Navigating fintech innovation

Flagship Advisory Partners is a boutique strategy and M&A advisory firm focused on payments and fintech. We serve clients globally and have a team of 40+ professionals who have a unique depth of knowledge in payments and fintech.

Latest Insights

Filter by

Topics & Themes

Topics & Themes

Apply

Clients

Clients

Apply

Type

Type

Apply

Topics & Themes

Clients

Type

Selected:

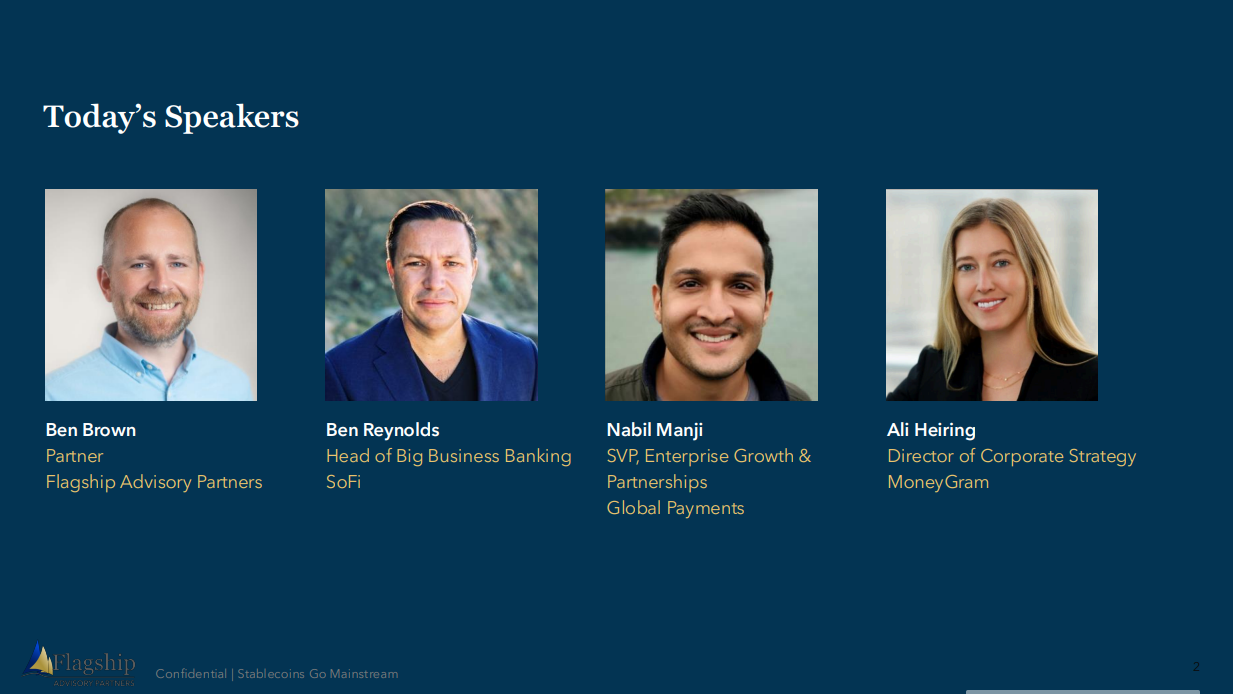

A panel discussion on the stablecoin landscape with Ben Brown (Partner, Flagship Advisory Partners), Nabil Manji (SVP, Head of Fintech Growth &...

Webinar

3 March 2026

Most Read Insights

Anupam Majumdar

Recent Posts

Money 20/20 Europe: What's Next for Payments?

Article

12 Jun 2025

Flagship Advisory Partners recently attended Money 20/20 Europe 2025 in Amsterdam, a pivotal event for the global fintech and payments industry. Our team engaged with key players and emerging innovators, gathering crucial insights into the trends shaping the future of finance. Flagship’s Key Industry Takeaways 1. Stablecoins: Hype vs. Reality Stablecoins emerged as one of the most discussed topics on the conference floor, particularly in the context of cross-border payments. Enthusiasm centers on their potential to serve as a cost-effective and transparent alternative to the often opaque correspondent banking system, especially in emerging market flows. However, key concerns persist around adoption, commercial models, and unresolved regulatory and treasury management hurdles. Questions remain about the heavy reliance on USD-denominated stablecoins, raising issues of monetary sovereignty for the EUR and GBP zones. 2. AI Transforming Product Innovation AI featured prominently across multiple tracks, notably in product innovation (e.g., advanced fraud detection and mitigation of GenAI threats) and operational efficiency (e.g., AI integration into marketing, digital commerce, and internal operations). Recent announcements regarding agentic AI for checkout sparked a wide spectrum of views. While some attendees noted practical deployment challenges and a longer-term horizon, others saw it as a near-term game-changer with transformative potential. 3. Wero - Europe's Sovereignty Play The Wero (EPI) initiative attracted substantial attention, with Europe aiming to strengthen its sovereignty in payments and reduce dependency on USD-backed stablecoins and non-EU wallet ecosystems. Initial rollouts in France, Germany, and Belgium target P2P use cases. Market observers are closely watching how adoption scales, particularly around cross-border functionality and ecosystem incentives. 4. Open Banking: Expanding Beyond Payments While open banking payments progress slowly, fintechs are pushing new use cases—particularly in credit underwriting and fraud prevention—leveraging transactional data for more intelligent decisioning. Visa and Tink unveiled new offerings, and discussions continued around strategies to reduce friction and accelerate adoption. 5. Rise of PayFac-as-a-service models ISVs and SaaS platforms are solidifying their role as vital distribution channels for SMB merchant payments. The growing presence of mature ISVs at Money20/20 highlights their evolution from peripheral players to fully-fledged PSPs and fintechs. 6. All Eyes on Embedded Lending With embedded payments reaching maturity, attention is rapidly shifting to embedded lending as the next frontier. Solutions such as merchant cash advances and invoice financing are gaining traction across both use cases. This evolution is seen as a natural next step to deepen monetization and value capture beyond payments. 7. Renewed Growth Opportunities in Card Issuing The card issuing landscape in Europe has undergone a shift, revealing new growth opportunities after years of underinvestment. Opportunities include enhanced value-added services, embedded payouts within vertical SaaS platforms, and innovative new use cases tailored to evolving consumer and business needs. 8. B2B Payments and the Office of the CFO B2B payments remain a focal point, with embedded fintech use cases within CFO-centric SaaS platforms (e.g., accounting software, accounts payable systems) continuing to gain traction. Upcoming regulatory changes, such as mandatory B2B e-invoicing in some EU markets, are likely to expand the fintech addressable market. Conversations highlighted the growing convergence between CFO software and fintech services, driven by consolidation and cross-domain innovation. 9. Cross-Border Payments Remain a Hot Topic A2A cross-border payment solutions dominated the visual footprint, alongside stablecoin propositions. Leading players like Thunes, TerraPay, Dandelion, and Visa Direct showcased their latest offerings. Financial sponsors remain drawn to the space, enticed by attractive unit economics and ongoing disruption. 10. Private Equity Recalibrates Its Investment Focus PE firms are shifting focus from traditional merchant acquiring—now heavily consolidated—toward emerging fintech verticals. Areas of interest include vertical and horizontal SaaS, B2B payments, fraud prevention, and chargeback management, signaling a broader diversification of investment theses. Flagship Attendees Erik Howell Partner Yuriy Kostenko Partner Anupam Majumdar Partner Will Hay Principal Charlotte Al Usta Principal Dan Carr Principal Please do not hesitate to contact Anupam Majumdar at Amupam@FlagshipAP.com with comments or questions.

perspectiveonkeyevents

financialinvestors

article

Executive Interview Series: Open Banking Payments with Wilko Klaassen, VP Business Development, Klarna Kosma

Executive Interview

18 Nov 2022

Flagship Advisory Partners’ Executive Interview Series provides readers with exclusive insights from thought leaders in the payments and fintech industry. The series offers diverse perspectives on everything from market developments to strategy to commentary on developments in the industry. This edition puts the spotlight on open banking developments in Europe. Flagship Advisory Partners met with Wilko Klaassen, VP Business Development at Klarna Kosma, Klarna’s newly created open banking business unit, to learn more about Kosma’s perspective on developments in open banking and how Kosma is addressing the challenges in open banking payments and data services. Image: Wilko Klaassen, VP Business Development, Klarna Kosma 1. Four years since the open banking regulations were introduced in Europe, how would you assess the market has evolved so far? Open banking has been a revolutionary concept that has democratized the access of A2A payments and data services for regulated third parties. The PSD2 regulations introduced in 2018 provided the early push by setting up a new standard. Since then, the market has accelerated due to wider participation from banks and fintechs. For us at Klarna, open banking began as an exciting journey in 2004 with SOFORT payments. In the early days, SOFORT was in fact one of the early drivers of PSD2 allowing consumers to pay by using bank transfers. Over the years, we have further optimized the user experience, extended our product portfolio, and stayed at the forefront of open banking innovation by constantly improving our services. If you look around today, open banking API services are well established overall, though the quality of bank coverage does differ across markets. You’ll find the quality of APIs and associated data to be great in several Northern and Western European markets, for example, the Netherlands, the UK, and the Nordics. Banks provide good endpoints to access PIS (payment initiation services) and AIS (account information services) in these markets, and we have seen good market adoption here. There are still some markets that are still struggling with API standards and the general quality of data. Therefore, while the market has seen an overall good momentum, the real potential is yet to be realized. 2. Why has open banking payment initiation services (PIS) been slow to be adopted in mainstream e-commerce verticals? A2A bank transfers running through PIS infrastructure have existed successfully as an online payment method in several markets historically. For instance, in the Netherlands, iDEAL is the main online commerce payment method that works on a PIS infrastructure and has enjoyed great success over the last 15 years. In Germany, SOFORT is one of the most important payment methods (amongst the top 3), with an awareness of 94% among consumers. However, if you look at pure PIS services, the volumes in online commerce have been low. Part of this low adoption is the lack of innovation at the front end (where the checkout experiences are driven). A2A bank transfers already existed, and PSD2 which was originally launched to drive innovation failed to make incremental step changes. Also, most of the innovation came through at the backend (e.g., bank API access). We now see some emerging payment use cases that are innovative, for example, the variable recurring payments (VRP) in the UK. Hopefully, these kinds of innovations will drive higher adoption of PIS in online commerce in the future. 3. How has account information services (AIS) taken off? What problems does AIS solve today? AIS (account information services) has been way more interesting and innovative as a market development. AIS provisions data and insights to solve existing gaps across several use cases. For example, mortgage lenders, loan underwriters, and lease companies have traditionally relied on cumbersome paper-based processes to perform customer income and verification checks. Now, most of these parties can use AIS to get real-time data feeds and solve these inefficiencies. We see AIS being adopted in a big way across several industries today, for example, financial institutions, underwriters, credit bureaus, and banks. At Kosma, we have developed a proven AIS product to provision underwriting and account verification use cases for big techs, challenger banks, insurance firms, retailers, lenders, investors, and banks. We also utilize AIS for the underwriting and customer account verification for our flagship Klarna Buy-Now-Pay-Later (BNPL) product. 4. How do you see AIS and PIS evolving in the near future? PIS only allows the initiation of a payment, as such it is only a payment enabler today and not a complete payment solution. You would need to embed several enablers and value-added services (e.g., risk management, reconciliation services, fraud detection, and others) to be functional in online commerce. I think we’ll see an evolution of such services on PIS going forward. I also anticipate some flexibility to come for PIS, e.g., expansion into recurring payments via variable recurring payments (VRP), and subscription based payments. AIS on the other hand has the potential to be more disruptive. Due to PSD2, you can integrate data from multiple banks into a single app. These data services can be combined and enriched with self-learning algorithms to offer predictive intelligence. Future AIS services can therefore be more advisory based. The real innovation in this space needs to come from fintechs that power front-end use cases; banks are not yet pushing for these services. 5. Who will emerge as the future market winners in open banking? Consumers and businesses will anticipate innovation to come from challenger banks (e.g., Revolut, N26, Monzo), and tech companies (e.g., Uber, Google, Airbnb). These firms have a lot of data and, have the technology in-house to build valuable applications on this data. I think open banking platform providers that offer the broadest and best bank connections will stand out from the rest of the pack. Everyone can offer an API connection, but providing the right value is often the tricky part. Providers with the largest connectivity will benefit from partnerships with Neobanks, tech companies, and power new use cases. Further innovation and product superiority are key factors in the open banking space. Klarna Kosma combines bank connectivity with innovation; therefore, I would say that we are set up for success in this space. Ultimately, I hope both businesses and consumers can be the actual benefactors from open banking. 6. The launch of Kosma seems to be Klarna’s first move into B2B infrastructure services. How is Kosma different from Klarna? Klarna and Kosma serve two different target groups. While Klarna provides consumers and retailers with branded plug-n-play BNPL products, Kosma offers open banking infrastructure services to anyone in need of customized open banking building blocks. Nevertheless, with Kosma, we’re building on the expertise and brand value of Klarna. Kosma might be a new name, but it is the engine that has been powering Klarna for all these years. Now we are making it available for other companies to help them scale their business with open banking. Kosma is not an end-to-end user brand in itself; the service is completely white-labeled for our licensed partners only. We have developed a single API that connects to a proprietary network of 15,000+ bank connections across 26 markets. Any business can use the same API to access open banking services across markets. Since all the connections are proprietary, we guarantee a high degree of data availability. On top of these connections, we also power the UX and AIS/PIS licensing for businesses. 7. Can you share some details of Kosma’s products and services in open banking? Kosma supports three main product lines: i. We offer a PIS payment product, a white-labeled offering that powers businesses to launch PIS and bank transfers. Given our SOFORT capabilities, we can power everything required for a bank transfer, e.g., account connections, UX, risk engine, and transaction flows. ii. Our AIS product provides customized data aggregation services to solve several use cases such as ID verification and income verification. iii. We also offer an account categorization product that provides unique insights from bank accounts/statements and can be supported across 200+ spend categories Next to these products, as Klarna, we also support our consumer-centric BNPL suite of products and SOFORT, our branded bank transfer payment method for online e-commerce. We are also fully licensed, and that license can be used by our partners, or they can utilize their own license and use us as a tech partner. 8. Can you share what’s next for Kosma on the horizon? We are currently developing new use cases by combining AIS and PIS products together. We are seeing that is the kind of innovation our clients are seeking. Further, our efforts go towards developing use cases for newer verticals, going beyond financial institutions to businesses that desire to embed financial products and services. Expanding to these verticals may also require us to get licensed. Therefore, we may plan to get additional licenses in the future. Beyond these initiatives, we’ll continue to utilize the power of Kosma infrastructure services to fuel our Klarna ecosystem of products (e.g., SOFORT bank connectivity and KYC, underwriting for Klarna BNPL products). Please do not hesitate to contact Anupam Majumdar at Anupam@FlagshipAP.com with comments or questions.

credit,processingtechnology

processorssolutionproviders

executiveinterview

Executive Interview Series: Open Banking Payments with Todd Clyde, CEO of Token

Executive Interview

22 Jul 2022

Flagship Advisory Partners’ Executive Interview Series provides readers with exclusive insights from thought leaders in the payments and fintech industry. The series offers diverse perspectives on everything from market developments to strategy to commentary on developments in the industry. This edition puts the spotlight on open banking developments in Europe. Flagship Advisory Partners met with Todd Clyde, CEO of Token, a leading open banking fintech, to learn more about Token’s perspective on developments in open banking and how Token is addressing some of the challenges in open banking payments and data services. 1. It has been four years since the open banking regulations were introduced in Europe. How would you assess the market adoption of PIS (payment initiation services) today? It has taken quite a bit of time, but PIS is finally picking up now. The initial adoption was slow, mainly because the regulations were implemented slowly. For instance, PSD2 regulations were postponed twice in Europe. Secondly, until the first half of 2020, banks were still not ready with their API implementations and therefore, the early open banking APIs were very basic and not usable. If you look at the adoption levels today, the UK has stayed at the front. The UK’s OBIE [ed. Open Banking Implementation Entity, a standards setting body] standardized access to banking rails and this has accelerated the growth of fintechs that can offer PIS services. Adoption in Europe has been good so far but is still a developing story. Markets like the Nordics, the Netherlands, Germany, Poland have remained at the forefront with higher open banking payment volumes. In the last 12 months at Token, we also saw a 10x growth in PIS payment volumes across these markets. I don’t think anyone is questioning the viability of open banking payments anymore; however, there is still room for market adoption to develop further. 2. What are some of the industries where open banking PIS has taken off / been widely adopted? What are some of the use cases that PIS is addressing today? Merchants like open banking payments because they offer great UX at the checkout, come at economical acceptance cost points, and generally offer higher conversion rates with low risk of fraud and chargebacks. Early adopters of open banking payments have been fintechs, challenger banks, and merchants in the high-risk verticals, for example, gaming and crypto. Over the last few years, we have seen more traditional industries such as utilities, public sector, non-profit and fund-raising platforms also adopting PIS across use cases. Several wallet providers offer open banking payments as a payment method for wallet top-ups. According to our estimates, half of wallet top-up volumes are via open banking enabled A2A payments. Today, a kind of herd mentality has kicked in where every merchant wants to offer a ‘pay by bank’ button at the checkout. It is not surprising that we see leading PSPs such as Stripe, Adyen, and others offering an open banking payment method, next to cards and other alternative payment methods (APMs) in traditional e-commerce verticals. Much of the success in open banking payments will come from general e-commerce merchants who are able to embed open banking as part of their checkouts. 3. Open banking payments been slow to be adopted in other mainstream e-commerce verticals. Would you agree with this statement? I think adoption of A2A payments in e-commerce environments varies across markets. For example, in India, the Universal Payments Interface (UPI) has been a huge success, powering open banking payments in traditional ecommerce. We see a similar trend in Brazil as well. According to a recent study by Token[1], 81% European consumers are quite open to using open banking as a payment method in online commerce, and 46% have made an A2A payment in the last 3 months. In the same study, we also discovered that instant bank transfers are a top 5 payment method across European markets. Therefore, there is an ample demand. Perhaps the issue lies on the supply side. Banks still control the UX for open banking payments, and European banks have followed their own paths and standards to open banking access. This can at times impact the quality of the user experience. 4. How has AIS (account information services) taken-off? What problems does AIS solve today? AIS took off much faster than PIS. The initial use cases supported were oriented towards data aggregation, usually around personal financial management (PFM) or cash management tools. Every high street bank built a PFM tool for consumers and businesses to keep record of all their financials in one place. Several fintechs such as Tink, MoneyHub, Yolt, and others emerged that offered white-label PFM capabilities. Today, PFM is an oversupplied market and kind of dead. The main use cases we see around AIS today are income checks (for lending), credit assessment (for investments, mortgages), KYC and onboarding (getting insights from credit scores, gambling history, others). We also see AIS being used in support of payments (e.g., credit assessment when applying for a credit card). Identity verification is another example of a great use case that will soon become hot. There is a white space in identity verification services, which is different to KYC/KYB services. 5. As open banking is still emerging and the potential is not yet fully fleshed out, what is needed to ‘crack the code’? I think we need a combination of regulatory forces and market innovations to solve the current limitations of open banking. On the regulatory side, the regulators have a role to play to fix some of the gaps left by PSD2 and ensure that regulations are enforced and implemented consistently across the markets. At the same time, open finance[2][3], the next step in open banking regulations, can act as a catalyst for market participants to create an ecosystem of financial access and solve the current limitations of API access standardization, IBAN discrimination and consumer/business identity. I also anticipate that market participants like ourselves would play an important role in contributing to such an ecosystem. 6. How is Token trying to be at the forefront of open banking? Could you walk us some of your products and services and the type of problems you are solving today? We want to be pioneers in solving the existing pain points in A2A payments via the latest payments technology and innovation. A2A payments have existed in the past but the barriers to adoption have been high. Now, with open banking APIs, we have the toolkit to make access to inter-bank networks accessible across the markets. For the first time, we are able to offer universal reach and great UX at lower costs through a single API. Token powers the underlying infrastructure for open banking payments. We offer broad connectivity to banks in the UK & Europe, and our platform powers businesses to launch and manage A2A payment capabilities. We are not trying to create an acceptance payment mark (e.g. like Trustly). We are not selling directly to merchants, but rather to PSPs who would like to benefit from our white-labeled proposition. In fact, many PSPs (e.g. Paysafe, Nuvei) are our clients. Token also offers AIS and data aggregation services with broad coverage for multiple use cases. For instance, a large credit scoring company uses Token’s AIS for their credit assessments. 7. Token recently received funding from several investors. What are your plans for the future? Any themes that you have been prioritizing (geo expansion, product expansion, others)? Indeed, we have just raised our Series C funding earlier this year, supported by both existing and new investors. We are looking for efficient growth, but not growth at all costs. Therefore, we are not making any drastic changes to our business model or current strategy. Our immediate priorities are to continue to build our platform; we’ll soon be adding premium products and functionality. There is a long tail of banks that we have on our radar, and we will continue building connectivity. At the same time, our teams continue to hire the best talent in the market to help us grow. We are also looking to expand beyond our existing markets and have plans to expand outside of Europe next year. Please do not hesitate to contact Anupam Majumdar at Anupam@FlagshipAP.com with comments or questions. [1] Research reference: Who will pay by bank? Token and Open Banking Expo link: https://token.io/blog/who-will-pay-by-bank [2]fhttps://www.ukfinance.org.uk/policy-and-guidance/reports-and-publications/exploring-open-financehf [3]fhttps://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13241-Open-finance-framework-enabling-data-sharing-and-third-party-access-in-the-financial-sector_en

a2apayments,embeddedfinancebaas,innovations

processorssolutionproviders

executiveinterview

Serrala & Tink Partnership: Genesis of Open Banking in B2B Payments

Article

1 Oct 2021

As we explored previously in this article, the integration of software and payment services in European B2B/corporate payments is relatively immature compared to the US. There is, however, great potential for this trend given Europe’s robust bank payments infrastructure and shift towards open banking. Most of the early adoption of open banking has focused on information aggregation and digital identity services rather than payments. Figure 1 illustrates that c.75% of all B2B ISVs (software providers) are AIS licensed (Account Information Services) only, not licensed for payments. ISVs that have a PIS license (Payment Initiation Services) are limited in number and often offer somewhat-immature integrated payment services. FIGURE 1: European TPPs: B2B ISVs Licensing by Business (total European B2B ISVs=65) Note: 59 of the TPPs (Third Payment Providers [of PSD2 services]) are in the business segment only, 6 TPPs are in the consumer and business segment. Other business lines include debt management and hosting ISV. Other geographies include Estonia, Italy, Norway, Finland, France, Ireland, Poland and Czech Republic with one B2B ISV in each market. Source: Flagship market research Serrala, a leading SaaS based AP (accounts payables) and AR (accounts receivables) automation platform recently announced a partnership with Tink that illustrates the tremendous market potential for integration of corporate AR/AP automation and corporate payments, enabled by cloud-based open banking technology. Tink is an open banking fintech unicorn that provides open banking connectivity services to more than 3 400 banks. The Tink and Serrala partnership will allow businesses to collect invoice/bill payments through open banking rails. Billers today often struggle with separate business processes and flows for the administration of their AR and related payments, often still relying on banks. Bills are also often still collected via traditional direct debits, which comes with limitations. Serrala’s integration of their core AR SaaS software with Tink’s open banking rails will enable billers to administer the automation of their AR and receipt of bill payments through a single integration and benefit from real-time push payments and related value-added services (as illustrated in Figure 2). Consumers could also benefit from added control, making their bill payments directly from their bank accounts through an integrated payment request link. FIGURE 2: Illustration of Serrala-Tink Partnership for Integrated Bill Payments Source: Flagship Advisory Partners research Serrala, who recently announced a strategic investment from Hg, is a pioneer in innovating corporate payments with integrated AR/AP workflows. As we describe in Figure 3, Serrala supports its corporate clients globally including 13 offices in Europe, North America, Middle Easy, and Asia Pacific. FIGURE 3: About Serrala and Services Source: Serrala website, crunchbase, linkedin Hg’s investment in Serrala and parallel partnership with Tink illustrates two prominent themes in market development. One, there is tremendous opportunity for value creation on the forefront of software-integrated payments servicing global multinational corporates. And two, open banking is a catalyst for this trend (particularly in Europe) as open banking enables more robust and technically agile use cases. We anticipate many more investments and partnerships within this part of the market Please do not hesitate to contact Anupam Majumdar Anupam@FlagshipAP.com with comments or questions.

b2bpayments,embeddedfinancebaas,innovations,perspectiveonkeyevents

processorssolutionproviders

article

Dissecting the European Open Banking / PSD2 TPP landscape

Article

15 Jun 2021

Since the introduction of PSD2 and open banking regulations in early 2018, 451 third party providers (TPPs) have procured licenses for payment services (PIS) and account services (AIS). Out of the 451, 422 are currently active. We recently analyzed the landscape of these active TPPs from the EBA register, examining their licensing demographics, the segments served and the underlying business models. We present some of our key findings in this article. As shown in Figure 1, UK continues to be the European open banking powerhouse accounting for c. 40% of all registered TPPs in Europe. UK’s open banking regulations offered TPPs with a standardized account to account (A2A) technical interface which has not surprisingly attracted a larger number of TPPs. In rest of Europe, the PSD2 technical standards and interfaces continue to be fragmented, and banks have been slow to offer the end points to access the A2A infrastructure, broadly explaining why TPPs growth in rest of Europe has lagged the UK. FIGURE 1: Number of TPPs Across Licensed Countries (May 2021) Source: EBA Register More than 90% of the TPPs today have an AIS license, indicating a strong interest in account aggregation services. This emphasis on AIS is evident across top TPP markets such as UK, Sweden and the Netherlands (see Figure 2) which are mature European fintech hotbeds. Fintechs in these markets, such as Klarna, Monner, Trustly and Monthio are enhancing their digital products and services with account aggregation services to drive value for both consumers and businesses. However, in other markets such as Poland, Denmark and France, we see a greater interest in PIS licenses. The prevalence of a higher number of ecommerce PSPs and wide prevalence of A2A payments (e.g. Poland) in these market are contributing factors to explain this trend. FIGURE 2: Break-Up by License in Top 8 Markets (% of registered TPPs) Source: EBA Register, Flagship analysis As we depict in Figure 3, c.85% TPPs serve consumers and businesses (with businesses being the largest sub-segment), the rest being fintechs that serve banks and businesses through infrastructure services. Of the TPPs that serve businesses and consumers, financial planning providers emerge as the largest segment making up c.20% of the TPPs. These fintechs are essentially AIS licensees that serve mainly consumers (and some businesses) by aggregating account data from banks and offer value added services in financial planning, investments, or savings. Online ecommerce PSPs and alternative A2A payments are the next largest segments making up more than 25% of the TPP break-up. Online PSPs view A2A payments as a complementary payment method (next to cards and APMs) that can serve specific verticals (such as recurring, gaming, non-profits, wealth management) better. SME accounting platforms and B2B payment fintechs are also a sizeable segment, contributing to c.20% and value the open banking rails to drive payments and efficiencies in the B2B payables /receivables and expense management processes. Infrastructure providers are generally newer fintechs that offer next-generation bank payment rails to connect businesses to banks and fuel the A2A payment connectivity. We also see a few specialized banking software vendors that have diversified into areas such as digital identity or PSD2 consent management services. FIGURE 3: Split Across Segments & Business Models Served (% of registered TPPs) Source: EBA Register, Flagship analysis across 370+ TPPs serving top 15 European geographies Examining the regulatory licensing segmentation of the TPP business models in Figure 4, we observe a significantly higher adoption of AIS licenses (rather than PIS) among European software/SaaS companies. This illustrates that open banking payment services are still nascent in the European ISVs/SaaS community. PIS licenses hand have largely attracted registered e-money, payments and credit institutions that already play a role in payment services. The primary PIS use cases are allowing consumers to perform an ecommerce checkout with an alternative A2A payment method or funding wallets or e-money through A2A payment rails. We also see emergence of PIS services with select B2B payment use cases, e.g., employee expense payments, payroll, or supplier payables. FIGURE 4: Dominant Regulatory Licenses Observed Across the TPP Business Models Source: EBA Register, Flagship analysis across 370+ TPPs serving top 15 European geographies Three years after the implementation of the regulations, the development of PSD2 and open banking as disruptive forces in the European payments industry is still a developing story. The TPP landscape has many entrants into the PSD2 paradigms, but a slow pace of development and no major disruptions. There is an early emphasis on account aggregation services, less so on payment initiation services. As the saying goes, people tend to overestimate near-term disruption and underestimate the long-term disruption, which seems to be the case for PSD2 to date. We do anticipate acceleration of use cases and scale running through PSD2 licenses and rails in the next couple of years. Please do not hesitate to contact Anupam Majumdar at Anupam@FlagshipAP.com or Joel van Arsdale at Joel@Flagshipap.com, with comments or questions.

credit,embeddedfinancebaas,innovations

processorssolutionproviders

article

No results found

Topics & Themes

A2A Payments

AI Artificial Intelligence

B2B Payments

Best Practices & Toolkits

Card Issuing

Compliance & Security

Credit

Embedded Finance & BaaS

Fintech & SaaS

Innovations

M&A

Open Banking

Payments Acceptance

Payments Orchestration

Perspective on Key Events

Processing & Technology

SaaS

X-Border Payments

%20(1).jpg)