Europe saw a proliferation of new alternative payment methods (“APMs”) during the past decade which accelerated during COVID. APMs including mobile wallets, account-to-account payments, “Buy Now, Pay Later” schemes, and other forms are thriving across Europe. The European Payments Initiative (EPI), is an ambitious initiative to create a Pan-European payment scheme to compete with Visa/Mastercard. Along with the fundamental challenges of such a broad coalition effort, EPI is quite late to the European APM game. As we discuss in this article, many APMs across Europe are already well-established, filling the market needs and opportunities arising from digital commerce with rich propositions.

APMs are Major Players in Europe

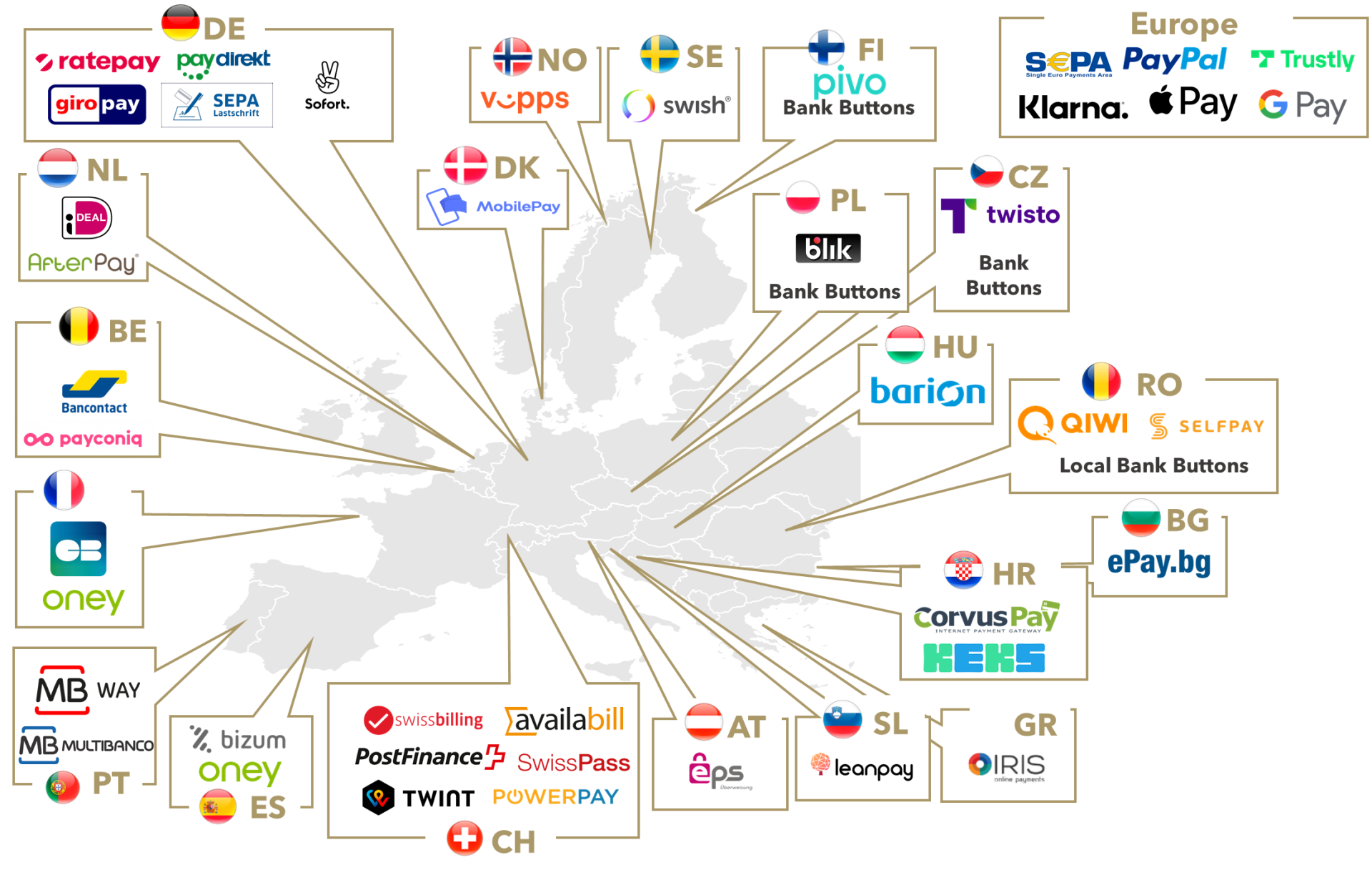

The rise of e-commerce in the early 2000’s gave rise to many non-card payment methods, including PayPal, PaySafe (various schemes), iDeal, Sofort, Trustly, and Klarna, among others. Some of these alternatives were wallets that leveraged existing card rails (e.g., PayPal), while others were entirely new frameworks built on account-to-account (“A2A”) bank transfer rails (e.g., iDeal, Blik). The number of APMs in Europe continues to proliferate; most EU countries have at least one thriving APM (see Figure 1).

FIGURE 1: Key Local Alternative Payments Methods in Europe (selected examples)

Sources: Flagship market observations

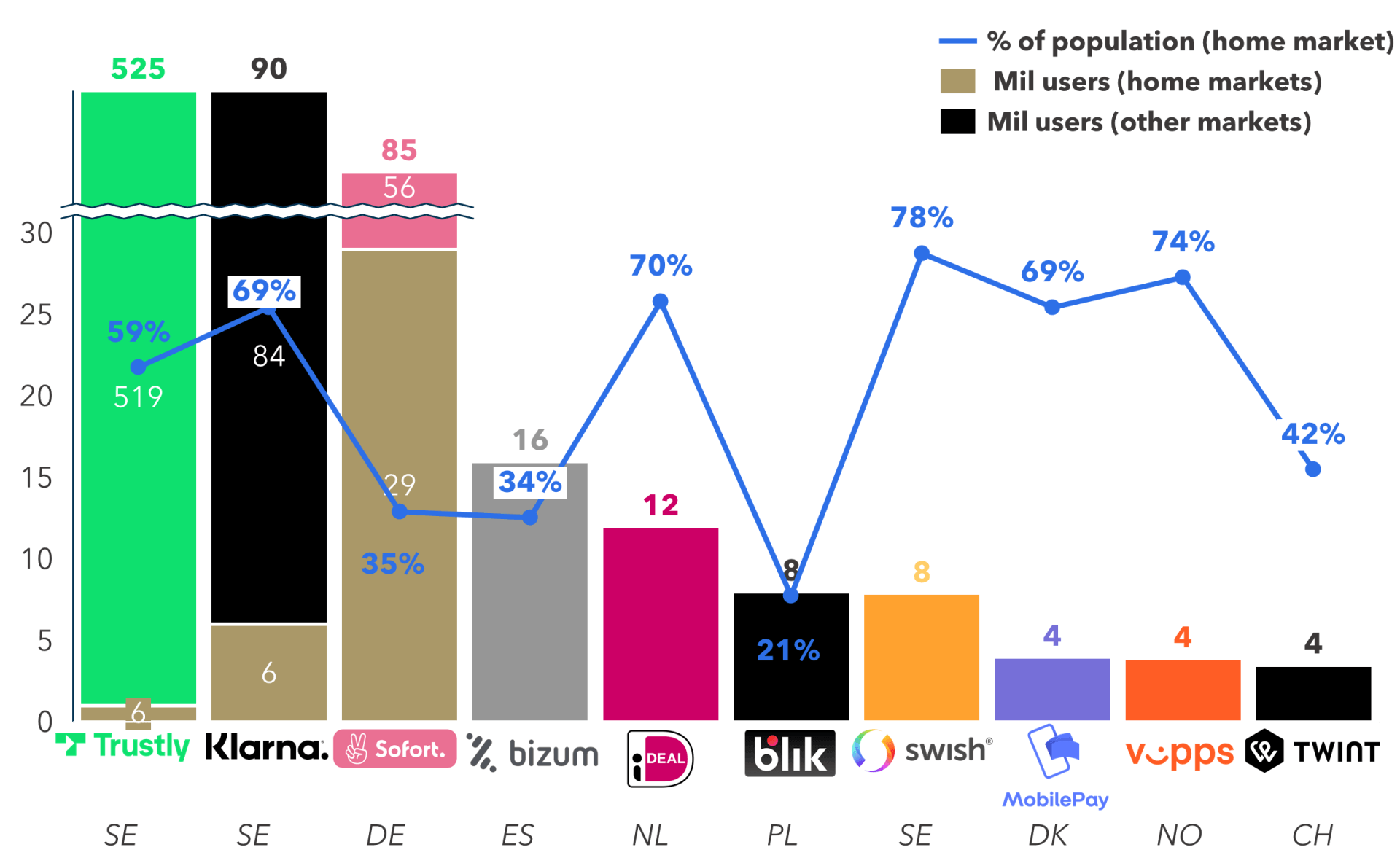

Several APMs have gained significant traction in their home markets: over 70% of the Dutch population use iDeal for online shopping, and nearly 80% of the Swedish population use local mobile payment scheme Swish (see Figure 2).

FIGURE 2: Number of Users and % Penetration of Population in Home Market (in mil, selected non-cards based alternative payment methods in Europe)

Source: Company websites, Flagship market observations

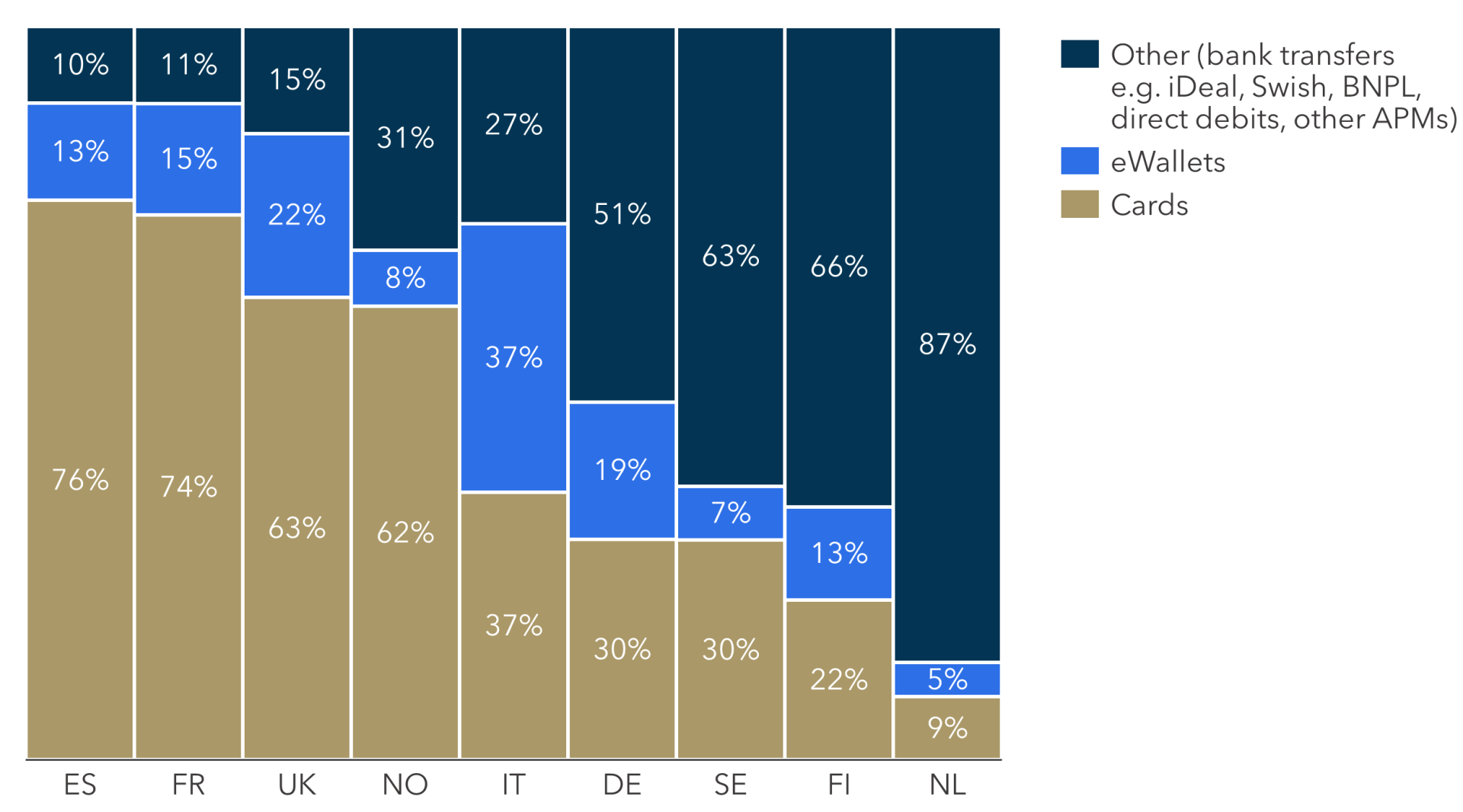

European APMs have significant penetration in e-commerce, accounting for over 60% of volume in many major continental European markets such as Germany (see Figure 3).

FIGURE 3: e/m-Commerce Payment Mix in Europe (select markets; % of e-commerce payment volume; 2020)

Source: Local e-commerce associations, Global Data, Flagship market observations

Rich Digital Product Orientation

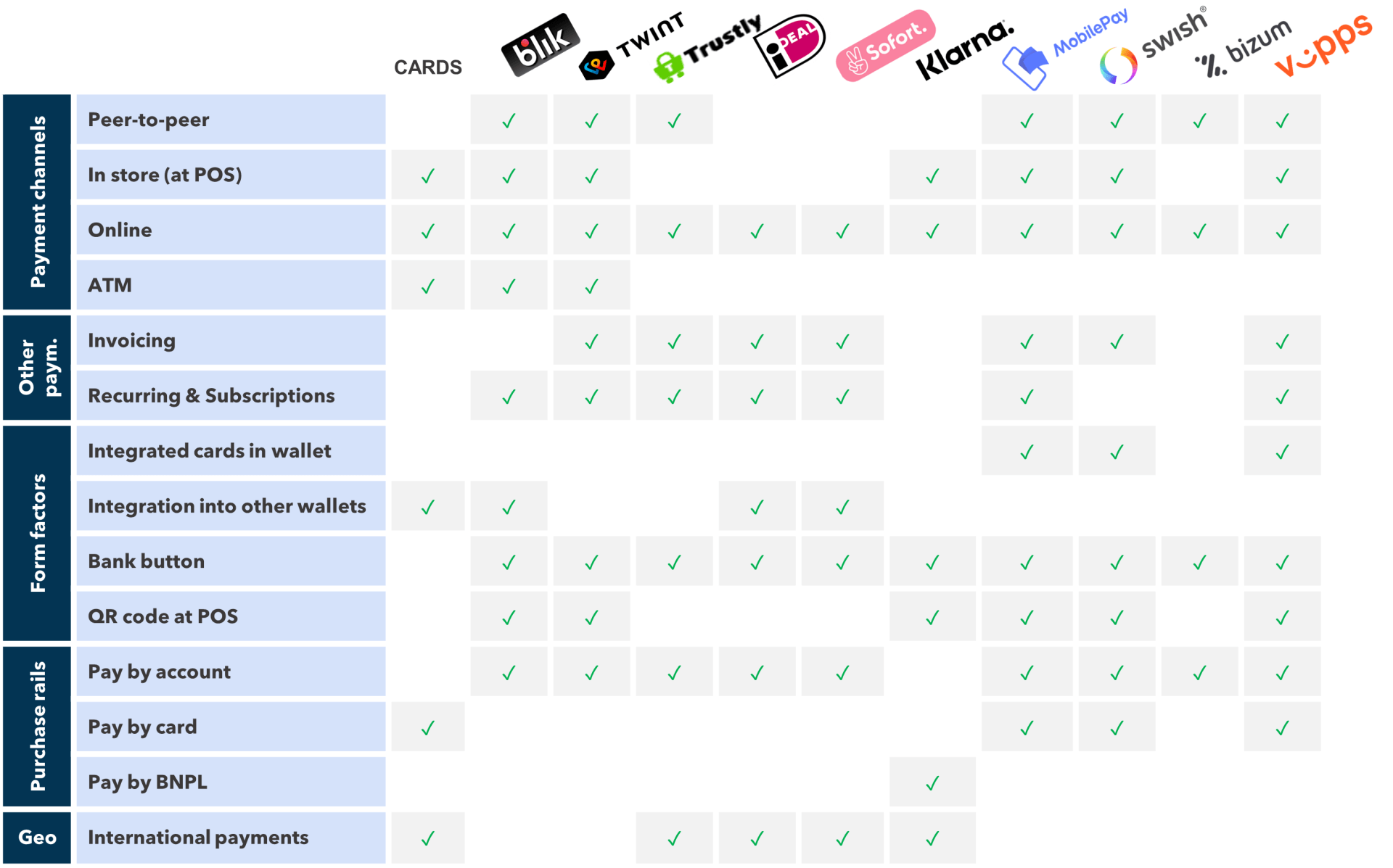

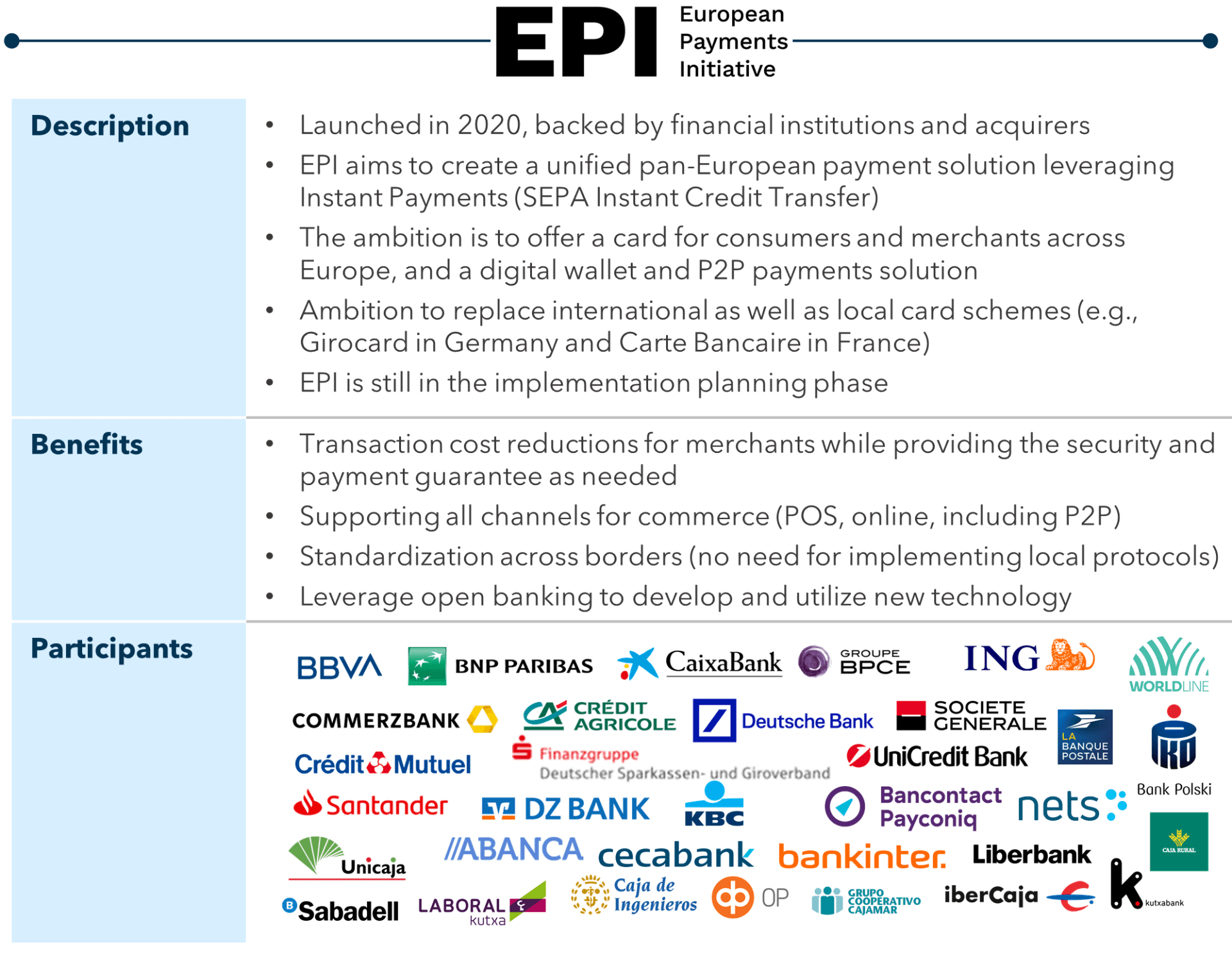

Many popular European APMs originated as peer-to-peer (P2P) digital payment propositions before expanding into consumer to business (C2B) payments. Many APMs also added value-added services (VAS) to increase customer usage and stickiness, including invoicing, loyalty, mobile phone subscriptions, parking payments, and payouts, among others. Figure 4 compares the breadth of features of selected APMs vs. traditional cards. In general, European APMs:

- Are oriented towards remote payments;

- Have a strong focus on P2P;

- Have limited support or traction for POS payments and cash withdrawals (QR code POS payments have limited traction in Europe);

- Have mixed form factors, with a “bank button”-style button at checkout being the most common;

- Use A2A (bank transfer) rails; and,

- Have a variety of VAS bolted on to the original payments proposition.

FIGURE 4: Comparison of Payment Methods

Source: Flagship market observations

Drivers of APM Adoption in Europe

The growth of APMs in Europe is attributable to a variety of factors. Drivers of consumer adoption include:

- Easier and faster e-commerce user experience than cards;

- More convenient P2P functionality than traditional account-to-account bank transfers;

- Better coverage of specific use cases (e.g., real-time money movement for gaming merchants);

- Consumer concerns about security and fraud risk online; and,

- Generational shift in perception and brand affiliation (which favors more digitally-oriented payment methods over “old school” cards).

Drivers of merchant adoption include:

- Lower cost of acceptance vs. cards (often not the case following interchange regulation in Europe; many wallets or cash to digital APMs are priced at a premium);

- Enabled for PSP collecting, often with superior gross margins that incentivize PSPs to drive acceptance;

- Low effort to add additional payment methods in e-commerce due to the “plug and play” model of many collecting Payment Service Providers (PSPs); and,

- Desire to meet the preferences of digital consumers by offering a wide variety of payment methods.

External structural influences have also played a key role in driving the growth of APMs:

- Regulatory focus on reducing barriers to entry into payments, deregulation of cross-border payments, reducing the cost of payments acceptance, and harmonizing payments in Euro (e.g., PSDII, interchange regulation);

- Convergence of digital identity and payment schemes; and

- Proactive political and regulatory focus on promoting alternatives to Visa and MasterCard, such as the European Payment Initiative (EPI) as shown in Figure 5.

In today’s market, APMs are benefitting from the ample supply of capital. Even earlier stage APMs are often well funded by VCs.

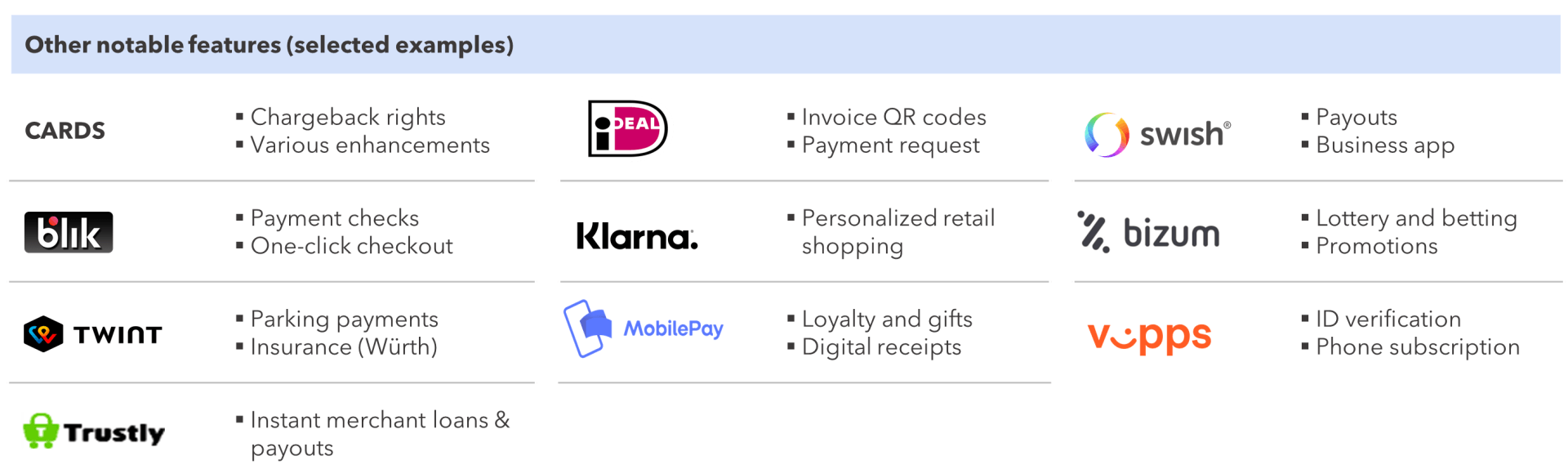

FIGURE 5: EPI – the Biggest APM of Them All?

Source: Flagship market observations

Imperatives for APM Growth

APMs have ample opportunity to continue displacing cash, cards, and legacy bank transfer payment methods:

- International expansion: Today, most popular APMs are domestic by nature, which is particularly true for bank-backed solutions. Initiatives such as P27 (an account-to-account scheme in the Nordics) illustrate the need for common payment infrastructures across countries, and the recently announced merger between Vipps, MobilePay and Pivo demonstrates that APMs are actively collaborating to reach a state of cross-border interoperability.

- Continued expansion of merchant acceptance: Given the sometimes-difficult integration of APMs into an online checkout process, some small merchants are left with limited choices. Plug-and play providers (i.e. SaaS platforms) increasingly allow even the smallest web shops to easily add local alternative payment methods into their online checkout process, which helps with conversion and eases the process of selling abroad. Furthermore, the APMs themselves have significantly improved their developer portals, which simplifies adoption by payment intermediaries who serve the small business segment.

- Cracking the code at the physical POS: Acceptance of APMs in-store has a track record of failure in most Western markets (e.g. MobilePay’s Bluetooth beacons) due to technical and physical integration challenges, clunky user experience vs. contactless cards or Apple Pay/Google Pay, and difficulty in changing customer behavior. Some APMs are focusing on using proven in-store wallets such as Google Pay to effect in-store NFC transactions (e.g., Blik in Poland), which initially appears to be promising. QR-code based payments are thriving in many other global markets including China, India, Russia, and others. We expect QR-based payments to accelerate as well in Western markets as POS hardware shifts towards more flexible Android and integrated devices.

Conclusion

APMs are thriving and proliferating across Europe, and globally. APMs thrive by addressing unmet needs in digital commerce, by adapting to local market opportunities, by enriching their apps with value-added services, and by enabling specific use cases or verticals that are otherwise underserved. APMs, energized by aggressive capital backing, will continue to evolve and grow. This evolution will include ongoing geographic expansion (e.g., AfterPay and Klarna), expansion into the POS environment, and evolution towards super-apps with broad based financial and commerce services. EPI has the intention of becoming the leading pan-Europe APM. While this goal is appropriately ambitious, it is also potentially too late considering the success of other APMs and the vast acceptance and usage ecosystems now built around existing APMs.

Please do not hesitate to contact Erik Erik@FlagshipAP.com, Simone Simone@FlagshipAP.com or Elisabeth Elisabeth@FlagshipAP.com with comments or questions.