Buy now, pay later (“BNPL”) is experiencing huge growth in awareness, uptake, and press coverage. Klarna is the largest and most visible standard-bearer, showcasing a 33% revenue growth rate and a $46 billion valuation in its last funding round in June 2021 implying a 30x revenue multiple. Fintech incumbents have issued a slew of BNPL press releases in Q3: Square acquiring Afterpay for 42x revenue, PayPal acquiring Paidy for 153x revenue, and PayPal, Revolut, Monzo, and Curve all announcing new BNPL offerings (see Figure 1).

FIGURE 1: Examples of BNPL Traction in the Marketplace

Source: Company reports and press releases

EU Banks BNPL Offerings

Based on the market activity levels in BNPL, the fact that BNPL was (arguably) born in Europe, and that many European markets traditionally are averse to revolving credit cards, we would expect European banks to be rushing to defend short-term lending and to capitalize on the growth of the new product category. We therefore analyzed the offerings of the top 5 banks (ranked by assets) in 10 leading European markets (50 banks in total), and were somewhat shocked with the results (see Figure 2):

- Only 2 EU banks (4% of the total), Barclays in the UK and Santander in Poland, offer full BNPL propositions;

- 17 EU banks (34% of the total) offered some sort of installments on credit cards, primarily via non-digital channels; and,

- The remaining 31 EU banks (62% of the total) only marketed traditional credit cards.

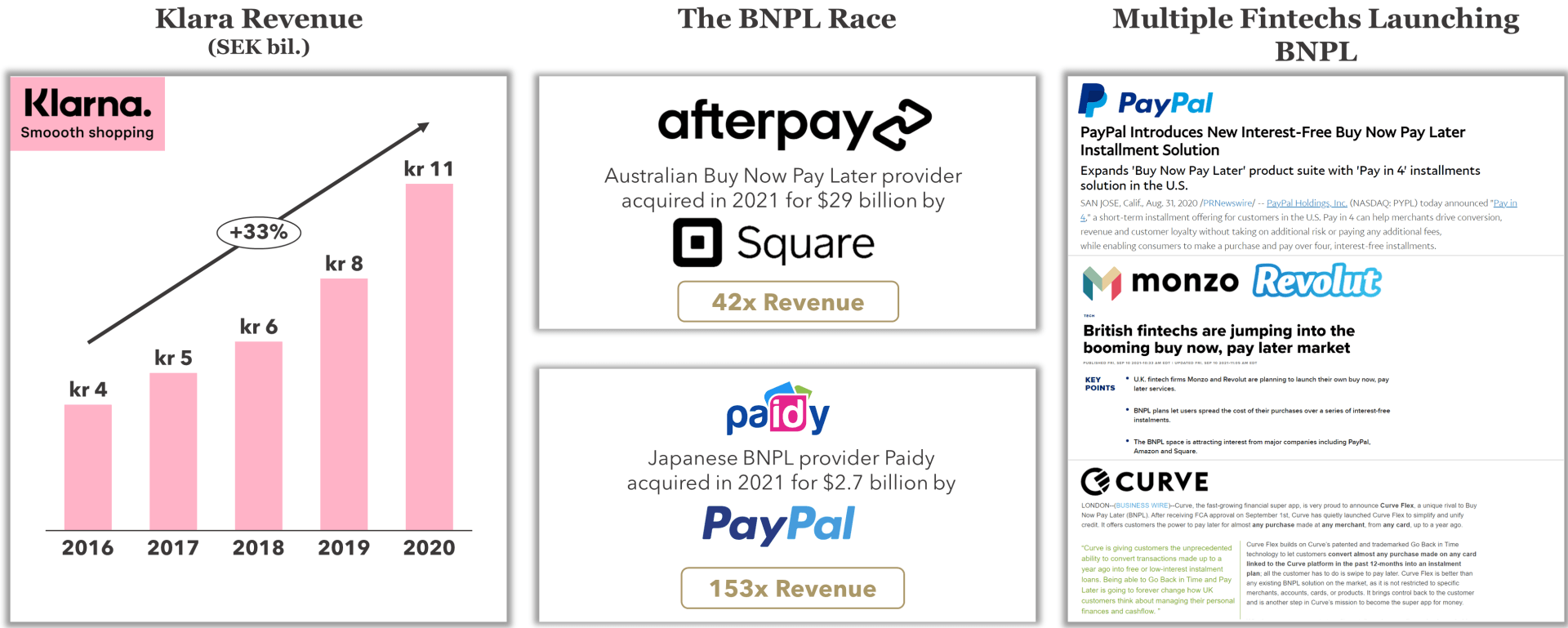

FIGURE 2: Transactional Credit Offerings Marketed by 50 Leading EU Banks

Source: Flagship Advisory Partners research

We also found that bank transactional credit offerings tend to cluster by country (see Figure 3):

- French banks offer installments at the POS;

- UK, Spanish, Italian, and Polish banks offer post-purchase installments via mobile/online banking;

- Several banks in CEE offer post-purchase installments via offline channels: branches, call center, and/or SMS;

- Most banks in Germany, Sweden, Italy, and Czech Republic simply do not market installments.

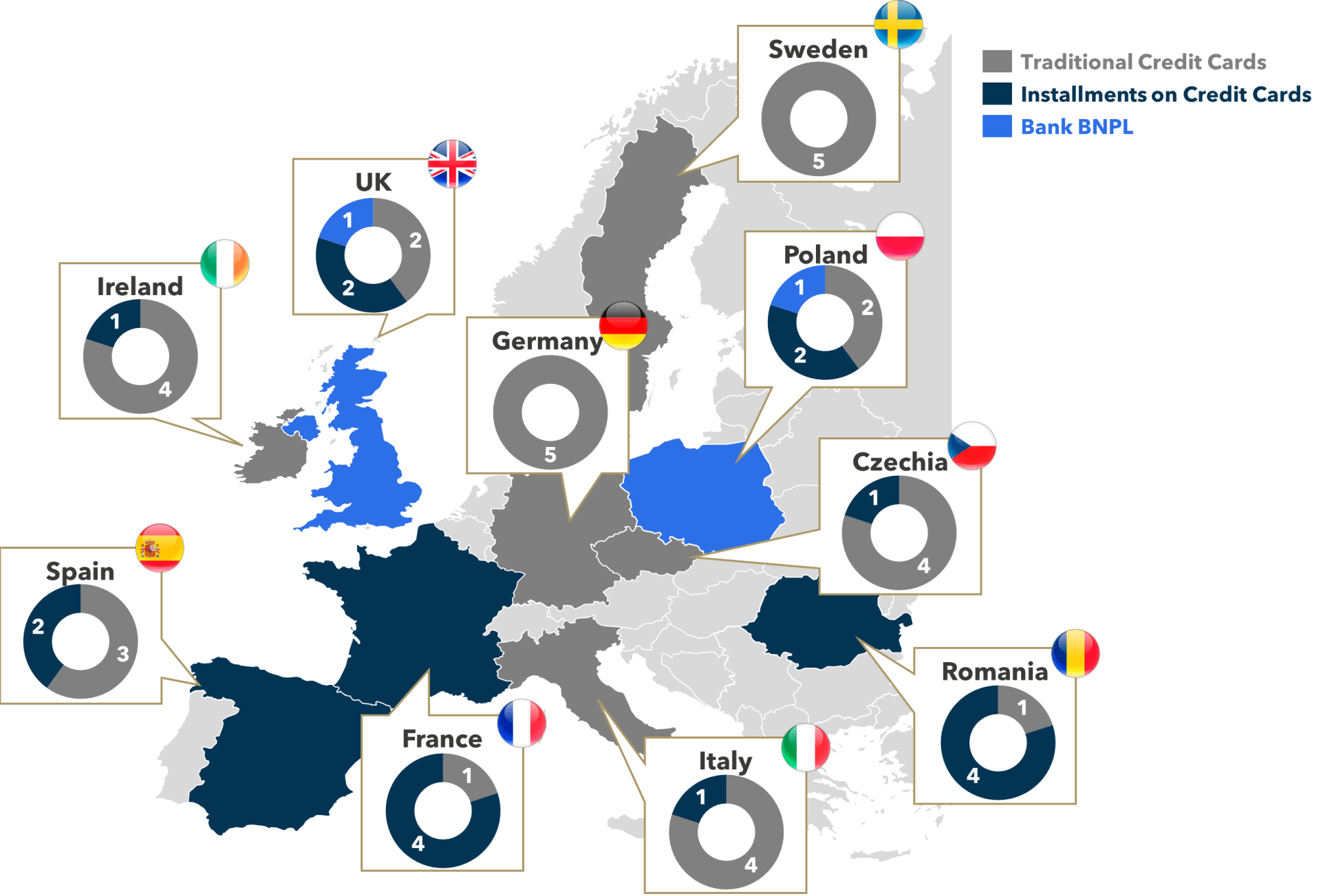

FIGURE 3: EU Bank Credit Card Installment Offerings by Country

Source: Flagship Advisory Partners research

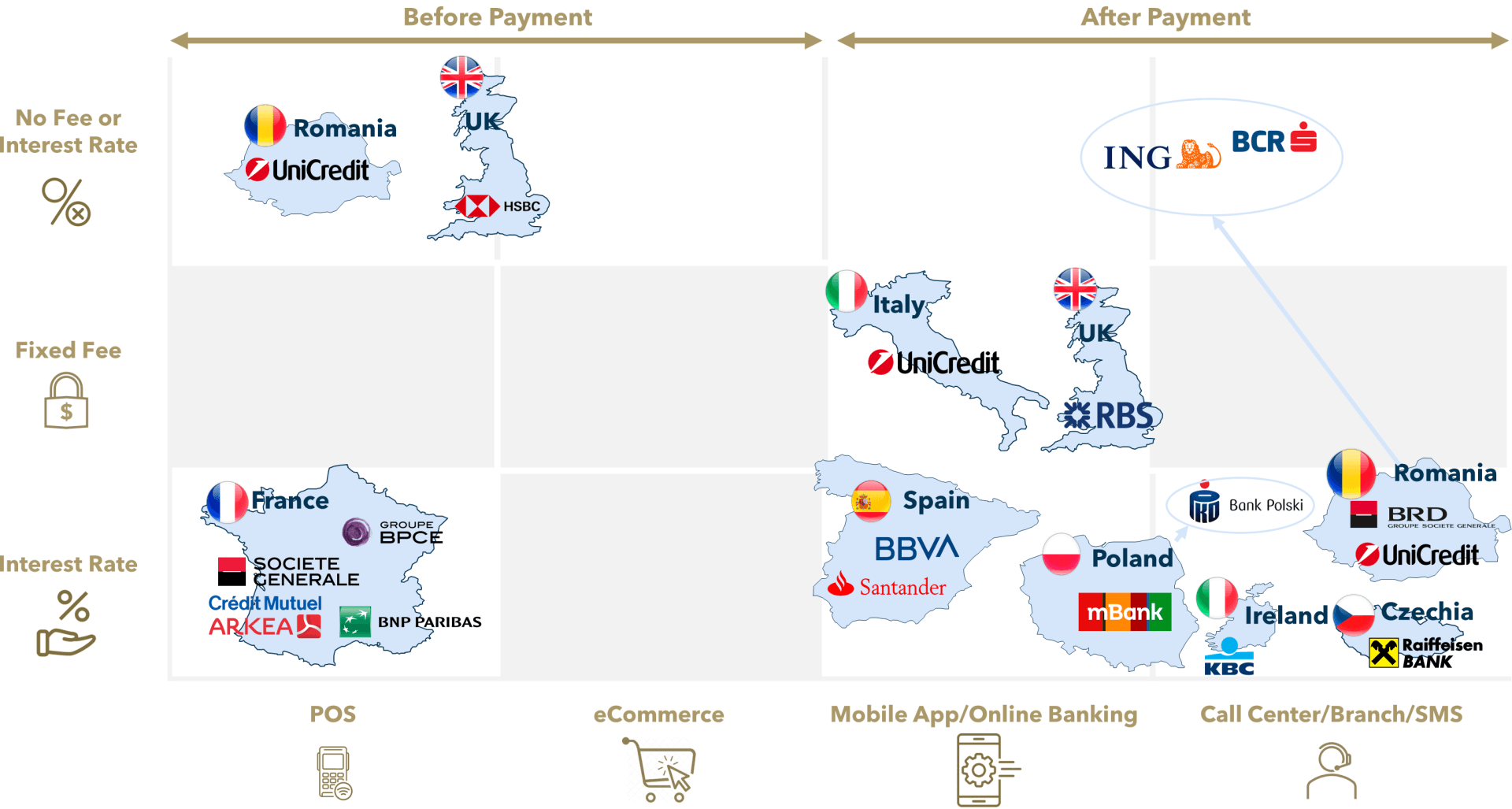

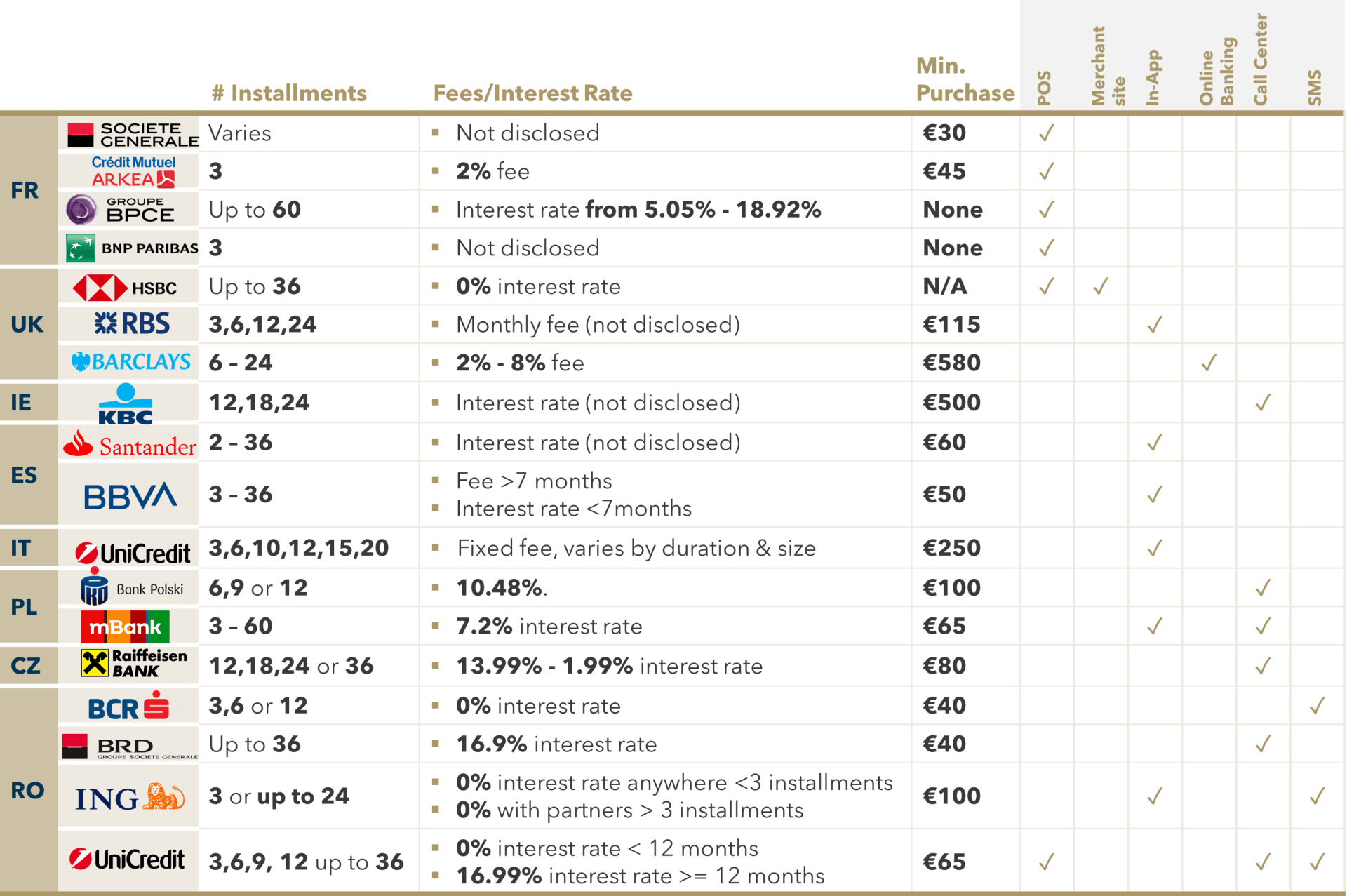

Pricing and terms of the installments offered vary widely, as summarized in Figure 4. Most installment options are lower priced than credit cards, and most banks utilize interest rates (APRs) rather than ad valorem fees.

FIGURE 4: Pricing and Terms of EU Bank Credit Card Installment Offerings

Source: Flagship Advisory Partners research

Reasons Behind the Lack of EU Bank BNPL Adoption

While a handful of EU banks have relatively strong digital installment offerings, most appear to have missed the boat on the BNPL wave. There are likely several drivers of this counter-intuitive behavior:

- Lack of natural channels to distribute pre-purchase BNPL, which in its most prevalent form requires a strong e/m-commerce PSP solution;

- Valid arguments that banks should rather focus on post-purchase installments where there is a more natural fit (since the transaction shows up in mobile/online banking);

- Conservative risk appetite;

- Higher regulatory scrutiny of banks than of fintechs;

- Operating model challenges: higher cost to process full “new to bank” credit applications, process overhead due to regulation, and legacy technical and operational infrastructures;

- Difficulty reconciling the internal business case for investment (domestic nature of European banking limits scale, higher investment requirements to digitize, etc.); and,

- Financing small ticket transactions loses out in the overall bank investment prioritization process vs. larger initiatives such as overall digitization, or against “safe bets” like investing into mortgages and personal loans.

The Path Forward

While EU banks have missed out on the first wave of BNPL, they still have many opportunities to grow via transactional credit. Partnering is arguably easier for banks than building organically. Example partnership options could include:

- Distribution of other BNPL providers’ products to the bank customer base (e.g., direct marketing to bank lists to sign up, etc.);

- Integrating bank-funded installments into the banks’ existing merchant acquiring alliance partners;

- Partnering with PSPs to distribute bank sales finance installments;

- Creating partnerships with fintechs to underwrite and fund fintech-originated installments

- Among others.

Those banks seeking to own the full product also have many options, such as:

- Starting out simple: use credit card back-ends to hold “swipe to put on installments” transactions from current accounts in mobile banking apps;

- More advanced lines of credit that enable slicing and combining transactions from multiple products into configurable installments;

- Building a BNPL “bank button” that can be distributed by PSPs;

- Among others.

Other players in the ecosystem can also work with banks for mutual benefit: card schemes can facilitate BNPL infrastructure and distribution on behalf of banks, acquirers and PSPs can distribute bank BNPL and installments (thereby obtaining the benefits of banks’ balance sheets), and vendors to banks, particularly card issuer processors, can provide white label solutions.

Banks may also realize some benefits from staying on the sidelines: increased regulatory scrutiny as BNPL grows will level the playing field vs. fintechs, banks could benefit from others paving the way for consumer awareness and then market post-purchase installments that fit naturally into a mobile banking proposition. Besides, banks will always have a significant cost of funding advantage over fintechs. While EU banks have clearly missed out on the first BNPL gold-rush, they still have good opportunities, and if they are creative, are not completely out of the game.

To share your views or discuss those above, please contact Erik Howell at Erik@FlagshipAP.com or Zuzana Krulišová at Zuzana@FlagshipAP.com