While the European market waits for open banking payments to find a foundation, alternative payment schemes built on account-to-account (A2A) banking rails continue to thrive. In this article we examine the European landscape for A2A payment schemes and open banking A2A payments.

Catalyzed By Mobile Commerce, A2A Schemes Thrive Across the EU

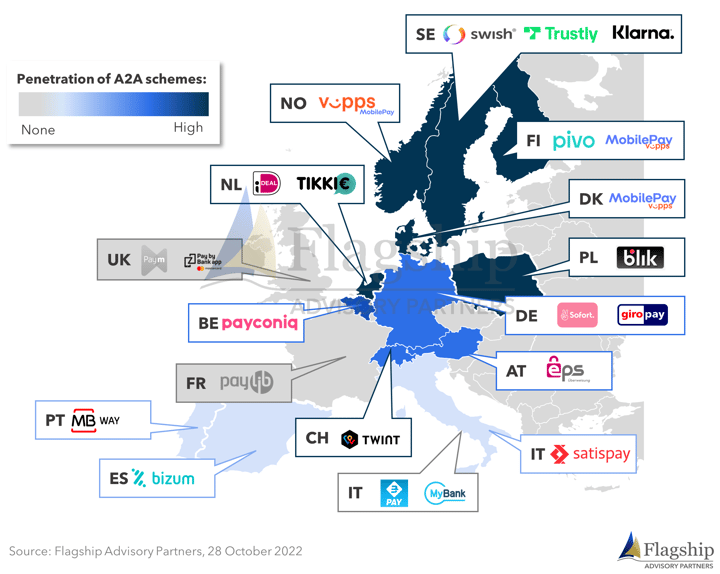

As shown in Figure 1, there are many European alternative payment methods (APMs) that are built on A2A rails. Most of these schemes are owned by bank coalitions, but not all (Trustly and Sofort/Klarna being notable private examples). Some of these schemes date back to the relatively early days of e-commerce (c. 2005) and were founded to displace offline bank transfers (e.g., paper Giro payments). Other similar schemes were founded more recently (c. 2015), spurred by the development of mobile apps and mobile commerce.

FIGURE 1: Landscape of Select European A2A APM Schemes

As we discuss shortly, many of the European A2A schemes are thriving, but not all. Some have failed, notably PayM in the UK and Paylib in France. Other schemes such as GiroPay/PayDirekt in Germany and Bancomat Pay in Italy, struggle to find traction and scale. Each of these schemes had the backing of major banks (a catalyst for success) but failed to achieve uptake by consumers who are otherwise well-served by cards, PayPal, or invoicing/BNPL within those respective markets.

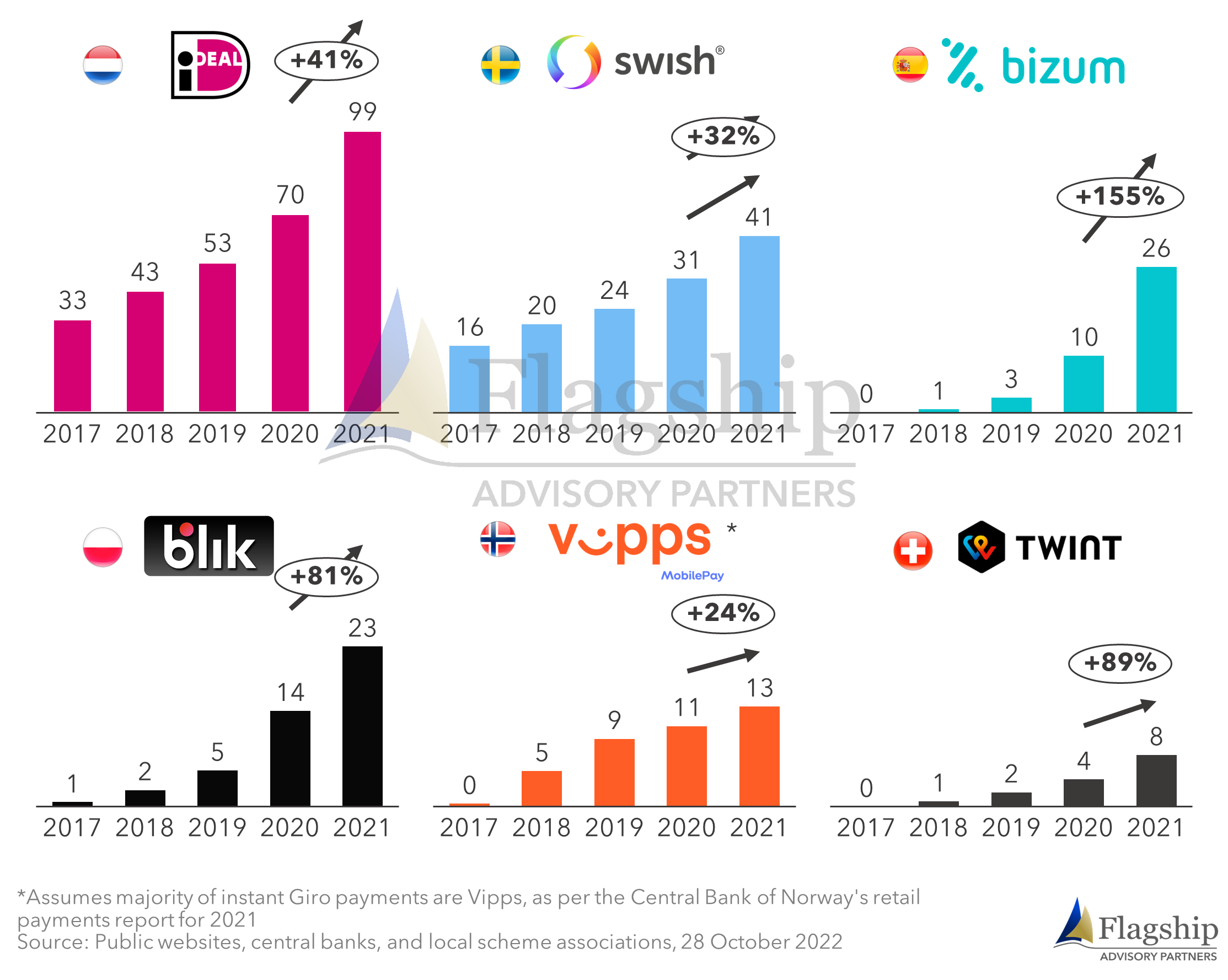

FIGURE 2: Transaction Volumes of Top European A2A APMs (€ Bil.; A2A volumes; '20-’21 growth rates, select APMs)

Ongoing growth in mobile commerce continues to drive accelerated growth for the most successful of these A2A schemes. As shown in Figure 2, for example, from 2020 to 2021, Blik volumes in Poland grew 81% while Twint volumes in Switzerland grew 89%. Even more tenured schemes such as iDEAL in the Netherlands grew 41% from ’20 to ’21, stimulated partly by COVID behaviors.

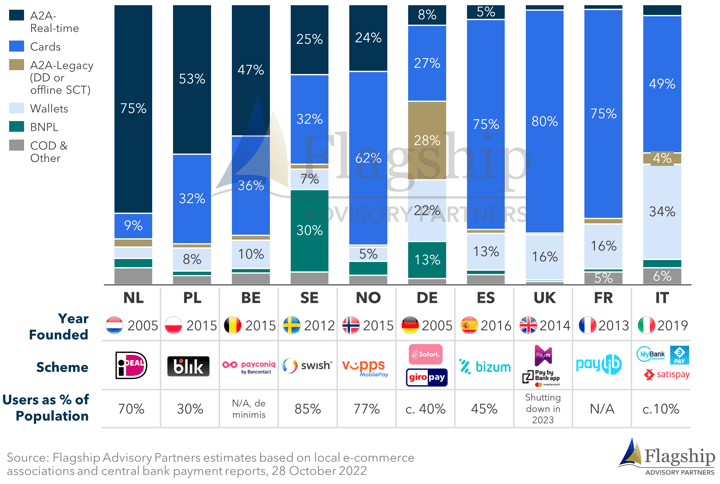

There remains ample opportunity for ongoing growth. As shown in Figure 3, most of these APM schemes (with the exception of iDEAL) have less than 30% penetration of C2B e-commerce in their home markets (compared to iDEAL’s c.75%). Beyond C2B e-commerce, there remains significant room for these schemes to grow in B2B e-commerce as well. We estimate that c. 20% of iDEAL’s total EUR 99 billion of volume in 2021 was business-to-business.FIGURE 3: C2B e/m-Commerce Payment Mix in Select European Markets (% of e/m-commerce payment turnover; 2021 est.)

The physical point-of-sale (POS) remains a source for ongoing growth. Virtually none of these A2A schemes have meaningful penetration of the POS opportunity. Blik leads the sample with an est. 15% of its volumes arising from POS commerce. None of the other A2A schemes have more than 10% of volumes coming from POS. Admittedly, many of these schemes have struggled to achieve a checkout experience that can rival the frictionless UX of Apple Pay or similar NFC payment methods at POS. While these A2A APMs may never rival contactless payments at the traditional POS checkout, the lines between traditional in-store checkout and mobile commerce are blurring. Thus, we fully expect high growth in the usage of A2A payments via their hybrid in-store/in-app experiences.

These successful A2A schemes continue to get better. All of these schemes operate with real-time payments (based on checkout and approval), but many are now migrating onto real-time clearing rails (money movement). User experiences also continue to get better. For example, Bizum, launched in 2016 by a consortium of Spanish banks, uses Iberpay’s real time payment clearing rails. Consumers are generally quite happy with the quality of the mobile apps from these schemes. The schemes noted in Figure 2 that provide a mobile app (e.g., Swish, Twint, Vipps) have a combined average rating of 90% on the Apple AppStore.

Open Banking Payments - a Solution in Search of a Problem

None of the highly successful A2A payment schemes noted in Figure 2 (effectively all of the bank-owned A2A schemes) operate via Open Banking. Schemes such as Trustly and Sofort/Klarna are migrating into Open Banking-based user experiences, and away from their traditional ‘screen scraping’ UXs. Therefore, is there room for Open Banking payment initiation services (PIS)?

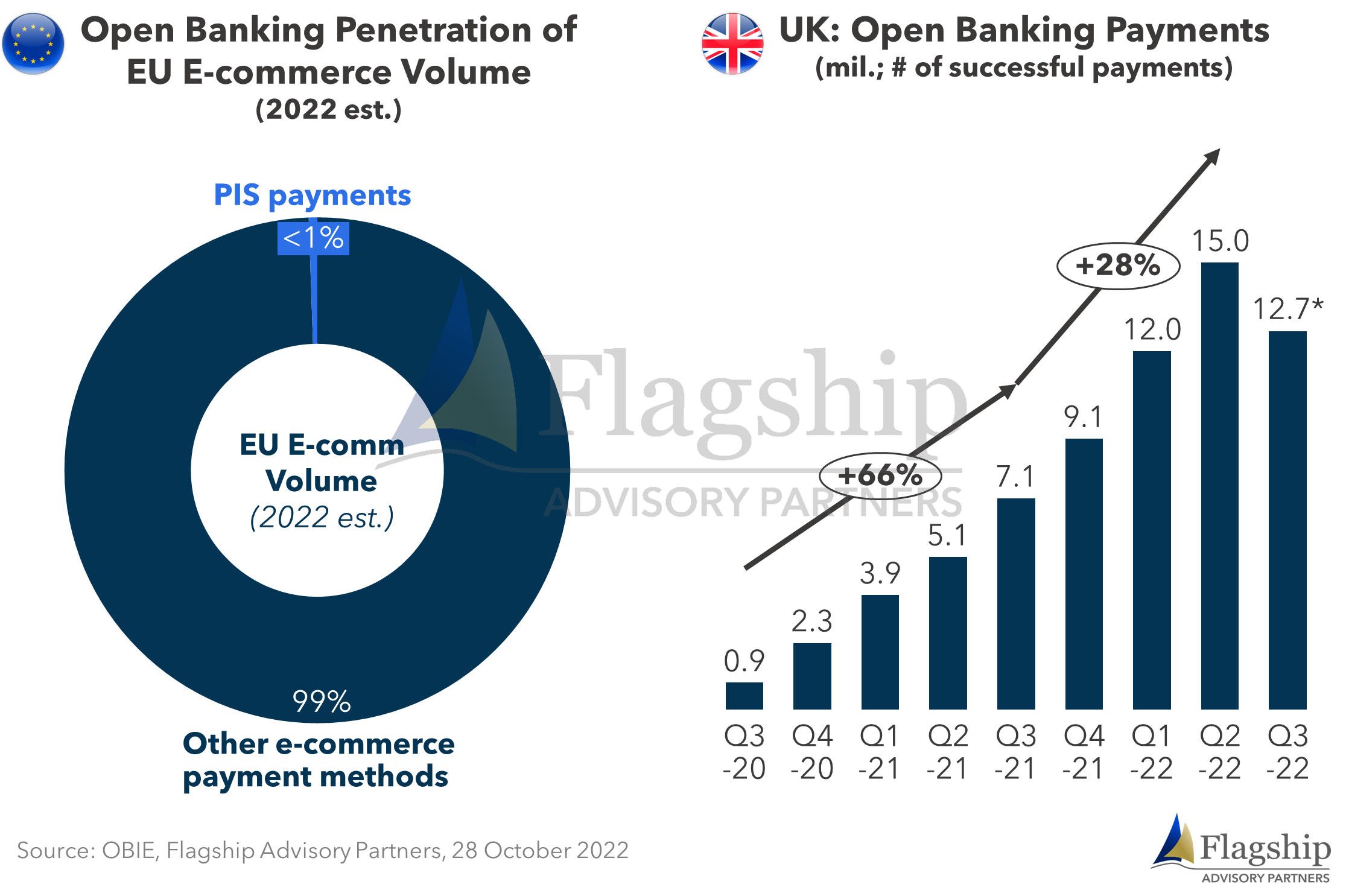

The answer as of today is, ‘not much’. Volumes of PIS payments today are de minimis, accounting for far less than 1% of European e-commerce. This despite having complete market readiness in most of the major Western European markets and broad support by leading European e-comm PSPs. If a European merchant wants to offer PIS payments today, they can generally find the service. So why the lack of uptake, as shown in Figure 4?

FIGURE 4: Penetration of Open Banking Payment Initiation Services

PIS payments are a solution in search for a problem. Sitting in the Netherlands at this moment, we simply do not have major needs for PIS. We have iDEAL for e-commerce, Tikkie for P2P payments, Apple Pay or other NFC for POS, and robust internet banking that is effectively free for larger payments. We also observe PIS user experiences that are often still high in friction, a function of heavy reliance on issuing bank policies and infrastructure.

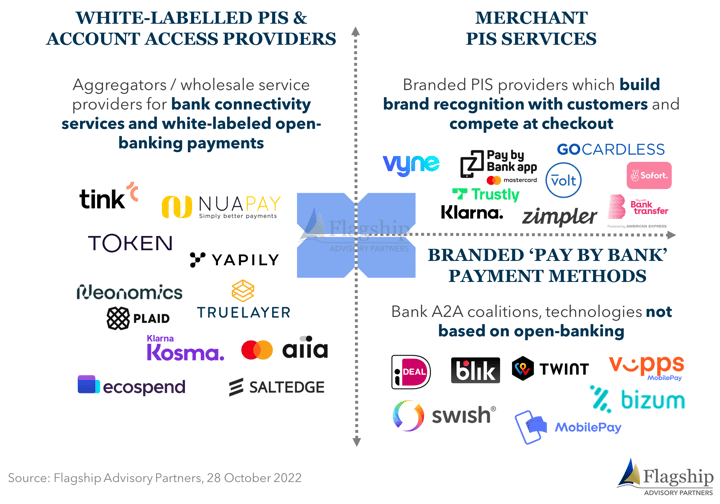

Providers of PIS payments (branded PIS and white-labeled PIS), such as those shown in Figure 5, must work harder in their go-to-market strategies and execution to find unmet needs. Firstly, there is a clear, geographically oriented opportunity. While the Netherlands has little need for PIS, markets such as the U.K., France, and Ireland (along with others) still do, as these markets lack mainstream options beyond cards, PayPal, and BNPL. We do see room for PIS to find niches to supplant traditional bank payments (high conviction) and in some cases, to potentially cannibalize cards and PayPal (low conviction). Central Europe also presents an opportunity, given the ongoing prevalence of offline payment methods and the relative lack of successful mainstream A2A schemes.

We also see specific vertical use cases where PIS can potentially thrive. For example, the real-time flows of PIS are highly relevant for improving the bespoke and manual flows of many B2B payment use cases. Most notably, small businesses are potentially ideal candidates to initiate and accept PIS payments to speed cash flows, reduce manual workflows, and eliminate exceptions. There are other more specific vertical use cases where we also see good opportunities for PIS (e.g., the first payment in a string of recurring Direct Debits, education payments, utility payments, email or chat-based payments, etc.).

While many PSPs now support PIS, there is much work to be done to educate merchants as to the value of the PIS option (a process that won’t happen without effort). Similarly, consumers also need to be taught to recognize and trust the PIS experience.

FIGURE 5: Provider Landscape for European Open Banking Payments

In Conclusion

European A2A schemes will continue to thrive and grow, expanding from their P2P and C2B e-commerce origins into other use cases such as B2B and POS. Those schemes that are today widely penetrated have already won the hearts of consumers and merchants alike, and their brands and user experiences will continue to improve and expand. Given the strong position of established A2A alternatives in many EU markets, we do not see a landslide of PIS volumes on the horizon. We also do not see widespread cannibalization of cards and wallet such as PayPal as some pundits prognosticated. But we do see an ongoing expansion of PIS volumes as a series of specific use cases are addressed over time. Successful providers of PIS services will achieve strategic focus on relevant geos, segments, and use cases and will successfully educate merchants and consumers to trust and use PIS.

Please do not hesitate to contact Joel Van Arsdale Joel@FlagshipAP.com or Anupam Majumdar Anupam@FlagshipAP.com with comments or questions.