General Observations

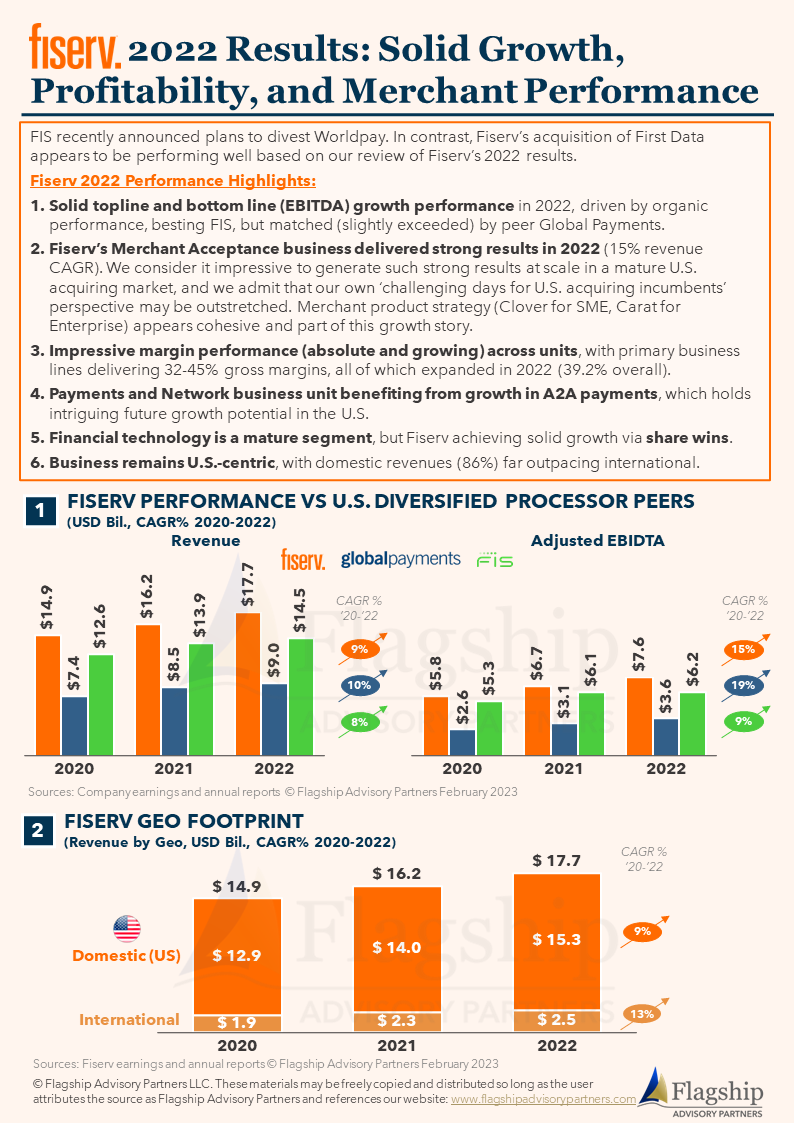

FIS recently announced plans to divest Worldpay. In contrast, Fiserv’s acquisition of First Data appears to be performing well based on our review of Fiserv’s 2022 results:

Fiserv 2022 Performance Highlights

- Solid topline and bottom line (EBITDA) growth performance in 2022. Performance outshined FIS, but was matched (slightly exceeded) by peer Global Payments.

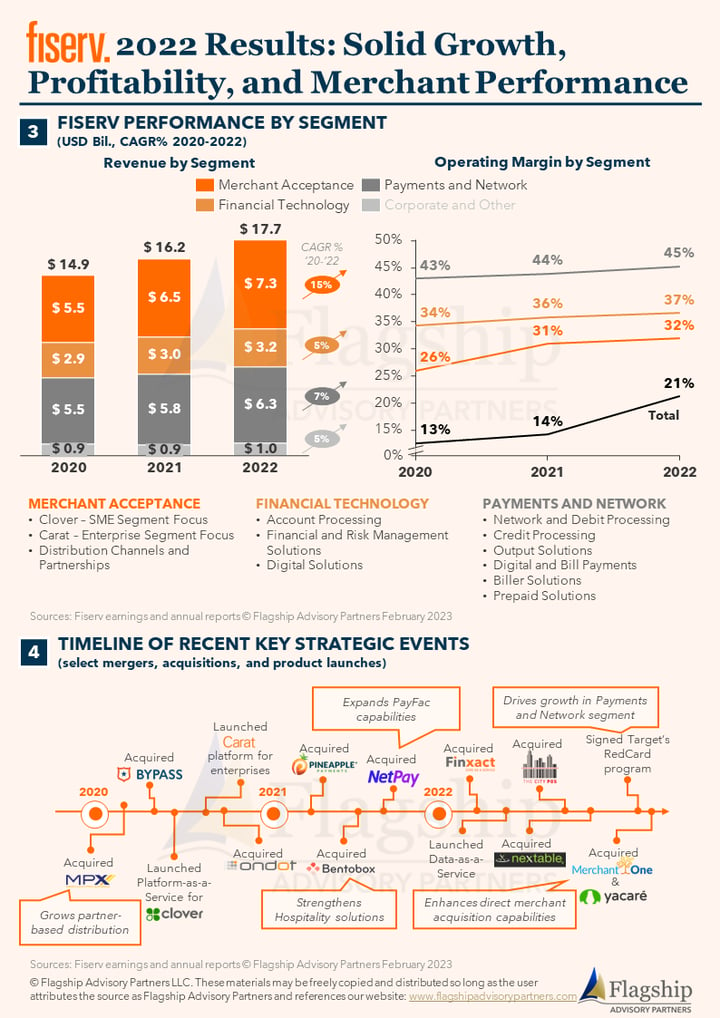

- Fiserv’s Merchant Acceptance business delivered strong results in 2022 (15% revenue CAGR). We consider it impressive to generate such strong results at scale in a mature U.S. acquiring market, and we admit that our own ‘challenging days for U.S. acquiring incumbents’ perspective may be outstretched. Merchant product strategy (Clover for SME, Carat for Enterprise) appears cohesive and part of this growth story.

- Impressive margin performance (absolute and growing) across units, with primary business lines delivering 32-45% gross margins, all of which expanded in 2022 (39.2% overall).

- Payments and Network business unit benefiting from growth in A2A payments, which holds intriguing future growth potential in the U.S.

- Financial technology is a mature segment, but Fiserv achieving solid growth via share wins.

- Business remains U.S.-centric, with domestic revenues (86%) far outpacing international.

Please do not hesitate to contact Joel Van Arsdale at Joel@FlagshipAP.com, Salvatore LoBiondo at Salvatore@FlagshipAP.com, or Simone Remba at Simone@FlagshipAP.com with comments or questions.