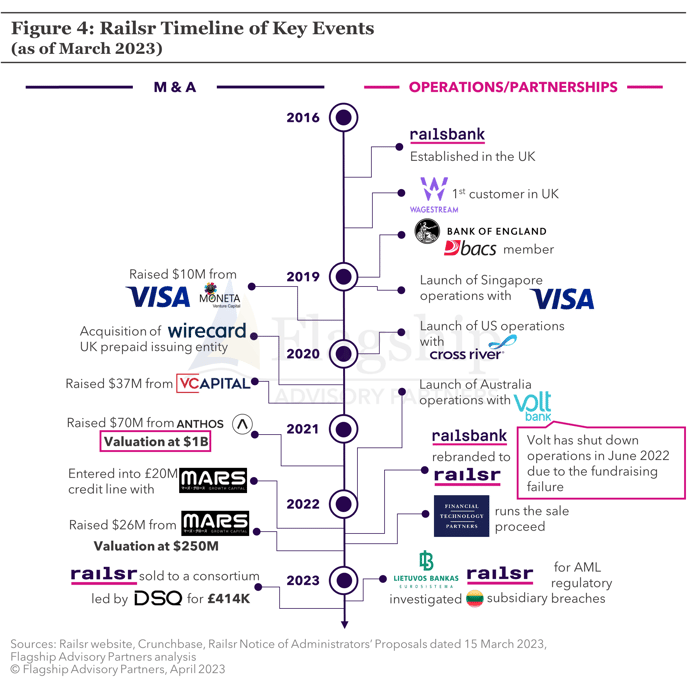

The struggles of Railsr, a former fintech unicorn that raised $187 million and was one of Europe’s most visible Banking as a Service (“BaaS”) providers, have been well documented. Once valued at $1 billion in 2021, Railsr was sold in a prepackaged bankruptcy to a consortium of investors and management for $500,000 plus up to another cca. $500,000 in trailing collected receivables. In this article we summarize key highlights from the bankruptcy filing documents and identify lessons learned.

Background

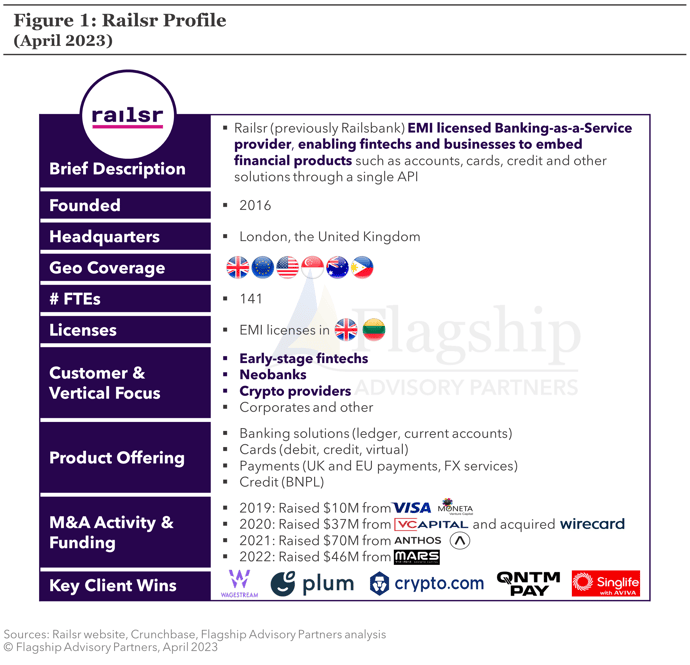

Railsr (formerly branded as Railsbank) is a partial BaaS provider that holds EMI licenses in the UK and Lithuania and provides a relatively broad offering of banking, card issuing, account-to-account (“A2A”) payments, and credit products to fintechs and corporates via APIs to enable clients to embed payments and banking products into their end-user facing apps and use cases (see Figure 1 below). Although primarily focused in the UK and Europe, Railsr also has a presence in APAC and the US, and reports that its clients service over 5 million end users.

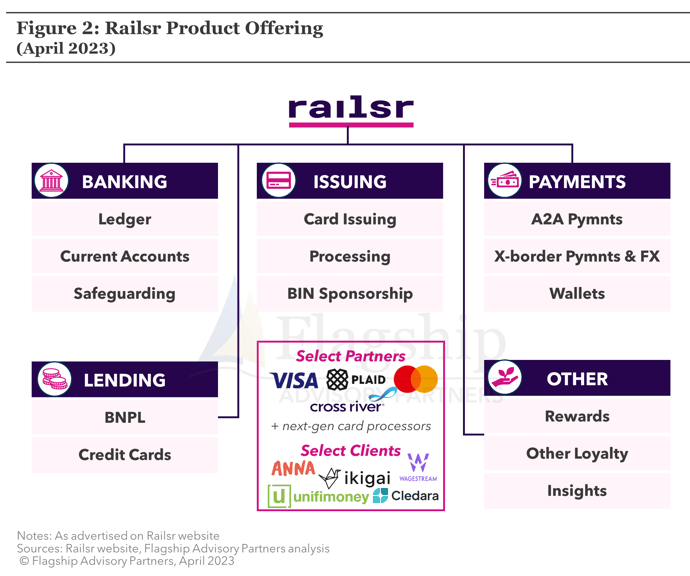

Railsr promotes its BaaS platform as providing a turnkey, vertically-integrated stack that offers a broad range of embedded financial products (see Figure 2 below):

Railsr promotes its BaaS platform as providing a turnkey, vertically-integrated stack that offers a broad range of embedded financial products (see Figure 2 below):

- Banking: current accounts, open banking, ledger transfer and safeguarding of assets

- Cards: BIN sponsorship, issuance of virtual and physical cards (debit, pre-paid, credit)

- Payments: A2A, X-border and FX transactions, mobile wallet

- Lending: credit facility solutions such as BNPL and Debt Funding

- Others: Embedded rewards, capabilities to promote customer loyalty, data-driven dashboards and insights

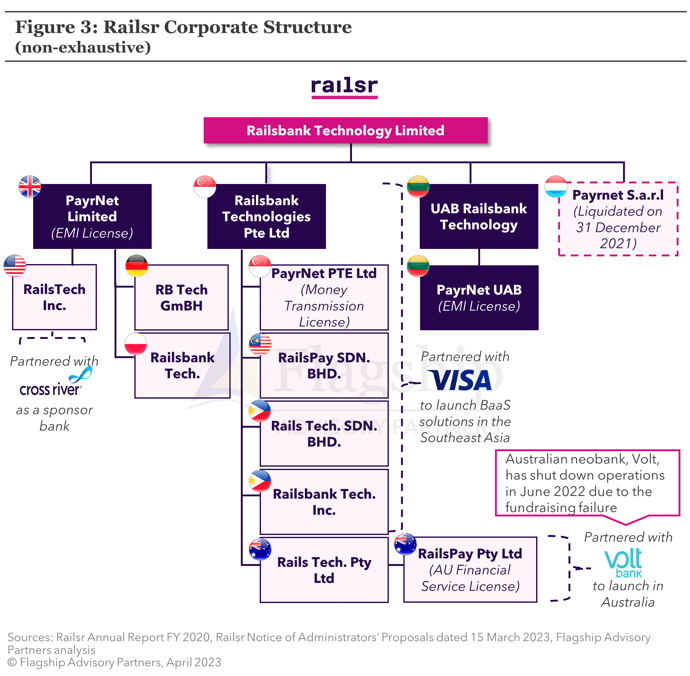

Like many BaaS providers, Railsr has signed multiple vendor and partnership agreements with processors, product vendors, payment networks, and sponsor banks to enable its offering, and to enter new markets (see Figure 3 below). Not all of these have been successful; e.g., Australian launch partner Volt ceased operations, and Railsr’s Lithuanian subsidiary, from which Railsr sources its European Union E-Money license, has compliance challenges.

Since its founding in 2016, Railsr embarked on an ambitious product and geo expansion roadmap (see Figure 4 below). In August 2020, Railsbank acquired the UK arm of troubled Wirecard Card Solutions, which as a much bigger business that Railsr at the time, caused many commentators to speculate if the acquisition was simply too big and/or too troubled to successfully integrate.

Financial Position

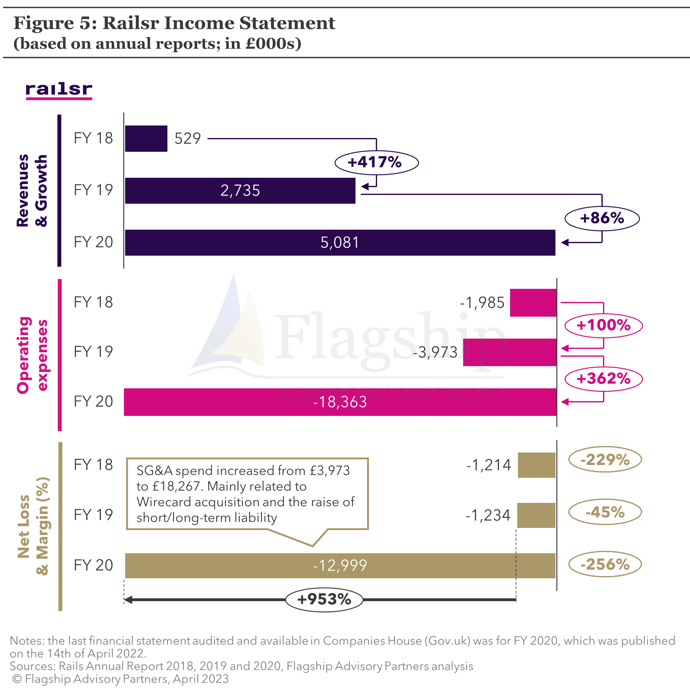

Railsr raised more than $185 million from multiple investors, and reported a valuation of $1 billion in July 2021. As market conditions became increasingly challenging, Railsr’s financial situation deteriorated. Although Railsr exhibited impressive revenue growth, expenses ballooned following the Wirecard acquisition, resulting in net losses increasing from £1.2 million in 2018 and 2019 to £13 million in 2020 (see Figure 5 below).

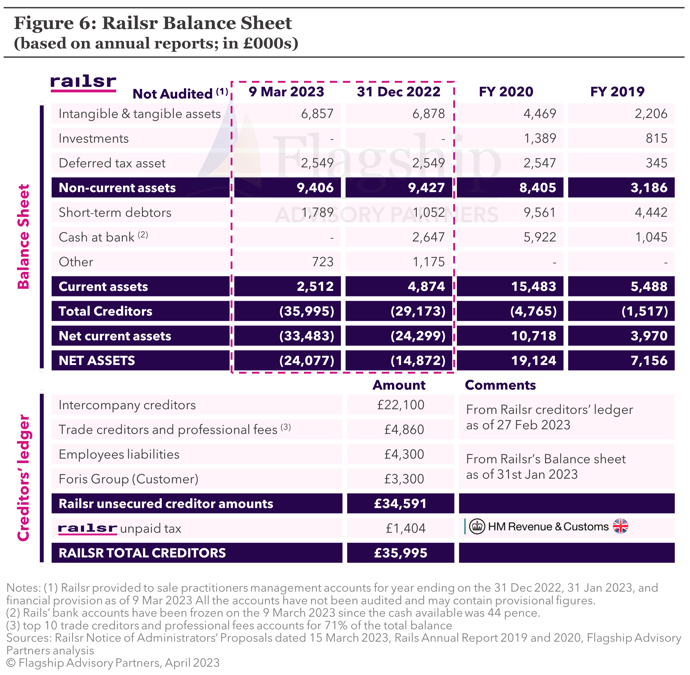

Although financial statements for 2021 are not available, analysis of bankruptcy filing documents shows a resulting massive decline in net assets between 2020 and 2022. By the end of 2022, Railsr was insolvent, and that gap increased by a further ~£10 million over the next 3 months (see Figure 6 below).

As of the reporting date of Railsr’s bankruptcy documents (9 March 2023), the company owed £36 million to creditors, including:

- £22.1 million to subsidiaries within the Railsr Group

- £4.9 million to trade creditors (the top 10 creditors account for 71% of the total balance)

- £4.3M in employee liabilities

- £3.3M to Foris, a customer

- £1.4M in tax payable to the UK Authorities

Sale

In the summer of 2022, Railsr engaged FT Partners to run a sale process. According to the bankruptcy filing, FT Partners approached 248 strategic and financial investors, but was unable to find an attractive buyer. D Squared Capital, a London-based financial investor, emerged as the preferred buyer in February 2023, after finalist Flutterwave, a Nigerian fintech unicorn, pulled out (according to market commentators).

On 8 February 2023, the sale to D Squared was blocked due to Railsr’s Lithuanian subsidiary, UAB PayrNet, being investigated for alleged AML regulatory breaches and terrorist-financing laws by the Bank of Lithuania, which prevented the subsidiary's customers from onboarding new end users. On 20 February 2023, Railsr management decided to run an accelerated sales process by re-engaging with D Squared and four prior bidders, and requested new offers within 1 week. The other bidders declined to submit offers, leaving D Squared as the only bidder.

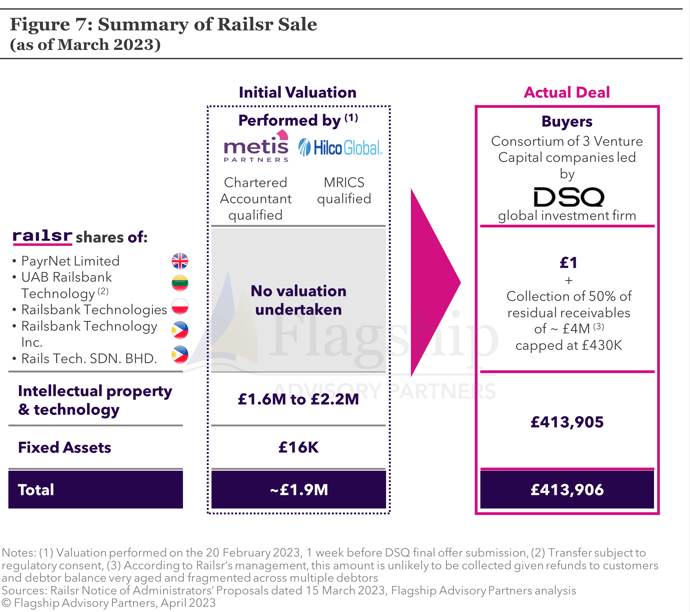

On 9 March 2023, Embedded Finance Limited (a consortium of D Squared, Moneta Venture Capital, VCapital, and other investors) acquired Railsr as part of a pre-packaged bankruptcy (see Figure 7 below). Railsr was acquired for $500,000 (approx. £413,906) compared to a third party valuation of the IP, tech, and fixed assets of ~£1.9 million.

Additionally, the buyer will return to creditors 50% of collected receivables (total estimated at £4 million) up to a cap of £430,000. According to Railsr’s management, between £1.9 million and £4 million of these outstanding receivables are likely uncollectible.

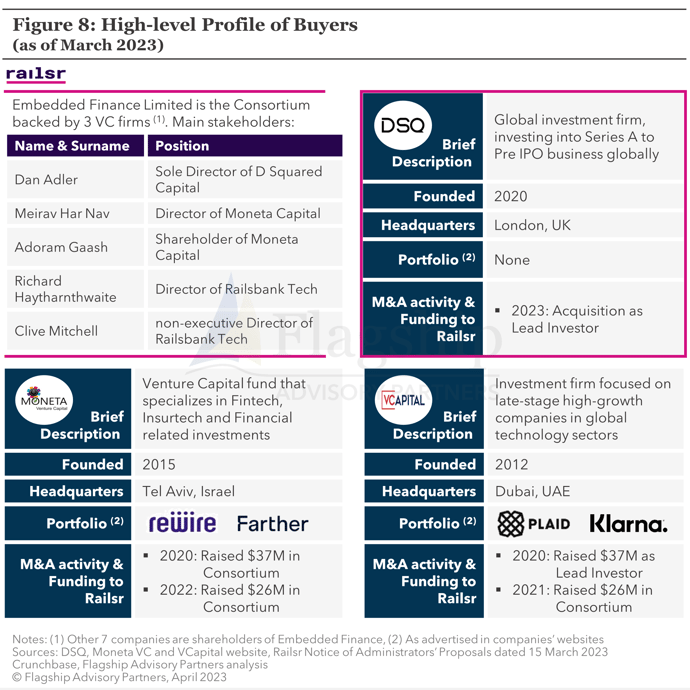

Notably, Railsr’s buyer, Embedded Finance Limited, is a consortium of 10 investors – (see Figure 8 below) that includes several former backers (Moneta Venture Capital and VCapital) and former management (Clive Mitchell, Railsbank co-founder, and non-executive Director of Railsbank Tech, and Richard Haytharnthwaite, Director of Railsbank Tech).

Key Lessons

Railsr’s bankruptcy reinforces a number of lessons learned for fintechs (noting that these are not necessarily specific to Railsr):

- Particularly in the “as a Service” segment, serving fintechs at large with a broad and/or generic offering is insufficient. Success requires sharp product and vertical focus.

- Aggregating multiple vendors to enable an end-user offering via APIs is undifferentiating. Value creation requires strong underlying tech assets coupled with unique and/or vertically-specific product features.

- Controlling costs and having a firm grasp on unit economics is critically important. As we illustrate in a recent article here, many fintechs are challenged by balancing growth and expense management.

- M&A has the potential to be transformational, but for early or growth stage fintechs, risks being too large and/or distracting to properly digest.

- Geographic expansion requires a well though-out strategy. Following the customer can be effective if the customer’s path accelerates the overall strategic vision, but if done incorrectly, far-flung geographic expansion dilutes valuable effort and resources.

Most importantly, Railsr is only the tip of the iceberg. The combination of adverse market conditions, over-supply in many segments, and challenging cash flows will lead to a wave of fintechs coming to market in 2023 in an effort to stave off bankruptcy. This creates a welcome environment for strategic buyers seeking to acquire strong product, tech, and geo expansion assets at reasonable valuations. For financial investors, 2023 will be an excellent time to acquire bolt-on assets for core portfolio companies, and to acquire new core assets to execute classic expense optimization and go-to-market improvement strategies.

Please do not hesitate to contact Erik Howell at Erik@FlagshipAP.com with comments or questions.