Every morning, small business owners open their laptops to a familiar headache. Their sales data lives in one system, their customer lists in another, and their marketing campaigns scattered across multiple platforms. To launch even the simplest promotion, they must stitch together emails, social ads, and reports from tools that don’t talk to each other.

This complexity doesn’t stop SMBs from investing in marketing – like payments, marketing is not really an optional activity for businesses that want to survive. 96% of SMBs advertise and 99% of them will maintain or increase their digital advertising spend this year. SMBs need to stand out in crowded markets and compete with much larger players. They are hungry for growth but trapped in fragmentation.

There is a clear opportunity for PSPs and vertical SaaS providers to use sales and payments data to help their clients to run more sophisticated digital marketing campaigns without a Ph.D. in data science. Doing this can let PSPs and vertical SaaS providers tap into a market 10x the size of payments itself.

Flagship Advisory Partners surveyed 137 SMBs across the US, UK, and Australia in late 2024 and 126 vertical SaaS platforms in the US in early 2025. This article dives into the mindset of SMBs around the world and describes why PSPs and vertical SaaS platforms are uniquely positioned to make marketing easier.

SMBs Want Integrated Solutions

For many SMBs, marketing remains one of the most complicated activities they do on a regular basis. Most SMBs today run marketing through a collection of separate tools — CRM systems, email platforms, social ad managers, analytics dashboards — none of which are integrated with their payments and commerce software. Our survey found that 82% of SMBs operate this way. However, this is not how they’d like to run their business: 85% of SMBs said a platform that let them set up and run digital advertising campaigns in ‘one click’ would be somewhat or very valuable. SMBs are overwhelmed with the complexity of running their business and hungry for integrated solutions that can make it easier.

Figure 1: SMB Marketing Stats

(geos include US, UK & Australia)

From Software Providers to Data Powerhouses

PSPs with integrated POS solutions and vertical SaaS platforms with embedded payments functionality are well-positioned to solve this problem for SMBs. They have the hard data on what people actually buy and they are involved in enabling key moments of the customer journey where decisions are being made.

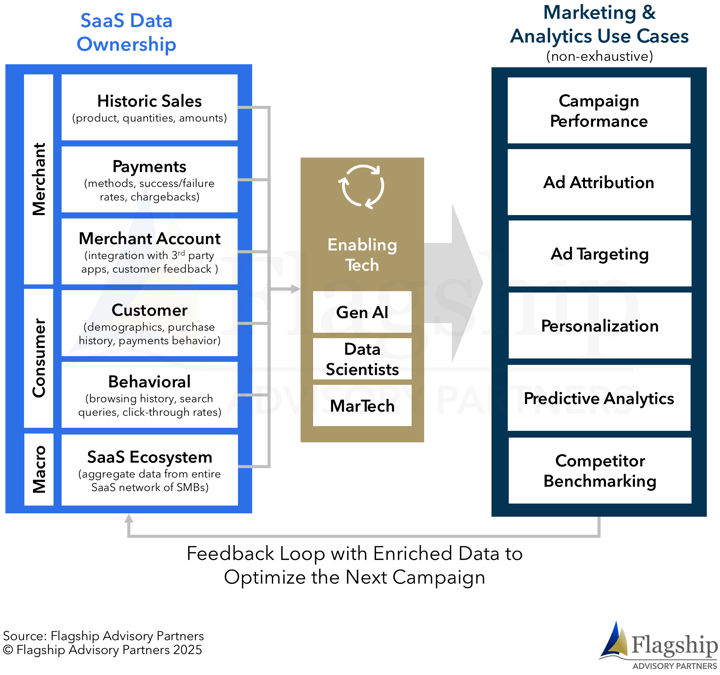

The convergence of business software and payments creates what is arguably the most valuable combination of assets in the commerce ecosystem: sales data from merchants, demographic data from buyers, and payments data from transactions. Together, this data paints a detailed picture of customer behavior and purchasing patterns — a picture that standalone marketing tools simply cannot match. It is precisely this combination of data that enables targeted, effective marketing at scale.

Embedded payments are no longer a niche play for a handful of companies. Today, 90% of vertical SaaS platforms have embedded card payment acceptance into their software, and more than half of SMBs in sectors like travel, gig economy, food & beverage, and beauty & wellness actively use the embedded payment product offered by their SaaS platform, according to a January 2025 ISV survey by Flagship Advisory Partners. At the same time, payment providers serving in-person commerce have deployed more than four million smart and cloud POS systems to SMBs. The convergence of software and payments has already happened both online and in-person.

Figure 2: Penetration of Embedded Card Acceptance by Vertical

(% of SaaS clients using the embedded card payment acceptance product, select verticals)

The “Secret Sauce” for Marketing Performance

The integration of the complementary data elements mentioned above is the “secret sauce” for simplifying digital marketing and driving more effective marketing campaigns. Without it, marketing remains largely guesswork for SMBs, who must rely on generic audience targeting and incomplete insights. With it, campaigns can be triggered by actual purchase behavior, personalized offers can be delivered to the right customers at the right time, and advertising budgets can be directed toward audiences most likely to convert. This is before even factoring in the powerful network effects created by hosting thousands of SMBs on a single platform.

We have already seen the value of this approach in the hundreds of commerce media networks launched by large retailers. In a commerce media network, advertisers can leverage a retailer’s proprietary data and channels (e.g., website, app, in-store displays) to better target ads. (A form of this concept exists in the payments world, too, through card-linked offers programs powered by vendors like Cardlytics and more sophisticated, recent initiatives like Chase Media Solutions and PayPal Ads.) More than $100 billion of ad spend is expected to flow through such networks by 2026. PSPs and vertical SaaS platforms can apply the same model to their SMB customers, unlocking profitable growth for merchants and new monetization streams for the platform.

Figure 3: SaaS Data Ownership & Marketing Use Case Examples

Closing the Gap in Marketing Capabilities

Today, few PSPs or SaaS platforms offer truly sophisticated digital marketing capabilities. There are some that offer basic tools such as punch card-style loyalty programs, email templates, and simple reports; for more advanced needs, such as real targeting or performance analytics, SMBs still must turn to third-party solutions. But, as we mentioned earlier, 85% of SMBs said a platform that let them setup and run digital advertising campaigns in ‘one click’ would be somewhat or very valuable. 90% of SMBs said they would share their payments data to enable these services and 45% said they would pay for them.

The gap between what is offered today and what SMBs want represents a substantial whitespace. PSPs and SaaS platforms that fill this gap are well placed to capture a share of the $455 billion SMBs already spend annually on digital marketing ($429B in the US1 , $21.5B in the UK2, $4.7 billion in Australia3), while strengthening merchant loyalty and retention in the process.

Figure 4: Benchmarking of Marketing & Data Analytics Offerings

(select SaaS/ PSP solutions, proprietary solutions)

Bringing It All Together with AI

Sales and payment data can help define the right audiences. Integrations between PSPs (or vertical SaaS platforms) and ad platforms like AdWords can make it easier to share that data. And campaign templates can make it easier to configure an ad campaign. But how do you truly make effective digital advertising a one-click experience?

AI is the missing piece that can unlock the full potential of payments and sales data for SMB marketing. Generative AI can be used to automatically suggest the right audiences, generate personalized content, and even recommend the optimal budget allocation. AI can also close the loop on measurement and iteration by digesting performance data, highlighting what worked (or didn’t), and instantly suggesting refinements for the next campaign. All of this effectively democratizes access to the sophisticated marketing capabilities that only large companies could afford in the past.

The most sophisticated platforms have already started to put AI to work in their SMB marketing solutions. Square Marketing built an OpenAI-assisted copy generator into Square Online in 2023. This tool can help write marketing emails for SMBs along with other creative capabilities (e.g., menu generation, photo enhancement, website copy generation, etc.). In early 2024, GoDaddy launched GoDaddy Airo, an AI-powered suite of tools designed to help small businesses establish and grow their online presence. Airo offers features like AI-assisted domain name search, logo generation, website creation, SEO optimization, and marketing assistance. In the US, Airo can even assist with automatically setting up a LLC through GoDaddy’s partnership with ZenBusiness. Shopify offers two tools, Magic and Sidekick, that bring the power of AI to SMB digital commerce. Sidekick is an AI digital assistant that can help with domain setup, business insights, and creative (copy and image creation). Magic can help SMBs create the copy and audiences for email marketing campaigns, then analyze performance and iterate on the campaign configuration.

Figure 5: AI Marketing Tool Examples

(select company and product observations)

Conclusion

PSPs with integrated POS solutions and vertical SaaS platforms with embedded payments functionality already sit at the heart of SMB operations. With embedded payments and access to unmatched data, they have the tools to transform marketing from a fragmented chore into a powerful growth engine. Those who act now, sequencing payments first and marketing next, will be best positioned to own the future of SMB growth.

Please do not hesitate to reach out to Elisabeth Magnor at Elisabeth@FlagshipAP.com in Europe, Ben Brown at Ben@FlagshipAP.com in North America, or Abigail Karl at Abby@Flagshipap.com with any questions.

[1] SMBs spend $620B on marketing services, according to Intuit, and 67% of SMB ad budgets are spent on digital channels, according to the Connected Commerce Council

[2] SMBs accounted for 45% of the £35.5B in overall digital ad spend in the UK, according to IAB

[3] SMBs accounted for 44% of the $16.4B (AUD) in overall digital ad spend in Australia, according to IAB Australia