General Obesrvations

- We see an acceleration of crypto currency usage in mainstream digital commerce (which we refer to here as crypto commerce).

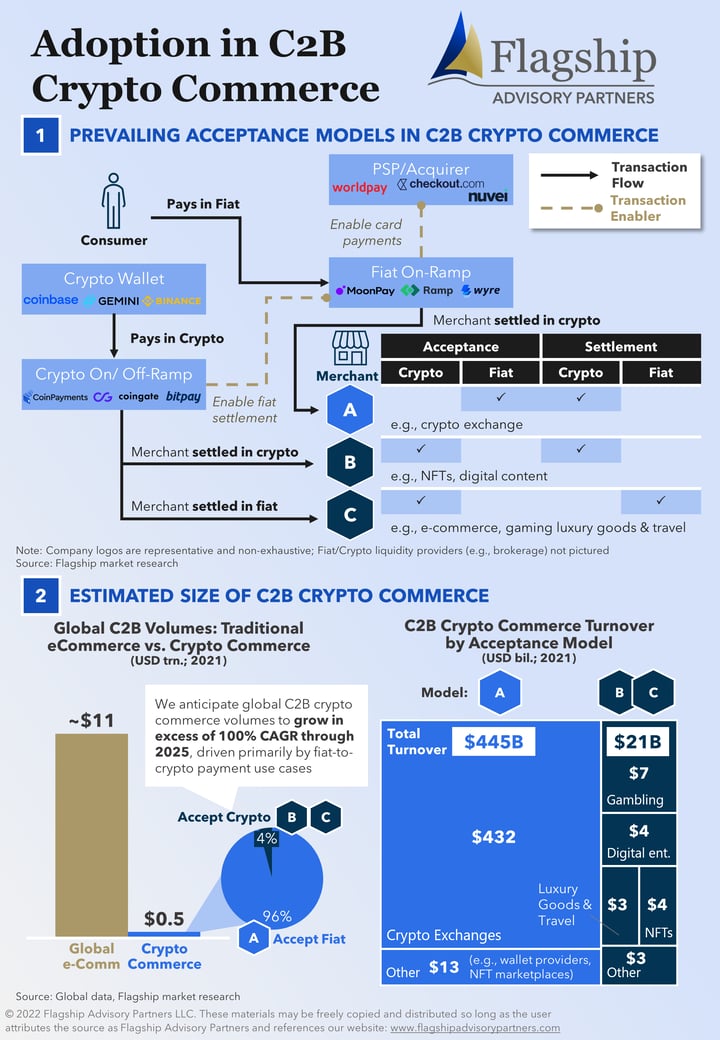

- As shown in Figure 2, 95%+ of crypto commerce volumes today are attributable to the crypto exchanges and wallets themselves (on-ramping and off-ramping into and from the crypto exchanges). But now we see rapid expansion into more traditional areas of commerce such as digital entertainment and services.

- New merchant segments are emerging (e.g., NFT marketplaces, DeFi), further expanding opportunities to use crypto currencies for commerce.

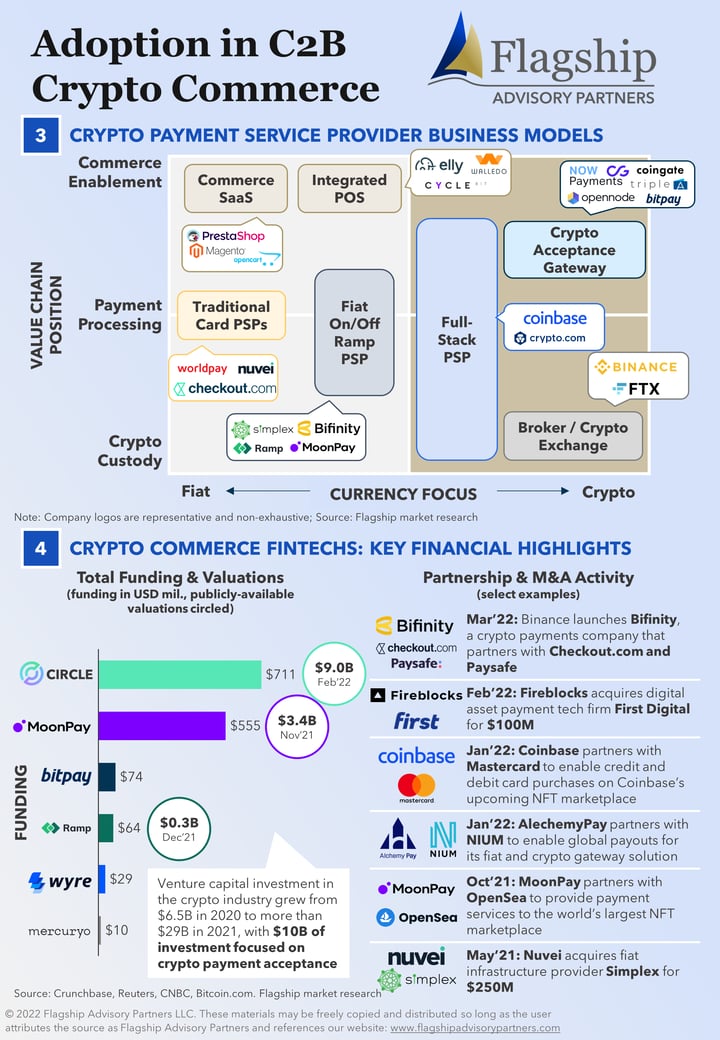

- The addressable opportunity in C2B crypto payments is driving the emergence of new fintech business models. These fintechs are bridging the gap between fiat and crypto ecosystems, helping crypto companies to enable fiat payments and helping mainstream fiat commerce companies to accept crypto currencies. For example, Binance recently launched its subsidiary Bifinity, which will independently empower its clients (wallets, merchants, exchanges, etc.) to participate in the crypto economy and to enable fiat-crypto/ crypto-fiat payment use cases.

- These fintechs are attracting significant funding and M&A activity as shown in Figure 4.

What's Next?

- Excluding exchange on-ramping and off-ramping volumes, crypto payment volumes are only 0.2% of global digital commerce today, though we estimate that these crypto commerce payments are growing at rates well in excess of 100% (possibly even 200-300%). We expect this rate of growth in crypto commerce to continue.

- Leading e-commerce PSPs (e.g., Nuvei, Worldpay, Checkout) are positioning to benefit from this growth by acquiring and building capabilities beyond just enabling fiat purchases of crypto currencies. Other payments ecosystem actors such as Square, PayPal, Visa, and MasterCard are also playing large bets to benefit from the growth in crypto commerce.

- We expect continue investment and M&A into crypto-focused fintechs, despite the markets native valuation volatility.

INFOGRAPHIC: Development of C2B Crypto Commerce

Please do not hesitate to contact Rom Mascetti Rom@FlagshipAP.com, or Anupam Majumdar Anupam@FlagshipAP.com with comments or questions.