Lost in the e-commerce hype of COVID-19 is the ongoing evolution of the physical point-of-sale (POS) towards next-generation product and service models. Mobile technologies and digital service models have reinvented POS solutions as affordable and easy to use (a major leap from legacy ePOS solutions which are expensive and challenging to deploy or adapt/integrate). We expect the shift towards Next-gen POS to accelerate on the backend of the pandemic when we expect a wave of physical business start-ups, making the present the right time for service providers or investors to position themselves for this wave of growth.

FIGURE 1: POS Product Convergence

What is Next-gen POS and Why is it So Powerful?

There is a broad range of next-generation POS proposition models, and a variety of names that get attached to them (as illustrated in Figure 1). At the low end of the market, mPOS and even pure app-based solutions (‘SoftPOS’) allow any smart phone or tablet to function as a POS device. Small businesses that need dedicated payments hardware now also have access to Android-based payment terminals (‘SmartPOS’), which are enabled for payment acceptance as well as running a range of core commerce software (e.g., a taxi running Uber on an android mini terminal like the PAX A77). Merchants that need superior business management software and often multiple devices are now well served by powerful software as a service (‘SaaS’) kits that include core business software with integrated payments (we refer to these SaaS kits as ‘Next-gen POS’ throughout the remainder of this article). Larger merchants still generally use more customized and componentized solutions delivered by value-added resellers (VARs) and integrators (also supported by mobile technologies).

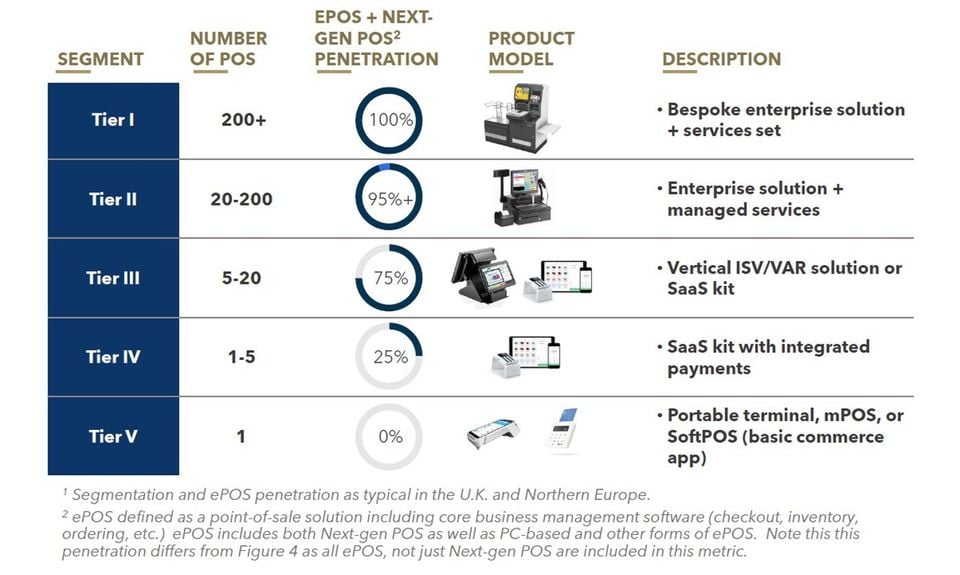

FIGURE 2: Merchant POS Segmentation1

Tier 3 & 4 merchants with 1-20 POS are the sweet spot for Next-gen POS. These merchants want and need business software with integrated payment services, but they do not want to pay for customized solutions. On the low-end of this segment (1 POS), software needs are quite basic. As merchants migrate towards multiple POS or multiple shop locations, the software and hardware need to become more complex. These merchants require vertical-specific software to connect their devices and locations, and to deliver on specific commerce use cases such as table management and online ordering and bookings.

Next-gen POS solutions are built on common mobile technologies, often using Apple iPads as the core platform. iPads have proven to be strong and resilient devices able to withstand sustained usage, particularly when coupled with supporting hardware such as stands and cases. Mobile platforms are also developer friendly environments where integration to other apps or hardware, including payments, is significantly easier than within traditional, proprietary or Windows environments. The use of standard mobile technology also greatly reduces the cost of Next-gen POS solutions. Traditional ePOS often carries price points of c. USD 5,000 plus monthly costs, while Next-gen POS can be procured for only USD 40-100 / month (with options to purchase hardware outright). Next-gen POS can be deployed without physical set-up, greatly reducing the costs for customer acquisition and enablement. Whereas traditional ePOS solution developers rely on VARs to distribute and deploy and service their solutions, Next-gen POS providers are focused on digital and multi-channel marketing supported with remote sales and servicing departments.

Who is Best Positioned to Win the Next-gen POS Market?

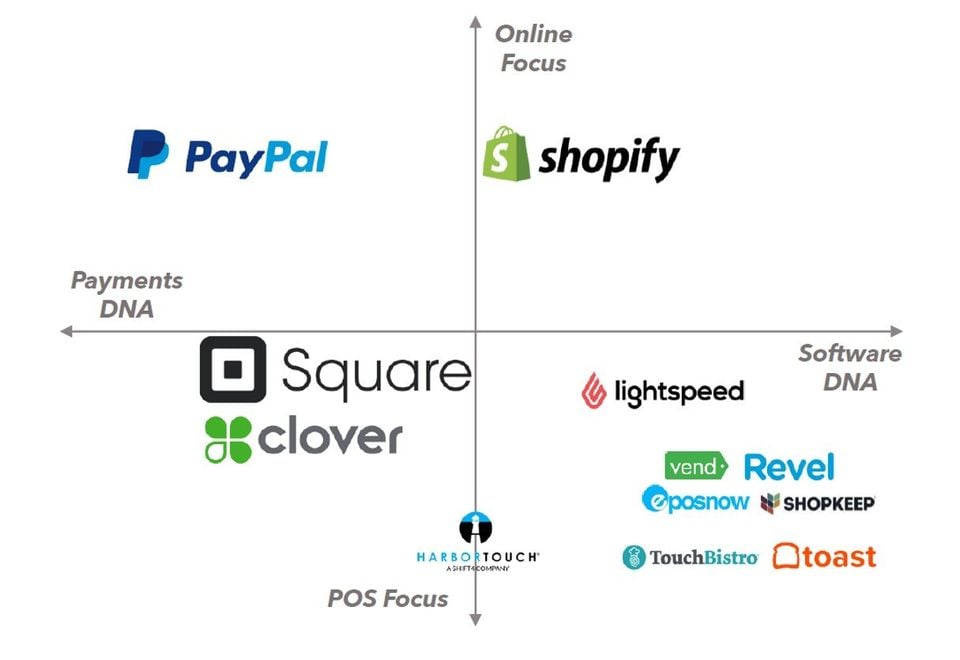

There are two distinct groups of companies addressing the Next-gen POS market: 1) providers with payments DNA and 2) providers with software DNA. The payments-DNA group of suppliers is led by Square and Clover (a Fiserv company). The software-DNA group of suppliers is more fragmented and characterized by high-growth SaaS companies such as Shopify and Lightspeed. In the U.S. market, the payments-DNA suppliers have already achieved impressive scale (c.>500,000 POS each, excluding mPOS). Within the software-DNA group, most providers have fewer than 50,000 POS enabled in the market, although the pre-COVID growth rates for these providers was impressive.

Figure 3: Supplier Landscape for Next-gen POS

Source: Flagship market observations

We do not view Next-gen POS as a ‘winner takes all’ marketplace; we expect many winners in the market. However, there are clear scale advantages (success is based on cost-to-acquire and cost-to-serve efficiencies) and we do expect winners to achieve meaningful scale in the relative near-term. Both payments-DNA providers and software-DNA providers have achieved meaningful scale in the U.S. market. Europe is somewhat less developed, with no Next-gen POS supplier enabling more than 25,000 POS as of today.

Software-DNA and payments-DNA providers position with different advantages in the market. Software-DNA providers have more advanced software, which is generally tailored for specific segments. These software-DNA providers also tend to be better at integrating adjacent software services such as loyalty, accounting, or HR services. Software-DNA providers position best with merchants operating multiple points of sale, where more advanced, sector-specific software is required.

Payments-DNA providers are better at serving smaller, single location merchants who have basic software needs. These providers are highly effective at monetizing smaller merchants and driving distribution scale with a range of POS and payments solutions (mPOS, portable payment terminals, tablet solutions, full POS stations). While market leading payments-DNA providers are driving more than one million POS, many of these POS are limited to payment acceptance usage and not the full SaaS usage. Use of the more robust Next-gen POS solutions such as Square Register or Clover Station (including printers, cash drawers, and more sophisticated software) are scaling rapidly which is helping these payments-DNA providers to move up market into the multi-POS segment.

Growth Potential

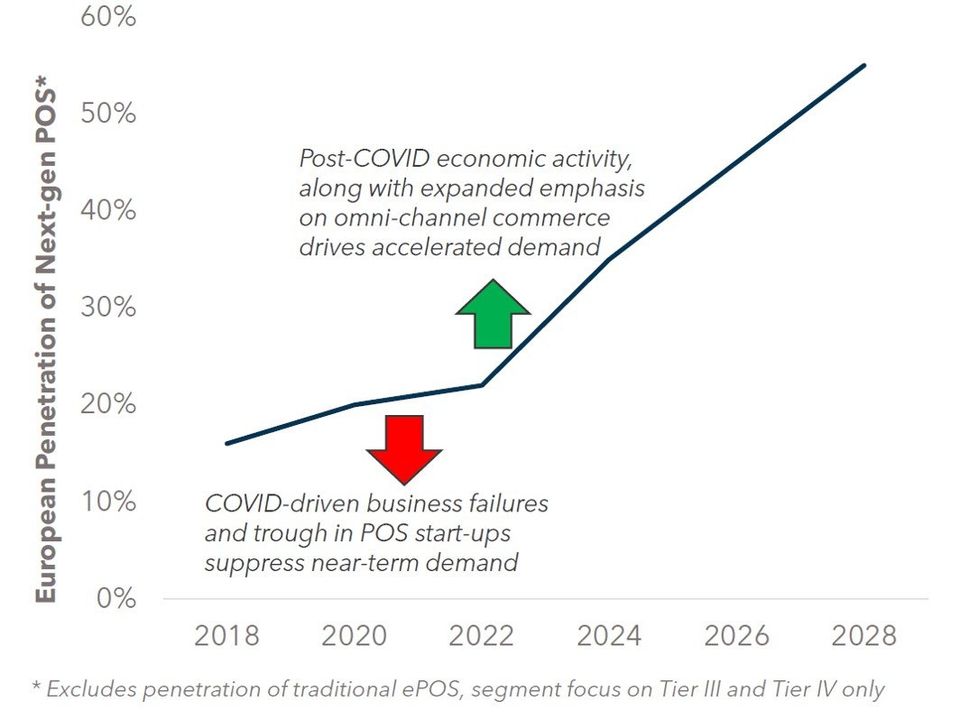

In the U.S., Next-gen POS are highly visible with established scale, but also great ongoing growth potential (software-DNA provider Touchbistro reported a near 100% topline growth in 2019). In Europe, Next-gen POS has low penetration today (c.20%), relative to the potential. COVID-19 is clearly challenging growth in the POS SME segment generally, with low start-up rates and high expected failure rates. However, COVID-19 is also causing merchants to be more focused on omni-channel readiness where Next-gen POS solutions have significant advantages over legacy ePOS. On the backside of the pandemic, we expect a wave of business start-ups, which will drive much of the demand for Next-gen POS. New-to-business merchants are overwhelmingly selecting Next-gen POS rather than traditional ePOS (we estimate 75%) while switching rates for established businesses are much lower given the pain that accompanies a migration of core business software (c.10% annual switching rates).

FIGURE 4: Next-gen POS Growth Potential

Keys to Success

Next-gen POS winners will have to be patient to wait out the near-term impacts of COVID for the wave of demand that will accompany the backend of the pandemic. Beyond this macro-economic and capital patience, we see the following keys to success for winning in the Next-gen POS marketplace:

1. Upselling / cross-selling a small number of highly adjacent SaaS and financial services: Providers such as Shopify and Square enable extensive marketplaces with hundreds of apps. However, Next-gen POS success is not defined by the number of apps in the marketplace as small merchants only use a few applications. Best in class next-gen POS suppliers will be those that are highly effective at marketing and monetizing a select handful of adjacent services such as accounting, loyalty, billing, or working capital loans.

2. Digital, multi-channel marketing: Next-gen POS is a great product because it is far more affordable than legacy ePOS solutions. However, this affordability brings lower customer lifetime values to providers, and business models which are sensitive to cost-to-acquire and cost-to-serve. Winning in Next-gen-POS requires multi-channel marketing feeding remote sales closure. The economics of Next-gen POS generally do not support the legacy VAR distribution models. Worth noting is that traditional payments distribution channels such as banks have also been challenged to adapt to selling SaaS solutions such as Next-gen POS.

3. Remote servicing: cost-to-serve must be highly efficient to drive profitability in Next-gen POS. Market leaders have established servicing models which are highly digital, supporting by inside servicing teams (not VARs).

4. Vertical specialization: winners will be vertically focused, meaning that both software and distribution is tailored to specific sectors such as quick-service food, fine dining, beauty and wellness, etc.

Next-gen POS solutions are redefining the POS market while creating a new class of highly valued SaaS providers and accelerating value-creation for a small number of payments providers who have scaled their position in business SaaS. While COVID-19 has introduced near-term growth challenges in point -of-sale, we expect a massive wave of growth for next-gen POS when the market emerges from the pandemic.

To share your views or discuss those above, please contact Joel van Arsdale at Joel@FlagshipAP.com.