In 2023, Flagship published insights across a wide range of payment and fintech topics. The scope and scale of Apple’s fintech ecosystem, in parallel with our analysis of fintech’s efficiency, generated the most traction amongst our readers. Other topics that gathered attention were our definition of the widely used catchphrase ‘embedded finance’, KKR’s failed investment in German PSP Unzer (and lessons learned), and the proliferation of digital wallets in the global economy. We summarize our most impactful insights below (and in this video).

In 2023, Flagship published insights across a wide range of payment and fintech topics. The scope and scale of Apple’s fintech ecosystem, in parallel with our analysis of fintech’s efficiency, generated the most traction amongst our readers. Other topics that gathered attention were our definition of the widely used catchphrase ‘embedded finance’, KKR’s failed investment in German PSP Unzer (and lessons learned), and the proliferation of digital wallets in the global economy. We summarize our most impactful insights below.

Links to our 5 most read insights here:

- Scope and Scale of the Apple Fintech Ecosystem

- High-Growth Fintechs Must Now Learn Efficiency

- Peeling Back the Onion of Embedded Finance

- KKR’s Failed Investment in German PSP Unzer

- Digital Wallets Thriving, Proliferating in All Directions

1. Scope and Scale of the Apple Fintech Ecosystem

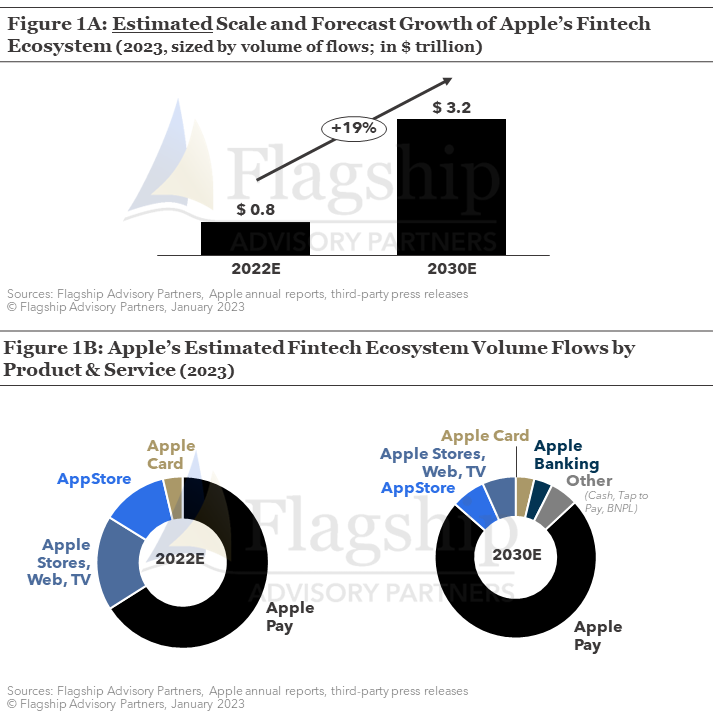

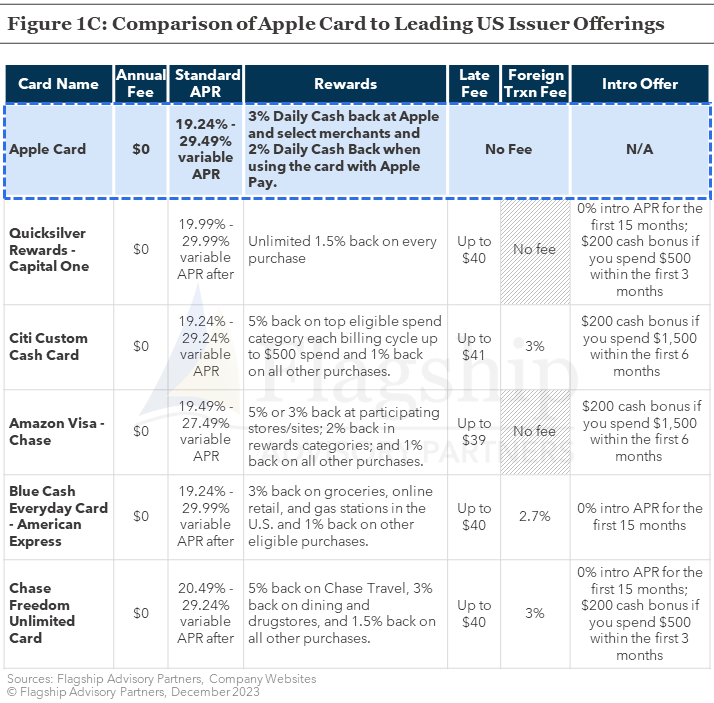

The dissection and sizing of Apple's fintech ecosystem was our most popular article. As Apple has heavily invested in its fintech business and does not publicly disclose any data, this is an interesting topic that Flagship frequently receives questions on from our clients, who increasingly see Apple as a competitor in the fintech and payments space. Flagship estimated that Apple ‘controlled’ c. $800 billion of payments flows in 2022, which we estimate to grow to $3.2 trillion by 2030, with the largest flow from ApplePay and a material proportion of growth from services that are yet not mature today (e.g. tap-to-pay, BNPL, banking). We followed up this article with an analysis of the failed Apple/Goldman partnership, where we estimated the profitability of the Apple Card program which we believe to be the root cause of Apple pulling the plug on the relationship.

Links: Scope and Scale of the Apple Fintech Ecosystem; The Rise and Fall of the Apple-Goldman Sachs Consumer Finance Partnership

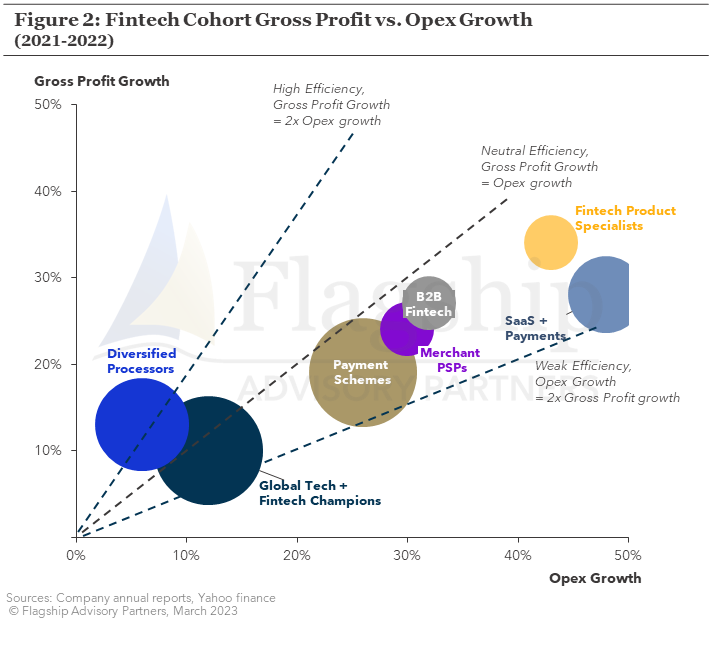

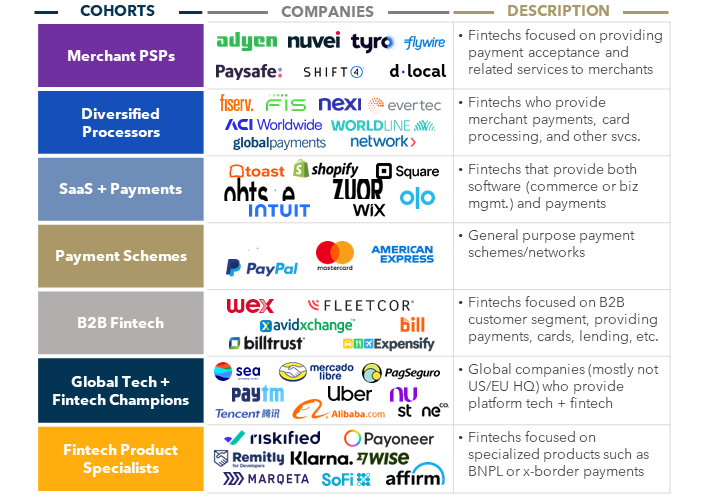

2. High-Growth Fintechs Must Now Learn Efficiency

The year 2023 started with a continuation of company valuations getting down-to-earth. In the prior period, there was an investor notion of limitless growth, and many fintech companies (as in many other industries) had become over-valuated. We double-clicked on the financials of 50 fintechs, which showed a clear difference between mature fintechs and high-growth fintechs. Mature fintechs such as ‘Diversified Processors’ outperformed their higher-growth peers on operating leverage, resulting in strong profit performance that generally exceeded expectations. We firmly believe that public investors in the current market environment will look for revenue-efficient investments, rather than patient long-term growth opportunities.

Link: High-Growth Fintechs Must Now Learn Efficiency

3. Peeling Back the Onion of Embedded Finance

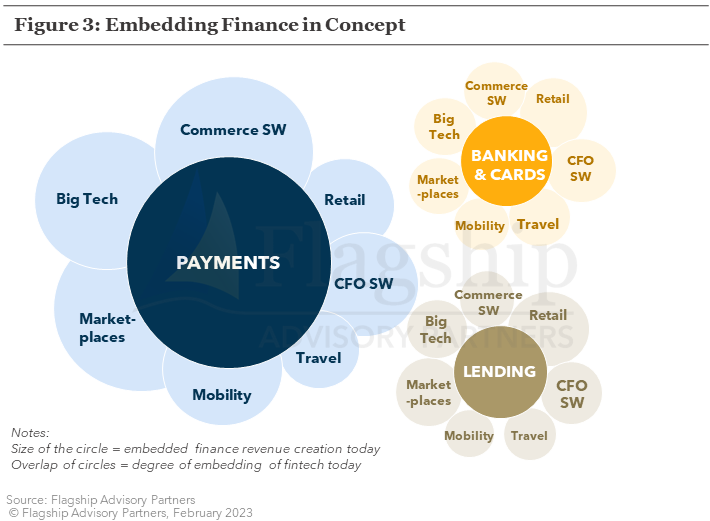

Fintech is full of acronyms and catchphrases, none more used and yet more confusing than ‘embedded finance’. As everyone seems to have a different definition and understanding of this term, we attempted to, given our constant exposure in the market, define and explain exactly what embedded finance is by peeling back the onion and illustrating its many layers with real-life examples.

Link: Peeling Back the Onion of Embedded Finance

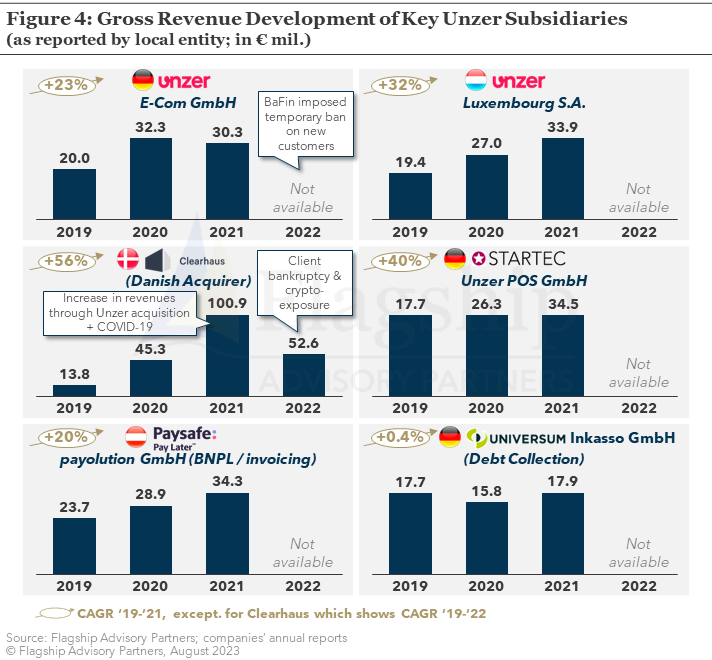

4. KKR’s Failed Investment in German PSP Unzer

KKR acquired a majority stake in Unzer from AnaCap for $668 million in August 2019, and after less than four years into the deal, KKR announced plans to hand over its majority stake in Unzer to its creditors. The failed investment in Unzer reinforced several key lessons in merchant payments. Here are our key four lessons: 1) Investors must pay a fair valuation to generate equity returns; 2) conglomerations of many small merchant PSPs acquired at full valuation is a challenging playbook for generating equity returns; 3) compliance matters; and 4) risk-seeking in merchant payments often does not end well.

Link: KKR’s Failed Investment in German PSP Unzer

5. Digital Wallets Thriving, Proliferating in All Directions

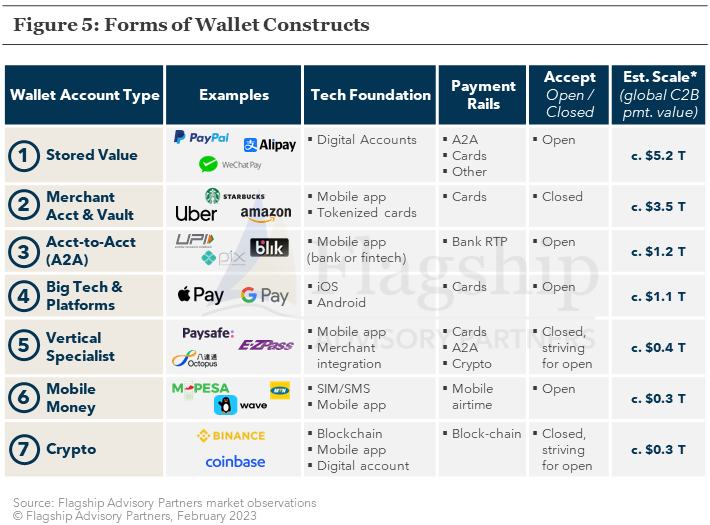

Digital wallets have gone through several rounds of trial and error in major economies, but there is no longer any basis to question the massive influence and potential of digital wallets. We estimate that wallets powered $12 trillion global C2B payment volumes in 2022, and penetrated e-commerce payments with 23%. In this popular article we examined the global state of digital wallets and the reasons behind their success.

Link: Digital Wallets Thriving, Proliferating in All Directions

We look forward to delving into more diverse topics that generate debate and challenge perspectives in the coming year. Should you have any questions, please do not hesitate to contact us at Info@FlagshipAP.com