US-to-Europe and Europe-to-US are popular corridors for fintechs seeking to expand geographically due to the huge size of the markets, regulatory uniformity with the region, cultural similarities, and market maturity levels. Roughly half of the top 50 European fintechs have expanded to the US, and Europe is typically the first stop for U.S. fintechs looking to broaden their geo footprint. Flagship frequently advises both European and American fintechs on global expansion, and therefore we summarize below the key differences between the regions and key considerations for fintechs seeking to expand from Europe to the US, and vice versa.

A2A Significantly More Advanced in Europe

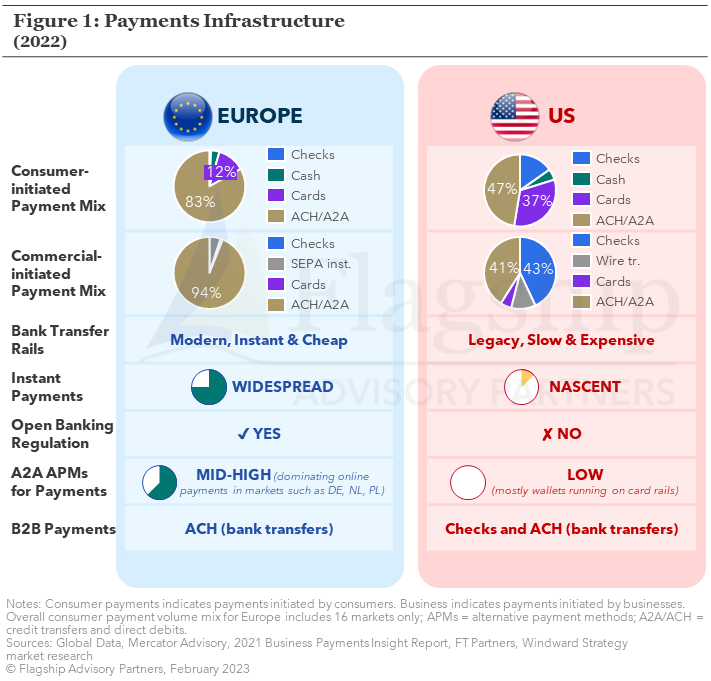

Europe has significantly more modern, open, fast, secure, and efficient account-to-account bank payments/transfer network rails than the U.S. (which we abbreviate to “A2A”, although it is typically referred to as “ACH” in the U.S.). This pronounced difference is due in large part to intense efforts by European regulators and governments to create a robust payments infrastructure and open the market to competition by non-banks (and arguably, with the subtext of creating competition to Visa and MasterCard). This has several key implications:

- For US fintechs considering entering Europe:

- Approach European market entry with a more holistic mindset (namely, that payments does not equal just cards), and recognize that A2A payment rails are both meaningful competitors to cards, and that they introduce new, sizable growth opportunities; and,

- Learn from the European experience to identify domestic growth opportunities in the home (US) market as the US transitions to its own A2A instant payments infrastructure (e.g., FedNow).

- For European fintechs considering entering the US:

- Identify how to leverage experience and capabilities with A2A in Europe to penetrate and win in the massive US market, while the US is still in the early days of building out its A2A instant payments infrastructure.

On the other hand, the US has a more developed cards market than Europe, buoyed by heavy usage of credit cards (due both to Americans’ affinity for borrowing on cards, coupled with generous rewards enabled by high, unregulated interchange rates) and commercial and virtual B2B cards (driven in part by the relatively lower quality of the US ACH infrastructure for B2B payments). This also has several key implications:

- For US fintechs considering entering Europe:

- Look for opportunities to leverage capabilities and expertise with credit cards into Europe (recognizing that interchange is significantly lower at 0.30%); and,

- Leverage commercial and virtual card capabilities in Europe to get out in front of the forthcoming growth wave in commercial and B2B virtual cards.

- For European fintechs considering entering the US:

- Build solutions (or partnerships) for credit cards to at least meet the table stakes for success in the US cards market.

Other key differences are summarized in Figure 1 below, but also include:

- Paper checks are still a sizable means of payment in the US, particularly for B2B payments (therefore creating massive opportunities to shift these payments to A2A and commercial/virtual cards); and,

- Online Alternative Payment Methods (“APMs” such as iDeal in The Netherlands, etc.) are significant in Europe, and in many cases, stronger products than cards for remote commerce, whereas in the US, APMs primarily function as wallets that hold cards (e.g., PayPal).

Credit and Interchange Drive a Vibrant Cards Market in the US

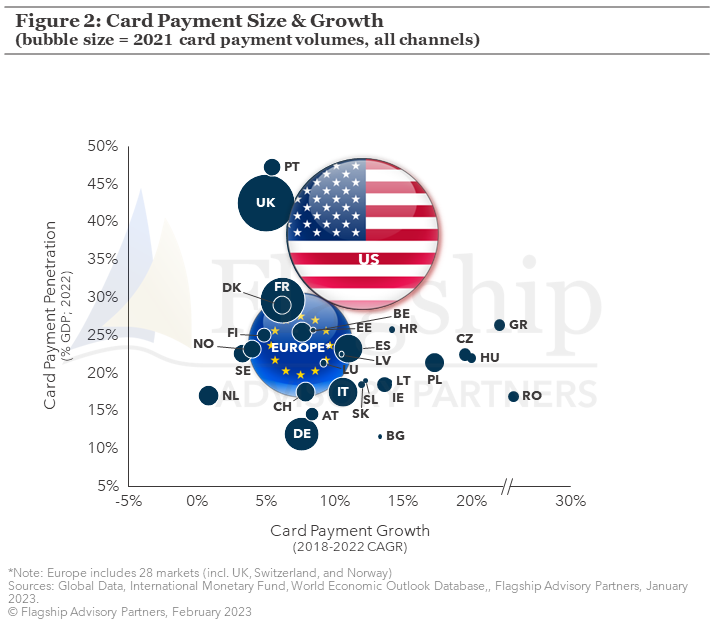

The US is the second largest cards market in the world as measured by spend, with $9.6 trillion in card volume (2022), nearly double that of Europe. Card volumes have grown faster in the US than in Europe during the past 5 years, primarily driven by growth in e-commerce (see Figure 2).

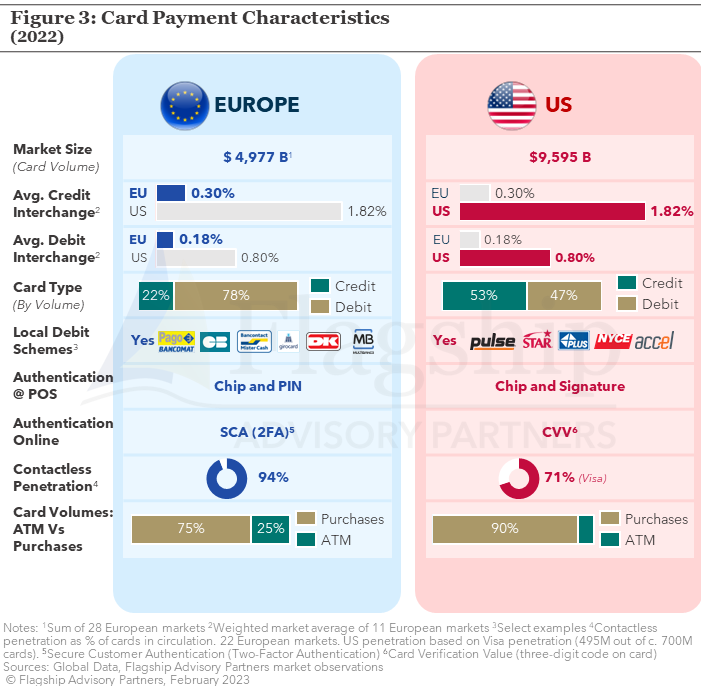

Americans are heavy users of credit cards (53% of total cards volume is on credit cards, vs. 22% in Europe). Part of this is due to a cultural affinity for using credit cards as a borrowing vehicle, whereas in many European countries, consumers perceive revolving credit as either confusing and/or less palatable than installment loans or overdrafts.

Another contributor to the massive US credit card market is significantly higher interchange rates than in Europe, which issuers use to fund aggressive rewards and cashback propositions to encourage consumers to use their credit cards, which (from the issuers’ perspective) creates a virtuous “flywheel” effect.

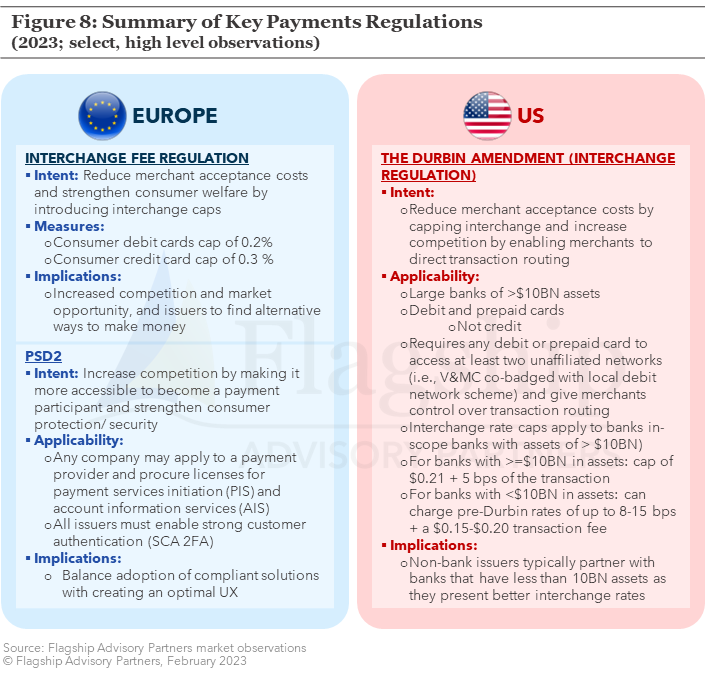

European regulators have been aggressive in seeking to reduce merchant acceptance costs, and via the Interchange Fee Regulation in 2015-2016, capped intra-EU consumer card interchange at 0.20% for debit and 0.30% for credit (with exclusions for commercial cards, three-party schemes, and closed loop schemes). Regulation of interchange effectively killed card-based reward schemes in Europe, leading to steep declines in many issuers’ credit card portfolios.

Most have never recovered, and subsequently, European issuers have limited investment in credit cards (and in many respects, cards in general), leading to a lack of innovation in the cards market and creating openings for other payment and financing means, such as Buy Now, Pay Later (“BNPL”) to exploit.

US debit card interchange is already somewhat regulated (summarized in Figure 8). Were US credit card interchange ever to be regulated, Europe serves as a highly relevant, cautionary case study for American issuers.

There are other key differences in the US vs. European card markets with implications for fintechs considering entering either market, which we summarize below:

- For US fintechs considering entering Europe:

- As noted above, interchange rates are significantly lower, meaning US economic models that rely on high interchange (e.g., program management) will require other economic levers;

- Debit is much more relevant in Europe, and in many cases, leaning too heavy on a credit card-based proposition will effectively cut out large parts of the target market;

- European regulations (PSD2) require Strong Customer Authentication, typically implemented in the cards world as 3D Secure, which results in technical requirements and UX challenges in the online checkout;

- In several markets, domestic debit schemes are relevant, and to be successful on a broad basis, require localization and local switch connections, which is a big lift given fragmentation in the markets (although this localization is not always required, and is highly dependent on the target customer base and use cases);

- Cash usage is still highly relevant in key European markets (e.g., Italy, Germany), and many ATMs do not surcharge, but acquirer DCC is widespread, eating into issuers’ FX margins;

- European consumer credit, small business, and commercial card propositions are typically less sophisticated, creating significant opportunities to win via innovation.

- For European fintechs considering entering the US:

- While the US market is huge and the economics are massively attractive, the market also has large, highly sophisticated competitors, requiring EU fintechs to think deeply about product and GTM strategies that will create a right-to-win;

- Credit is a must-have for long-term success;

- Regulations require debit card issuers to co-badge cards with at least one domestic “PIN” debit scheme, which use single message transaction protocols (as opposed to the dual message used in Europe by regular Visa and MasterCard);

- 3D Secure is in many cases a non-starter for US customers from a UX perspective, therefore fraud detection and management capabilities may require significant upgrades;

- Contactless terminal penetration and therefore usage of Apple Pay and Google Pay is significantly lower; and,

- US cards verification at the POS for non-contactless transactions is “chip and signature” compared to “chip and PIN” in Europe.

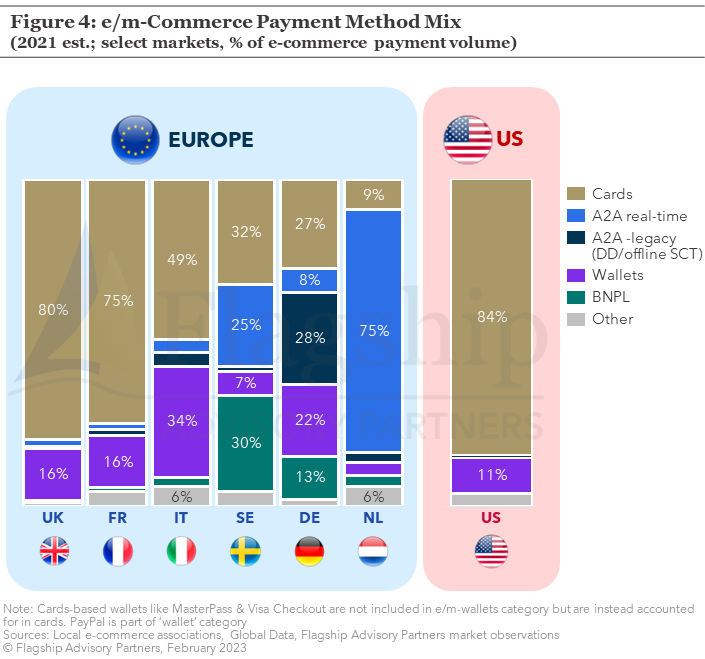

Online Payments: Cards in the US, APMs in Europe

Cards (and card-funded wallets such as PayPal, Apple Pay, and Google Pay) are the dominant online payment method in the US due to speed (vs. ACH) and easy user experience (as 3D Secure is not mandated). Cards are well entrenched, but we do, however, anticipate some fintech disruption in the future, see this article. In Europe, we observe significant variation in preferred online payment methods across markets. Many account-to-account (A2A) based alternative payment methods (APMs) have gained significant traction in their home markets; iDeal in the Netherlands, Swish in Sweden, and Blik in Poland to name a few. These APMs offer a superior UX than cards in an online environment (since the PSD2 regulation in Europe requires the use of Strong Customer Authentication, and the 3D Secure implementations are typically clunky), which has been the primary driver for their widespread adoption. In markets like the Netherlands, Sweden and Poland, card penetration online is therefore low. In countries where no major APM has gained traction, cards and card-funded wallets remain the key online payment method (e.g., UK, France, and Spain). We illustrate the e-commerce payment mix in Figure 4 below.

Significantly Higher Payment Acceptance Costs in the U.S.

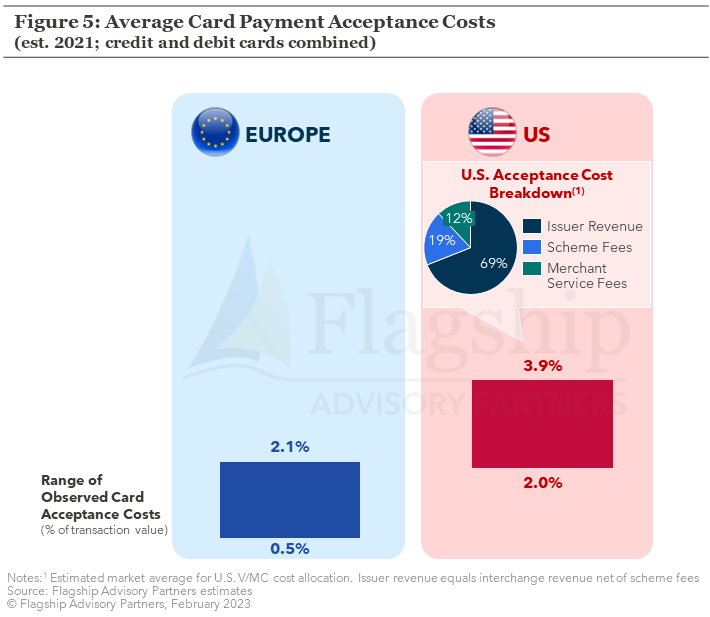

As interchange and scheme fees are passed by acquirers on to merchants (who then adjust pricing towards the end consumer), and as noted above, interchange rates in the US are far higher than in Europe, the cost of payment acceptance in the US is far above European averages (see Figure 5). As we discuss in this article, a winning strategy in the US for card schemes has long been to introduce new, more expensive interchange categories, and increase merchant acquiring scheme fees in order to fund incentives for issuers. Increased cost of acceptance in the US has given rise to some merchants implementing cash discounting (sticker price is ‘default’ credit card payment and consumer receives discount by paying in cash), and surcharging (sticker price is ‘default’ cash payment, and merchant charges additional fee for cards). In Europe, it was common for merchants to surcharge for more expensive payment methods (such as credit cards) to drive consumers to select a cheaper payment method prior to 2018, after which Europe ruled that no surcharges were allowed.

Significantly different usage of payment methods and cost of acceptance has several implications:

- For US fintechs considering entering Europe:

- Cards are not the only game in town in e/m-commerce, and APMs are often more competitive from a UX and cost perspective; and,

- 3D Secure is effectively required for card issuers, and due to many links in the chain, points of failure are unfortunately common, requiring issuers to innovate to improve the UX, as we discuss in this article.

- For European fintechs considering entering the US:

- Cards are (for now) the only game in town in e/m-commerce, and due to lack of 3D Secure, issuers need sophisticated fraud management tools to manage risk; and,

- Leveraging European A2A and APM know-how coupled with nascent instant ACH payments in the US is likely to reach a receptive audience among US merchants, who have strong rationale to explore alternative, lower-cost payment methods that they can embed into their apps and loyalty programs.

B2B Payments: Huge Upsides in Both Markets

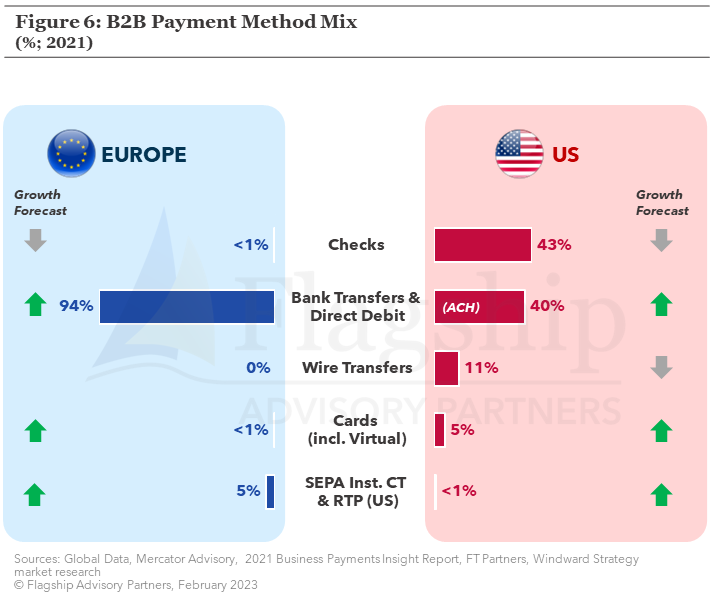

B2B payments in the US are characterized by the ongoing usage of paper checks and invoices; more than 40% of B2B payment volumes are via traditional checks. This is (again) mainly due to the legacy ACH system which has not yet been fully replaced/updated for real-time, rich-data payments. US businesses still issue and accept massive volumes of checks, making various forms of check digitization (typically via conversion to ACH transactions) and processing a critical service within the domain of B2B payments. Commercial and virtual cards have grown massively in the US, due to the ease of use, speed, control, and data richness that checks and ACH lack.

In contrast, European A2A bank payments infrastructure is often real time, data-rich, and low cost. Virtually all European B2B transactions flow through these bank payment rails, with low usage of alternative payment networks or value-added services. We contrast these differences in payment mix in Figure 6 below. Key implications are:

- For US fintechs considering entering Europe:

- Europe will experience a similar wave of growth in commercial and virtual B2B cards as in the US, since despite the much better A2A infrastructure, it is still geographically fragmented, cards offer richer data, and there is no limit on the size of the transaction (some European A2A schemes are not instant above certain amount thresholds). European banks and issuers tend to have relatively less sophisticated commercial card offerings compared to their US counterparts (or none at all), creating an opportunity for US commercial card players to get ahead of the forthcoming growth wave in Europe.

- For European fintechs considering entering the US:

- The US B2B payments opportunity is huge. European players, with relatively more experience and capabilities in A2A and cross-border payments, can get ahead of the growth curve on the digitization of US B2B payments. However, physically doing so requires a bank sponsor (see below), which introduces complexity, time, and an extra layer of cost into the implementation process.

Meaningful Differences in Licensing and Regulations

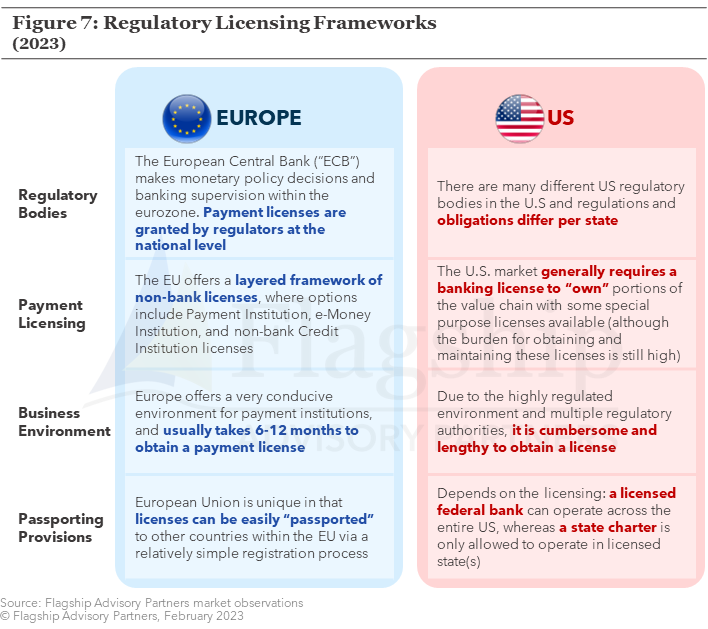

Both Europe and the US are similar in the sense that there are some licensing aspects that impact the entire region, while individual state (US) and country (Europe) nuances remain. We summarize this in Figure 7 below, but at the risk of over-simplification, there are a few key takeaways:

- For US fintechs considering entering Europe:

- Unlike in the US, you do not need to literally be a bank to issue or accept payments. Europe has (relatively) easy-to-obtain non-bank licenses (although how easy varies by country) that can then be passported around the European Union. Picking the right country to obtain a license from is critical, as some national regulators are significantly more burdensome than others;

- The UK is no longer in the European Union, so separate licenses are required, although the structure is very similar; and,

- While this license passporting provides the ability to issue or accept payments in multiple countries, entities must still comply with local regulations in each country. These are mostly harmonized, but there can be meaningful variations;

- There is a relatively low supply of BIN/license sponsors compared to the US, but because they are not (typically) banks, the regulatory overhead burden is lower than in the US.

- For European fintechs considering entering the US:

- You literally need a bank license to issue or accept payments in the US. Generally, a “federal” bank license is preferred as it can passport regulation across states;

- Therefore, while some state regulations are relevant, such as in the credit space, using a federal bank license effectively allows providers to ignore individual state regulations. Therefore, the US regulatory environment can actually be much more uniform than in Europe. European fintechs should not be needlessly confused about state regulations if they are only processing payments since these federal bank charters make the issue largely irrelevant. State laws are however still relevant for data privacy and other issues outside of pure payments;

- There is a good supply of banks that offer BIN/license sponsorship, although the compliance work required from the entity being sponsored is significantly higher than in Europe (as US bank sponsors expect clients to staff a full compliance team and be very buttoned up).

On the regulatory front, there are also significant differences:

- For US fintechs considering entering Europe:

- As noted above, interchange in Europe is far lower (capped at 0.2% for consumer debit and 0.3% for consumer credit), requiring different economic models for card issuing;

- The PSD2 regulation requires Strong Customer Authentication, which for cards is typically implemented by 3D Secure, which as noted above often results in a poor UX; and,

- PSD2 also requires various disclosures of FX rates that typically require technical development.

- For European fintechs considering entering the US:

- The Durbin Amendment regulation imposes interchange caps on debit and prepaid cards and is applicable for banks (as only banks can issue cards in the US) with assets over $10 billion. Companies who wish to issue cards and want to avoid interchange caps therefore must select a bank sponsor with assets of less than $10 billion;

- The Durbin Amendment also requires debit and prepaid card issuers to support a second non-Visa/MasterCard network, meaning in practice one of the US domestic “PIN” debit networks. As noted above, these networks use single rather than dual message transactions, and there are a variety of operational and technical considerations to supporting additional networks (e.g., additional settlement, reconciliation, and chargeback processes, new sets of mandates, etc.).

Closing Remarks

For many European and American fintechs, crossing the pond is a logical first step in a geographic expansion strategy. The markets are huge, with many similarities, and are (comparatively) relatively easier to enter than other regions such as APAC, LatAm, or MEA (although those regions have arguably higher growth). That said, there are also meaningful differences between the two regions, and several nuances that preclude a simple “take what we do here and also do it there” strategy. While most fintechs admirably seek to maintain a global, uniform platform, the degree of localization (both on the product, GTM, and technical fronts) should not be underestimated. In Flagship’s experience, none of these localization/market entry issues are insurmountable, and the market opportunity is often highly attractive, but the process (like most growth levers) requires careful construction of the vision and roadmap for entering the new market, along with careful planning and strong execution.

Please do not hesitate to contact Erik Howell at Erik@FlagshipAP.com or Elisabeth Magnor at Elisabeth@FlagshipAP.com with comments or questions.