There are a fortunate subset of companies who have benefitted from the COVID-19 pandemic, those overweight in digital-commerce and underweight in travel. Most companies are struggling with the P&L impacts of the downturn however, and are looking for evasive actions to drive revenue expansion and cost reduction. Many have already taken initial steps to address immediate cost reduction opportunities (e.g., staff reductions), and we recommend that everyone make the effort now to update your payments strategy roadmaps as discussed here. A logical next step in responding to the today’s challenges is to negotiate vendor cost reductions while also addressing any operational deficiencies that became apparent during the crisis and preparing for new realities such as increased market volatility and remote work.

Before renegotiating lower vendor costs, we suggest first assessing how future-proofed your overall payments vendor network is, and then renegotiating with individual vendors based on that forward-looking vendor strategy.

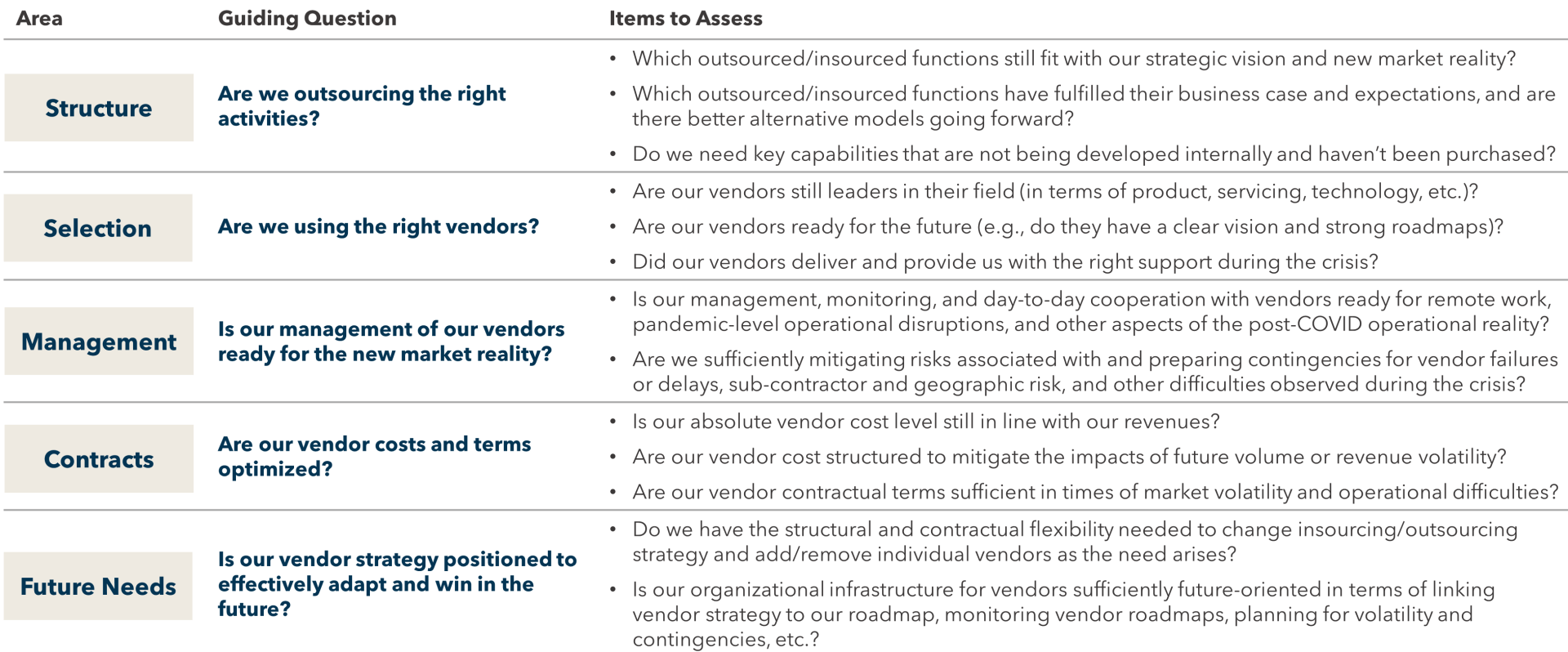

Performing this future-proofing assessment can be done by reviewing five key areas.

Keys to Success

Good roadmaps are just one component of a broader strategy framework that must also include the voice of your customers, a universally shared strategic vision, and a prioritized backlog. All four of these strategy components should be viewed together, and each should feed into the others. The roadmap itself is the detailed and actionable plan for how to achieve the vision, the backlogs are prioritized to deliver the initiatives in the roadmap, and the entire strategy should be based on customer and stakeholder feedback. Robust roadmaps should include the following components:

- Structure to assess whether the organization is outsourcing the right activities. This should include examining whether currently outsourced/insourced functions still fit with the organization’s strategic vision and new market reality, which outsourced/insourced functions have fulfilled their business case and expectations, whether there better alternative models going forward, and whether key capabilities are needed that are not being developed internally but also have not been purchased.

- Selection to assess whether the organization is outsourcing to the right vendors. This includes examining whether current vendors are still leaders in their field (in terms of product, servicing, technology, etc.), if those vendors are ready for the future (e.g., do they have a clear vision and strong roadmaps?), and whether the current vendors delivered and provided the right support during the crisis.

- Management to assess whether the organization’s current processes to manage vendors are ready for the new market reality. This may include examining whether management, monitoring, and day-to-day cooperation with vendors is ready for remote work, pandemic-level operational disruptions, and other aspects of the post-COVID operational reality. Additionally, we suggest examining whether there are sufficient risk mitigants and contingencies in place for vendor failures or delays, sub-contractor and geographic risk, and any other operational difficulties observed during the crisis.

- Contracts to assess whether vendor costs and terms are optimized based on the new reality. Certainly cost reductions should be sought, but targets for cost reductions should be based on whether absolute vendor cost levels are still in line with revenues, and whether those costs are structured to mitigate the impacts of future volume and revenue volatility. Vendor contractual terms should also address market volatility and any operational difficulties experienced to date during the pandemic.

- Future needs to assess if the organization’s overall vendor strategy is positioned to effectively adapt and win in the future. This examination should include whether the organization has the structural and contractual flexibility needed to change insourcing/outsourcing strategy and add/remove individual vendors as needs arise. Additionally, the assessment should examine whether the organizational infrastructure for vendors is sufficiently future-oriented, such as linking vendor strategy to the organization’s overall roadmap, monitoring vendor roadmaps, and planning for volatility and contingencies, among others.

FIGURE 1: Payments Vendor Network Future-Proofing Framework

Once the vendor strategy has been assessed, it is time to hunt for cost reductions and future-proofing enhancements.

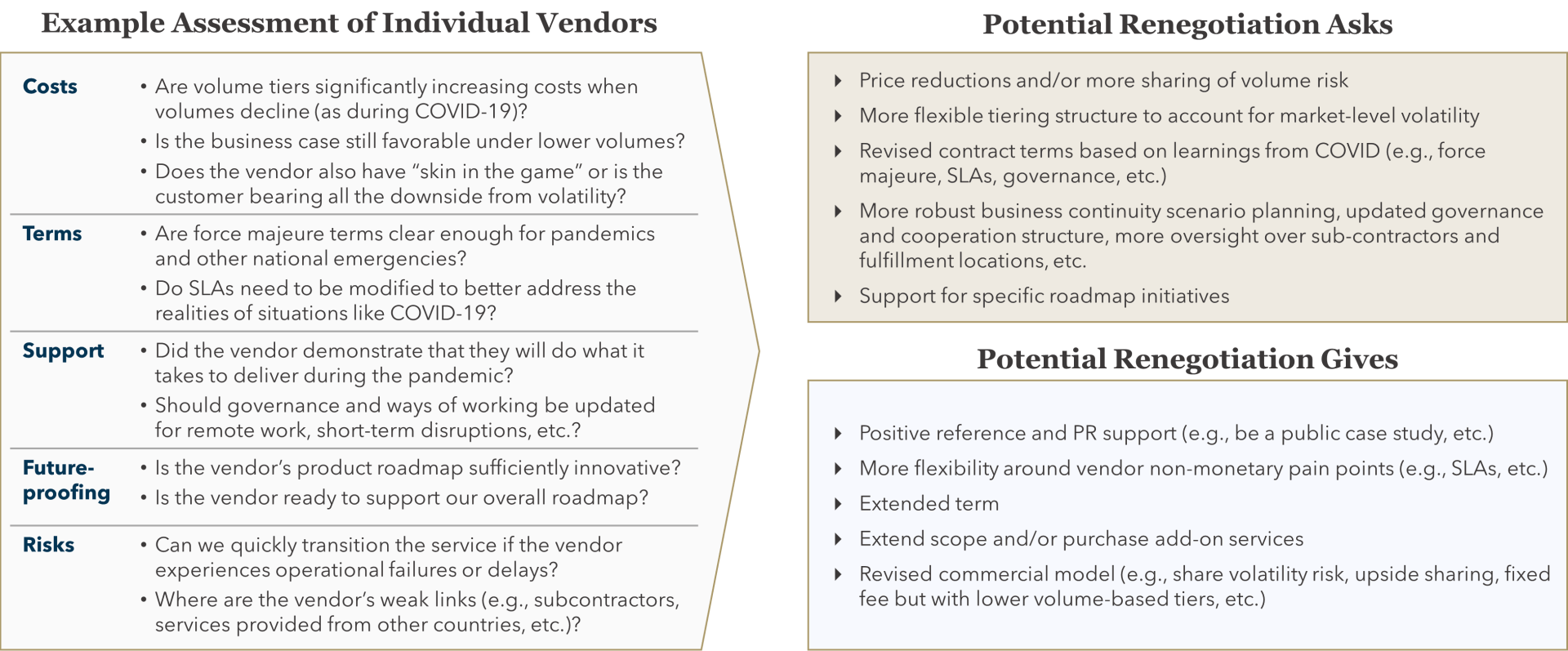

To achieve optimal results, we suggest first assessing each vendor individually to identify specific objectives and tactics for renegotiation. This assessment can take a similar form to the overall future-proofing assessment described above (illustrated in Figure 2 below).

- Costs: Are costs efficient relative to market? Are you benefiting from your own scale? Does the vendor also have “skin in the game” or is the customer bearing all the downside risk from volatility?

- Terms: Are force majeure terms clear enough for pandemics and other national emergencies, and do SLAs need to be modified to better address the realities of situations like COVID-19?

- Support: Did the vendor demonstrate that they will do what it takes to deliver during the pandemic, and should governance and ways of working be updated for remote work, short-term disruptions, etc.?

- Future-proofing: Is the vendor’s product roadmap sufficiently innovative, and is the vendor ready to support the organization’s overall roadmap?

- Risks: Can the organization quickly transition the service if the vendor experiences operational failures or delays, and where are the vendor’s weak links (e.g., subcontractors, services provided from other countries, etc.)?

Based on the above assessment, objectives for the renegotiation with each vendor can be set, and renegotiation tactics defined. Objectives typically take the form of “asks” and can include items such as:

- Price reductions and/or more sharing of volume risk;

- More flexible tiering structure to account for market-level volatility;

- Revised contract terms based on learnings from COVID (e.g., force majeure, SLAs, governance, etc.);

- More robust business continuity scenario planning, updated governance and cooperation structure, more oversight over sub-contractors and fulfillment locations, etc.; and/or,

- Support for specific roadmap initiatives.

Keep in mind that good vendor relationships are long-term partnerships, therefore give and take will be necessary. Determining what “gives” to offer in exchange for the “asks” can be challenging, so we suggest starting with non-monetary gives and then moving to commercial items as necessary. Example “gives” can include items such as:

- A positive reference and PR support (e.g., offer to be a public case study, etc.);

- More flexibility around vendor non-monetary pain points (e.g., SLAs, etc.);

- Extended term;

- Extend scope and/or purchase add-on services; and/or,

- Revised commercial model (e.g., share volatility risk, upside sharing, fixed fee but with lower volume-based tiers, etc.).

FIGURE 2: Individual Payments Vendor Assessment and Renegotiation Tactics

While renegotiating with vendors, we recommend maintaining this partnership mindset. Good vendors will recognize that the market has fundamentally changed and will show a willingness to support their clients. But vendors also need to address their own revenue shortfalls. Mutually addressing the needs of both parties will result in the best long-term outcome.

Flagship Advisory Partners provides payments and fintech clients with a range of vendor and partnership support, including vendor selection, strategic partnership formation, negotiation support, and cost and contract optimization. Our unique experience includes advising market leading brands on the formation of partnerships to optimize returns on payments, and supporting numerous financial institutions and merchant services providers on processor selections, negotiations, and contract and cost optimizations.

To learn more about how we can help, please contact Erik@FlagshipAP.com .

If you are a payment accepting merchant interested to improve your vendor network and capability set, we recommend reviewing our approach to optimizing payment acceptance here.