We recently analyzed and compared the composition of the MasterCard payment facilitator lists in North America and Europe1. The lists are similar in size, with 244 payfacs in North America and 232 in Europe2. However, the composition of the two payfac lists is quite different and we believe that this difference tells an interesting story about the development of these two payments marketplaces.

For each payfac on the Mastercard payment facilitator list we identified two key characteristics: 1) is the company an ISV (independent software vendor) where software is the primary business and payments are secondary, and 2) in what business category or vertical is the payfac focused.

1 European economic area countries only, excluding Russia, Turkey, and other non-EEA countries

2 Payfac counts exclude unidentifiable or defunct companies

North America is a Mature ISV Market, Europe is Not

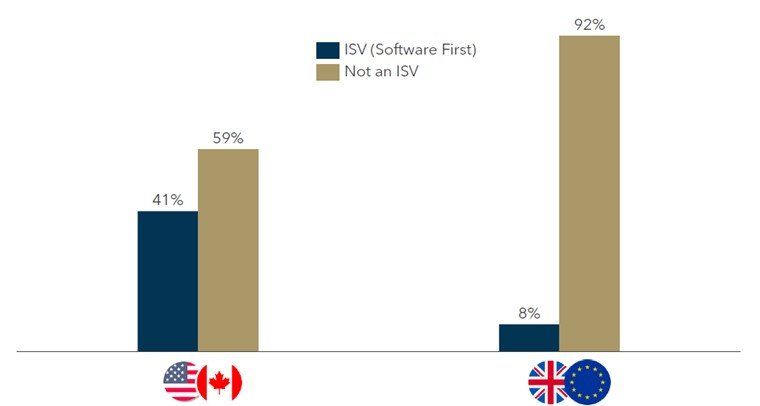

The first key difference between North America and Europe is the penetration of ISVs. In North America, 41% of all payfacs are ISVs, whereas in Europe, only 8% of payfacs are ISVs. The North American market for integrated payments is vastly more mature than in Europe. North American software firms commonly integrate and monetize payments, with registration as a payfac a key step along this strategic journey. In Europe, few software vendors have a strategic focus on payments to the point of moving into superior operating models such as becoming a payfac.

FIGURE 1: Penetration of ISVs Among Payfacs

North America is More Vertically Specialized and Diversified

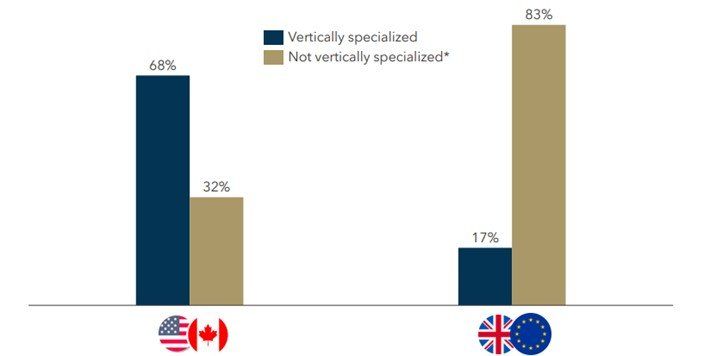

The second key difference between the North American and European market for payfacs is that most North American payfacs are vertically specialized, whereas in Europe, relatively few payfacs are vertically specialized. In North America, 68% of payfacs are vertically specialized, while 32% we categorized into three non-specialized categories: 1) C2B payment acceptance generalists such as ISOs providing multi-channel and multi-vertical payment services, or 2) general e-commerce payment service providers, or 3) financial service providers beyond just payments. In Europe, only 17% of payfacs are vertically specialized beyond these more general categories (C2B general, e-comm, or financial services).

FIGURE 2: Vertical Specialization of Payfacs

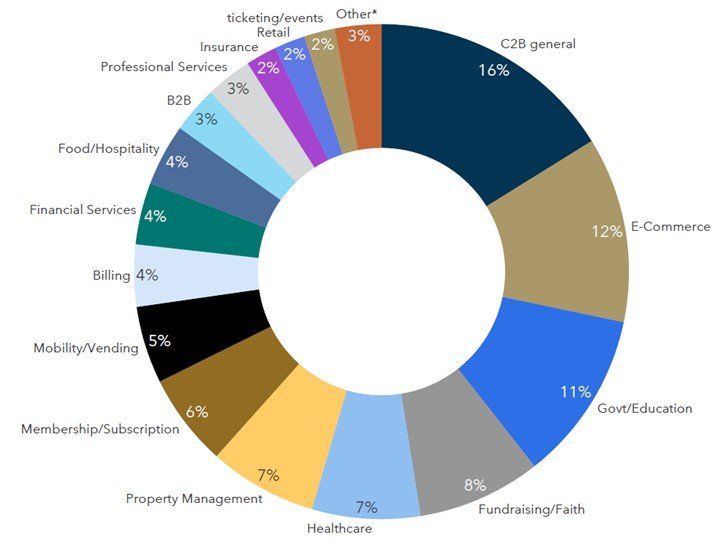

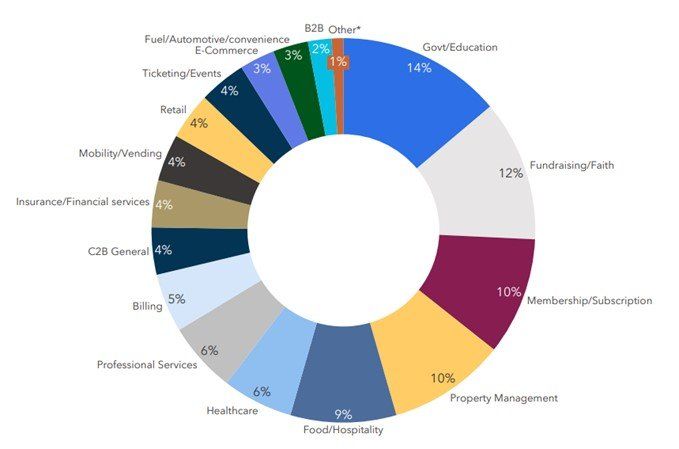

North American payment facilitators are generally vertically specialized, leading to a population which is broadly diversified across many verticals as shown in Figure 3 below. The leading vertical specializations for payfacs in North America are government/ education, fundraising/faith, healthcare, property management, and membership services. In Europe, there is no specialized vertical which comprises more than 3% of the payfac list. Rather, half of European payfacs focus on general e-commerce and 17% are financial services providers beyond just payments (which typically means a focus on FX services or virtual banking).

Figure 3: Vertical Categorization of All Payfacs

North America

EU and UK

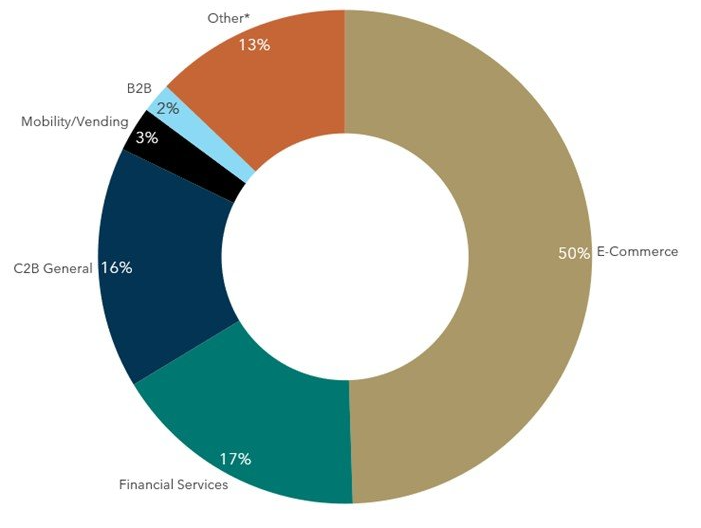

The presence of vertical specialization among payfacs in North America goes hand-in-hand with the penetration of ISVs, who tend to be vertically specialized. As shown in Figure 4, the vertical categorization of ISV payfacs in North America shows a similar profile as the general payfac list with categories such as govt/education, fundraising/faith, membership/subscription, and property management being the most sizable vertical categories.

FIGURE 4: Vertical Categorization of North American ISV Payfacs

Implications for Market Development

The contrast between the North American and European payfac marketplaces is driven by market structure and relative stage of development. Europe is geographically diverse, and smaller geos do not support vertical specialization, thus most EU paypacs are generalists. The U.S., conversely, is a single, large, and homogenous market where verticals are independently scale-relevant and where competitive pressures force payment facilitators to become vertically specialized. North American verticalization is also boosted by greater acceptance of cards across verticals (as payfac registration is, by definition, card driven). For example, in the U.S., it is common to pay for government charges, membership fees, or even rent with a card. In Europe, bank transfers are more prevalent, and cards are not always accepted in verticals such as government/education, membership, and property management.

As European markets for both payment services and software consolidate across countries, we do expect greater payfac vertical specialization. There is tremendous upside for European ISVs to become payfacs and for acquirers to supply this development.

To share your views or discuss those above, please contact Joel Van Arsdale at Joel@FlagshipAP.com .