g., procurement and expense management managed by finance, spend policies by H.R., travel booking approvals by respective employee managers, etc.).

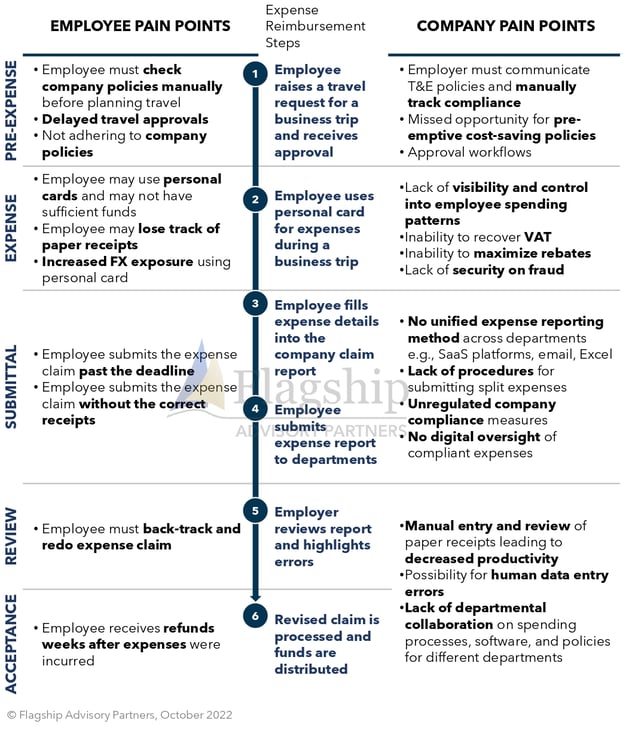

Consequently, fragmented departmental workflows, software, and a lack of true visibility into spend have made spend management a slow and burdensome process, creating pain points and missed opportunities for efficiency and cost optimization (illustrated in Figure 1). Additionally, the lack of data integrations across these software packages ultimately hinders the organization from obtaining clear visibility and oversight of company expenditures.

FIGURE 1: Spend Management Pain Points

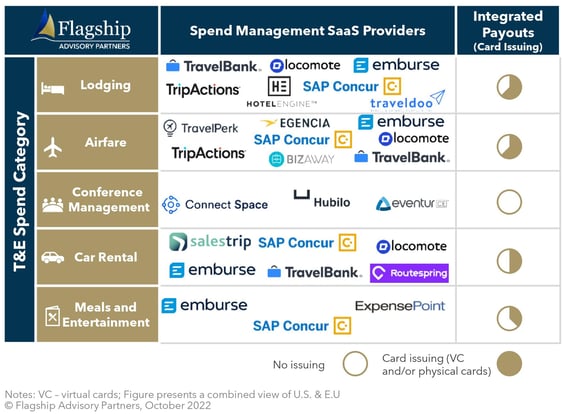

Historically, payments has been a separate and disjointed process from the spend management value chain. Companies have typically relied on corporate and personal cards as employee spend tools, and very often, these purchase flows remain decoupled from spend management SaaS. As illustrated in Figure 2, most SaaS providers do not offer integrated payout products (note that we exclude large T&E SaaS such as Emburse, SAP Concur, and Travel Bank that power virtual card payouts to support employee spend use cases). Spend management SaaS have built direct data feeds from corporate card issuers to drive data reconciliation; however, most of these integrations lack deeper benefits such as in-depth spend visibility, enhanced spend administration, and real-time spend controls.

FIGURE 2: Maturity of Integrated Fintech Across Spend Management SaaS Providers (select vendors, U.S. & EU)

Spend Management Fintechs Gain Traction by Providing Integrated Solutions

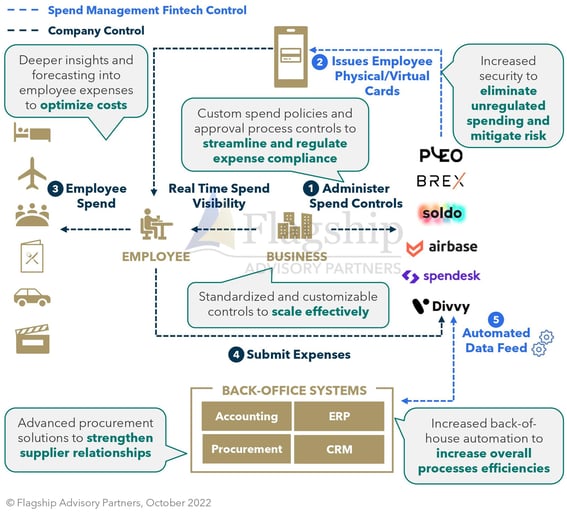

In the last few years, a new breed of fintechs has emerged that offer spend management, payments, and expense administration in a single solution (see Figure 3). Fintechs like Brex, Divvy, Ramp, Pleo, Spendesk, and others offer a unified platform that allows companies to configure spend management (e.g., manage employee spend policies, create automated approval workflows), define and create spend control rules (granular rules for employee and departmental spend), provide the payment form factors for employees to spend (physical or virtual cards), deliver greater visibility of employee spend (through real-time visibility), and simplify the expense administration process for employees (through digital capture and automated workflows). Such platforms can unify and rectify several spend management pain points whilst offering additional value-adds such as consolidation and reimbursement of expenses, invoice management, and budgeting.

FIGURE 3: Value Proposition of Spend Management Fintechs

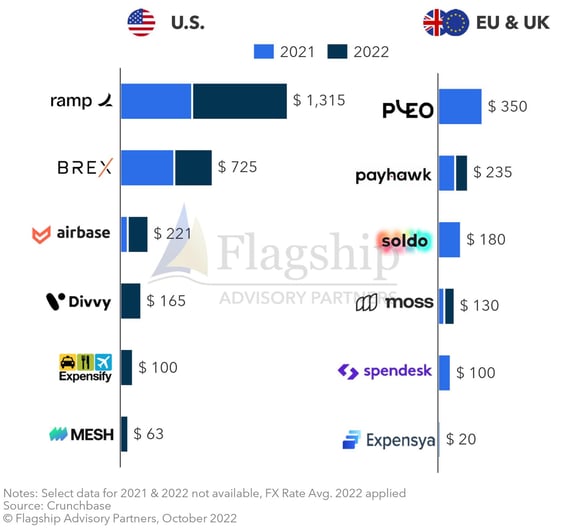

Spend management fintechs’ first adopters were U.S. tech-savvy start-ups and early-stage SMBs operating in legal, media, and healthcare verticals. These verticals were traditionally underserved by large corporate card issuers, creating a clear entry point for fintech challengers. Fintechs such as Brex, Airbase, and Ramp have penetrated these underserved verticals by offering corporate card products integrated with spend management SaaS. While the SaaS toolkit is native to these fintechs, most work with next-generation card issuing processors such as Marqeta, Galileo, and i2c for technical card processing capabilities and/or program management. Recently we have seen a rapid proliferation and capital injection into European spend management fintechs such as Pleo, Spendesk, Soldo, Moss, and Payhawk who followed the U.S. lead by initially targeting SMBs and fast-moving start-up ecosystems (see Figure 4).

FIGURE 4: Recent Funding for Spend Management Fintechs (select providers, USD Mil.)

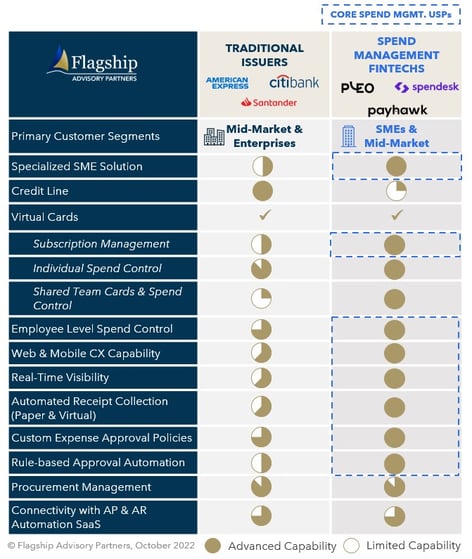

The functionality offered by these fintechs is becoming increasingly sophisticated compared to traditional corporate cards from global issuers. As we illustrate in Figure 5, spend management fintechs’ unique selling points are built on a higher degree of employee spend controls, vendor-level spend controls, real-time restrictions on purchase amounts, real-time transaction velocity checks, limits on purchases against merchant categories, and custom spend rules at an employee and departmental level.

FIGURE 5: Traditional Commercial Card Issuers vs. Spend Management Fintech Providers

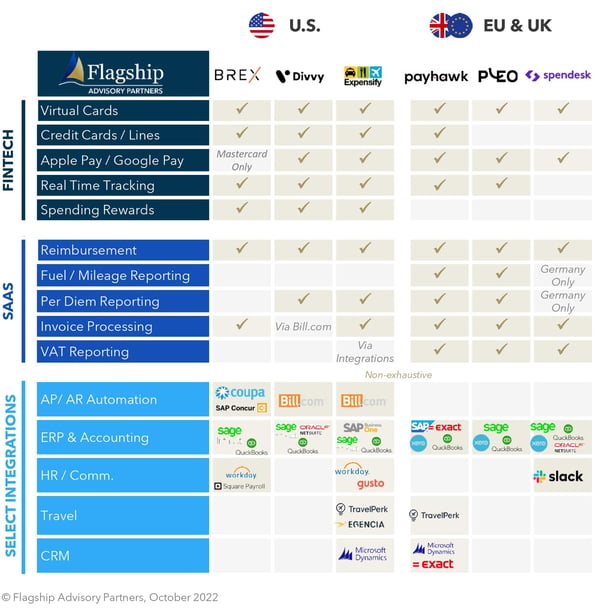

Spend management fintechs also offer deeper integrations with accounting and ERP systems for automated reconciliations (often in real-time) compared to traditional commercial card issuers, which facilitates easier expense tracking across departments. Businesses can therefore administer and monitor employee spend in real time, reconcile data across systems and gain clear visibility over company spend from a single unified source. Additional value-adding SaaS capabilities provided by these fintechs include fuel/mileage reporting, VAT assistance, and invoice processing (shown in Figure 6).

FIGURE 6: Overview of Select U.S. and EU Spend Management Fintech Capabilities

Key Growth Areas

Looking at the early and continued success of spend management fintechs, we outline below a few forward-thinking themes where we predict the next phases of growth.

Expanding from serving SMBs to larger corporates

While start-ups and SMBs were the first clients in this space, spend management fintechs are now developing to serve mid-market and enterprise clients. For example, in June 2022, U.S. spend management fintech Brex announced that they are pivoting away from their historical sweet spot of servicing start-ups and SMBs to prioritize larger enterprise clients. In the same period, fellow U.S. fintech Ramp reported that most of their recent growth generates from mid-market and enterprise segments as opposed to SMBs. The shift towards serving larger corporates is a logical evolutionary step, given the revenue potential from large spend volumes.

However, larger corporates come with more complex hierarchical spend management needs that only bigger players with sophisticated product sets can meet (e.g., SAP Concur), in contrast to smaller fintech solutions.

Convergence across spend management, procurement, and cash management SaaS

While businesses (mainly mid-sized or enterprises) primarily rely on separate SaaS for spend management, procurement, and treasury/cash management functions, we observe a convergence in software needs across these functions. For example, global procurement and spend management software Coupa recently expanded into treasury, allowing its clients to manage accounts payables, spend management, and cash management/liquidity from the same platform. In the SMB segment, we also see a similar trend with U.S. AP/AR and procurement fintech Bill.com acquiring employee spend management fintech Divvy in May 2021 for $2.5 billion. This convergence of needs across such software adjacencies opens the playing field for spend management fintechs to expand into new products and verticals.

Fintech product expansion from cards to bank payments, payment acceptance, and lending

Spend management fintechs are expanding into new areas to power businesses outside of just employee spend through cards. In 2021, European fintech Payhawk launched a one-click bill payment and reimbursement product in partnership with fintech infrastructure provider Railsr. Another example is Jeeves, a global expense management fintech that has expanded into B2B x-border payments, working capital loans, and revenue-based financing.

Spend management fintechs have gained relevancy by unifying propositions across spend management SaaS and payments in the historically underserved in the SMB segment. While early success has been promising, most of these fintechs have yet to operate at scale. With visible tailwinds towards serving new client needs and expansion into new product sets, we remain bullish on these fintechs gaining scale and driving success in the B2B payments marketplace.

Please do not hesitate to contact Anupam Majumdar Anupam@FlagshipAP.com, Brittany Logan at Brittany@FlagshipAP.com, or Simone Remba at Simone@FlagshipAP.com with comments or questions.