*This is the second in a three-part series in which we examine the evolution of software-integrated payments and fintech. In this second part, we analyze the best practices of SaaS platforms and ISVs offering integrated payments across verticals.

ISVs and SaaS platforms continue to grow into their potential within payments, which is only the beginning of the broader expansion into fintech. While certain software verticals are ahead of others, we observe the same raw potential, and many of the same best practices across sectors. Virtually all ISVs/SaaS platforms should be strategically focused on fintech expansion.

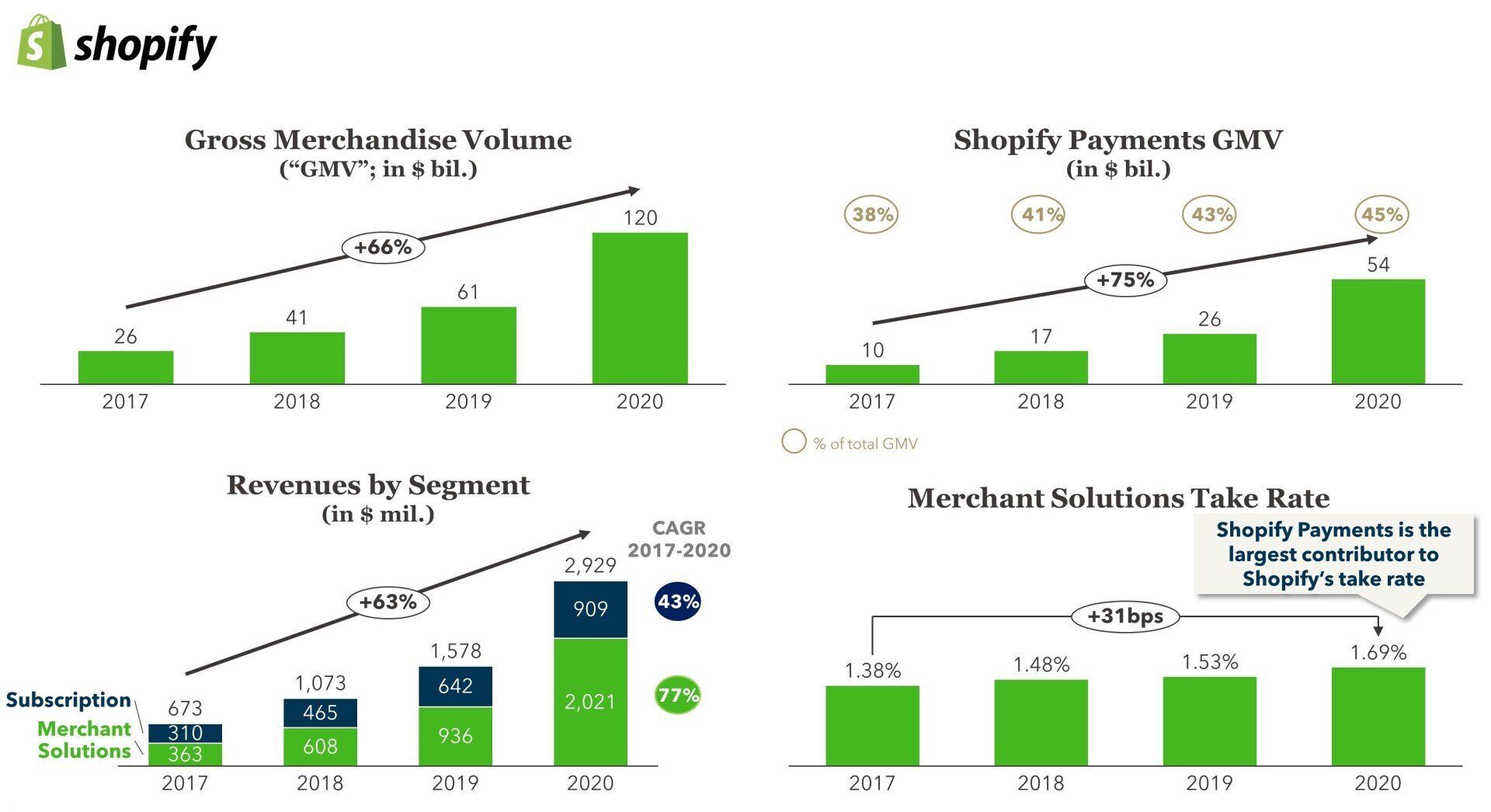

Imbedded, strategic payments services improve the merchant proposition and vastly expand the revenue potential of the platform. Shopify is the bellwether for SaaS potential in payments. In its earnings release in February 2021, Shopify announced 86% YOY growth in revenues to $ 2.9 bil, led by Merchant Solutions (where payments are the majority). Shopify Payments volume grew at a CAGR of 75% between 2017 and 2020 to $ 54 bil. in 2020 (45% of all Shopify GMV). Primarily due to its success in payments, Shopify earns a 1.69% merchant solutions take rate on GMV. Shopify Payments now operates in 17 countries.

FIGURE 1: Massive Potential – The Scaling of Shopify Payments

The revenue generation potential of payments is to fall in love with, but strategic payments also vastly improve the customer proposition and experience. Traditional approaches to payments involve many partners (or plugins) and a poorly integrated customer experience: multiple portals to access data, transaction and payment data are in different locations, multiple logins and point of servicing, multiple contracts, etc. With a well-built strategic payments proposition, a merchant has only one point of service and one dashboard and control panel to manage the business.

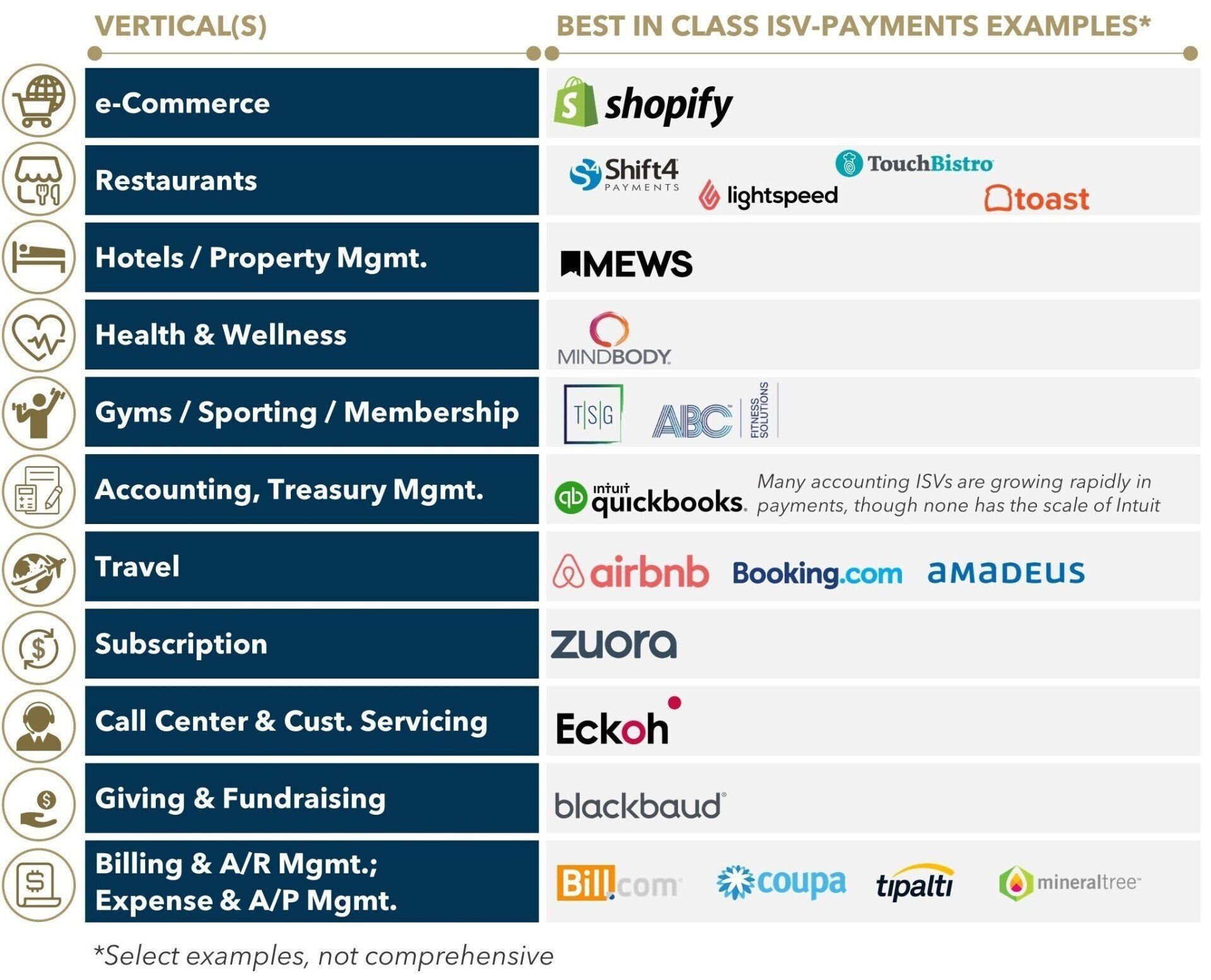

While Shopify is clearly a best practice among e-Commerce platforms, there are countless SaaS platforms that are thriving in payments globally, across verticals. As noted in Figure 2 and illustrated in Figure 3, we observe integrated payments success stories across many software verticals (noting that this figure is far from comprehensive in listing the many global success stories).

FIGURE 2: Best in Class ISV/SaaS-Payments Platforms

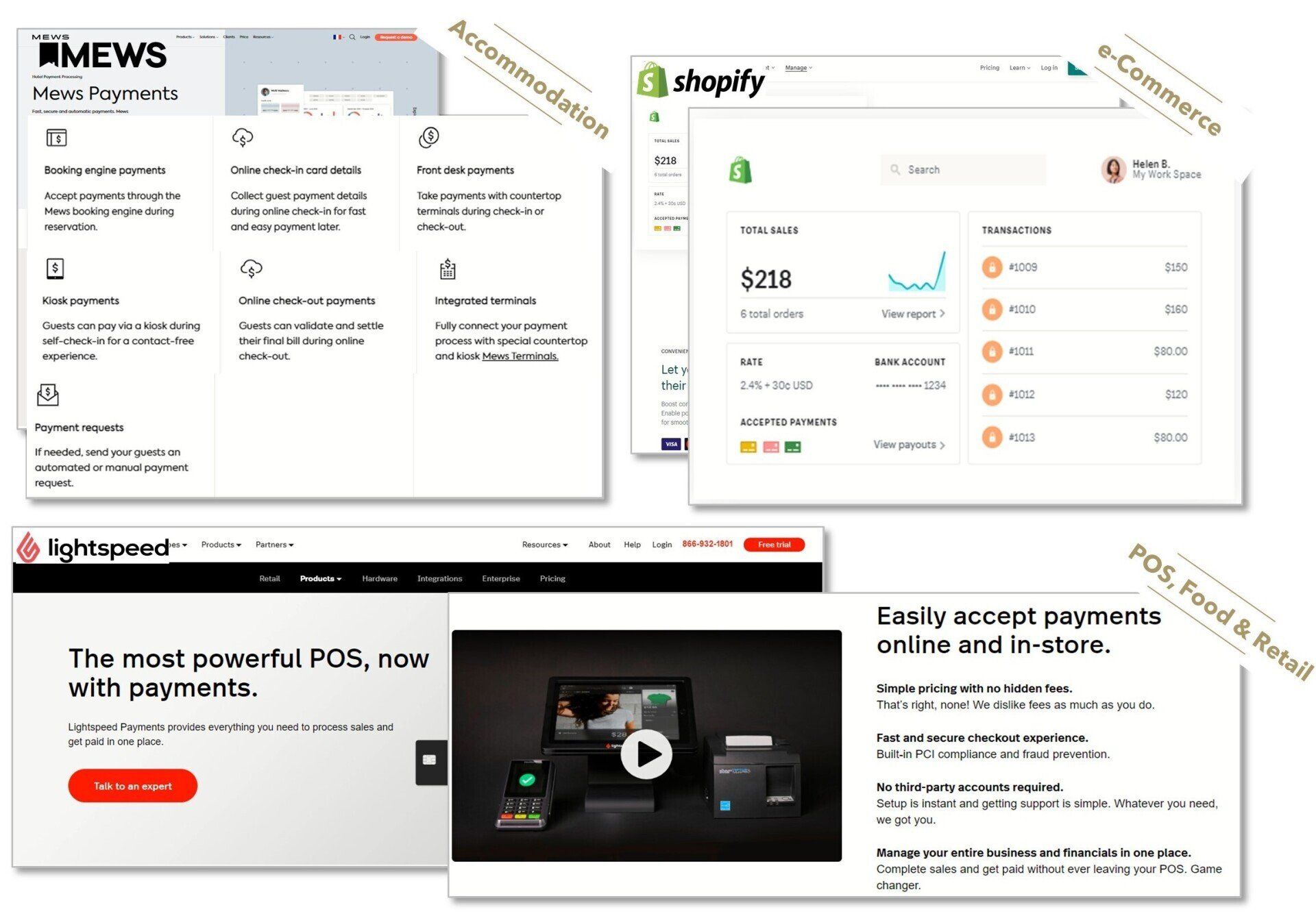

In restaurants, U.S. payments companies such as Shift4 and Heartland established the potential for integrated SaaS + payments years ago, and we now see cloud-based SaaS providers such as TouchBistro, Toast, and Lightspeed growing rapidly with integrated payments. In hotel property management SaaS, Mews has established a robust suite of payment services in support of the unique needs of small hotels. In health, wellness, and fitness, companies such as MindBody, TSG, and ABC have powerfully imbedded and lucrative payments offerings. In accounting, Intuit has long been a champion providing a broad range of omni-channel payment services for the SME segment with unique integration into the QuickBooks accounting software.

In travel each of Airbnb, Booking, and Amadeus continue to expand their payments offerings (authorization pay-in, pay-out, fraud management, etc.) as an extension of their core booking and property management services. Zuora has built a market-leading bundle of subscription management and payments. And finally, a variety of other SaaS providers such as Blackbaud continue to expand their uniquely crafted SaaS + payments offerings in government, education, and fundraising verticals.

FIGURE 3: Selected Examples of ISVs/SaaS + Payments Propositions

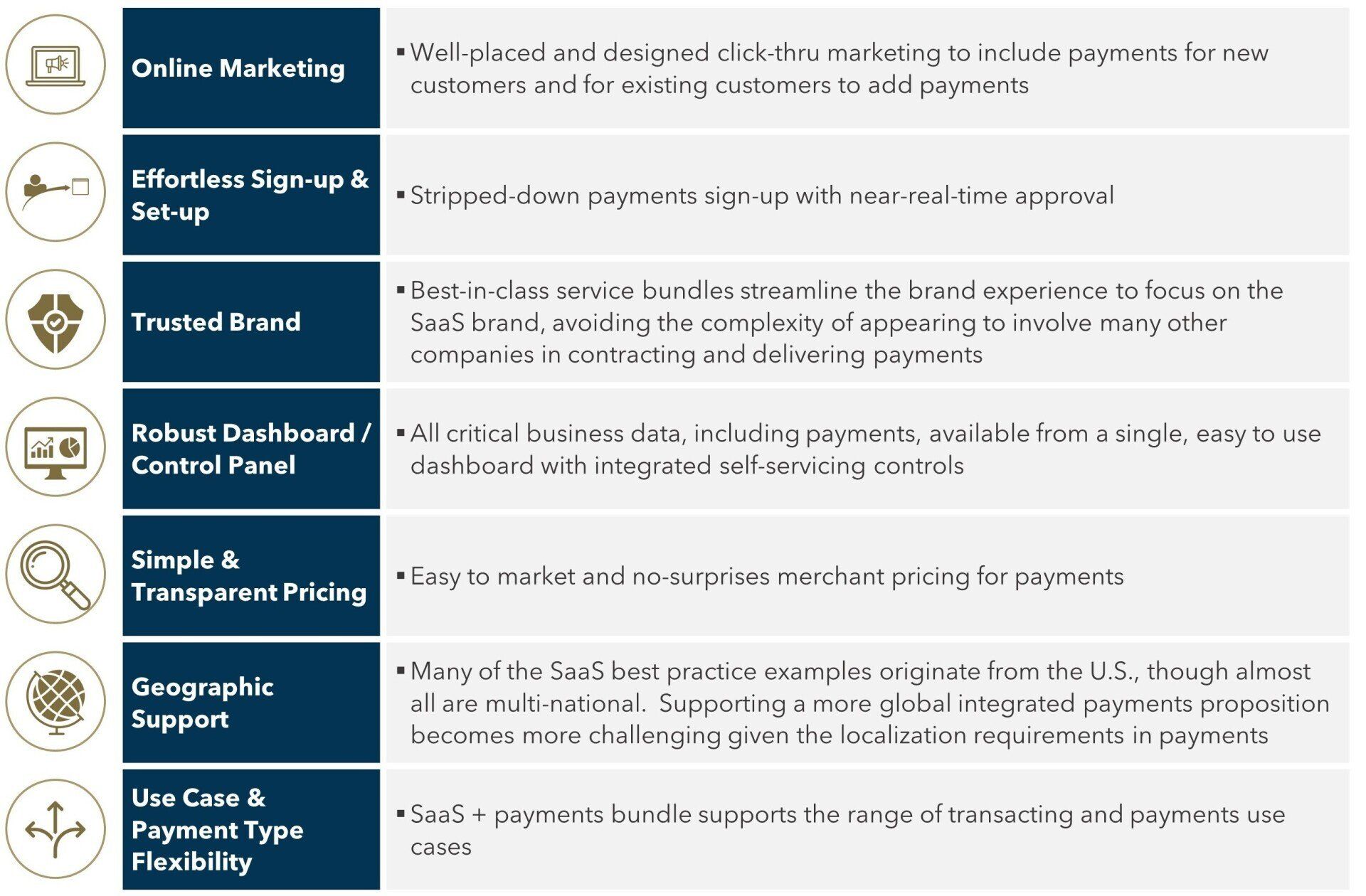

Across these various software verticals, we observe a somewhat common set of best practices for developing, marketing, and monetizing a winning payments proposition. We outline these best practices in Figure 4 below.

FIGURE 4: Best Practices for Growing SaaS-based Payments

COVID taught us that it is also critical that SaaS platforms cater to a wide variety of omni-channel payments use cases (as listed below).

- One-click (stored credentials) checkout – tokenized payment credentials allow for streamlined checkout for a registered user

- In-app – checkout and payments optimized for the mobile phone including fraud detection, authentication, and payment methods

- Robotics / chat – payments embedded into digital customer servicing environments

- Subscription/recurring – recurring payments, optimized for the unique needs of ongoing subscription continuity

- e-invoice / text / email + pay-by-link – invoicing or various forms of request-to-pay including imbedded pay-by-link

- POS – physical transacting via a payment device, or soon, via PIN-on-glass (aka SoftPOS)

SaaS-Payments potential applies equally across SaaS verticals and transacting use cases. SaaS + Payments enhance the overall utility of the SaaS package while also greatly reducing the cost to acquire and to serve a payments services customer. Even small payments merchants can cost $400+ to acquire. With strong marketing, SaaS-Payments customer acquisition cost is near zero. Similarly, a well-built SaaS proposition can also greatly reduce the cost to serve payments given that merchants naturally gravitate towards digital self-servicing.

A global proposition requires significant ongoing development; each country presents its own requirements for success. Many countries have preferred local payment methods beyond cards which must be supported (e.g., iDeal in the Netherlands). Each country tends to have its own address, name, and KYC conventions, and many have their own language and currency. Some, such as Brazil, have complex tax requirements. And a few have onerous requirements for maintaining data in country (e.g., Russia, Turkey, and India). When expanding SaaS-Payments globally, platforms must adapt the product internally and potentially by expanding their partner network.

Payments is clearly the lead financial service, but there is ample room to grow from there. Shopify Payments also allows its merchants to access other financial services such as Shopify Capital (live in the US, UK, and Canada) and card issuing (soon). Best practices clearly indicate strong merchant demand and profitability potential for working capital loans and platforms are in an ideal position to market loans given their insight into merchant cashflows. The potential for further expansion into core banking, card issuing, and treasury services also looks promising given the expanding technical possibilities of global virtual banking.

SaaS platforms that optimize proposition design and marketing and expand across countries tend to be richly rewarded. Small ISVs with simple referral partners tend to earn only about 30% of the net revenue of payments, while scaled players can earn 75% or more. Platforms with strategic payments also benefit from stickier customers and the potential for ongoing expansion into financial services. We observe many software providers across verticals, channels, and transaction use cases leveraging best practices to achieve success in payments and it is clear in 2021, that all SaaS businesses should be strategically focused on maximizing their potential in fintech.

Please do not hesitate to contact Joel Van Arsdale at Joel@FlagshipAP.com or Charlotte Al Usta Charlotte@FlagshipAP.com with comments or questions.