The SME business segment has traditionally been profit-challenged for large commercial banks. Many fintechs love the segment however, due to general under-penetration and opportunities to differentiate with digital products and quick and easy user experiences. Despite the pandemic, fintechs continue to pile into the SME segment as illustrated by recent introductions of business banking services from Starling and Monzo. Both new entrants and incumbents will need to adjust their strategies for SME banking during the pandemic and we expect less emphasis on lending (or at least lending not temporarily supported by national guarantee/employment schemes) and more emphasis on transaction banking services.

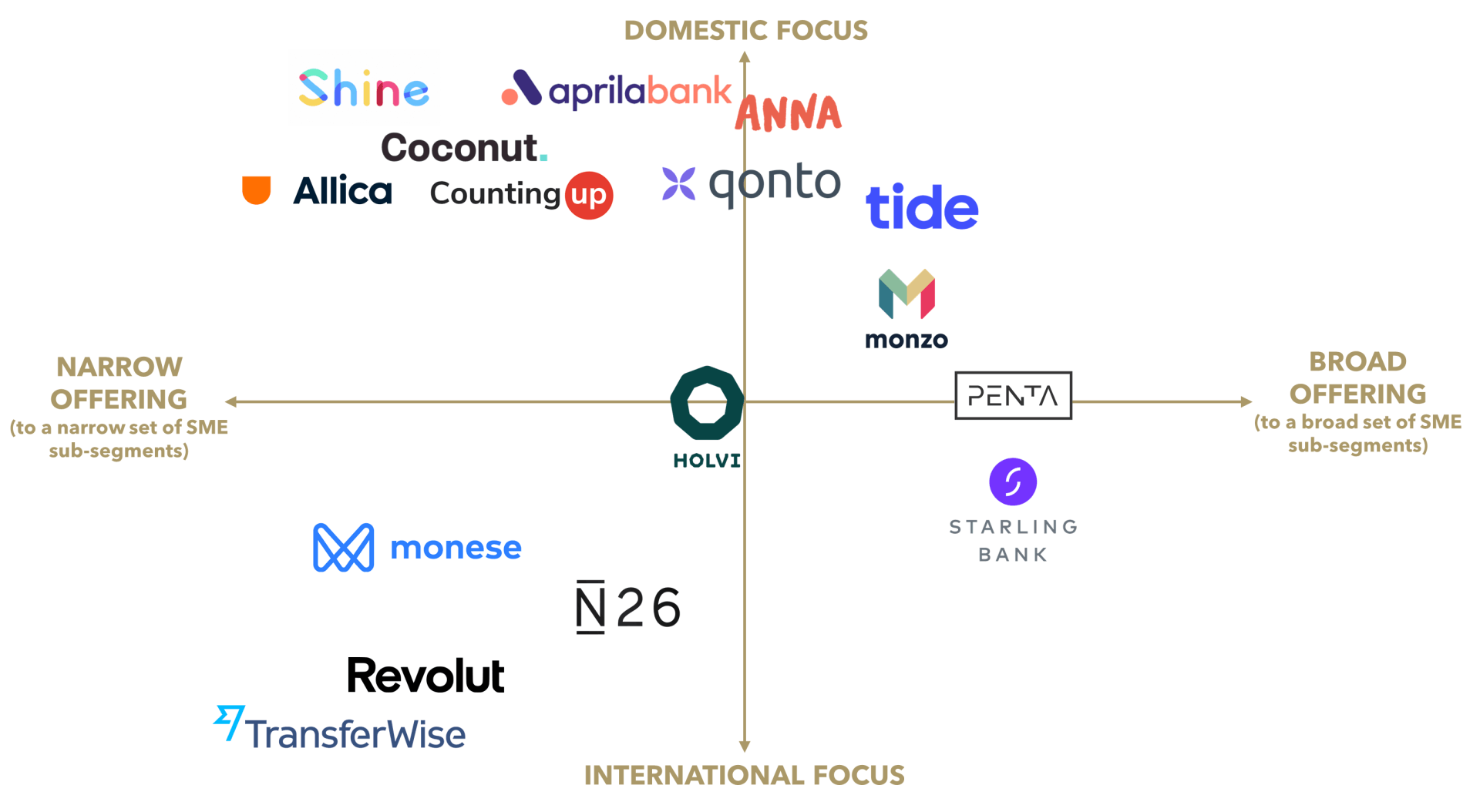

As of today (see Figure 1 below), most fintechs with SME banking propositions offer a rather basic bundle (e.g. a current account product with associated cards and spending analytics/controls), whereas a few fintech banks like Starling use marketplaces to broaden their SME offering. Few fintechs focus on SME verticals (Penta being an exception) and virtually no fintech enables a robust, cross-border banking and FX proposition.

FIGURE 1: European Fintechs With SME Banking Propositions (selected examples)

Since there is still significant opportunity in the SME banking space in Europe, below we describe several keys to success based on our experience.

First, meet basic digital hygiene standards, including quick and easy fully online boarding, robust self-servicing via digital channels, and the ability to speak to a live customer service agent when needed. More advanced digital features are of course certainly welcome, but SMEs tend to be more conservative than the general population (the freelancer sub-segment being a notable exception).

Second, the product construct needs to be sufficiently compelling and do more than one thing. This includes:

- Being optically price competitive (in many markets, free, although “competitive” does not have to mean “lowest price”);

- Offer one-stop shopping within the traditional banking sphere, such as deposit accounts bundled with payments, cards, payment acceptance, FX, and ideally a line of credit in a simple, easy to buy package; and,

- Ideally, provide a non-monetary reason to switch providers, such as strong integration with key software, useful features (invoicing, receipt and expense collection, tax management), perks (discounts, access, premium look and feel), etc.

Third, the service should be tailored to SME needs (primarily, making their lives simpler). This includes integrating well with accounting and other software, and handling somewhat more complex needs than consumer products such as multiple user accounts (e.g., second signatory, accountant, etc.), FX transactions, bulk payment orders, etc.

Fourth, while the current credit environment is deteriorating, SMEs ultimately need a path to credit. The concept of a small starter line of credit or credit card is a traditional approach, but in today’s market digital factoring is a strong alternative (as the risk is reduced because the credit risk is on the B2B buyers of the SME’s products/services, and those buyers are often better established). A key arrow in traditional banks’ quivers is that they are well positioned to monitor and provide SME credit, while fintechs who remain transaction banking-only risk eventual loss of SME customers to credit institutions as their customers mature (or worse, never attracting these customers the first place).

Finally, and probably more controversially, to serve a broader definition of the SME segment the offer should ideally be as omnichannel as possible (meaning, not just in-app). While pure digital has proven traction in the consumer segment, many small business owners want to know that a person can help them, oftentimes in person. While branches have the disadvantage of cost overhead, they are still effective tools for retention and cross-sell in the SME segment.

Payments specialists have proven that the SME segment can be lucrative with the right focus and execution. We see similar opportunities for fintech banks that can effectively deliver full-service SME banking services adhering to these (above) keys to success. Specifically, the following three opportunities jump out as strategies for fintechs to penetrate the SME banking opportunity.

Opportunity #1: Segment (and Even Sub-segment) Focus

Multi-national SMEs are particularly underserved as SME banking tends to be highly domestic in its design, marketing, and compliance. Speaking from personal experience, it can be challenging for a small multi-national business such as Flagship to obtain the right footprint of banking services. The pandemic is likely to drive new start-ups that are more digital/remote work-oriented and more multi-national, as individuals made redundant (or sensing market opportunities) collaborate across borders. Players that can provide onboarding for multi-national ownership structures, strong FX and multi-currency capabilities, and integration with international software packages (e.g., Xero, etc.) will have an advantage as the segment is highly underserved.

Opportunity #2: Credit Innovation

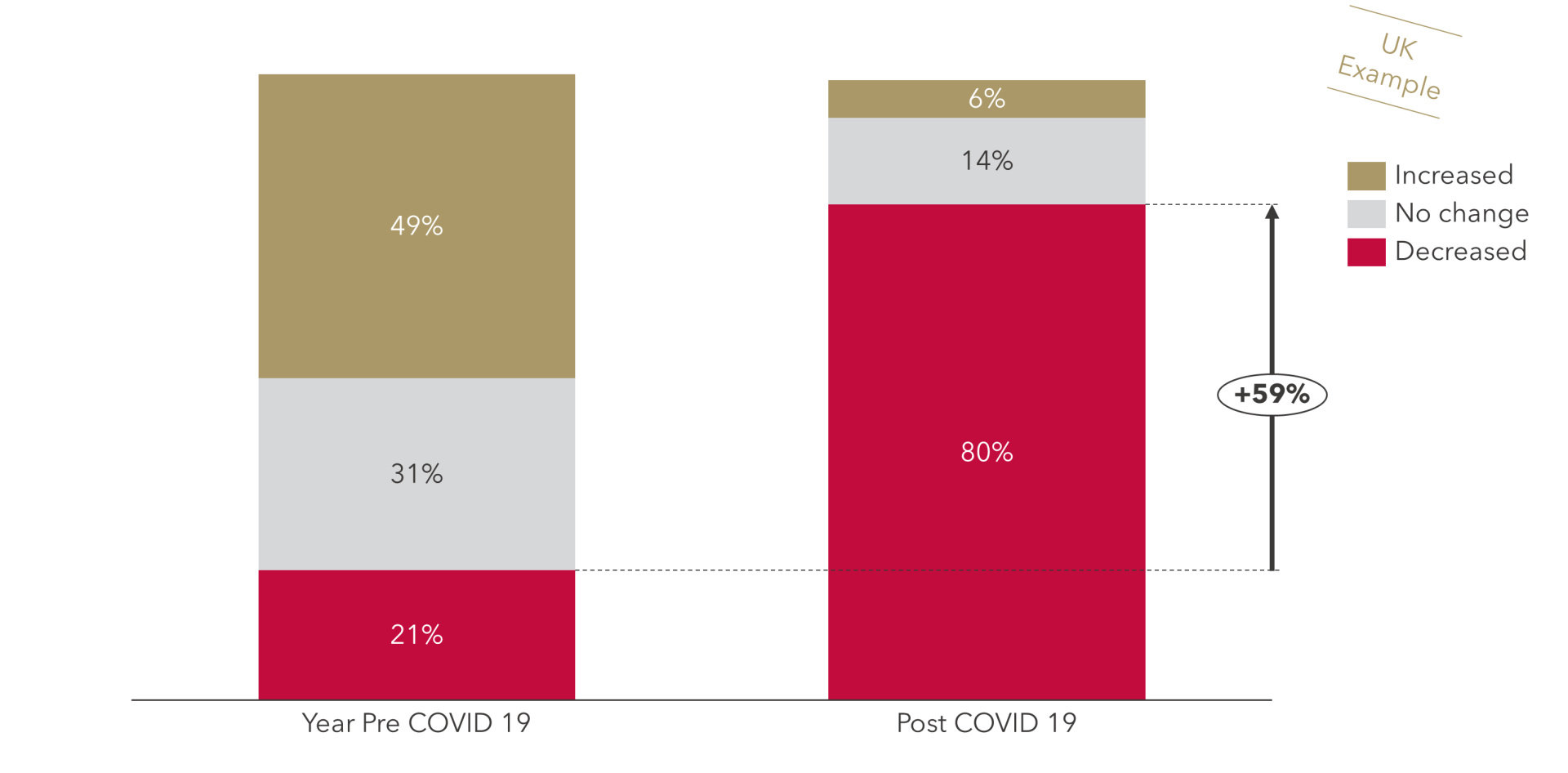

As a result of the pandemic, SME revenues have plummeted during the past few months (see Figure 2), leading to increased liquidity needs. National governments have responded with various approaches to support SMEs, but when these programs end, lenders will naturally pull back due to increased credit risk. In such a difficult credit environment, offering SMEs a path to credit will therefore be an even stronger and more differentiating proposition than under normal conditions. Digital factoring and fuel cards are examples of existing products that provide access to credit, but due to their more focused nature reduce overall exposure. However, there are also other significant opportunities for new credit product innovation in the SME credit space, such as defining a specific path to credit (e.g., credit line granted and grows based on pre-defined transaction banking behavior). Technical capabilities such as leveraging data science and increased access to account information driven by PSD2 APIs can also be used to differentiate on underwriting capabilities.

FIGURE 2: SME Revenue Change Resulting From the Pandemic (UK; % of respondents; n=600)

Opportunity #3: Integrated Software and SaaS Services

As we describe in a separate article here, integration of payment services into the broader universe of software and SaaS services is a major defining trend in European payments. The same can be said for all fintech services. SMEs like simple, bunded products. Given this behavior, over time, fintech services will increasingly be bundled into broader business SaaS packages (e.g., a restaurant package). This means that SME banking providers must strive to integrate and work with software vendors, but also to construct their own relevant bundles or application value-adds. For example, ensuring that the bank account is integrated into relevant SME accounting software, commerce front-end software (i.e., web shops, POS) property management software, payroll software, and various other software domains. This integrated approach also provides SME banking providers with significant opportunities to drive new revenue streams via value-added services.

The SME space is evolving rapidly, so to share your views or discuss those above, please contact Erik Howell at Erik@FlagshipAP.com.