Not long ago pundits in Western markets questioned the prospects of digital wallets; though admittedly, wallets in Western markets had many false starts (MCX/CurrentC, Isis/Softcard, V.me, Google Wallet, and numerous other failed telco, merchant, or bank coalitions). There is no longer any basis to question the massive influence and potential of digital wallets, which we estimate powered $12 trillion of global consumer-to-business (C2B) payments volumes in 2022, including a majority of global digital commerce and 23% of all 2022 global consumer spend. Since 2015, digital wallet proliferated around the world, across commerce channels and verticals, stimulating a broad range of use cases, and powered by numerous technical innovations. Herein we examine the global state of digital wallets and what drives success.

Digital Wallets Come in Many Forms

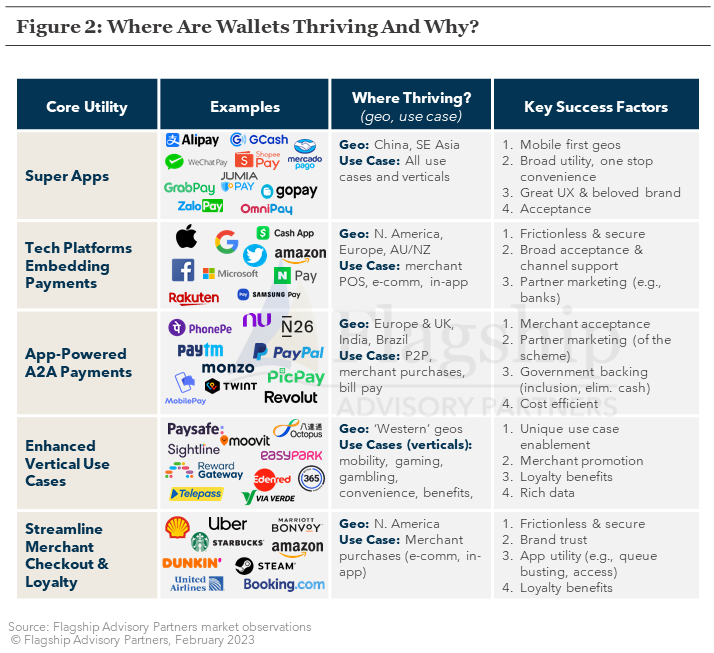

Setting aside the universal importance of the mobile phone and related technologies, when we examine successful digital wallets, we see many different constructs. Figure 1 defines some of these constructs on the basis of the account type, foundational technology, payment rails, and acceptance footprint. We also estimate the global scale of each wallet construct, isolating (where possible) the C2B commerce volumes. Across all constructs, in total, these wallets power an amazing $12 trillion of estimated global C2B payment value in 2022.

The world’s largest wallets are built on stored-value accounts, including Chinese leaders Alipay and WeChat Pay, as well as PayPal. Next largest by scale, are merchant accounts powered by vaulted cards. Most digital commerce in North America is powered by merchant ‘card on file’, a long-established form of digital wallet. Next are what we categorize as ‘big tech’ or ‘platform’ wallets, which are powered by mobile operating systems, social platforms, search platforms, and commerce platforms. The rise of real-time, account-to-account bank payment rails is powering a new family of wallets, often banking apps, powered by schemes such as UPI (India) and Pix (Brazil). Next, we categorize ‘vertical specialist’ wallets. In this category, we include wallets that focus on vertically-driven use cases such as mobility and gambling. African mobile money platforms, powered by apps but also basic mobile SIM technology, are already scale through still growing into C2B. Finally, we include crypto wallets, which obviously declined in size in 2022 along with the global value of crypto.

Digital wallets are not a one-size fits all construct. Wallet accounts can be merely a conduit for straight-through payment flows or they can be the foundation for super-apps. Wallets can rely on cards rails, A2A rails, or non-traditional forms of on-ramps and off-ramps (cash, crypto, etc.). When achieving real scale, most wallets do look to expand their acceptance footprint, but there are also many successful case studies that remain closed-loop.

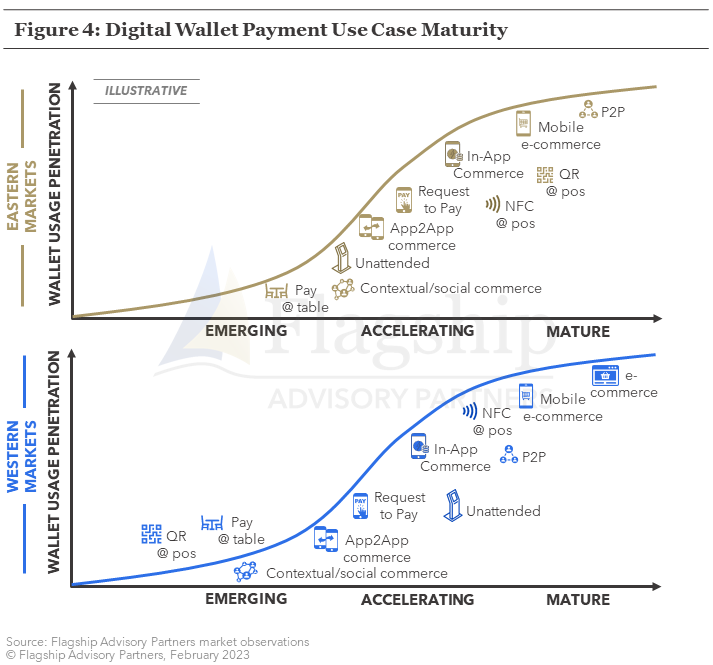

Moving on from wallet construct, we next segment the digital wallet landscape by the core value proposition or utility of the wallet, illustrated in Figure 2.

In China and SE Asia, ‘super apps’ are the most prevalent form of digital wallet value proposition. Super apps generally support payments across many use cases: e-comm, POS (via QR code), pay request, among others. Beyond omni-channel payments, super apps are designed to deliver broad utility to the mobile-first generation, for example: mobility, food ordering, travel, and gaming. These apps also often support broader banking services such as lending.

Big tech wallets focus on enabling frictionless payments via phone HW/SW and by embedding their payment platforms into in-app commerce (i.e., content, app, or virtual goods). Google struggled for years to achieve success with a digital wallet beyond the Play store (in-app) payments foundation, but now seems to have better traction on the back of robust contactless acceptance and deeper Google Pay e-payment penetration. As we discuss in a separate article (Apple Fintech Ecosystem), we estimate that Apple controlled c. $800 billion of spend in 2022, most of which came from Apple Pay. We view Apple Pay as a major success across POS and digital commerce, though other of Apple’s fintech products are less successful to date, or just now coming to market. Meta Pay (formerly Facebook Pay) primarily supports payments on Meta’s own social platforms.

Mobile apps powered by A2A (account-to-account) are growing rapidly in many European markets as well as India and Brazil. In both India and Brazil, usage of apps powered by A2A payment rails exploded in the last three years, driven by a push for financial inclusion, and inexpensive payments for merchants. India’s UPI network processed $1.5 trillion of volume in 2022 (c. 35-40% attributable to C2B commerce). These wallets are generally bundled into broader banking apps.

Vertically specialized wallets are intriguingly diverse, driven by niche value propositions across many use cases and sectors of spend. Gambling is a vertical that adopted digital wallets early in its evolution towards digital commerce. These wallets offer payments for online gaming and betting, in-casino deposits and withdrawals (some), and can support loyalty and offers from operators. Employee benefits are another interesting use case where apps act as wallets for various prepaid use cases such as lunch vouchers, gym memberships, or public transport. Open-loop mobility apps often emerge from public transport, tolling, or parking, expanding into adjacent use cases.

Vertical use case enablement is also a key value proposition for many merchant wallets, which are generally proprietary/closed-loop. Uber and similar apps enable a variety of mobility use cases such as ride sharing and food delivery (these merchant platforms often evolve into open-loop wallets such as GrabPay). Leading hotel merchant apps can support booking, but also check-in, room access, and room service. Wallets are also quite useful within café/restaurant to order @ table or to order to skip the queue. Auto wallets (i.e., smart cars) and fueling apps are still emerging, but will enable fueling/recharging and purchase of goods or service along a journey. For each of these apps, payment functionality, generally via a vaulted card, are mission critical to powering frictionless use cases. Loyalty benefits are also often a value-add to merchant digital wallets.

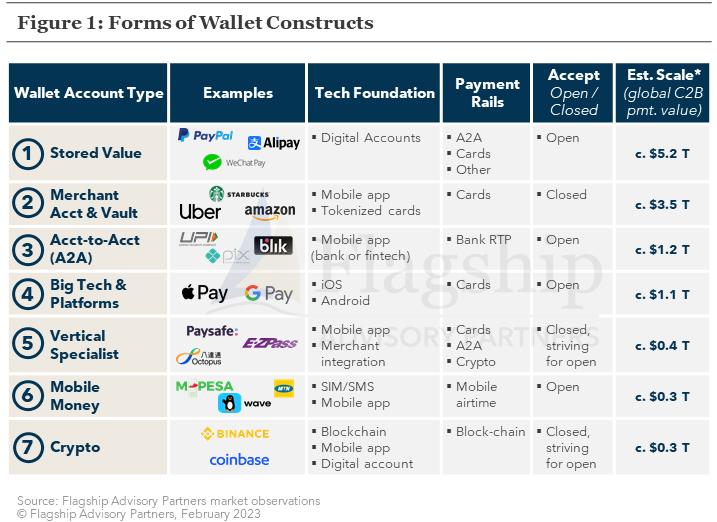

In Figure 4, we highlight that payment use cases via wallets are at various stages of maturity depending on the country of reference. P2P payments and enabling of digital commerce are the most mature use cases, while QR payment at POS is either maturing (China or SE Asia), accelerating (India), or emerging (Europe).

Wallets Propelled By Technology Innovation

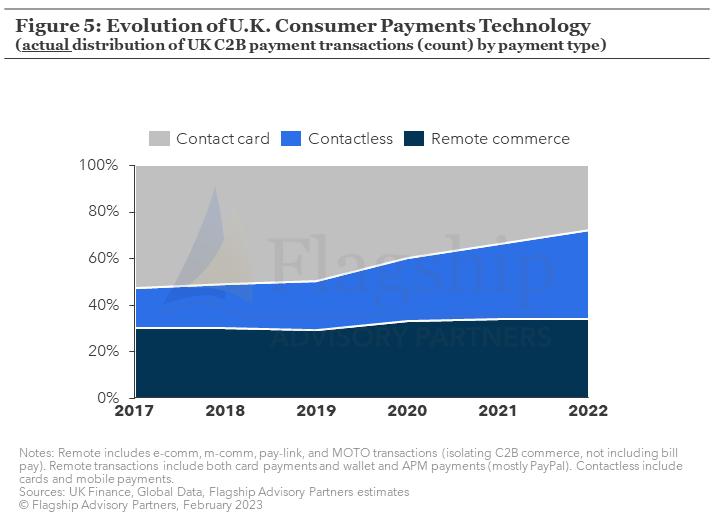

Wallet payments are accelerating on the back of ongoing technology innovation and penetration, for example: penetration of contactless technology, Android payments hardware, and app-to-app interoperability. In Figure 5, we use data from the U.K. to illustrate the dramatic shift from face-to-face plastic card transactions to digital commerce and to contactless payment (both catalysts for wallet-based payments).

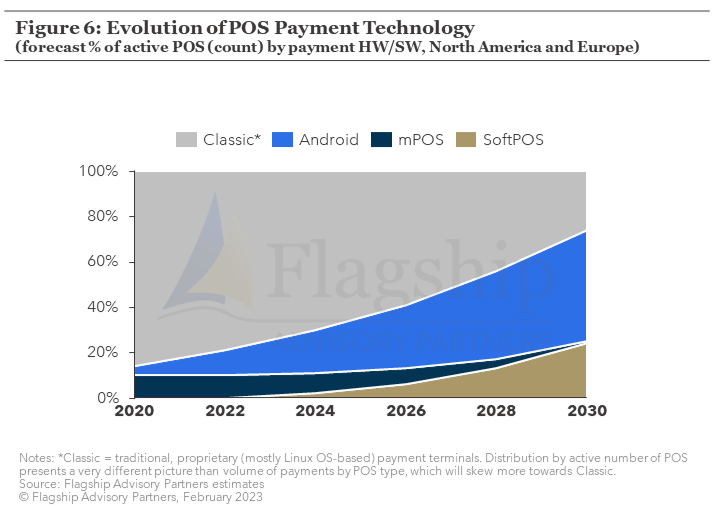

Point-of-sale (POS) payments HW/SW is also undergoing a technology innovation from proprietary systems to Android OS and API ecosystems where the POS SW communicates openly other app-based services (China again being well ahead of Western markets here). In Figure 6, which includes data for North America and Europe, we show the rapid acceleration of Android terminals and expected acceleration of SoftPOS, a POS solution ideally suited for app-to-app commerce. QR-code acceptance @ POS, a lynchpin of many wallets, is more readily available on Android or app-based POS (i.e., SoftPOS) relative to classic card terminals. On this more modern technology, digital wallet payments at the POS are more easily enabled and embedded.

Conclusions

Digital wallets are rapidly penetrating the market around the world and across use cases. While niche wallets are some of the most intriguing on the emerging/accelerating horizon, in the aggregate, wallets are no longer niche. We estimate that digital wallets will drive more than one-quarter of global consumer spend in 2023, growing to more than half of all consumer spend in the next decade. Fintech service providers, enterprise merchants, technology platforms, and other stakeholders all have a strategic imperative to leverage digital wallets to drive business growth and user experience improvement. Fortunately, the technology foundation for enabling wallets is now largely in place, and the sky is the limit for wallet innovation.

Please do not hesitate to contact Joel Van Arsdale at Joel@FlagshipAP.com with comments or questions.