Corpay, Alpha Group

Innovations

Innovations

Image Credit: Corpay, Alpha Group

Niko Beranek, Amilee Huang • 4 September, 2025

Klarna, the Buy Now, Pay Later fintech, has officially revived its plans to go public. After pausing its IPO plans in April amid market volatility, the company has now filed for IPO on the New York Stock Exchange under the ticker KLAR with plans to sell 34.3 million shares to raise $1.27B at a 14B valuation.

This insight highlights Klarna’s journey, from its founding to its current state, covering valuation milestones, financial performance, and growth across customers and merchants.

As Klarna takes this next step, its IPO will serve as both a test of investor confidence in BNPL and a signal for the broader future of fintech IPOs.

1. IPO Offering and Historic Valuation

(in billions of $)

Peak valuation reached in 2021 funding round led by SoftBank

Peak valuation reached in 2021 funding round led by SoftBank

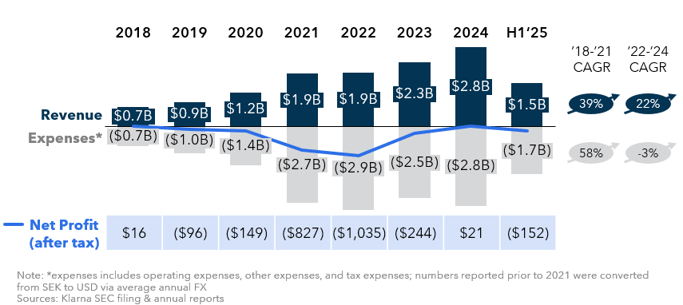

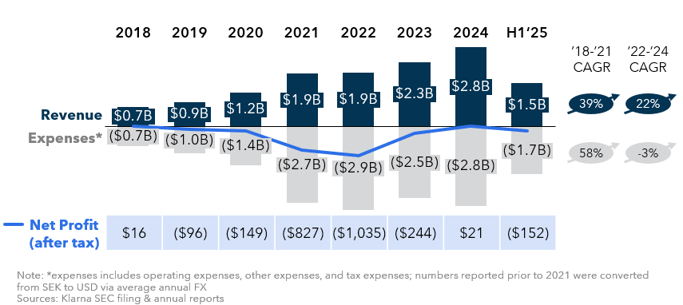

2. Financial Performance

(net profit in millions of $, revenue and expenses in billions of $)

- Klarna’s accelerated expansion into the U.S. in 2019 drove growth, but eroded profitability

- Expense discipline, particularly reduced U.S. credit losses, has helped cut losses since 2022

- Klarna achieved net profitability in 2024 but reverted to a loss in H1 2025

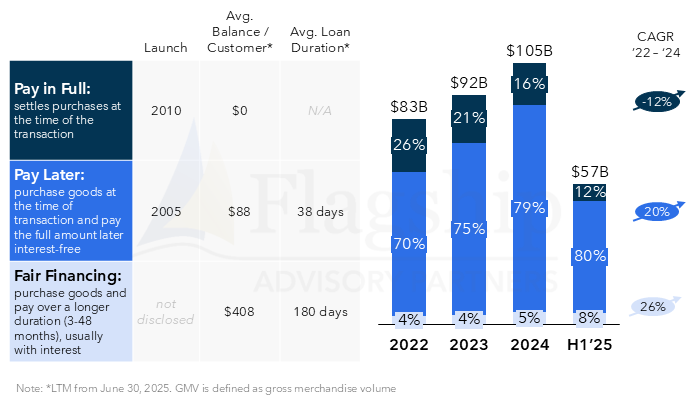

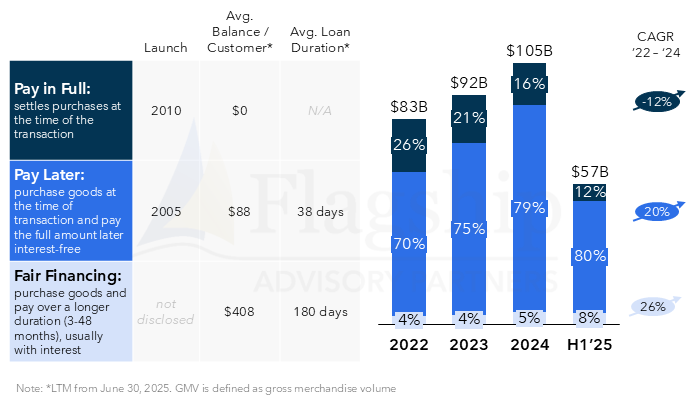

3. GMV Breakdown by Payment Options

(% of GMV, GMV in billions of $)

- Pay in Full: settles purchases at the time of transaction

- Pay Later: purchase goods at the time of transaction and pay the full amount later interest-free

- Fair Financing: purchase goods and pay over a longer duration (3-48 months), usually with interest

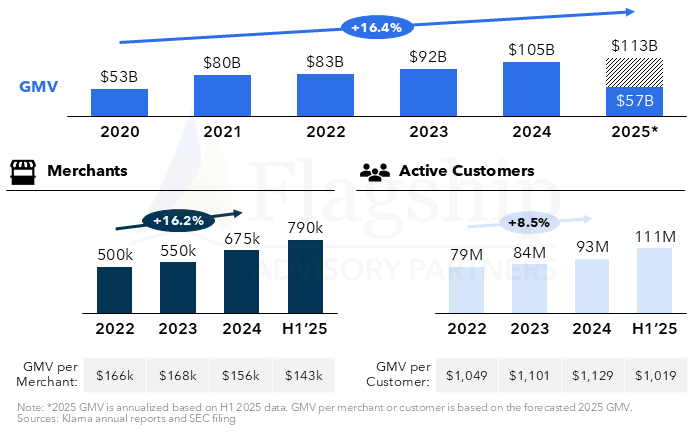

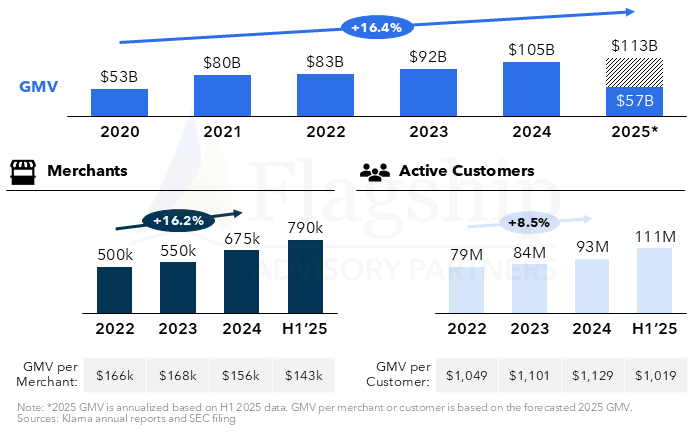

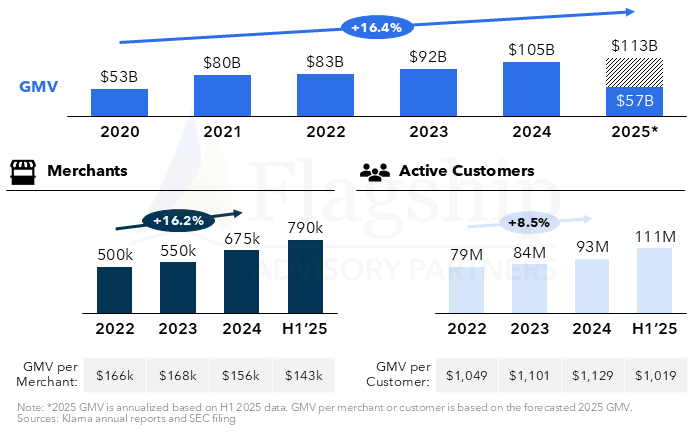

4. Network Growth

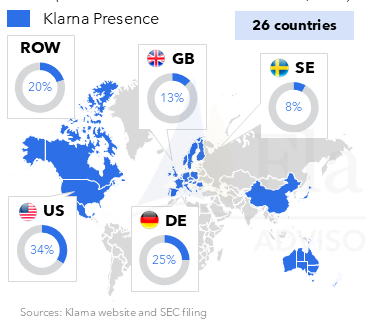

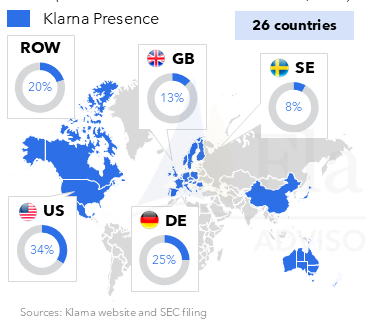

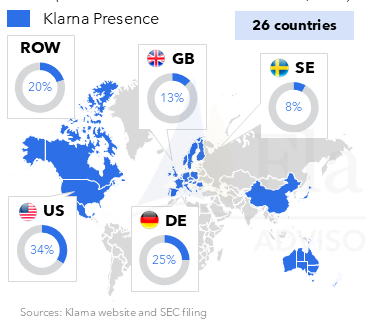

5. Geographic Presence

(% of revenue 6 months ended June 30, 2025)

6. Klarna's Push for AI

- Automate customer support: 69% of chats resolved by AI in ~ 2 minutes

- Improves merchant conversion: AI-powered personalized shopping feeds

- Enhance credit underwriting: supplements underwriting models

- Increase productivity: used in engineering, operations and marketing teams

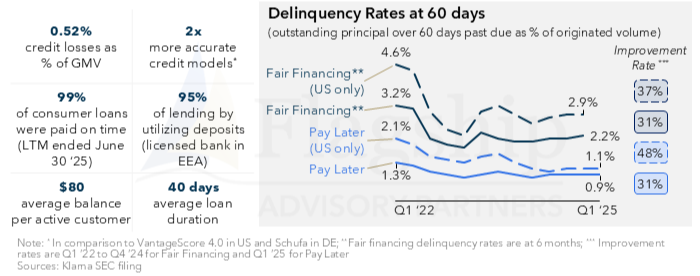

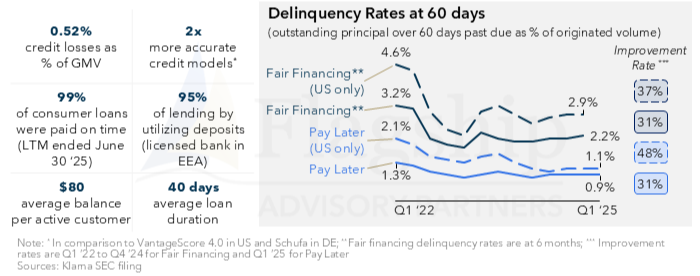

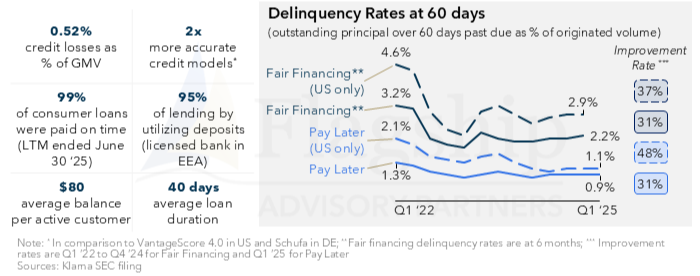

7. Credit Quality Indicators

General Commentary & Highlights

- U.S. Listing: Klarna’s choice of New York underscores the U.S. as a destination for fintech IPOs (vs. current HQ in Stockholm)

- Fintech Signal: The deal will serve as a test case for investor appetite toward late-stage fintech listings and credit/lending businesses after a muted IPO cycle despite macroeconomic challenges

- AI Narrative: Klarna’s heavy emphasis on AI may appeal to tech-focused investors, though its durability as a competitive moat remains unproven with recent drawbacks (e.g., due to declining service quality and customer dissatisfaction, Klarna has started to rehire human agents again)

- Reduced Credit Risk: Overall delinquency rates have improved by about one-third since Q1 ‘22

- Return to Profitability: Klarna narrowed losses through lower credit losses and efficiency, achieving a 2024 profit but returning to losses in H1 2025

- BNPL Implications: Klarna’s IPO can be a strong indicator of market sentiment towards BNPL

Please do not hesitate to contact Niko Beranek at Niko@FlagshipAP.com or Amilee Huang at Amilee@FlagshipAP.com with comments and questions.

Image Credit: Corpay, Alpha Group

Klarna, the Buy Now, Pay Later fintech, has officially revived its plans to go public. After pausing its IPO plans in April amid market volatility, the company has now filed for IPO on the New York Stock Exchange under the ticker KLAR with plans to sell 34.3 million shares to raise $1.27B at a 14B valuation.

This insight highlights Klarna’s journey, from its founding to its current state, covering valuation milestones, financial performance, and growth across customers and merchants.

As Klarna takes this next step, its IPO will serve as both a test of investor confidence in BNPL and a signal for the broader future of fintech IPOs.

1. IPO Offering and Historic Valuation

(in billions of $)

Peak valuation reached in 2021 funding round led by SoftBank

Peak valuation reached in 2021 funding round led by SoftBank

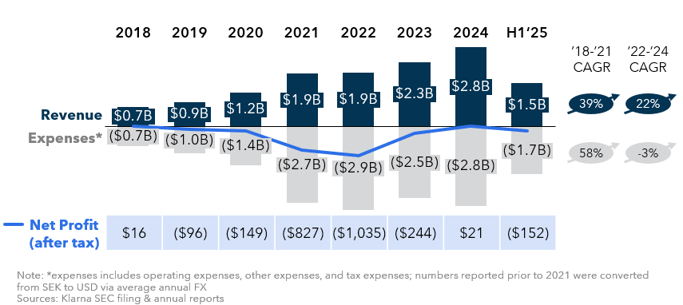

2. Financial Performance

(net profit in millions of $, revenue and expenses in billions of $)

- Klarna’s accelerated expansion into the U.S. in 2019 drove growth, but eroded profitability

- Expense discipline, particularly reduced U.S. credit losses, has helped cut losses since 2022

- Klarna achieved net profitability in 2024 but reverted to a loss in H1 2025

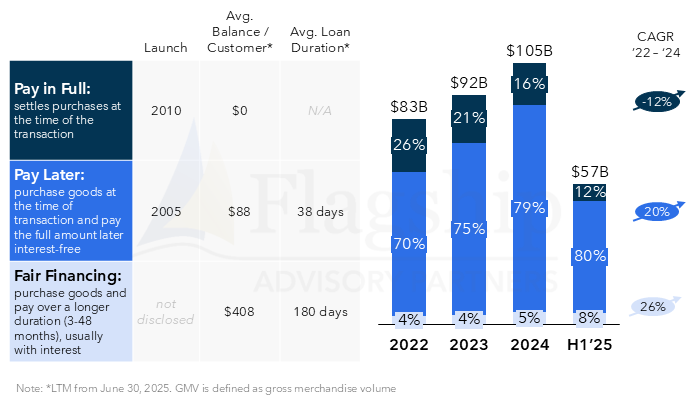

3. GMV Breakdown by Payment Options

(% of GMV, GMV in billions of $)

- Pay in Full: settles purchases at the time of transaction

- Pay Later: purchase goods at the time of transaction and pay the full amount later interest-free

- Fair Financing: purchase goods and pay over a longer duration (3-48 months), usually with interest

4. Network Growth

5. Geographic Presence

(% of revenue 6 months ended June 30, 2025)

6. Klarna's Push for AI

- Automate customer support: 69% of chats resolved by AI in ~ 2 minutes

- Improves merchant conversion: AI-powered personalized shopping feeds

- Enhance credit underwriting: supplements underwriting models

- Increase productivity: used in engineering, operations and marketing teams

7. Credit Quality Indicators

General Commentary & Highlights

- U.S. Listing: Klarna’s choice of New York underscores the U.S. as a destination for fintech IPOs (vs. current HQ in Stockholm)

- Fintech Signal: The deal will serve as a test case for investor appetite toward late-stage fintech listings and credit/lending businesses after a muted IPO cycle despite macroeconomic challenges

- AI Narrative: Klarna’s heavy emphasis on AI may appeal to tech-focused investors, though its durability as a competitive moat remains unproven with recent drawbacks (e.g., due to declining service quality and customer dissatisfaction, Klarna has started to rehire human agents again)

- Reduced Credit Risk: Overall delinquency rates have improved by about one-third since Q1 ‘22

- Return to Profitability: Klarna narrowed losses through lower credit losses and efficiency, achieving a 2024 profit but returning to losses in H1 2025

- BNPL Implications: Klarna’s IPO can be a strong indicator of market sentiment towards BNPL

Please do not hesitate to contact Niko Beranek at Niko@FlagshipAP.com or Amilee Huang at Amilee@FlagshipAP.com with comments and questions.

Peak valuation reached in 2021 funding round led by SoftBank

Peak valuation reached in 2021 funding round led by SoftBank